This is clearly missing an 'Empire of Repo' book. https://twitter.com/archanaupa/status/1344349748376043521

Empire of Repo: monetary plumbing in the age(s) of financial globalisation.

US version, with a bit more ooomph:

Empire of Repo

The Plumbers that changed the World of Finance.

Empire of Repo

The Plumbers that changed the World of Finance.

Chapter 1. Repo Wild Wild West

when the German banker Paul Warburg argued that the US financial system did ‘violence to every banking tenet held sacred in the Old World’, he referred to the US repo (then call) market.

when the German banker Paul Warburg argued that the US financial system did ‘violence to every banking tenet held sacred in the Old World’, he referred to the US repo (then call) market.

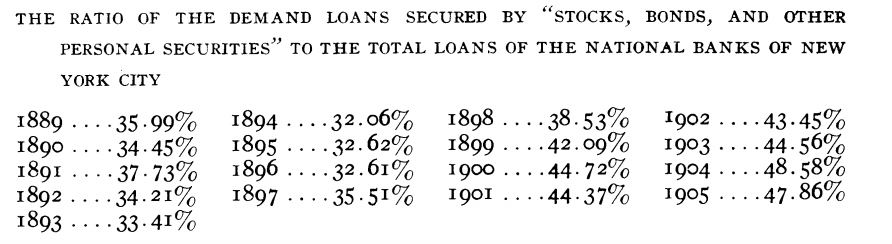

Anna Youngmann (1906) described this as 'financial banking' that powered leverage on the NYSE.

She could have termed it shadow banking, the mechanics were identical, and so were the main actors (JP Morgan, Citi).

She could have termed it shadow banking, the mechanics were identical, and so were the main actors (JP Morgan, Citi).

to defend themselves against accusations that they were ruthless speculators, Repo Pioneers argued that they merely provided safe assets to a world without a central bank or deposit guarantees.

The 1933 Pecora Commission basically killed the US repo market, giving the Fed powers to regulate call market, including haircuts/rehypothecation and severly restricting market-based finance

not for long though.

not for long though.

Chapter 3. Repo Returns: Salomon Brothers vs the (monetarist) Federal Reserve.

A tale of intraday liquidity https://www.ft.com/content/4da3a0c1-472c-45bb-8c3b-ff395eca67fa

A tale of intraday liquidity https://www.ft.com/content/4da3a0c1-472c-45bb-8c3b-ff395eca67fa

Chapter 4. Repo seduces the Bundesbank and paves the way for 'Whatever it takes' 10 years later. https://www.tandfonline.com/doi/abs/10.1080/09692290.2016.1207699

Chapter 5: The end of empire? Lehman and its aftermath.

Chapter 6. The predictable failure of the Rebel Alliance*

*the Financial Stability Board, the European Commission (FTT) and some lost central bankers (Jeremy Stein)

*the Financial Stability Board, the European Commission (FTT) and some lost central bankers (Jeremy Stein)

Chapter 7. Empire strikes back (brought to you by PIMCO). https://www.ft.com/content/c784b7f5-6a07-4500-bb4a-da4f95f891f8

Read on Twitter

Read on Twitter