Opendoor $OPEN / $IPOB SPAC

Opendoor $OPEN / $IPOB SPAC

Grew +150% YoY pre-COVID - but that came to a FULL STOP

Grew +150% YoY pre-COVID - but that came to a FULL STOP Transforming UX, Pricing & Purchasing in REAL ESTATE market

Transforming UX, Pricing & Purchasing in REAL ESTATE market Led by TIER-1 management (ex-Bain Cap., TPG, McKinsey, GS)

Led by TIER-1 management (ex-Bain Cap., TPG, McKinsey, GS) Can it win against $Z $RDFN

Can it win against $Z $RDFNHere is an EASY thread

Opendoor $OPEN is an online real estate company founded in 2014 by Keith Rabois, Eric Wu, Ian Wong and JD Ross

In 2018, it raised $ 400m from Softbank Group and $ 300m from General Atlantic in 2019 https://techcrunch.com/2018/09/27/opendoor-just-raised-400-million-in-funding-from-softbanks-vision-fund/

In 2018, it raised $ 400m from Softbank Group and $ 300m from General Atlantic in 2019 https://techcrunch.com/2018/09/27/opendoor-just-raised-400-million-in-funding-from-softbanks-vision-fund/

In 2018, it raised $ 400m from Softbank Group and $ 300m from General Atlantic in 2019 https://techcrunch.com/2018/09/27/opendoor-just-raised-400-million-in-funding-from-softbanks-vision-fund/

In 2018, it raised $ 400m from Softbank Group and $ 300m from General Atlantic in 2019 https://techcrunch.com/2018/09/27/opendoor-just-raised-400-million-in-funding-from-softbanks-vision-fund/

In 2014, the startup advertised itself as:

“work with sellers directly to purchase home[s],”

“work with sellers directly to purchase home[s],”

“work with local partners to rehab, maintain, and improve our portfolio of properties,”

“work with local partners to rehab, maintain, and improve our portfolio of properties,”

“work with sellers directly to purchase home[s],”

“work with sellers directly to purchase home[s],” “work with local partners to rehab, maintain, and improve our portfolio of properties,”

“work with local partners to rehab, maintain, and improve our portfolio of properties,”

“partner with local brokers and Realtors to market, list on [the multiple listing service], and resell to retail buyers and investors”

“partner with local brokers and Realtors to market, list on [the multiple listing service], and resell to retail buyers and investors”By Jordan Novet From

https://venturebeat.com/2014/05/29/heres-investor-keith-rabois-bold-new-home-selling-startup-opendoor/

https://venturebeat.com/2014/05/29/heres-investor-keith-rabois-bold-new-home-selling-startup-opendoor/

In EASY terms:

Sellers submit their property’s details and Opendoor makes an as-is cash offers

Sellers submit their property’s details and Opendoor makes an as-is cash offers

Opendoor then refurbishes the house it purchased and relists it for sales

Opendoor then refurbishes the house it purchased and relists it for sales

$OPEN is an "instant buyer” (iBuyer) as they purchase property as-is and pay in cash in an instant

$OPEN is an "instant buyer” (iBuyer) as they purchase property as-is and pay in cash in an instant

Sellers submit their property’s details and Opendoor makes an as-is cash offers

Sellers submit their property’s details and Opendoor makes an as-is cash offers Opendoor then refurbishes the house it purchased and relists it for sales

Opendoor then refurbishes the house it purchased and relists it for sales $OPEN is an "instant buyer” (iBuyer) as they purchase property as-is and pay in cash in an instant

$OPEN is an "instant buyer” (iBuyer) as they purchase property as-is and pay in cash in an instant

Is that all? Well here is all you can do with Opendoor:

Sell to Opendoor

Sell to Opendoor

Sellers share a video walkthrough and upload some of the property’s details

Sellers share a video walkthrough and upload some of the property’s details

Opendoor makes an instant cash offer for the property “as-is”

Opendoor makes an instant cash offer for the property “as-is”

Sell to Opendoor

Sell to Opendoor Sellers share a video walkthrough and upload some of the property’s details

Sellers share a video walkthrough and upload some of the property’s details Opendoor makes an instant cash offer for the property “as-is”

Opendoor makes an instant cash offer for the property “as-is”

List with Opendoor

List with Opendoor Opendoor advances up to $ 10k for repairs (interest-free)

Opendoor advances up to $ 10k for repairs (interest-free) Sellers just pay 5% in fees for selling with Opendoor

Sellers just pay 5% in fees for selling with Opendoor Local experts assist sellers during the sale

Local experts assist sellers during the sale

Buy from Opendoor

Buy from Opendoor Users browse through open listings & can visits houses with tour assistants (unassisted tours are also possible in certain localities)

Users browse through open listings & can visits houses with tour assistants (unassisted tours are also possible in certain localities) Users submit basic information required to close the sale (personal information, financial records, payment method)

Users submit basic information required to close the sale (personal information, financial records, payment method)

The user makes an offer through the Opendoor app or by email

The user makes an offer through the Opendoor app or by email In certain localities, buyers can “return” their home to Opendoor under certain conditions https://www.opendoor.com/w/terms#guarantee

In certain localities, buyers can “return” their home to Opendoor under certain conditions https://www.opendoor.com/w/terms#guarantee

