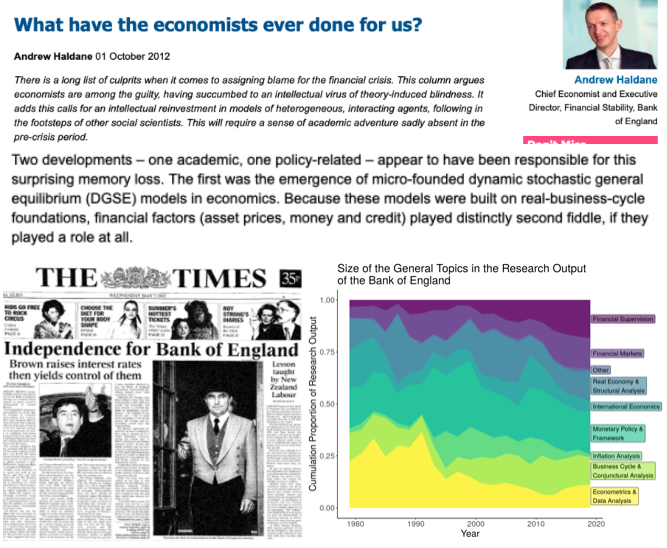

1/Since 2008, calling out use of (some) econ models by central banks has become as steady as Big-Ben chime

But what do we know about import, production & use of econ research in policy institutions?

Christmas thread on excavating academia-policy pipeline at the Bank of England

But what do we know about import, production & use of econ research in policy institutions?

Christmas thread on excavating academia-policy pipeline at the Bank of England

2/ thread is based on research with @jcaacostamacia @claveau_f @clemfon @AGoutsmedt & @cescoeco and funded by @RebuildMacro (paper to be put online shortly)

I'm however sole responsible for selective narration & for those moments when storytelling takes over analytical nuance

I'm however sole responsible for selective narration & for those moments when storytelling takes over analytical nuance

3/ We did this research to fill a gap between :

-histories of macroeconomic models focused on *progress* (or regress) in overcoming theoretical, empirical & technical hurdles, usually within academia, which assumed these models are then transferred to policy institutions

and

-histories of macroeconomic models focused on *progress* (or regress) in overcoming theoretical, empirical & technical hurdles, usually within academia, which assumed these models are then transferred to policy institutions

and

4/ -histories pointing to ‘scientization’ of central banks (aka growing reliance on economists & their science for policy decisions)

yet arguing that ‘science’ is mostly used to conceal political aspects of decisions, wield power, expand governance regimes or grow reputations…

yet arguing that ‘science’ is mostly used to conceal political aspects of decisions, wield power, expand governance regimes or grow reputations…

5/ …. beliefs that policy decisions can be improved through relying on econ science are not considered – you don’t need to agree to build these beliefs into your story

Other lit is histories of central banks, many great ones but focused on decision-makers, not in house research

Other lit is histories of central banks, many great ones but focused on decision-makers, not in house research

6/ We combined archives, interviews & quantitative analysis of BoE staff & their output to study

-why BoE executives felt that they needed ‘research’ from 60s onward

-how staff developed some research lines

-how these have been used in policy-decision process (or neglected)

-why BoE executives felt that they needed ‘research’ from 60s onward

-how staff developed some research lines

-how these have been used in policy-decision process (or neglected)

7/ 3 caveats:

-we document uses of research, not influence. That's quite different

-our object is ‘research’ rather than ‘expertise’, which requires claim for epistemic superiority. In our case, epistemic battles were often overshadowed by hierarchical structures

-we document uses of research, not influence. That's quite different

-our object is ‘research’ rather than ‘expertise’, which requires claim for epistemic superiority. In our case, epistemic battles were often overshadowed by hierarchical structures

-nor is our object ‘knowledge.’ There are many types of knowledge produced by BoE beyond analytical ones. See for instance this cool paper on uses of Agents’ economic reports https://www.bankofengland.co.uk/working-paper/2020/monetary-policy-and-the-management-of-uncertainty-a-narrative-approach

So here's our story of econ research at the Bank of England (BoE)

So here's our story of econ research at the Bank of England (BoE)

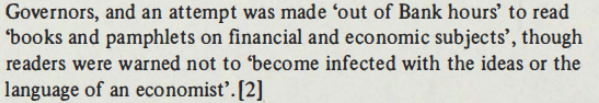

9/ What most histories note is that BoE DNA was to be a bank, not a research institution, meant to ‘decide’, not ‘think’ & to use practical feel for markets rather than analytical knowledge of the economy

Pre-history of research was need for more statistics & business survey...

