1/x EOY Review thread.

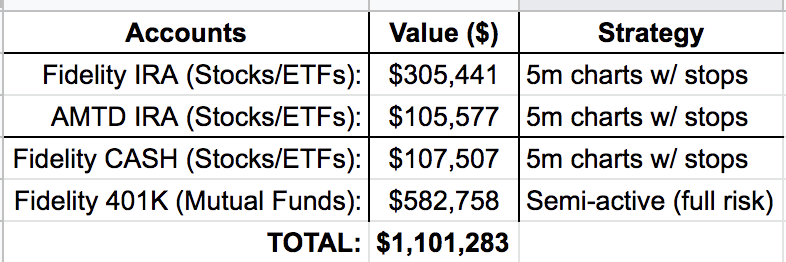

Goal for the yr was to compound daily to $1m in total investments (which hit in late fall), added another $100k in Dec. Unlike alot on here, I'm not selling anything; I have no subs boosting my returns or ulterior motive. This thread is my review of the yr.

Goal for the yr was to compound daily to $1m in total investments (which hit in late fall), added another $100k in Dec. Unlike alot on here, I'm not selling anything; I have no subs boosting my returns or ulterior motive. This thread is my review of the yr.

2/x

Honestly, I didn't think I'd get here in March. I realize market conditions were a big boost to my returns. I also realize I'm not the biggest trader on here (not even close), I'm not the best trader on here (far from it). I'm just sharing what actually happened in my yr.

Honestly, I didn't think I'd get here in March. I realize market conditions were a big boost to my returns. I also realize I'm not the biggest trader on here (not even close), I'm not the best trader on here (far from it). I'm just sharing what actually happened in my yr.

3/x

I don't post P&L often. Main focus is on execution, 2nd focus is learning & improving. Daily P&L is a distraction to me - doesn't help me or you to constantly post P&L (just my 2c). If you focus on execution, gains will follow. If I can do this, then anyone can do the same.

I don't post P&L often. Main focus is on execution, 2nd focus is learning & improving. Daily P&L is a distraction to me - doesn't help me or you to constantly post P&L (just my 2c). If you focus on execution, gains will follow. If I can do this, then anyone can do the same.

4/x

I'm like a turtle compared to some of you options pros. My biggest day was +8% (small acct). Most days, only 0.5-1.5% - some sharp red days, too. But I am a consistent turtle! ~1% per day compounded adds up.

Here's an ex. I posted earlier in the yr. Real life not as smooth.

I'm like a turtle compared to some of you options pros. My biggest day was +8% (small acct). Most days, only 0.5-1.5% - some sharp red days, too. But I am a consistent turtle! ~1% per day compounded adds up.

Here's an ex. I posted earlier in the yr. Real life not as smooth.

5/x

Prior to 2020, I mostly traded swings on 30m charts (& LT investments). This is my 1st yr actively trading (well 3/4 of a yr). There's a theory of 10k reps to become an expert. Got a lot of practice & screen time this yr - partly b/c of pandemic which helped me improve.

Prior to 2020, I mostly traded swings on 30m charts (& LT investments). This is my 1st yr actively trading (well 3/4 of a yr). There's a theory of 10k reps to become an expert. Got a lot of practice & screen time this yr - partly b/c of pandemic which helped me improve.

6/x

In March, nothing was working for me & I was getting my butt kicked. Swings were getting killed as soon as I put them on. I was trading short as well - but that wasn't easy either. Along came #thestrat & that was the *only* thing that worked for a while (other than LT buys).

In March, nothing was working for me & I was getting my butt kicked. Swings were getting killed as soon as I put them on. I was trading short as well - but that wasn't easy either. Along came #thestrat & that was the *only* thing that worked for a while (other than LT buys).

7/x

I didn't think I could trade 80 $VIX, but I could w/ #thestrat. Started w/ selling at horizontal resistance...but ended up leaving lots of $$$ on the table by late Spring. Forced myself to write "sold too early" on here for about 4 wks before annoying myself enough to change.

I didn't think I could trade 80 $VIX, but I could w/ #thestrat. Started w/ selling at horizontal resistance...but ended up leaving lots of $$$ on the table by late Spring. Forced myself to write "sold too early" on here for about 4 wks before annoying myself enough to change.

8/x

15m charts worked great for a while, ideally scaling at upper rail of BF & trailing the rest. Then something change in Oct & stops were killing me. Switched to 5m & instantly had better control of risk & saw immediate improvement. Again, main focus on execution - not P&L.

15m charts worked great for a while, ideally scaling at upper rail of BF & trailing the rest. Then something change in Oct & stops were killing me. Switched to 5m & instantly had better control of risk & saw immediate improvement. Again, main focus on execution - not P&L.

