If 2020 has taught investors one thing, it’s that the Fed is all-powerful.

Except in fighting wealth inequality. A thread: https://www.bloomberg.com/opinion/articles/2020-12-31/the-fed-is-powerful-except-in-fighting-wealth-inequality?sref=nNOdD5kh

Except in fighting wealth inequality. A thread: https://www.bloomberg.com/opinion/articles/2020-12-31/the-fed-is-powerful-except-in-fighting-wealth-inequality?sref=nNOdD5kh

At its core, the Fed sets the level of interest rates in the economy.

Low rates (now) = higher prices for stocks and risky assets = the wealthiest profit

Higher rates (circa 2018) = higher U.S. Treasury yields = those who can afford to save the most (i.e. the wealthy) profit

Low rates (now) = higher prices for stocks and risky assets = the wealthiest profit

Higher rates (circa 2018) = higher U.S. Treasury yields = those who can afford to save the most (i.e. the wealthy) profit

In other words, as long as you have a sizable amount of money to begin with, monetary policy on its own is a win-win.

It’s tempting to paint the Fed as a villain always looking out for Wall Street. In reality, higher rates and tighter policy are hardly a great wealth equalizer.

It’s tempting to paint the Fed as a villain always looking out for Wall Street. In reality, higher rates and tighter policy are hardly a great wealth equalizer.

That’s not to say the Fed should escape criticism entirely. Buying high-yield ETFs, for instance, went way too far and defied all explanation: https://www.bloomberg.com/opinion/articles/2020-04-14/federal-reserve-s-high-yield-etf-buying-defies-explanation?sref=nNOdD5kh

But back to the topic at hand: wealth inequality.

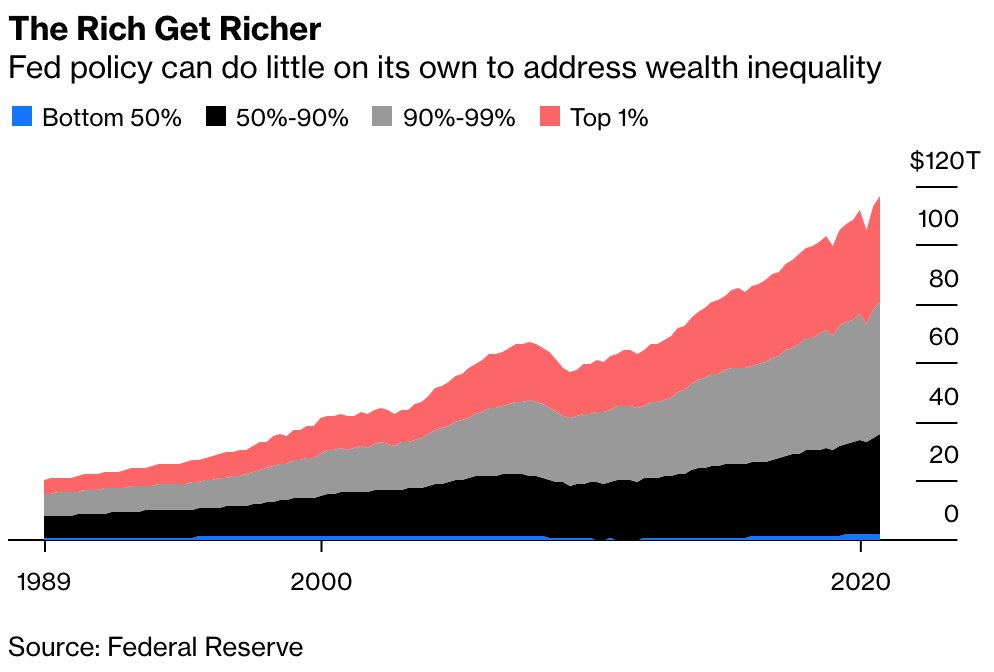

On an absolute basis, the wealth of the top 1% grew by almost **$6 trillion** just from March 31 through Sept. 30.

The total wealth of the bottom 50% is **$2.4 trillion**.

On an absolute basis, the wealth of the top 1% grew by almost **$6 trillion** just from March 31 through Sept. 30.

The total wealth of the bottom 50% is **$2.4 trillion**.

But dig a bit deeper and you find something interesting.

From 3/31 through 9/30, the overall wealth of Americans in the bottom half increased by more than 20%, the largest two-quarter jump since 2013. It was also a bigger boost than any of the other groups tracked by the Fed.