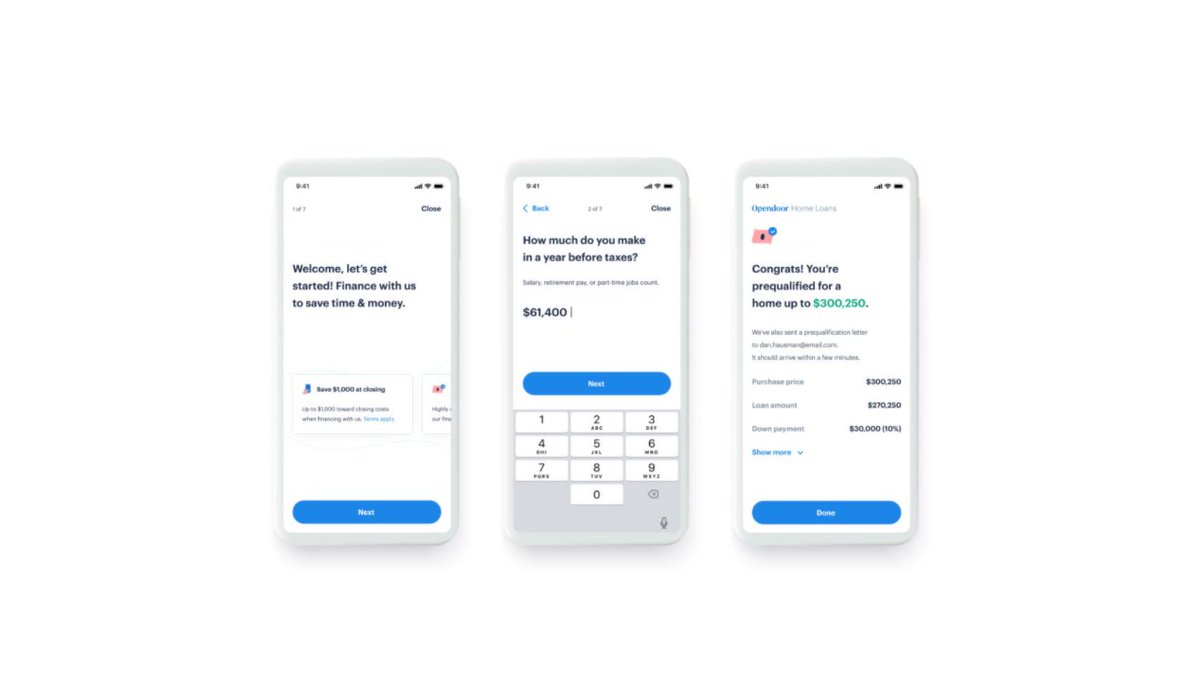

Finance with Opendoor

Finance with Opendoor Buyers don’t have to pay for application origination, underwriting or processing fees and down payment comes in at minimum 3%

Buyers don’t have to pay for application origination, underwriting or processing fees and down payment comes in at minimum 3% A mortgage consultant helps home buyers during the process

A mortgage consultant helps home buyers during the process Buyers can now refinance their home

Buyers can now refinance their home

Great! So this is:

A well-designed user interface that removes the hurdles of buying or selling a home

A well-designed user interface that removes the hurdles of buying or selling a home

But how is Opendoor paying the right price and acquiring the right homes?

But how is Opendoor paying the right price and acquiring the right homes?

A well-designed user interface that removes the hurdles of buying or selling a home

A well-designed user interface that removes the hurdles of buying or selling a home But how is Opendoor paying the right price and acquiring the right homes?

But how is Opendoor paying the right price and acquiring the right homes?

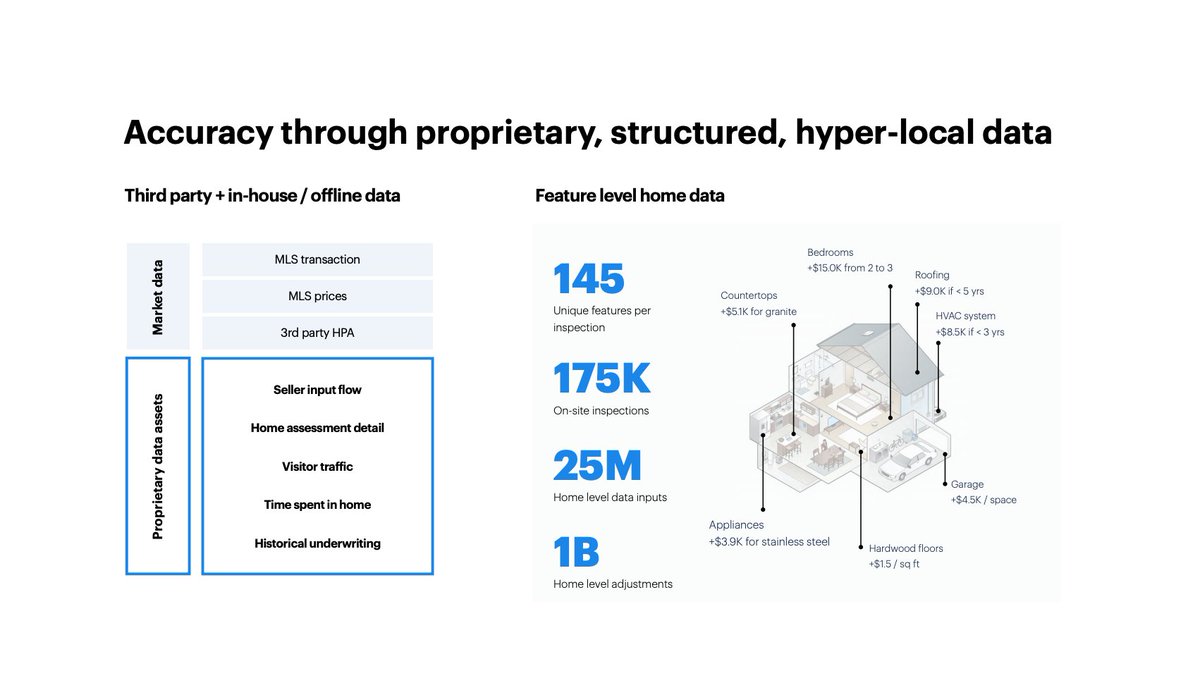

Well, it all comes down to DATA, as Opendoor has

25m home level data inputs

25m home level data inputs

145 unique features per inspection and 175.000 on-site inspections

145 unique features per inspection and 175.000 on-site inspections

Improvements in its model’s accuracy enable it to make 63% of its offers automatically in Q1 ’20 vs 41% in Q1 ’18

Improvements in its model’s accuracy enable it to make 63% of its offers automatically in Q1 ’20 vs 41% in Q1 ’18

25m home level data inputs

25m home level data inputs 145 unique features per inspection and 175.000 on-site inspections

145 unique features per inspection and 175.000 on-site inspections Improvements in its model’s accuracy enable it to make 63% of its offers automatically in Q1 ’20 vs 41% in Q1 ’18

Improvements in its model’s accuracy enable it to make 63% of its offers automatically in Q1 ’20 vs 41% in Q1 ’18

And these improvements are possible thanks to massive amounts of data

“We look at every single transaction that's been conducted in any of our markets since at least when transactions are recorded, which normally goes back 10 years.”

