[THREAD] A Sober Look at SPACs

Sorry to rain on the SPAC parade, but it's important to understand the inherent shareholder disadvantages in the current SPAC structure:

- Higher cost/dilution

- Lower returns

Great article from Harvard Law.

Source: https://corpgov.law.harvard.edu/2020/11/19/a-sober-look-at-spacs/

Sorry to rain on the SPAC parade, but it's important to understand the inherent shareholder disadvantages in the current SPAC structure:

- Higher cost/dilution

- Lower returns

Great article from Harvard Law.

Source: https://corpgov.law.harvard.edu/2020/11/19/a-sober-look-at-spacs/

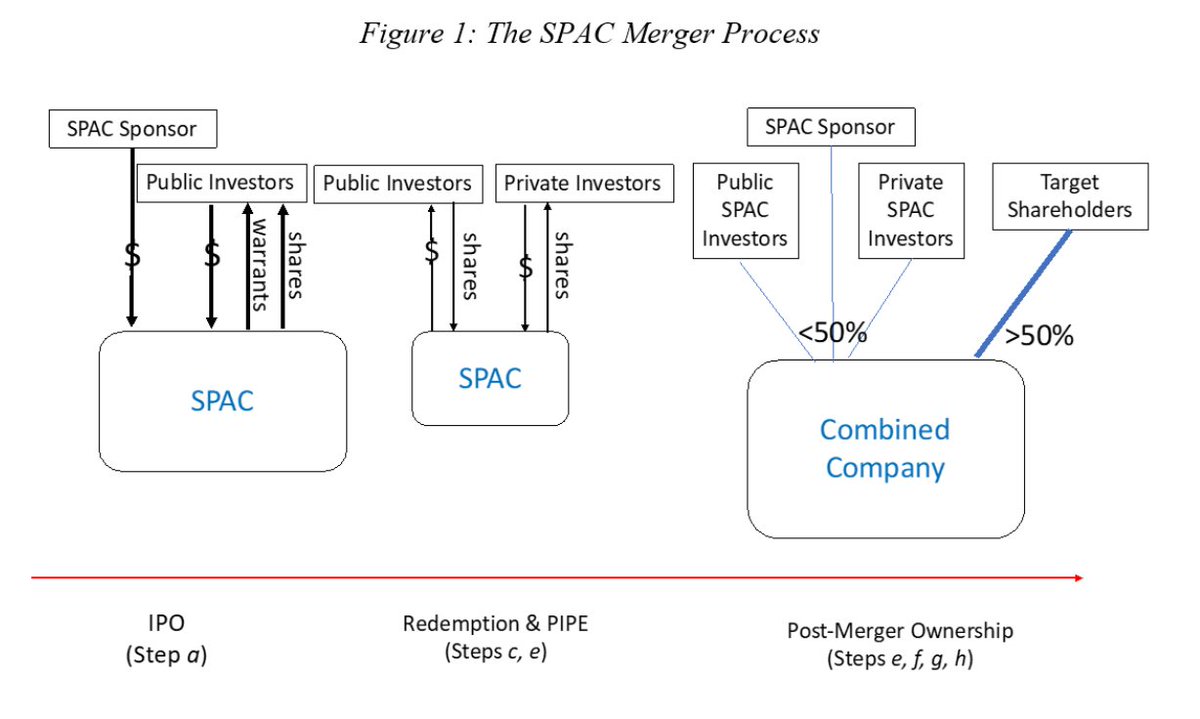

1/ The SPAC Structure

SPACs raise cash and have 2 years to find a company to take public.

SPAC owners dilute shareholders via three ways:

- Warrants

- Shares

- Rights

This leads to SPACs historic high costs & poor post-merger performance.

Here's an illustration ...

SPACs raise cash and have 2 years to find a company to take public.

SPAC owners dilute shareholders via three ways:

- Warrants

- Shares

- Rights

This leads to SPACs historic high costs & poor post-merger performance.

Here's an illustration ...

