One of the most hated and misunderstood products in all of personal finance is Cash Value Whole Life Insurance.

Mentioning strategies like Infinite Banking will get you kicked out of groups and called an idiot.

So why do I have a policy?

//Time for a Thread//

1/20

Mentioning strategies like Infinite Banking will get you kicked out of groups and called an idiot.

So why do I have a policy?

//Time for a Thread//

1/20

Please Note

-I DO NOT sell insurance

-I am open to being wrong about this. Show me why. BUT please read the ENTIRE thread first.

2/20

-I DO NOT sell insurance

-I am open to being wrong about this. Show me why. BUT please read the ENTIRE thread first.

2/20

When the pandemic started in March we stopped spending and hoarded cash like crazy.

Our savings account swelled to 100K.

Interest rates fell like a rock, so I started looking for ways to get some safe yield and stumbled across Cash Value Whole Life Insurance (CVWLI)

3/20

Our savings account swelled to 100K.

Interest rates fell like a rock, so I started looking for ways to get some safe yield and stumbled across Cash Value Whole Life Insurance (CVWLI)

3/20

What is CVWLI?

According to Investopedia,

“Whole life insurance provides coverage for the life of the insured. In addition to paying a death benefit, whole life insurance also contains a savings component in which cash value may accumulate...

4/20

According to Investopedia,

“Whole life insurance provides coverage for the life of the insured. In addition to paying a death benefit, whole life insurance also contains a savings component in which cash value may accumulate...

4/20

...These policies are also known as “permanent” or “traditional” life insurance.”

5/20 https://www.investopedia.com/terms/w/wholelife.asp

5/20 https://www.investopedia.com/terms/w/wholelife.asp

What does this mean?

At the end of the insureds life, the insurance company is obligated to pay out a death benefit, hence the name Whole Life.

Second, after the cost of insurance, there is cash in the policy that grows Tax Deferred at a guaranteed rate Plus dividends.

6/20

At the end of the insureds life, the insurance company is obligated to pay out a death benefit, hence the name Whole Life.

Second, after the cost of insurance, there is cash in the policy that grows Tax Deferred at a guaranteed rate Plus dividends.

6/20

But UncommonYield, CVWLI is way more expensive that Term!

You are right!

If you use CVWLI ONLY for the death benefit it is ALOT more expensive than Term.

That is why own term!

So why CVWLI?

Cash accumulation or saving

7/20

You are right!

If you use CVWLI ONLY for the death benefit it is ALOT more expensive than Term.

That is why own term!

So why CVWLI?

Cash accumulation or saving

7/20

Traditional CVWLI policies are optimized for the death benefit and have ZERO cash value the first few years.

When structured for cash accumulation you can NET 3-5% on cash AFTER the cost of insurance and fees over the life of the policy.

What does this look like??

8/20

When structured for cash accumulation you can NET 3-5% on cash AFTER the cost of insurance and fees over the life of the policy.

What does this look like??

8/20

To maximize cash value in the policy you overfund it by paying in

9 parts Paid Up Additions (PUA, or pre-bought insurance)

1 part base premium

The PUA portion for the policy shows up as almost all cash in the policy while adding some death benefit.

9/20

9 parts Paid Up Additions (PUA, or pre-bought insurance)

1 part base premium

The PUA portion for the policy shows up as almost all cash in the policy while adding some death benefit.

9/20

By overfunding 85% of the cash you put into the policy shows up year ONE.

After 4-7 years you BREAK EVEN and have as much cash value as you put in.

After that, your money grows at 3-5% per year.

10/20

After 4-7 years you BREAK EVEN and have as much cash value as you put in.

After that, your money grows at 3-5% per year.

10/20

Here is a great video comparing how funding the policy different ways impacts the cash value from @ibcglobalinc

11/20

11/20

So why don’t insurance sales people sell it like this?

Commissions.

The larger the base premium the larger the commission. They get a commission from PUAs but it is much smaller.

Money can bring out the worst in people.

So what did I do?

12/20

Commissions.

The larger the base premium the larger the commission. They get a commission from PUAs but it is much smaller.

Money can bring out the worst in people.

So what did I do?

12/20

I got a few quotes from some SHADY salesman, but luckily found the people @ibcglobal.

Steve and his team are great.

13/20

Steve and his team are great.

13/20

I chose to go with @MassMutual because

-They are the biggest

-They are the least dependent on bonds (they own 60% bonds vs the industry average of 80%)

-They have historically great returns

-They are a mutual company, ie they are owned by the policy holders.

14/20

-They are the biggest

-They are the least dependent on bonds (they own 60% bonds vs the industry average of 80%)

-They have historically great returns

-They are a mutual company, ie they are owned by the policy holders.

14/20

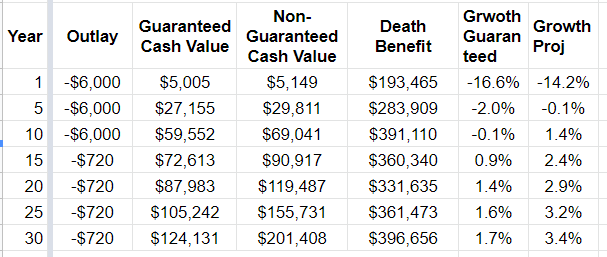

What does my policy look like?

I wanted to start small.

Based on my age the lowest my base premium could be was $720 per year.

I plan on putting in $6k a year for 10 years, and then base premium after that. If the illustration holds this is how it will preform.

15/20

I wanted to start small.

Based on my age the lowest my base premium could be was $720 per year.

I plan on putting in $6k a year for 10 years, and then base premium after that. If the illustration holds this is how it will preform.

15/20

How do I plan on using my policy?

1) First and foremost it will be my cash reserve / emergency fund.

Doing some research insurance companies can be more sound than banks.

https://twitter.com/UncommonYield/status/1328015346738081792?s=20

16/20

1) First and foremost it will be my cash reserve / emergency fund.

Doing some research insurance companies can be more sound than banks.

https://twitter.com/UncommonYield/status/1328015346738081792?s=20

16/20

2) A guarantee to my daughter that has special needs. I do not want her to be a burden on her brothers. This will not take care of all her needs, we also have a ABLE account for her, but it is a start.

17/20

17/20

3) I will use it to buy large purchases I used to buy with cash without interrupting compounding.

See below

https://twitter.com/UncommonYield/status/1329114087754768388?s=20

18/20

See below

https://twitter.com/UncommonYield/status/1329114087754768388?s=20

18/20

If you are not doing the following do not even consider CVWLI

1) Investing up to match for your 401(k) or 403(b)

2) Have term insurance to cover your family obligations

3) Maxing out your Roth IRA

4) Have 4-6 months of expenses in Cash for emergencies

19/20

1) Investing up to match for your 401(k) or 403(b)

2) Have term insurance to cover your family obligations

3) Maxing out your Roth IRA

4) Have 4-6 months of expenses in Cash for emergencies

19/20

It is hard to get everything across in a thread, I left ALOT out, so I’m working on an eBook. Stay tuned!

What do you think of concept?

If you made it this far you either

Hate it or Love it

Am I wrong?

Am I right?

Let me know your thoughts below.

20/20

What do you think of concept?

If you made it this far you either

Hate it or Love it

Am I wrong?

Am I right?

Let me know your thoughts below.

20/20

Read on Twitter

Read on Twitter