“We look at every single transaction that's been conducted in any of our markets since at least when transactions are recorded, which normally goes back 10 years.”

“So we have at least the last 10 years of data of all the transactions that have happened along with every single parcel that exists in these markets” Ian Wong by Kevin McAllister for Protocol https://www.protocol.com/opendoor-selling-real-estate-pandemic

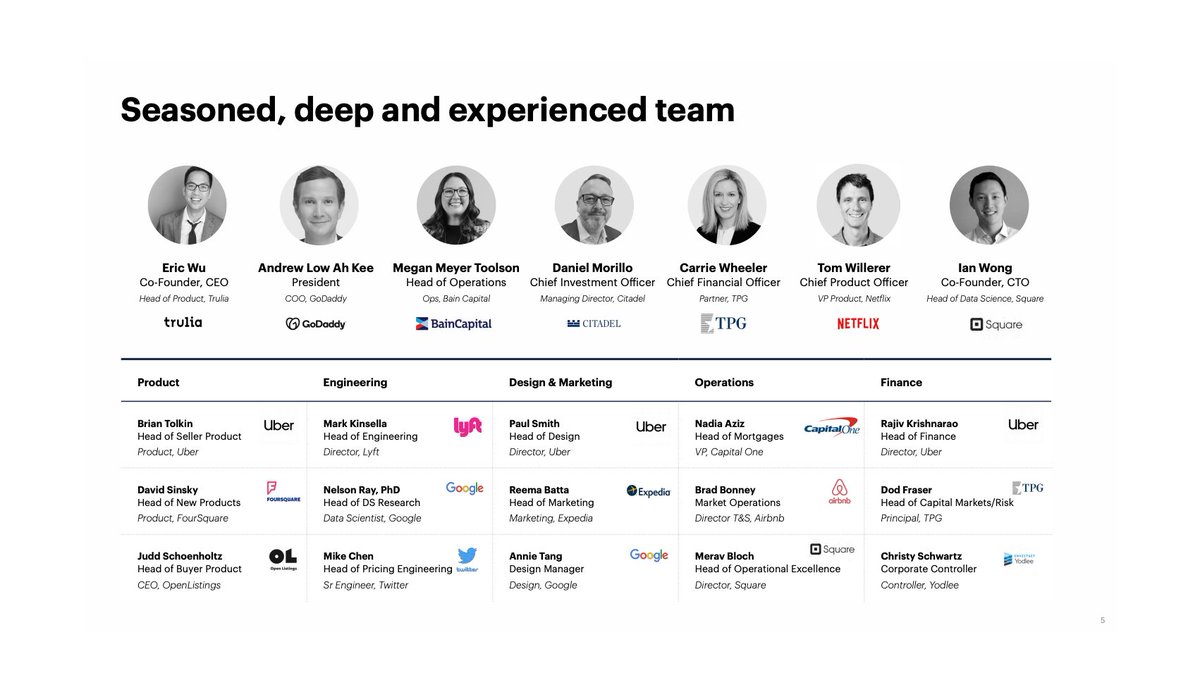

Who is at the helm?

Opendoor is a founder-led company as Eric Wu is CEO and Ian Wong serves as CTO

Opendoor is a founder-led company as Eric Wu is CEO and Ian Wong serves as CTO

Management has deep experience from TIER-1 investment and management consulting firms and leading tech companies

Management has deep experience from TIER-1 investment and management consulting firms and leading tech companies

Here is a closer look at Opendoor’s key people

Opendoor is a founder-led company as Eric Wu is CEO and Ian Wong serves as CTO

Opendoor is a founder-led company as Eric Wu is CEO and Ian Wong serves as CTO Management has deep experience from TIER-1 investment and management consulting firms and leading tech companies

Management has deep experience from TIER-1 investment and management consulting firms and leading tech companiesHere is a closer look at Opendoor’s key people

Eric Wu

Co-founder and Chief Executive Office at Opendoor

Co-founder and Chief Executive Office at Opendoor

Founded http://Movity.com , a location data analytics company (acquired by http://Trulia.com in 2011)

Founded http://Movity.com , a location data analytics company (acquired by http://Trulia.com in 2011)

Graduated from the University of Arizona with a bachelor of science in Economics

Graduated from the University of Arizona with a bachelor of science in Economics

Co-founder and Chief Executive Office at Opendoor

Co-founder and Chief Executive Office at Opendoor Founded http://Movity.com , a location data analytics company (acquired by http://Trulia.com in 2011)

Founded http://Movity.com , a location data analytics company (acquired by http://Trulia.com in 2011) Graduated from the University of Arizona with a bachelor of science in Economics

Graduated from the University of Arizona with a bachelor of science in Economics

Ian Wong

Co-founder and Chief Technology Officer that leads Opendoor’s team of engineers & data scientists

Co-founder and Chief Technology Officer that leads Opendoor’s team of engineers & data scientists

Previously, he built machine learning applications at Square and Prismatic

Previously, he built machine learning applications at Square and Prismatic

Got degrees in Electrical Engineering and Statistics from Stanford

Got degrees in Electrical Engineering and Statistics from Stanford

Co-founder and Chief Technology Officer that leads Opendoor’s team of engineers & data scientists

