1/ My wrap-up thread of 2020 (pensions)

OK so many of you, myself included, would rather wish #GoodRiddance2020....but before we do I thought it would be useful to summarise all the important changes to pensions in the NHS. OK here goes....

OK so many of you, myself included, would rather wish #GoodRiddance2020....but before we do I thought it would be useful to summarise all the important changes to pensions in the NHS. OK here goes....

2/ Following extensive modelling by @TheBMA and publication of the @TheBMA Goldstone modeller in 2019, there was extensive lobbying of government about the unfairness of pension taxation, particularly the annual allowance. Several thousand members wrote to their MPs and there was

3/ an extensive media campaign. Many clinicians decided to http://www.modelyourpension.com and realised they were #payingtowork, and consequently were forced to reduce their additional work or decline extra sessions. @TheBMA called for #ScrapAAinDB (and treasury's own advisors - Office

4/ for Tax Simplification) agreed.

Government announced “a review of the taper” but @NHSEngland knew that would come too late to help winter 19/20 so devised a compensation scheme to allow doctors to work without worrying about AA. Wales followed, and Scotland offered their own

Government announced “a review of the taper” but @NHSEngland knew that would come too late to help winter 19/20 so devised a compensation scheme to allow doctors to work without worrying about AA. Wales followed, and Scotland offered their own

5/ “recycling” scheme to allow members to keep employer contributions if forced out of the pension scheme through punitive taxes. Sadly NI government offered nothing at all.

6/ In Jan 20 @TheBMA took @Matthancock to the High Court about the scandalous ability for the SoS to be able to withhold pension if a member was CHARGED (not convicted) of a serious offence. Judge agreed this was “wrong in principle & inherently unfair”

7/ Mar 20 - budget. Mixed news- threshold & adjusted income both increased by £90k each taking many out of the taper, but minimum AA reduced to £4k from £10k making it even more punitive. Crucially AA still remained deeply unfair when combined with LTA https://twitter.com/goldstone_tony/status/1237733605566226433

8/ Many doctors with incomes far below the new threshold income will face tax bills as a result of exceeding the standard annual allowance, which remains at £40k. AA still remains a car crash of a tax- deeply unsuited to defined benefit schemes, @TheBMA continue to fight this.

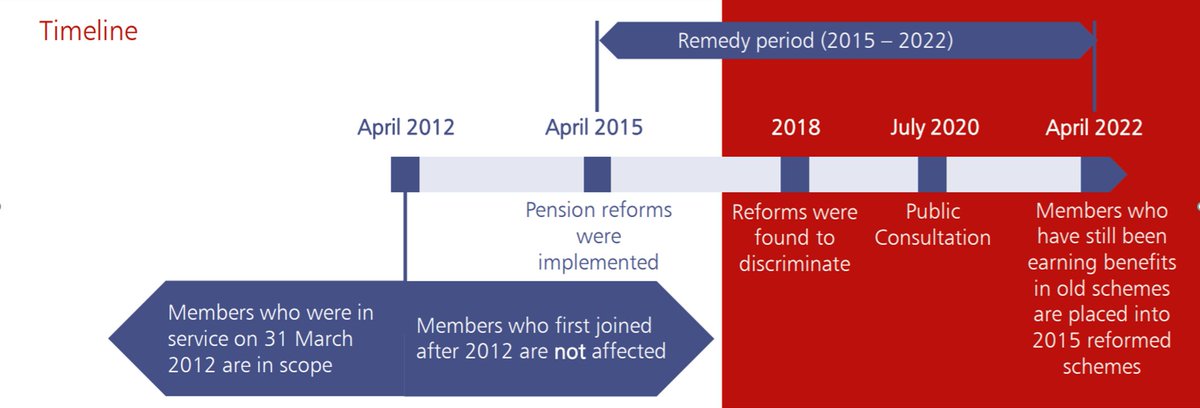

9/ July 2020- Government announced consultation into "McCloud" age discrimination. When the 2015 schemes were introduced, those within 10 yrs of retirement offered some protection to keep their old scheme. It was this protection, not the 15 scheme itself, that's discriminatory.