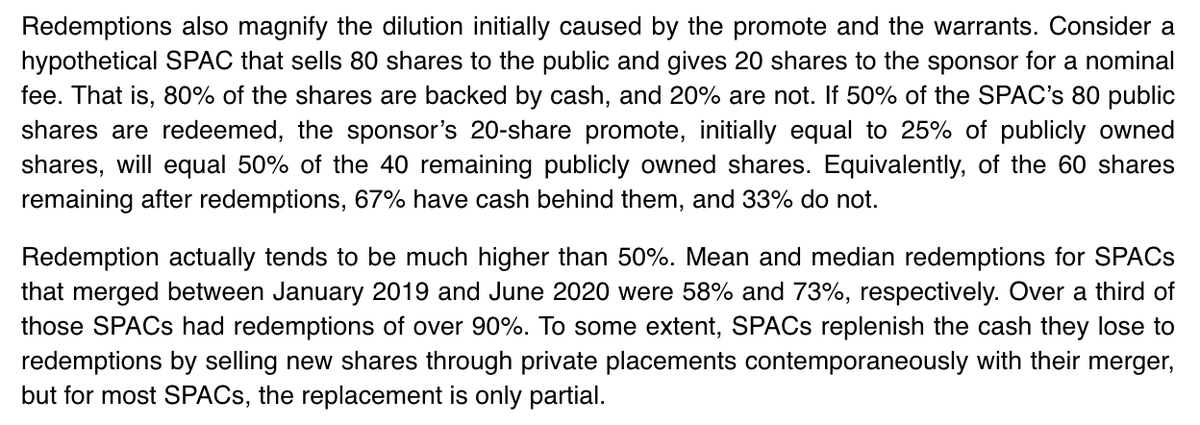

2/ Further Embedded SPAC Dilution

The article mentions 3 other forms of dilution:

- SPAC sponsors pay themselves with "promote" of 25% of SPAC IPO proceeds

- Redeeming shareholders receive 11.6% annual return (incentive to redeem)

- SPACs pay u/w fee on IPO proceeds

The article mentions 3 other forms of dilution:

- SPAC sponsors pay themselves with "promote" of 25% of SPAC IPO proceeds

- Redeeming shareholders receive 11.6% annual return (incentive to redeem)

- SPACs pay u/w fee on IPO proceeds

3/ The Cost of SPAC Dilution

Due to the above dilution, SPACs don't actually have $10/share in cash.

The median SPAC’s dilution amounts to a staggering 50.4% of cash delivered in a merger

For each $10 share, there is $6.67 in cash and $3.33 in dilution overhanging the merger.

Due to the above dilution, SPACs don't actually have $10/share in cash.

The median SPAC’s dilution amounts to a staggering 50.4% of cash delivered in a merger

For each $10 share, there is $6.67 in cash and $3.33 in dilution overhanging the merger.