Pre-history of research was need for more statistics & business survey...

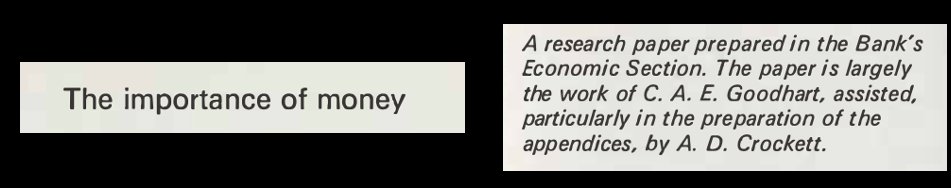

10/ Though gov+HMTreasury were in charge of monetary policy, late 60s, BoE officials felt they needed 2 types of analytical knowledge

(1)on behavior, types & effects of monetary aggregates: they wanted to mature a stance toward “applied monetarism” & recruited Charles Goodhart

(1)on behavior, types & effects of monetary aggregates: they wanted to mature a stance toward “applied monetarism” & recruited Charles Goodhart

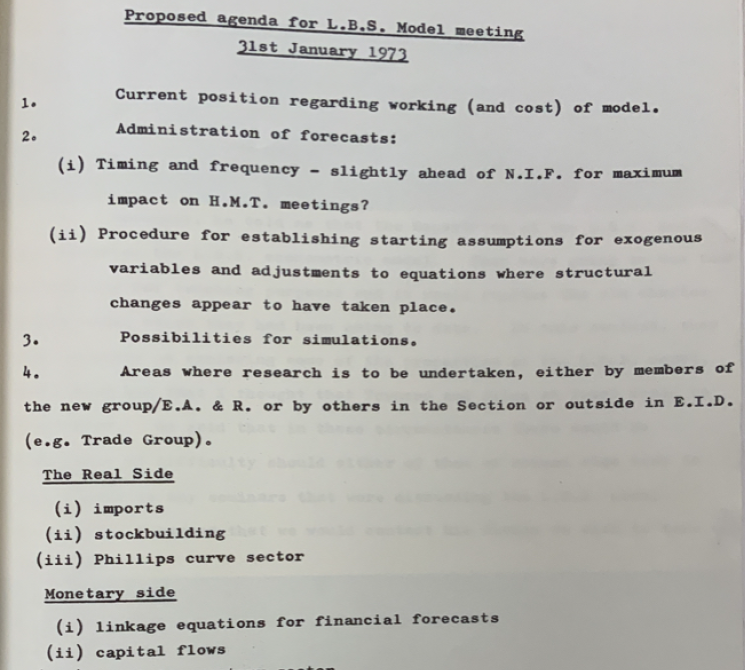

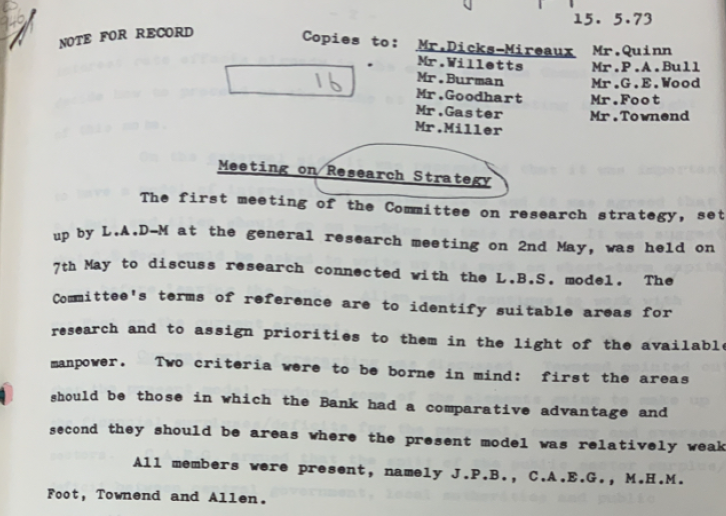

11/ (2)on evolution of macro aggregates. Developing in-house forecasting & policy simulation facilities would help them counteract the influence of HM Treasury, they felt, so they bought a macroeconometric model from LBS & set up Consultants Panel (story https://twitter.com/Undercoverhist/status/1183731770539282435)