Co-founder and Chief Technology Officer that leads Opendoor’s team of engineers & data scientists Previously, he built machine learning applications at Square and Prismatic

Previously, he built machine learning applications at Square and Prismatic Got degrees in Electrical Engineering and Statistics from Stanford

Got degrees in Electrical Engineering and Statistics from Stanford

Carrie Wheeler

Chief Financial Officer and independent board member at Opendoor

Chief Financial Officer and independent board member at Opendoor

Spent 21 years at TPG as Partner and Head of Retail & Consumer Investing and started as an analyst at $GS

Spent 21 years at TPG as Partner and Head of Retail & Consumer Investing and started as an analyst at $GS

Earned her Bachelor of Commerce (with Honors) from Queen’s University

Earned her Bachelor of Commerce (with Honors) from Queen’s University

Chief Financial Officer and independent board member at Opendoor

Chief Financial Officer and independent board member at Opendoor Spent 21 years at TPG as Partner and Head of Retail & Consumer Investing and started as an analyst at $GS

Spent 21 years at TPG as Partner and Head of Retail & Consumer Investing and started as an analyst at $GS Earned her Bachelor of Commerce (with Honors) from Queen’s University

Earned her Bachelor of Commerce (with Honors) from Queen’s University

Megan Meyer Toolson

Head of Operations at Opendoor

Head of Operations at Opendoor

Previously, spent almost 2 years at Bain Capital and over 2 years at McKinsey & Company as a Business Analyst

Previously, spent almost 2 years at Bain Capital and over 2 years at McKinsey & Company as a Business Analyst

She earned her MBA from Stanford Graduate School of Business

She earned her MBA from Stanford Graduate School of Business

Head of Operations at Opendoor

Head of Operations at Opendoor Previously, spent almost 2 years at Bain Capital and over 2 years at McKinsey & Company as a Business Analyst

Previously, spent almost 2 years at Bain Capital and over 2 years at McKinsey & Company as a Business Analyst She earned her MBA from Stanford Graduate School of Business

She earned her MBA from Stanford Graduate School of Business

Great! So here we have a strong management team

And a strong product, driven by data and changing the customer experience

And a strong product, driven by data and changing the customer experience

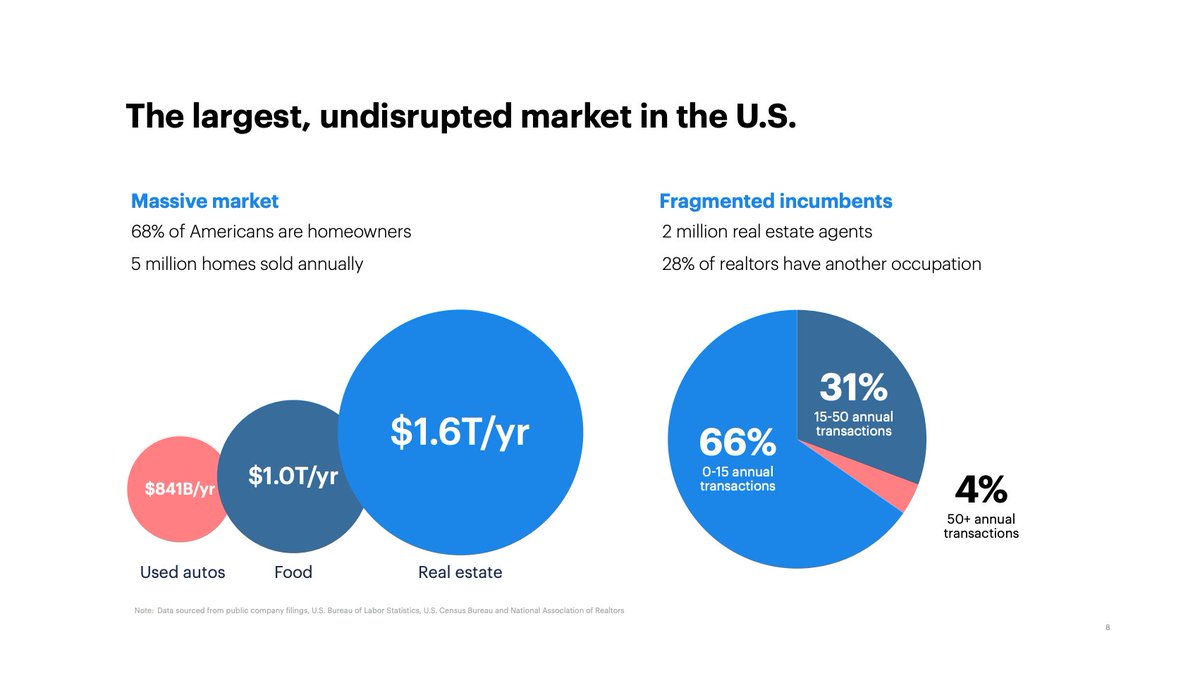

How large is the market?

And a strong product, driven by data and changing the customer experience

And a strong product, driven by data and changing the customer experienceHow large is the market?

The whole Opendoor story started when Peter Thiel (co-founder of $PLTR and $PYPL) suggest to Keith Rabois:

“[…]Peter Thiel suggested that I come up with an idea to innovate in residential real estate,”

“[…]Peter Thiel suggested that I come up with an idea to innovate in residential real estate,”

“It’s the largest part of the economy unaffected by the Internet. And that was definitely true then” - Keith Rabois

By Jordan Novet for Venture Beat

By Jordan Novet for Venture Beat

Yes, the largest part of the economy unaffected by the internet, mainly run by sales agents

There a 2m active real estate agents in the USA

There a 2m active real estate agents in the USA

1.36m of those are Realtors: they have a real estate license and are members of the National Association of Realtors (NAR)

1.36m of those are Realtors: they have a real estate license and are members of the National Association of Realtors (NAR)

There a 2m active real estate agents in the USA

There a 2m active real estate agents in the USA 1.36m of those are Realtors: they have a real estate license and are members of the National Association of Realtors (NAR)