10/ Government must remedy this accross the entire public sector. After 2022, everyone will be put in the new reformed 2015 scheme. That leaves the period in between the scheme introduction - so from 2015-22 (7 years) as the "remedy period". Members will be offered a choice

11/ whether to have "legacy"(1995/08) or "reformed"(2015) benefits during that 7 year period. You may think this is an easy decision- I promise you its not! For one you need to work out the AA tax position out accross 4 different regimens during that period! Many will need advice

12/ @TheBMA crafted a response to the consultation and there are 3 important themes

1) Strong support for "DCU"- deffered choice underpin - this means you get to choose which pension is best at retirement. Basically it means if gvmnt move goalposts, you always get best pension

1) Strong support for "DCU"- deffered choice underpin - this means you get to choose which pension is best at retirement. Basically it means if gvmnt move goalposts, you always get best pension

13/

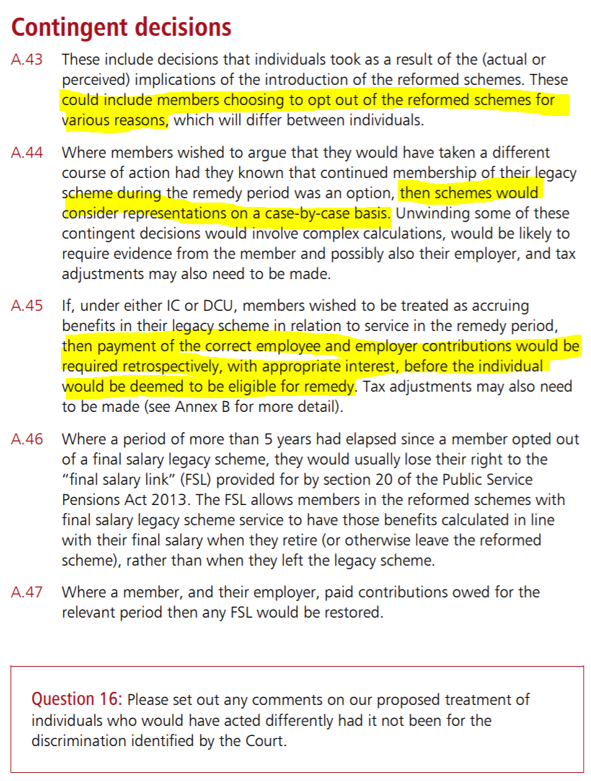

2) Treatment of so-called "contingent decisions" i.e. members who made decisions (i.e. opt outs) based on the discrimination. They should automatically get a remedy, not a "case by case" basis

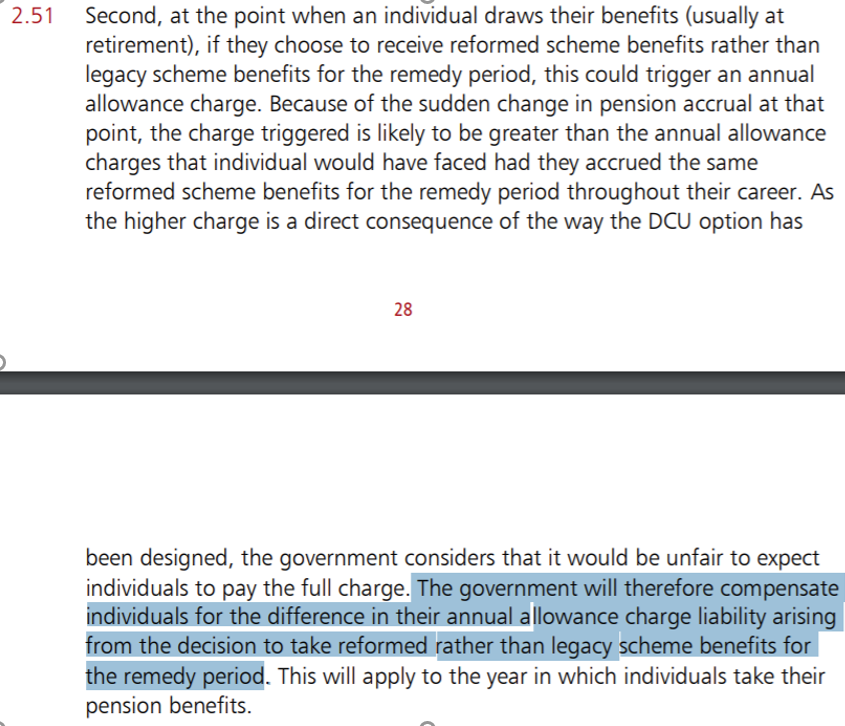

3) Finally government talk of "compensation" if people take reformed scheme at

2) Treatment of so-called "contingent decisions" i.e. members who made decisions (i.e. opt outs) based on the discrimination. They should automatically get a remedy, not a "case by case" basis

3) Finally government talk of "compensation" if people take reformed scheme at

14/ "DCU" - must ensure this fully compensates for AA charges if choosing "reformed" vs "legacy" benefit.