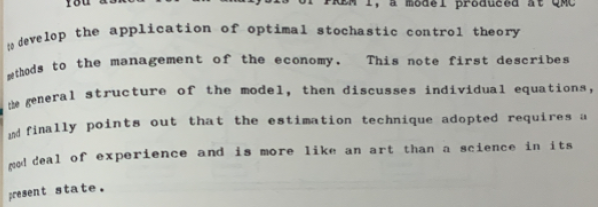

Recruits of new ‘Economic Division’ were however not quite sure that they were doing 'research'

they felt understaffed, undertrained, merely offering “artistic” estimation procedures

1980s were spent refining behavioral equation, transmission channels, estimation techniques

they felt understaffed, undertrained, merely offering “artistic” estimation procedures

1980s were spent refining behavioral equation, transmission channels, estimation techniques

13/J. Flemming, 1st Econ Division head w/ academic stature, lured edgy UK econometricians like Hall, Henry, Miles, etc. They brought rational expectations primarily for empirical consistency reasons, w/ officials acquiescing bc they didn’t want models w/ always mistaken agents

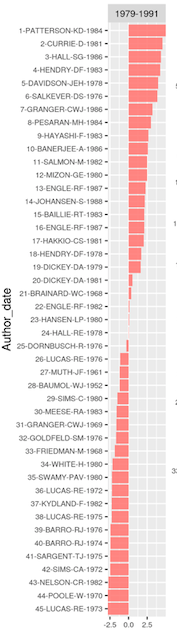

14/What BoE researched cited compared w/ other central bank econs highlights US new classical undercite & UK econometrics (Hendry’s LSE approach) overbite

(note:rather than nth paper on Lucas, systematic account of many reasons why econs endorsed Ratex in 1980s is much needed)

(note:rather than nth paper on Lucas, systematic account of many reasons why econs endorsed Ratex in 1980s is much needed)

15/ These were the years of high econometrics at the Bank, as seen in relative & short-lived bump in academic pubs/research WP

Paradoxically, it was lack of systematic importance of econ research for decision-makers that allowed pursuit of academically oriented research agenda

Paradoxically, it was lack of systematic importance of econ research for decision-makers that allowed pursuit of academically oriented research agenda

16/ Such research regime ended in 1992

-UK exited European Exchange Rate Mechanism, perceived failure triggered policy change

-inflation target was set w/ accompanying quarterly Inflation Report

-BoE reorganised itself anticipating operational independence (granted 1997)…

-UK exited European Exchange Rate Mechanism, perceived failure triggered policy change

-inflation target was set w/ accompanying quarterly Inflation Report

-BoE reorganised itself anticipating operational independence (granted 1997)…

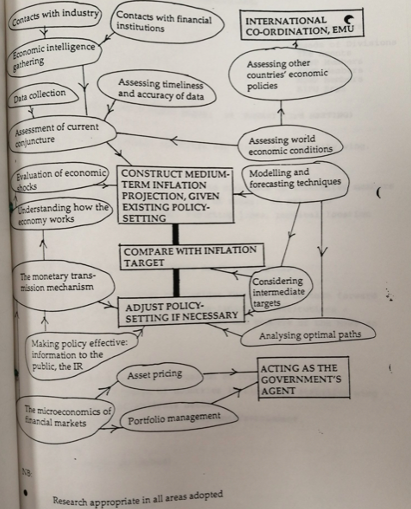

17/ ….around 2 wings/missions: Monetary Stability (MS) & Financial Stability (FS).

