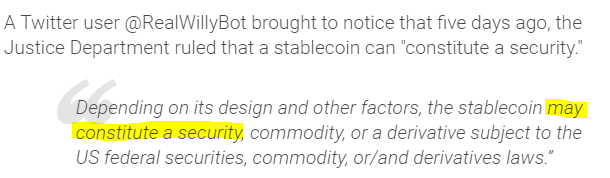

1/ $BTC's weekly RSI is at its highest point ever and we are going to get hit with the wall of fear soon. Tether fud is key in the crypto bullmarket playbook and it already started to raise it's head (notice how it's been rather quiet during the bear?) https://www.fxstreet.com/cryptocurrencies/news/us-treasury-to-consider-stablecoins-as-security-202012301155

2/ In order to climb the wall of fear, information, education and a cold observation of narratives is necessary. Tether fud served several functions in a bull market, one always was to keep retail from hiding in stable before larger corrections or at tops.

3/ Luckily today we have more options when it comes to stables but Tether is still dominant. It's also a rogue entity, hard to control and as one of the oldest crypto assets surprisingly (?) resilient. Is it a security? Let's check what assets are deemed securities in the USA:

4/ US courts apply the "Howey Test" in order to define securities. If a scheme "involves an investment of money in a common enterprise with profits to come solely from the efforts of others", the shares are usually deemed securities.

5/ Is there an investment of money? Is there an expectation of profits from the investment? Is the money invested into a common enterprise? Are the profits resulting from the efforts of a third party? To each of these I would tend to answer "No" in the case of USDT.

6/ I found a distinction from a class from the University of Alabama useful which describes securities as "an investment where one parts with his money in the hope of receiving profits from the efforts of others, and not where he purchases a commodity for a personal consumption.

7/ Again, Tether fits the personal consumption part quite well and personally I don't know anybody who buys Tether in the hope of receiving profits "from the efforts of others", despite the occasional arbitrage opportunity when it depegs from the dollar.

8/ But let's go to the source, the Securities Act of 1933. It defines a security as "any note, stock, treasury stock, security future, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, [...]

9/ collateral-trust certificate, pre-organization certificate or subscription, transferable share, investment contract, voting-trust certificate, certificate of deposit for a security, fractional undivided interest in oil, gas, or other mineral rights, any put, call, [...]

10/ straddle, option, or privilege on any security, certificate of deposit, or group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, [...]

or privilege entered into on a national securities exchange relating to foreign currency,[...]or any certificate of interest or participation in, temporary or interim certificate for, receipt for, guarantee of or warrant or right to subscribe to or purchase any of the foregoing."

12/ Tether lacks the profit-sharing, transferable share and voting criteria for starters. You will notice how derivatives on currencies are considered securities, currencies themselves aren't. A stablecoin doesn't have to be considered a de-facto currency but it's closest to it.

13/ Another element to consider is that the CFTC considers cryptocurrencies as commodities. ( https://twitter.com/Stillm4n/status/1344030231124914178) Certain utility tokens that ICOed have been successfully deemed securities by the SEC but so far it's only a few and they all exhibit distinct properties.

14/ I am referencing the CFTC in order to point out how the SEC doesn't operate in a vaccum. The regulators (imo) are also struggling over spheres of influence. Based on the Howey Test and the Securities Act, an interested party could stand a good chance against the SEC in court.

15/ Now that we established some of the facts, let's get back to the crypto markets. This timing is by no means a coincidence. It's a "precursor to shakeouts" as @Swingularities put it in a conversation I had with him. And it's going to make the shakeout more effective.

16/ This time around Tether fud is also going to have the added benefit of strengthening the fully regulated stable offered by the Winklevoss twins while potentially damaging a hard to control rogue asset that has proven to be very resilient over the years.

17/ The actions against XRP fulfill a specific role in this bull market too (there is merit to the claim that alts can't enter a bull market while "everybody is in them and waiting". Stripping a retail demographic of their capital & scaring others creates necessary fundamentals.

18/ Take these musings with a grain of salt as I am no lawyer. This is my layman understanding after reading up on US regulations a bit over the years combined with general observations of crypto market cycles.

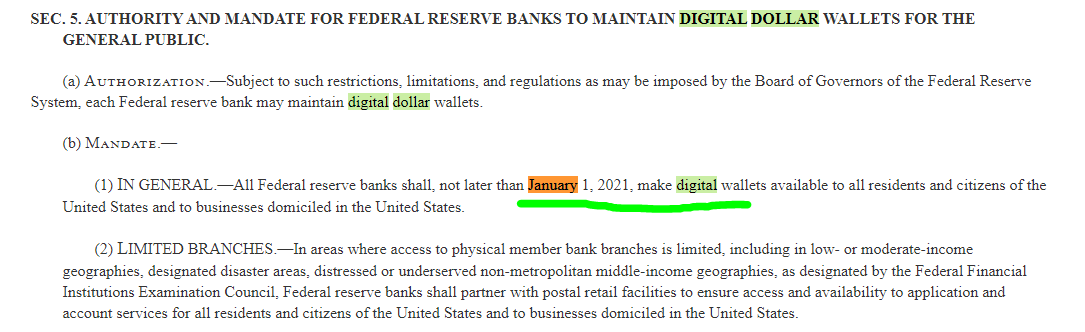

19/ Addendum: While at least to me it looks like the case for stables being securities is weak. An increase in regulatory scrutiny is likely. There is a strong motivation to make the Central Bank Digital Currencies the go to digital money:

https://www.congress.gov/bill/116th-congress/senate-bill/3571/text?q=%7B%22search%22%3A%5B%22%5C%22digital+dollar%5C%22%22%5D%7D&r=1&s=1

https://www.congress.gov/bill/116th-congress/senate-bill/3571/text?q=%7B%22search%22%3A%5B%22%5C%22digital+dollar%5C%22%22%5D%7D&r=1&s=1

Curious what legal professionals like @jchervinsky think about the layman ideas I laid out here. Would be very much interested in hearing your opinion on the matter.

Read on Twitter

Read on Twitter