9/x

Didn't think I could trade 5m charts w/ charts w/ the volume that I trade, but it turns out that I can w/ trail stops. My system is scalable, too. I added a 3rd acct mid-summer. Never would be able to trade 3 accts simultaneously in the volume that I do w/o trail stops.

Didn't think I could trade 5m charts w/ charts w/ the volume that I trade, but it turns out that I can w/ trail stops. My system is scalable, too. I added a 3rd acct mid-summer. Never would be able to trade 3 accts simultaneously in the volume that I do w/o trail stops.

10/x

Sizing trades & trailing stops by ATR helps take emotion out of trades (still a work in progress for me). Also, I found %trail stops keep up w/ fast price moves better than a fixed $ TS (b/c math). Trail stops worked very well for me. Do what works best for YOU. It's your $.

Sizing trades & trailing stops by ATR helps take emotion out of trades (still a work in progress for me). Also, I found %trail stops keep up w/ fast price moves better than a fixed $ TS (b/c math). Trail stops worked very well for me. Do what works best for YOU. It's your $.

11/x

I found it harder to grow a larger acct - mostly mental, but also "good faith violations" held me back. Never ran into these violations before swing trading - basically just means trades are slower to clear which means I can't use all of my capital.

I found it harder to grow a larger acct - mostly mental, but also "good faith violations" held me back. Never ran into these violations before swing trading - basically just means trades are slower to clear which means I can't use all of my capital.

12/x

The mental part of a larger acct is that my spreadsheet would tell me to buy $50K (max) of stock XYZ, but I'd only start w/ $5K or $10K. To compensate for that, I'd end up trading a ton of names (probably too many). I need to work on that for next yr. Working on goals now.

The mental part of a larger acct is that my spreadsheet would tell me to buy $50K (max) of stock XYZ, but I'd only start w/ $5K or $10K. To compensate for that, I'd end up trading a ton of names (probably too many). I need to work on that for next yr. Working on goals now.

13/x

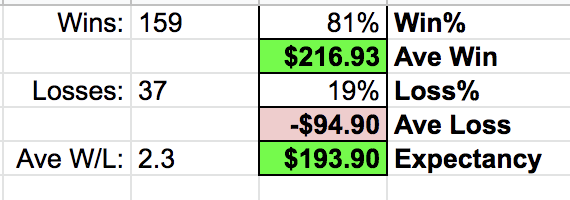

Trading metrics were a big help to me this yr. Never used them before - highly recommend. I can push %win >80% by selling at horizontal resistance, but overall max profitability is from holding winners longer (so ave win/ave loss). This is data from 1 of my smaller accts.

Trading metrics were a big help to me this yr. Never used them before - highly recommend. I can push %win >80% by selling at horizontal resistance, but overall max profitability is from holding winners longer (so ave win/ave loss). This is data from 1 of my smaller accts.

14/x

So, in 10 trades, I'm "winning" ~8/10 trades (2/10 losers). The winners mostly take care of themselves. 1 small loser - no big deal. Biggest problem of 2020 was 1 big(ger) loser. If I can reduce or eliminate bigger loser - my metrics would be much better. Made progress w/ 5m

So, in 10 trades, I'm "winning" ~8/10 trades (2/10 losers). The winners mostly take care of themselves. 1 small loser - no big deal. Biggest problem of 2020 was 1 big(ger) loser. If I can reduce or eliminate bigger loser - my metrics would be much better. Made progress w/ 5m

15/x

There's a place in my portfolio for LT holdings. In a market that's going straight up, it can be hard for trading accts to keep up (at least for me). Best system that I've found is buying severely oversold conditions & holding for LT.

There's a place in my portfolio for LT holdings. In a market that's going straight up, it can be hard for trading accts to keep up (at least for me). Best system that I've found is buying severely oversold conditions & holding for LT.

16/x

Best trade of the yr was buying a mutual fund (FGCKX) on 3/12 & holding all yr. Worst trade was buying $ARKW at 44.21 & selling out for a $2K gain. That probably bothers me the most. Note I was in $LK runner for the fraud report - lost $1.6K on that. That was just annoying.

Best trade of the yr was buying a mutual fund (FGCKX) on 3/12 & holding all yr. Worst trade was buying $ARKW at 44.21 & selling out for a $2K gain. That probably bothers me the most. Note I was in $LK runner for the fraud report - lost $1.6K on that. That was just annoying.

17/x

Sorry for the long thread. Will post some 2021 goals in the next few days & cover more trading stuff there. Again, main focus on execution, trading clean + gains will follow (whatever your methodology). If I can do this, so can anyone else that makes it a goal & works hard.

Sorry for the long thread. Will post some 2021 goals in the next few days & cover more trading stuff there. Again, main focus on execution, trading clean + gains will follow (whatever your methodology). If I can do this, so can anyone else that makes it a goal & works hard.

Read on Twitter

Read on Twitter