And of course a HUGE thank you to the 4500+ people that used @TheBMA tool to respond to the consultation. Dont waste money on solicitors BTW, @TheBMA has your back on this.

And of course a HUGE thank you to the 4500+ people that used @TheBMA tool to respond to the consultation. Dont waste money on solicitors BTW, @TheBMA has your back on this.

15/ And in December 20 @TheBMA have been working with our legal team and NHSE/I to finalise the details of the 19/20 AA compensation scheme in Eng/Wls

The scheme has been scrutinised by expert QCs in tax, employment & public law - it very valuable to you so don't miss out

The scheme has been scrutinised by expert QCs in tax, employment & public law - it very valuable to you so don't miss out

16/ Some very important deadlines to meet. There is a full step by step guide and some instructional videos here

Key deadlines:

1) Scheme pays- July 21

2) Application form- Mar 22

Dont miss them, #UseItorLoseit https://twitter.com/goldstone_tony/status/1336044152228876291?s=20

Key deadlines:

1) Scheme pays- July 21

2) Application form- Mar 22

Dont miss them, #UseItorLoseit https://twitter.com/goldstone_tony/status/1336044152228876291?s=20

17/ So all in all its been an eventful year in pensions (and for other reasons!). @TheBMA pensions committee @Vish_Sharm @Krishanx have been working extremely harm to secure these

19/20 compo scheme

19/20 compo scheme

2020 budget raised TI/AI

2020 budget raised TI/AI

Ongoing McCloud remedy discussions

Ongoing McCloud remedy discussions

19/20 compo scheme

19/20 compo scheme 2020 budget raised TI/AI

2020 budget raised TI/AI Ongoing McCloud remedy discussions

Ongoing McCloud remedy discussions

18/ So what's next in 2021

We are concerned that

High rate relief removed ENTIRELY by tiering (not justified in CARE @nhs_pensions)

High rate relief removed ENTIRELY by tiering (not justified in CARE @nhs_pensions)

(Non existent) relief removed AGAIN by AA / Taper

(Non existent) relief removed AGAIN by AA / Taper

(Non existent) relief removed AGAIN by LTA

(Non existent) relief removed AGAIN by LTA

And THEN you are taxed on pension

And THEN you are taxed on pension

We are concerned that

High rate relief removed ENTIRELY by tiering (not justified in CARE @nhs_pensions)

High rate relief removed ENTIRELY by tiering (not justified in CARE @nhs_pensions) (Non existent) relief removed AGAIN by AA / Taper

(Non existent) relief removed AGAIN by AA / Taper (Non existent) relief removed AGAIN by LTA

(Non existent) relief removed AGAIN by LTA And THEN you are taxed on pension

And THEN you are taxed on pension

19/ We think that is  % unfair

% unfair

There is currently a review of "tiering" in the scheme which we are feeding into. You can't remove all higher rate relief by one mechanism, and then take the same £1 of relief away by other additive methods.

Something has to change.

% unfair

% unfairThere is currently a review of "tiering" in the scheme which we are feeding into. You can't remove all higher rate relief by one mechanism, and then take the same £1 of relief away by other additive methods.

Something has to change.

20/ Clinicians under unprecented winter pressures & COVID really shouldn't be dealing with this hideously complex & thoroughly unfair tax. Do the right thing

@RishiSunak & #ScrapAAinDB as per OTS

Wishing everyone a better 2021. Pls stay safe!

Please RT & share with colleagues

@RishiSunak & #ScrapAAinDB as per OTS

Wishing everyone a better 2021. Pls stay safe!

Please RT & share with colleagues

Read on Twitter

Read on Twitter