1.36m of those are Realtors: they have a real estate license and are members of the National Association of Realtors (NAR)

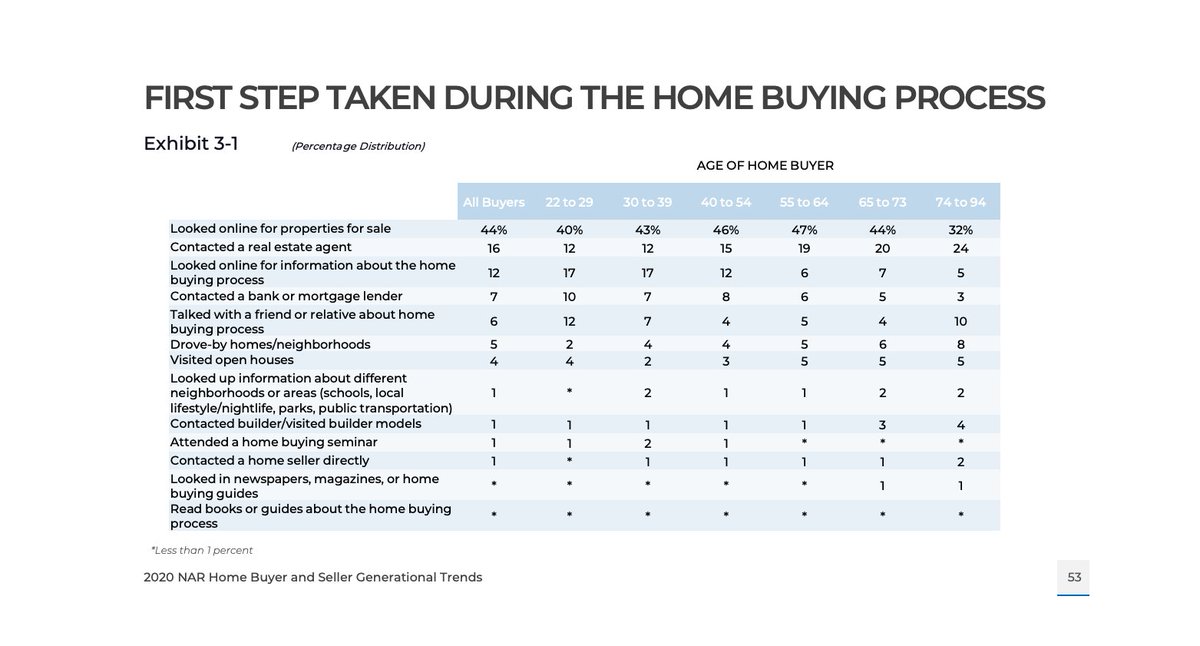

Great! But what do home buyers do FIRST? Go online or talk to an agent?

12% of the 22 to 29 year olds contacted a real estate agent

12% of the 22 to 29 year olds contacted a real estate agent

While over 20% of the +55 year olds contacted a real estate agent

While over 20% of the +55 year olds contacted a real estate agent

Over 40% of 22 to 54 year olds looked FIRST for a property online

Over 40% of 22 to 54 year olds looked FIRST for a property online

12% of the 22 to 29 year olds contacted a real estate agent

12% of the 22 to 29 year olds contacted a real estate agent  While over 20% of the +55 year olds contacted a real estate agent

While over 20% of the +55 year olds contacted a real estate agent  Over 40% of 22 to 54 year olds looked FIRST for a property online

Over 40% of 22 to 54 year olds looked FIRST for a property online

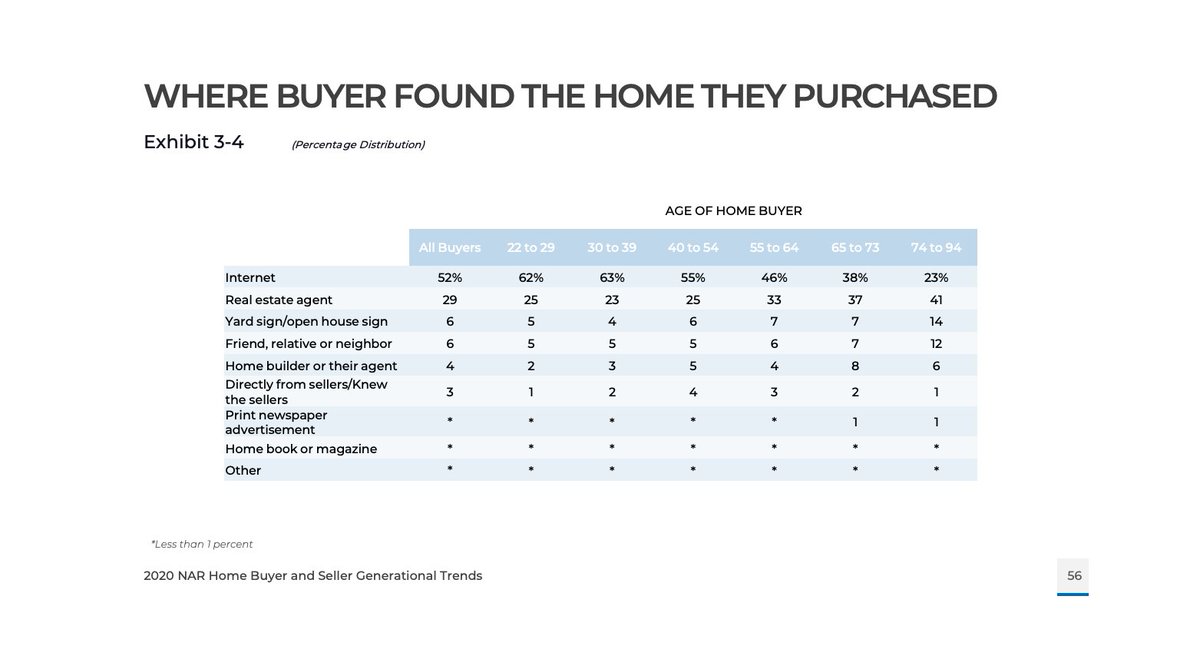

Where did buyers found the home they purchased?