From 3/31 through 9/30, the overall wealth of Americans in the bottom half increased by more than 20%, the largest two-quarter jump since 2013. It was also a bigger boost than any of the other groups tracked by the Fed.

Yes, you read that right.

For all the massive financial-market gains, the top 1%, the top 10%, and the top 50% all didn’t see such a large relative boost to their overall wealth levels.

So, what happened?

For all the massive financial-market gains, the top 1%, the top 10%, and the top 50% all didn’t see such a large relative boost to their overall wealth levels.

So, what happened?

Fiscal policy. Specifically, the CARES Act.

This kind of legislation, targeted to support the most vulnerable Americans, has been the exception rather than the norm.

When it comes to wealth inequality, the foe is Congress. It has always been Congress. https://www.bloomberg.com/opinion/articles/2020-11-02/failure-on-fiscal-relief-will-widen-racial-inequality?sref=2o0rZsF1

This kind of legislation, targeted to support the most vulnerable Americans, has been the exception rather than the norm.

When it comes to wealth inequality, the foe is Congress. It has always been Congress. https://www.bloomberg.com/opinion/articles/2020-11-02/failure-on-fiscal-relief-will-widen-racial-inequality?sref=2o0rZsF1

We’re seeing this dynamic play out in real time with the debate over $2,000 stimulus checks and the impact that is having on the #GASen runoffs.

The level of government support during the Covid-19 crisis has made a big difference for a lot of families. https://www.bloomberg.com/opinion/articles/2020-12-17/fed-ends-with-a-whimper-can-georgia-cause-a-bang

The level of government support during the Covid-19 crisis has made a big difference for a lot of families. https://www.bloomberg.com/opinion/articles/2020-12-17/fed-ends-with-a-whimper-can-georgia-cause-a-bang

What happens when that targeted support isn’t there?

Research from the St. Louis Fed shows that the inflation-adjusted wealth gap widened between White households and Black and Hispanic ones since the global financial crisis. https://www.stlouisfed.org/on-the-economy/2020/november/real-state-family-wealth-covid19-racial-gaps

Research from the St. Louis Fed shows that the inflation-adjusted wealth gap widened between White households and Black and Hispanic ones since the global financial crisis. https://www.stlouisfed.org/on-the-economy/2020/november/real-state-family-wealth-covid19-racial-gaps

During that period, deficits declined as congressional Republicans reined in fiscal spending during Barack Obama’s final term. The Republican-led Congress also passed the Tax Cuts and Jobs Act of 2017 that skewed toward helping corporations and the wealthy.

Stocks liked both.

Stocks liked both.

But stocks also liked this year’s stimulus!

Some on Wall Street are optimistic that 2020 has changed the thinking on fiscal spending. Yet there are ample reasons to be skeptical.

The big test will come later in 2021 when there’s not such a clear crisis. https://www.bloomberg.com/opinion/articles/2020-10-20/stocks-near-record-highs-are-tuning-out-covid-stimulus-concerns

Some on Wall Street are optimistic that 2020 has changed the thinking on fiscal spending. Yet there are ample reasons to be skeptical.

The big test will come later in 2021 when there’s not such a clear crisis. https://www.bloomberg.com/opinion/articles/2020-10-20/stocks-near-record-highs-are-tuning-out-covid-stimulus-concerns

Will politicians embrace their power to send funds to the unemployed and those in lower income brackets? Will they expand access to health care and education, and bring the nation's infrastructure up to 21st-century standards?

These are tough questions.

These are tough questions.

By contrast, the path ahead is simple for the Fed: It will keep rates near zero until the economy approaches full employment and inflation averages 2%.

It will do that regardless of whether wealth inequality grows even more extreme or reverses course. https://www.bloomberg.com/opinion/articles/2020-06-09/fed-needs-better-answers-on-runaway-markets-and-inequality

It will do that regardless of whether wealth inequality grows even more extreme or reverses course. https://www.bloomberg.com/opinion/articles/2020-06-09/fed-needs-better-answers-on-runaway-markets-and-inequality

So in some ways, 2020 taught us that the Fed is powerful — except in the one area that counts for putting the U.S. economy on more solid footing.

/end https://www.bloomberg.com/opinion/articles/2020-12-31/the-fed-is-powerful-except-in-fighting-wealth-inequality?sref=nNOdD5kh

/end https://www.bloomberg.com/opinion/articles/2020-12-31/the-fed-is-powerful-except-in-fighting-wealth-inequality?sref=nNOdD5kh

Read on Twitter

Read on Twitter