Yet financial wing's missions were subsumed to monetary stability mission (see centrality on 1994 figure)

Moreover, 2 wings exhibited ≠ combination of operational & analytical skills...

Yet financial wing's missions were subsumed to monetary stability mission (see centrality on 1994 figure)

Moreover, 2 wings exhibited ≠ combination of operational & analytical skills...

18/ FS “did not do much conceptual research”, or, more exactly, some “a la carte”

Its supervision duties were transferred to a Financial Services Authority in 1997 (to governor's utter dismay), Financial Stability nevertheless launched & maintained a Financial Stability Review

Its supervision duties were transferred to a Financial Services Authority in 1997 (to governor's utter dismay), Financial Stability nevertheless launched & maintained a Financial Stability Review

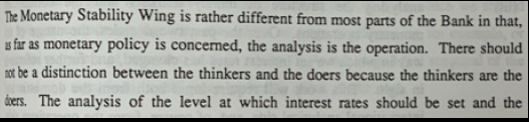

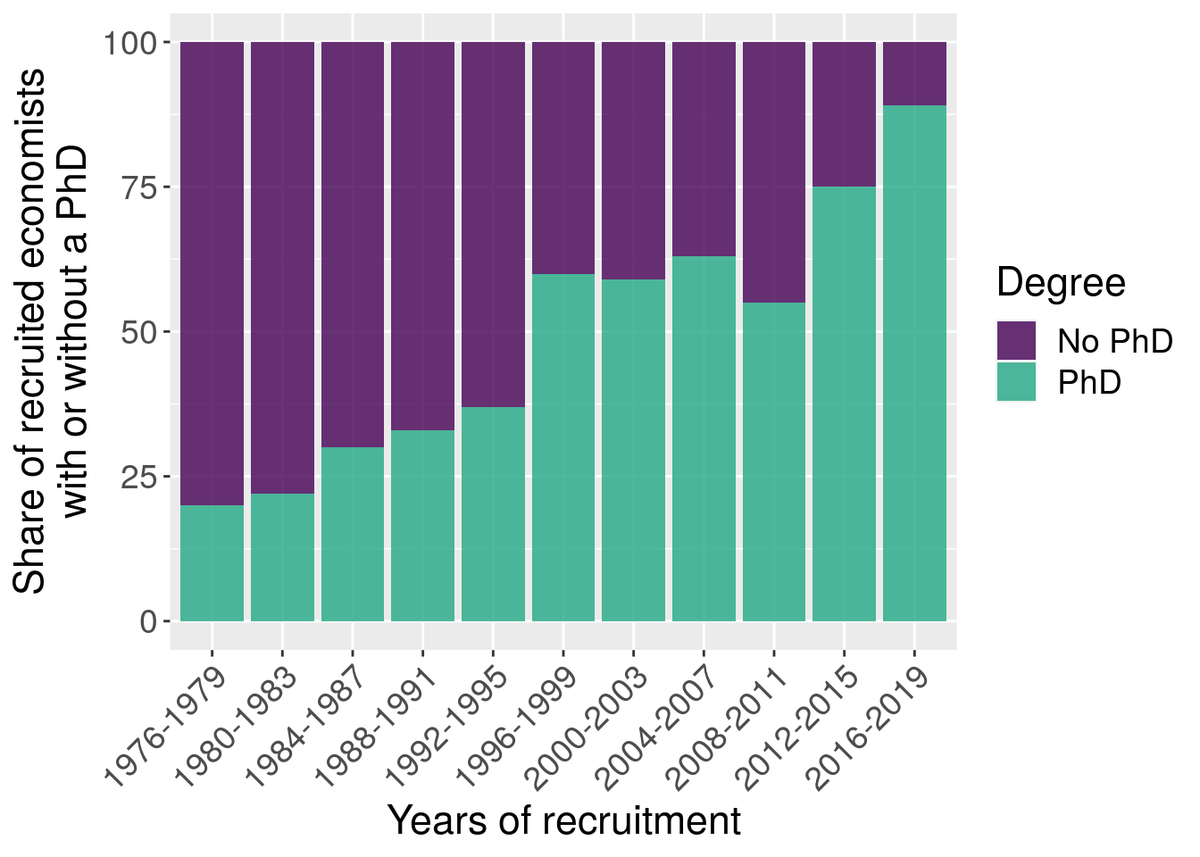

19/ by contrast, Monetary Analysis had recruited a man w/ a plan, who insisted that “the doers are the thinkers" and that recruits needed highest academic credentials