62% of the 22 to 29 year olds found it online

62% of the 22 to 29 year olds found it online

While over 35% of the +55 year olds found it through a real estate agent

While over 35% of the +55 year olds found it through a real estate agent

Over 55% of 22 to 54 year olds found it online

Over 55% of 22 to 54 year olds found it online

62% of the 22 to 29 year olds found it online

62% of the 22 to 29 year olds found it online While over 35% of the +55 year olds found it through a real estate agent

While over 35% of the +55 year olds found it through a real estate agent  Over 55% of 22 to 54 year olds found it online

Over 55% of 22 to 54 year olds found it online

Here is the full report from the NAR

https://www.nar.realtor/sites/default/files/documents/2020-generational-trends-report-03-05-2020.pdf

https://www.nar.realtor/sites/default/files/documents/2020-generational-trends-report-03-05-2020.pdf

So property hunting is moving online, are real estate firms also making the switch?

According to the NAR, 46% of Real Estate Firms cited keeping up with technology as one of the biggest challenges for the next 2 years

According to the NAR, 46% of Real Estate Firms cited keeping up with technology as one of the biggest challenges for the next 2 years

Here is the full report

https://cdn.nar.realtor/sites/default/files/documents/2019-real-estate-in-a-digital-age-08-22-2019.pdf

According to the NAR, 46% of Real Estate Firms cited keeping up with technology as one of the biggest challenges for the next 2 years

According to the NAR, 46% of Real Estate Firms cited keeping up with technology as one of the biggest challenges for the next 2 yearsHere is the full report

https://cdn.nar.realtor/sites/default/files/documents/2019-real-estate-in-a-digital-age-08-22-2019.pdf

So how could the real estate’s agents role evolve?

Buyers have more data at hand (online pictures, listing information and history)

Buyers have more data at hand (online pictures, listing information and history)

Gone are thus the days where real estate agents would present the raw information to buyers

Gone are thus the days where real estate agents would present the raw information to buyers

Buyers have more data at hand (online pictures, listing information and history)

Buyers have more data at hand (online pictures, listing information and history) Gone are thus the days where real estate agents would present the raw information to buyers

Gone are thus the days where real estate agents would present the raw information to buyers

Buyers now review properties online and solicit the help of a real estate agent for the documentation, price negotiation…

Buyers now review properties online and solicit the help of a real estate agent for the documentation, price negotiation…“In the near future, buyers will look to real estate agents as strategic experts to help make sense of all this data” https://www.forbes.com/sites/forbesrealestatecouncil/2020/03/18/the-future-of-homebuying-three-predictions-for-2025/

This looks very much aligned with what Opendoor proposes

Easily browse properties online

Easily browse properties online

Visit a home with a tour assistant or on your own

Visit a home with a tour assistant or on your own

Solicit the help of an agent for financing matters / documentation needs

Solicit the help of an agent for financing matters / documentation needs

Easily browse properties online

Easily browse properties online Visit a home with a tour assistant or on your own

Visit a home with a tour assistant or on your own Solicit the help of an agent for financing matters / documentation needs