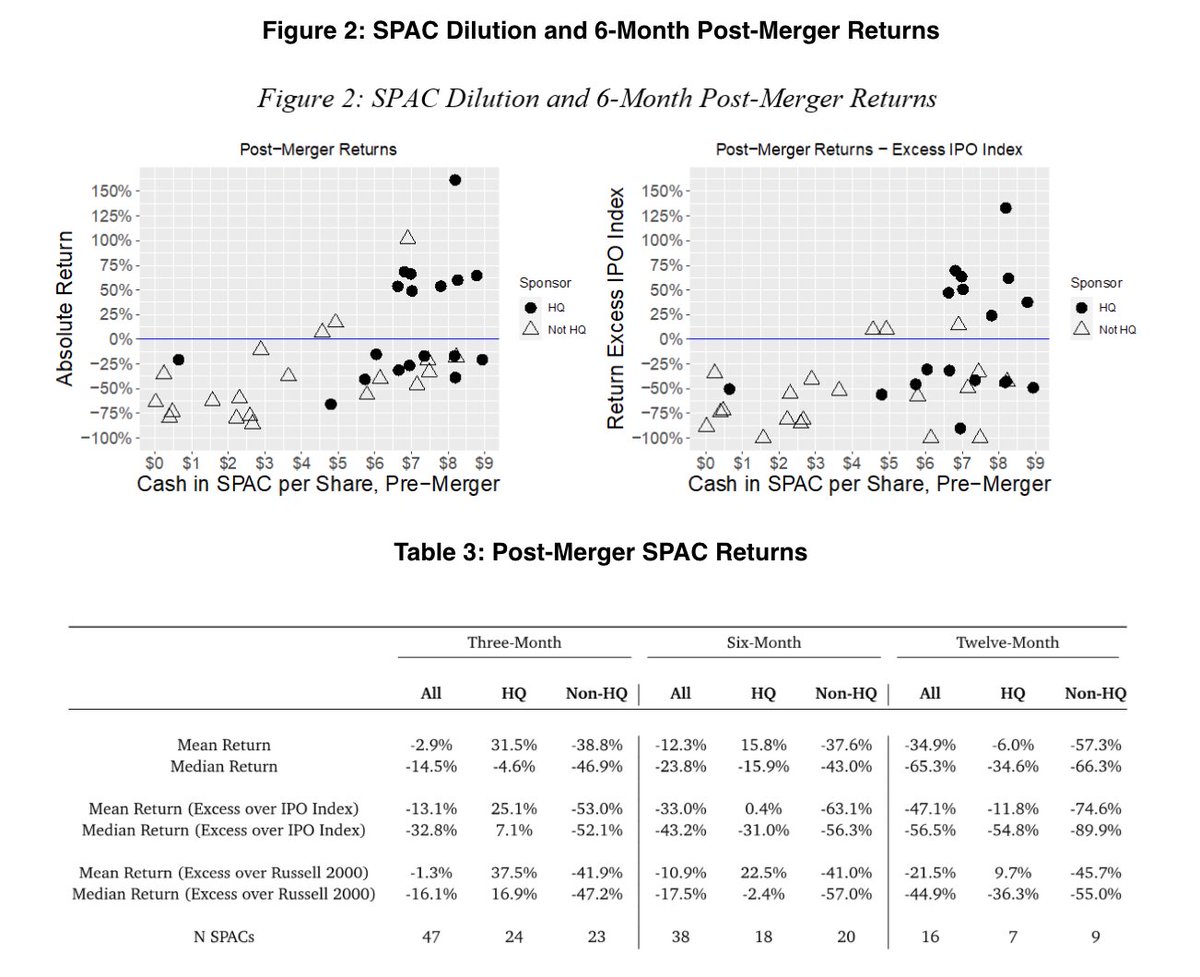

4/ Who Bears The Cost?

"A reasonable inference is that targets negotiated prices or share exchanges based on the cash value of SPAC shares, and that SPAC shareholders bore the cost of SPACs’ dilution."

In other words, SPAC shareholders get screwed and ear the cost of dilution.

"A reasonable inference is that targets negotiated prices or share exchanges based on the cash value of SPAC shares, and that SPAC shareholders bore the cost of SPACs’ dilution."

In other words, SPAC shareholders get screwed and ear the cost of dilution.

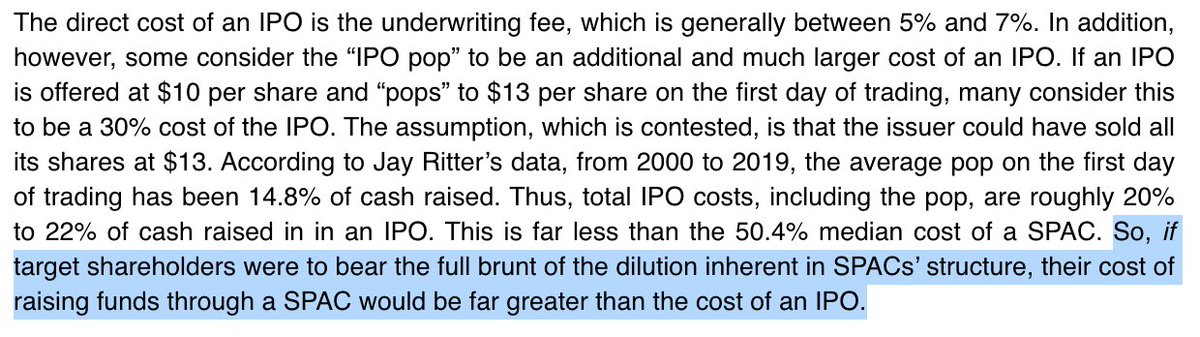

5/ SPAC vs. IPO Cost

"If indeed SPACs are a cheaper way to go public than IPOs, it is only because SPAC shareholders are bearing the cost of SPACs and thereby subsidizing targets going public."

While most think SPAC IPOs are cheaper than traditional ways, it's not always true!

"If indeed SPACs are a cheaper way to go public than IPOs, it is only because SPAC shareholders are bearing the cost of SPACs and thereby subsidizing targets going public."

While most think SPAC IPOs are cheaper than traditional ways, it's not always true!

6/ How To Do SPACs Right

@BillAckman's Pershing is the poster-child of a great SPAC IPO.

"Pershing Square has sponsored a SPAC with a very different and less dilutive structure, and a few other SPACs have gone public with no warrants and hence less dilution."

Hope this sticks

@BillAckman's Pershing is the poster-child of a great SPAC IPO.

"Pershing Square has sponsored a SPAC with a very different and less dilutive structure, and a few other SPACs have gone public with no warrants and hence less dilution."

Hope this sticks

Read on Twitter

Read on Twitter![[THREAD] A Sober Look at SPACsSorry to rain on the SPAC parade, but it's important to understand the inherent shareholder disadvantages in the current SPAC structure: - Higher cost/dilution - Lower returnsGreat article from Harvard Law. Source: https://corpgov.law.harvard.edu/2020/11/19/a-sober-look-at-spacs/ [THREAD] A Sober Look at SPACsSorry to rain on the SPAC parade, but it's important to understand the inherent shareholder disadvantages in the current SPAC structure: - Higher cost/dilution - Lower returnsGreat article from Harvard Law. Source: https://corpgov.law.harvard.edu/2020/11/19/a-sober-look-at-spacs/](https://pbs.twimg.com/media/EqgKHxhXMAEDfs0.png)