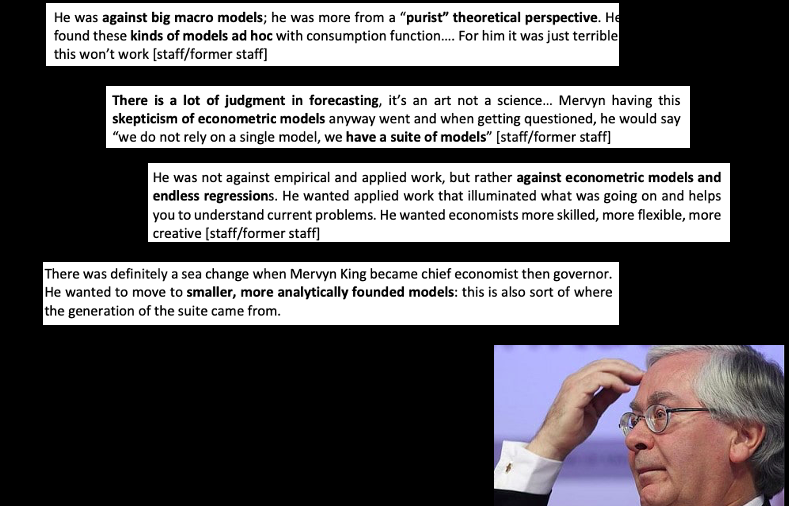

A reputed tax microeconomist, Mervyn King was seen as having clear vision on content & use of macro models:

A reputed tax microeconomist, Mervyn King was seen as having clear vision on content & use of macro models:

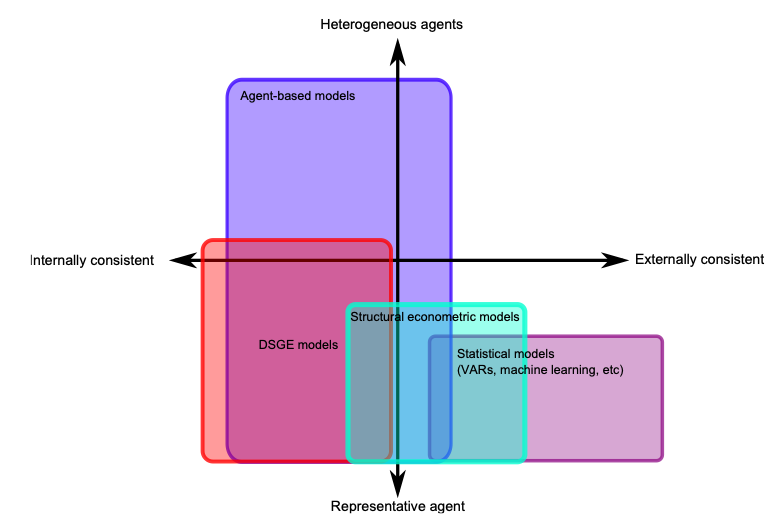

20/ As elsewhere in policy circles, King insisted that models needed to be properly microfouded & slimmer than previous large scale generations

As elsewhere, hybrid more than substitute new macroeconometric models were conceived

At BoE, new model BEQM rolled out in 2000s

As elsewhere, hybrid more than substitute new macroeconometric models were conceived

At BoE, new model BEQM rolled out in 2000s

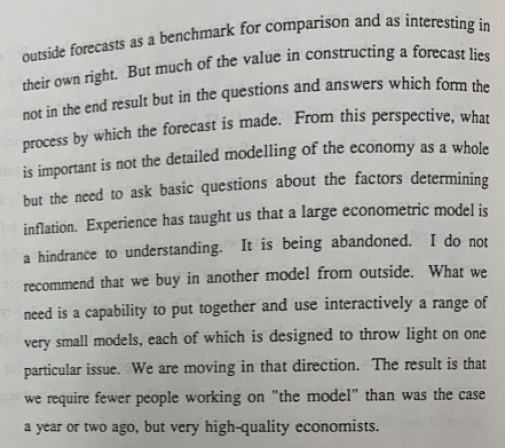

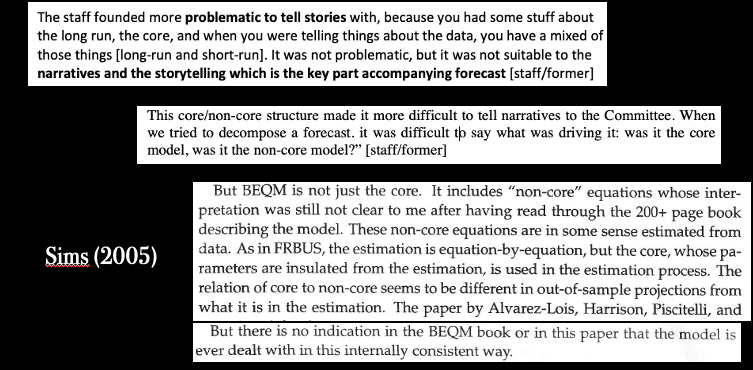

21/ What King & others officials insisted on what that BoE models should be judged by ability to “tell consistent stories about the economy”

(note:what we chased is not most faithful representation of King’s actual views, but how staff perceived it. 1994 quote below is by him)

(note:what we chased is not most faithful representation of King’s actual views, but how staff perceived it. 1994 quote below is by him)

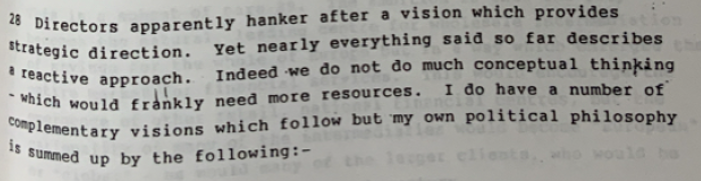

22/ BUT b/c Monetary Policy Committee (MPC) members operated in a radically uncertain context, King also emphasized, their decisions should not be taken on the basis of single model

What was needed was more a “suite” of models, combined with judgment. Fan charts were introduced

What was needed was more a “suite” of models, combined with judgment. Fan charts were introduced

23/ (the suite King & others -here Whitley- advocated was initially considered a rethorical device. Models listed below all existed, didn’t enter inflation forecasting & decision process. In next decades, under leadership of Simon Price & others, it evolved into a decision tool)

24/ King's vision infused staff modeling culture

they defended hybrid core/non core BEQM against attacks by Sims on lack of empirical consistency on grounds that central banking models should be judged by storytelling ability

but BoE officials also found structure confusing

they defended hybrid core/non core BEQM against attacks by Sims on lack of empirical consistency on grounds that central banking models should be judged by storytelling ability

but BoE officials also found structure confusing

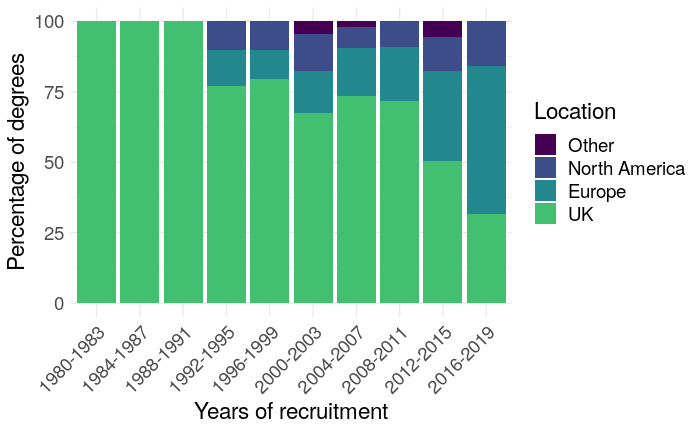

25/ King view therefore contributed to turn the Bank into a “monetary institute,” where more PhD econs recruited & some research emulating academic standards was produced on monetary policy & forecasting, but...