Solicit the help of an agent for financing matters / documentation needs

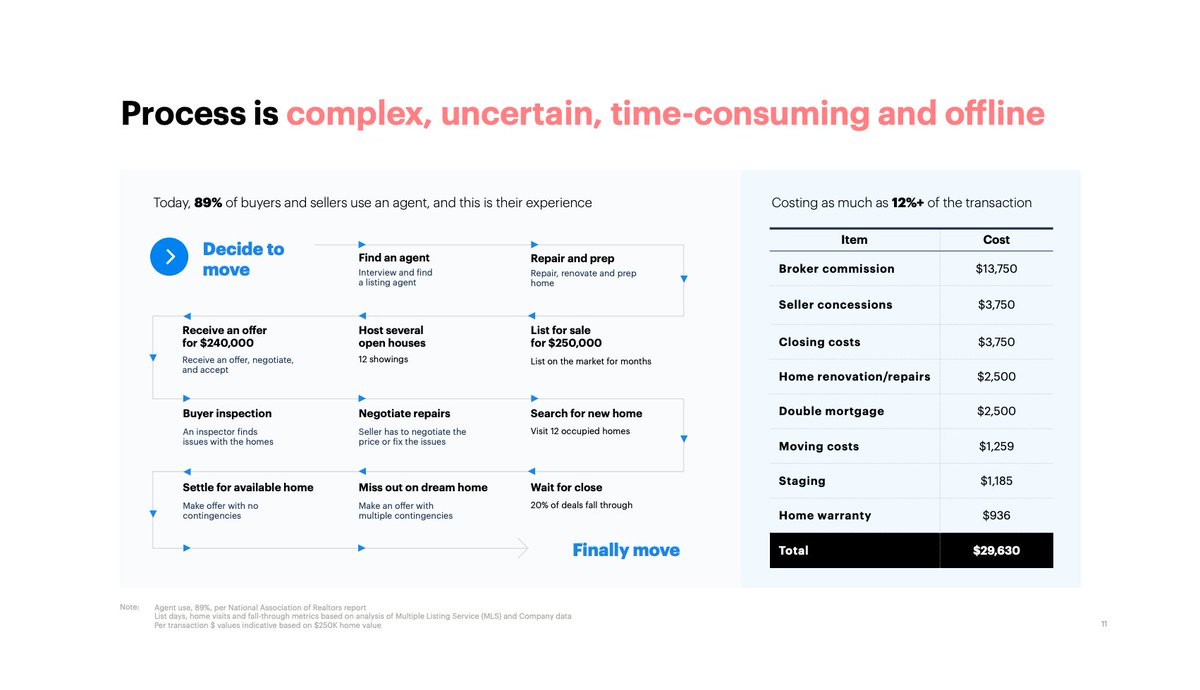

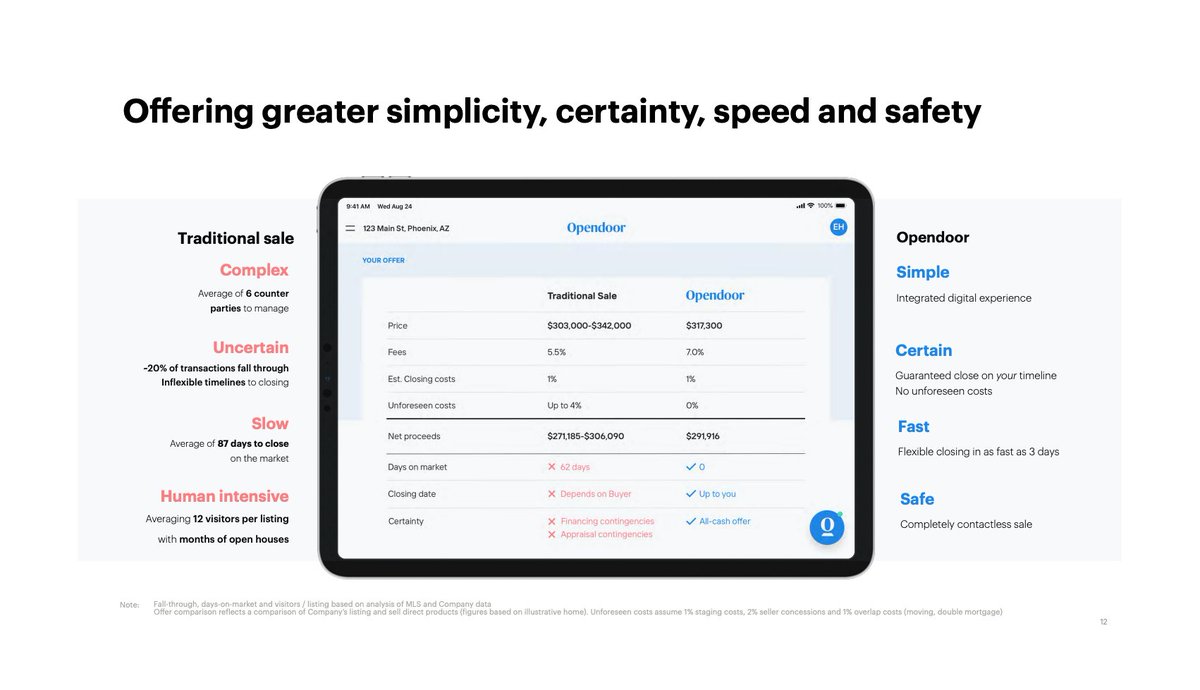

Going from a complex and time consuming process

Find a trustworthy agent

Find a trustworthy agent

Repair and renovate the house

Repair and renovate the house

List the house, negotiate offers and wait for closing

List the house, negotiate offers and wait for closing

Find a trustworthy agent

Find a trustworthy agent Repair and renovate the house

Repair and renovate the house List the house, negotiate offers and wait for closing

List the house, negotiate offers and wait for closing

To a simple fast and certain process

Buyers can easily browse through listings

Buyers can easily browse through listings

Offers and payments are fully digitised and backed by Opendoor

Offers and payments are fully digitised and backed by Opendoor

Users can request assistance from agents

Users can request assistance from agents

Buyers can easily browse through listings

Buyers can easily browse through listings Offers and payments are fully digitised and backed by Opendoor

Offers and payments are fully digitised and backed by Opendoor Users can request assistance from agents

Users can request assistance from agents

This translates into a Net Promoter Score (NPS) of 70, for comparison:

This translates into a Net Promoter Score (NPS) of 70, for comparison:$NFLX has a NPS of 68

$AAPL has a NPS of 68

$AMZN has a NPS of 62

$CVNA has a NPS of 84

$UBER has a NPS of 37

However not everyone is as optimistic about these “instant buyers” (also called “iBuyers” as their purchase property as-is and pay in cash in an instant)

Collateral Analytics has found that iBuyers on average charge higher fees than traditional agents

Collateral Analytics has found that iBuyers on average charge higher fees than traditional agents

Collateral Analytics has found that iBuyers on average charge higher fees than traditional agents

Collateral Analytics has found that iBuyers on average charge higher fees than traditional agents

Driven by the need for these iBuyers to compensate for liquidity risks and carrying costs

Driven by the need for these iBuyers to compensate for liquidity risks and carrying costsHowever, Collateral Analytic’s report end with:

“For some sellers, needing to move or requiring quick extraction of equity, this is certainly worthwhile”

This is exactly what Opendoor is targeting as their CTO explained:

This is exactly what Opendoor is targeting as their CTO explained:“What we've seen is that customers not only crave convenience now, […] They also really want assurance that [the process] is safe” Ian Wong by Kevin McAllister for Protocol https://www.protocol.com/opendoor-selling-real-estate-pandemic

Another study, by Mike DelPrete who focussed on Zillow and Opendoor found that these iBuyers almost paid fair value:

Another study, by Mike DelPrete who focussed on Zillow and Opendoor found that these iBuyers almost paid fair value:

“The evidence in this research study strongly suggests that iBuyers are offering close to fair market value for the homes they purchase” Mike DelPrete by Jeff Andrew for Curbed https://archive.curbed.com/2019/11/12/20960037/ibuyers-zillow-opendoor-fair-offers

Great! So Opendoor offers a fair deal to customers

But isn’t it taking on TOO MUCH RISKS? What if the market collapses?

But isn’t it taking on TOO MUCH RISKS? What if the market collapses?

Home prices tend to decrease in a downturn - an unexpected downturn that was not forecasted by Opendoor’s models could have a considerable impact

Home prices tend to decrease in a downturn - an unexpected downturn that was not forecasted by Opendoor’s models could have a considerable impact

But isn’t it taking on TOO MUCH RISKS? What if the market collapses?

