Deficit spending and easy money used to be a tool reserved for crises. It's now the default policy as the prevailing view is that there are only positive (stimulus/wealth effect) & no negative (if higher inflation comes, that's good) consequences to more debt and endless easing.

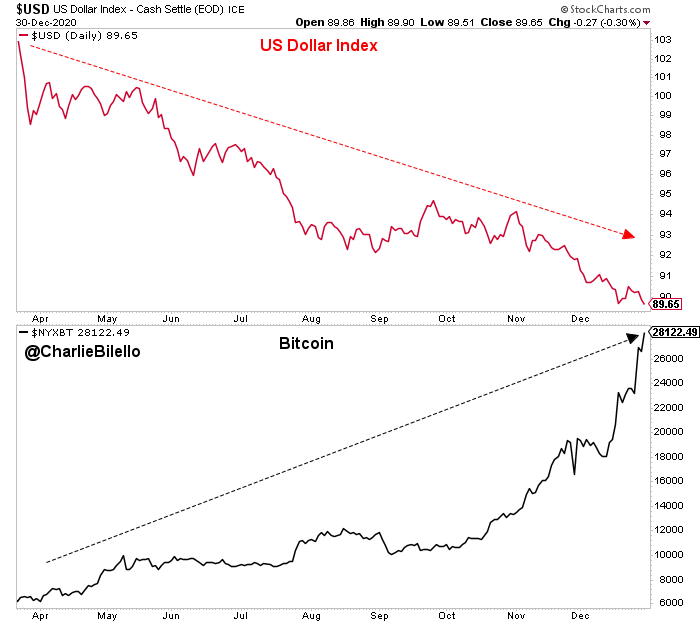

The less the Federal Government and the Federal Reserve care about the value of the dollars in your pocket, the less they are worth.

The best narrative in support of Bitcoin is that there should be an alternative to this centralized madness.

The best narrative in support of Bitcoin is that there should be an alternative to this centralized madness.

Read on Twitter

Read on Twitter