(figures are on BoE econs producing research, not all BoE econs)

(figures are on BoE econs producing research, not all BoE econs)

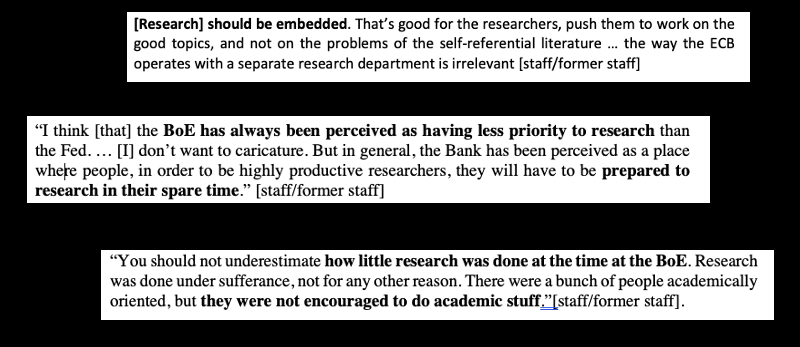

26/ …. staff wasn’t suppose to produce independent forecast & publish in academic journals

BoE research was meant to serve policy & was now de facto embedded in formal decision-making processes

In-house research became increasingly perceived as distant from academic debates

BoE research was meant to serve policy & was now de facto embedded in formal decision-making processes

In-house research became increasingly perceived as distant from academic debates

27/ Though MPC members increasingly interested in financial wing's research (figure below shows speeches picked up more fin research before crisis) primacy of FSA, research culture gaps & focus on monetary policy prevented systematic exchange, an issue highlighted by 2008 crisis

28/ Whether in-house research was used in 2008 crisis management & crisis reshaped research orientations is unclear (diverging interviews here)

Asset purchases were considered in 2000s research, by Yates & other on ZLB & Japan, mentioned in few speeches (fi by Paul Tucker)...

Asset purchases were considered in 2000s research, by Yates & other on ZLB & Japan, mentioned in few speeches (fi by Paul Tucker)...

29/ But team tasked w/ reviewing policy options late 2009 was soon asked to answer ‘how much QE’ instead

Workstreams paired staff from Monetary Analysis, & markets (operational staff) to rush to study implementation, legal aspects, auctions...

Workstreams paired staff from Monetary Analysis, & markets (operational staff) to rush to study implementation, legal aspects, auctions...

30/ .... but MPC members felt that BoE researchers lacked implementation skills. To complicate the story further, in wake of QE decision, MPCs offered diverging rationales for the policy – from money-pumping to risk-mitigating & portfolio rebalancing

31/QE then fueled stream of policy evaluation & distributional effects (see this new NBER paper on this lit https://www.nber.org/papers/w27849 )

Inflation forecasting was performed w/ new DSGE model COMPASS, which did not include a financial sector but was ebedded in a forecasting plateform

Inflation forecasting was performed w/ new DSGE model COMPASS, which did not include a financial sector but was ebedded in a forecasting plateform

32/Further incentive to align w/ academic frontier came from Carney’s ‘One Bak Research Agenda’, outlined in 2013, creation of independent Research Hub, international recruitment. Too early to assess results beyond standardization of recruitment

33/ Finally, chief econ Haldane’s appetence for wide array of modeling strategies & interdisciplinarity led to development of stable of Agent-Based Models by financial wing, though none of them (yet) embedded in systematic decision process (see Plassard https://ideas.repec.org/p/gre/wpaper/2020-30.html)

34/ Bottom line: in the case of the Bank of England, the academic frontier is only one of many factors shaping research through time, in combination with econ history, shifts in mandates, policy routines and policy-makers’ visions

35/ Academia-policy pipelines are sometimes long & circumvoluted. They need to be more systematically excavated & compared by historians, as well as discussed by economists, policy makers, medias & publics

Grateful to @RebuildMacro for allowing us to give it a try

/end/

Grateful to @RebuildMacro for allowing us to give it a try

/end/

needless to say: comments welcome

Read on Twitter

Read on Twitter