But isn’t it taking on TOO MUCH RISKS? What if the market collapses? Home prices tend to decrease in a downturn - an unexpected downturn that was not forecasted by Opendoor’s models could have a considerable impact

Home prices tend to decrease in a downturn - an unexpected downturn that was not forecasted by Opendoor’s models could have a considerable impact

“[…] bear significant risks if prices decline. A downturn in home prices, not forecast by the iBuyer market analysts could be devastating as they ramp up their business platforms” By Collateral Analytics

From https://collateralanalytics.com/wp-content/uploads/2019/08/CA-RESEARCH-iBuyers-A-new-choice-for-home-sellers-but-at-what-cost.pdf

From https://collateralanalytics.com/wp-content/uploads/2019/08/CA-RESEARCH-iBuyers-A-new-choice-for-home-sellers-but-at-what-cost.pdf

Opendoor already went through a downturn

Opendoor already went through a downturn Due to the pandemic, the Commerce Department reported that new home sales were down 15.4% versus the previous year

Due to the pandemic, the Commerce Department reported that new home sales were down 15.4% versus the previous year

This led Opendoor to lay off 35% of its workforce and suspended home buying

This led Opendoor to lay off 35% of its workforce and suspended home buying $OPEN managed to effectively cut down on expenses and keep its losses under control

$OPEN managed to effectively cut down on expenses and keep its losses under control

What else should we watch? Well, the iBuyer market is competitive, here are some players:

· Zillow Offers

· RedfinNow

· Knock

· Entera

· Offerpad

· We Buy Ugly Houses

· Houzeo

· Zillow Offers

· RedfinNow

· Knock

· Entera

· Offerpad

· We Buy Ugly Houses

· Houzeo

The leading players (Zillow, Redfin, Opendoor) have a similar offerings

The leading players (Zillow, Redfin, Opendoor) have a similar offerings A competitive edge might be acquired through improved pricing models

A competitive edge might be acquired through improved pricing models But in the long run, this might end in a “fees”-war between the leading players

But in the long run, this might end in a “fees”-war between the leading players

Financials Check

Financials Check

Note: period is 9 months ended September 30

Total revenue decreased by 34% YoY to $ 2.3B in 2020 down from $ 3.5B in the previous period

Total revenue decreased by 34% YoY to $ 2.3B in 2020 down from $ 3.5B in the previous period Opendoor stopped buying homes during the pandemic

Opendoor stopped buying homes during the pandemic

Sales reached $ 4.7B in 2019 (full year), up 159% from $ 1.8B in 2018

Sales reached $ 4.7B in 2019 (full year), up 159% from $ 1.8B in 2018 Sales grew 157% from $ 711m over the 2017 to 2018 period

Sales grew 157% from $ 711m over the 2017 to 2018 period

Gross margins stood at 7.8% in 2020 up from 6.5% in the previous period

Gross margins stood at 7.8% in 2020 up from 6.5% in the previous period Operating expenses decreased 26% to $ 301m from $ 409m

Operating expenses decreased 26% to $ 301m from $ 409m Net loss reached $ 119m down from a loss of $ 247m a year earlier

Net loss reached $ 119m down from a loss of $ 247m a year earlier

Opendoor had current assets stood at $ 923m versus current liabilities of $ 179m

Opendoor had current assets stood at $ 923m versus current liabilities of $ 179m Opendoor got about $ 1B in cash following the SPAC merger

Opendoor got about $ 1B in cash following the SPAC merger

What do number tell? This is a competitive market with thin margins

What do number tell? This is a competitive market with thin margins

“Opendoor thinks it can generate $458 million in “contribution profit” by 2023, or 4.7% of revenue. That’s still a pretty thin margin” by Chris Bryant for Bloomberg https://www.bloomberg.com/opinion/articles/2020-10-14/opendoor-is-a-13-5-billion-spac-sensation-that-will-buy-your-house

THE BOTTOM LINE

THE BOTTOM LINE

The real estate market is digitising as a new generation of buyers favour online tools

The real estate market is digitising as a new generation of buyers favour online tools Opendoor’s refreshed UI and customer experience attract customers in droves as it managed to grow sales at +150% over the 2019 to 2017 period

Opendoor’s refreshed UI and customer experience attract customers in droves as it managed to grow sales at +150% over the 2019 to 2017 period

Opendoor is a founder-led company and management has as pristine track record

Opendoor is a founder-led company and management has as pristine track record Despite the recent downturn in sales, Opendoor managed to safeguard its financial position and rebound post-COVID

Despite the recent downturn in sales, Opendoor managed to safeguard its financial position and rebound post-COVID

The iBuyers market is competitive and strongly correlated to the state of the broader economy

The iBuyers market is competitive and strongly correlated to the state of the broader economy Margins are thin and heavy competition might decrease these in the long run

Margins are thin and heavy competition might decrease these in the long run

We take a small speculative stake for now

We take a small speculative stake for now

We will increase if $OPEN manages to improve its margins while growing it sales back to pre-COVID levels

We will increase if $OPEN manages to improve its margins while growing it sales back to pre-COVID levels We will cut if margins decrease or if $OPEN fails to take the lead in the iBuyers market

We will cut if margins decrease or if $OPEN fails to take the lead in the iBuyers market

$DHER.DE is on our watchlist

$DHER.DE is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ TechCrunch

✑ Crunchbase

✑ Crunchbase

✑ Collateral Analytics

✑ Curbed

✑ Forbes

✑ Protocol

✑ I Sold My House

✑ Mike DelPrete

✑ Venture Beat

✑ Reuters

✑ Bloomberg

✑ Collateral Analytics

✑ Curbed

✑ Forbes

✑ Protocol

✑ I Sold My House

✑ Mike DelPrete

✑ Venture Beat

✑ Reuters

✑ Bloomberg

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter