0/ Thread: Catalyzing climate fintech -- The multi-trillion $ challenge with no time to waste

A quick thread and some ideas (should have asked @CharleyMa or @mengxilu to help me with this...)

A quick thread and some ideas (should have asked @CharleyMa or @mengxilu to help me with this...)

1/ Spent some time over the holidays searching around for climate fintech (climate action meets open finance) resources. A few preliminary finds and takeaways.

Please drop a note, send up a flare, comment below if you’re involved or want to be.

Please drop a note, send up a flare, comment below if you’re involved or want to be.

2/ Point #1: This is going to take time. Multiple phases need to be co-sequenced but the impact / opportunity is massive.

The ‘rules of the game’ (TCFD, SASB, emissions trading specs, etc.) are still being defined. There’s a bit of a wait-and-see dilemma for entrepreneurs.

The ‘rules of the game’ (TCFD, SASB, emissions trading specs, etc.) are still being defined. There’s a bit of a wait-and-see dilemma for entrepreneurs.

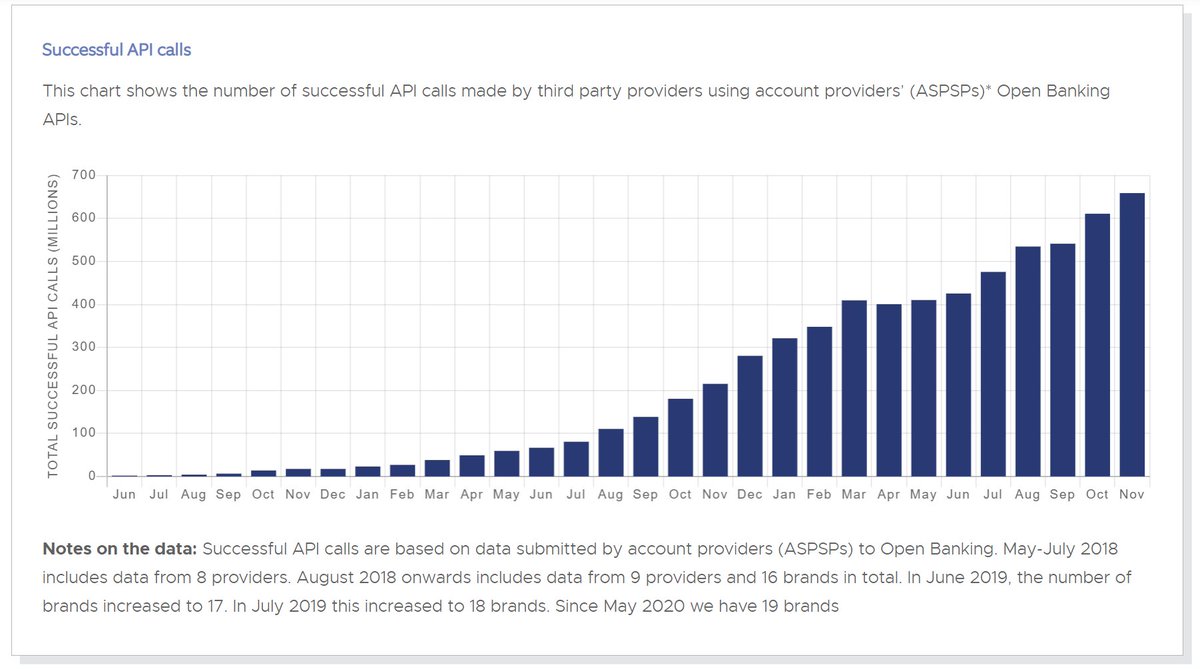

3/ Not dissimilar from when PSD2 and other open banking / finance regulations started taking fuller form, innovators felt derisked and started diving in headfirst.

How can we pull more builders into climate fintech sooner as standards continue to crystallize?

How can we pull more builders into climate fintech sooner as standards continue to crystallize?

4/ Point #2: The market needs more proactive guidance from key stakeholders; iteration time is limited.

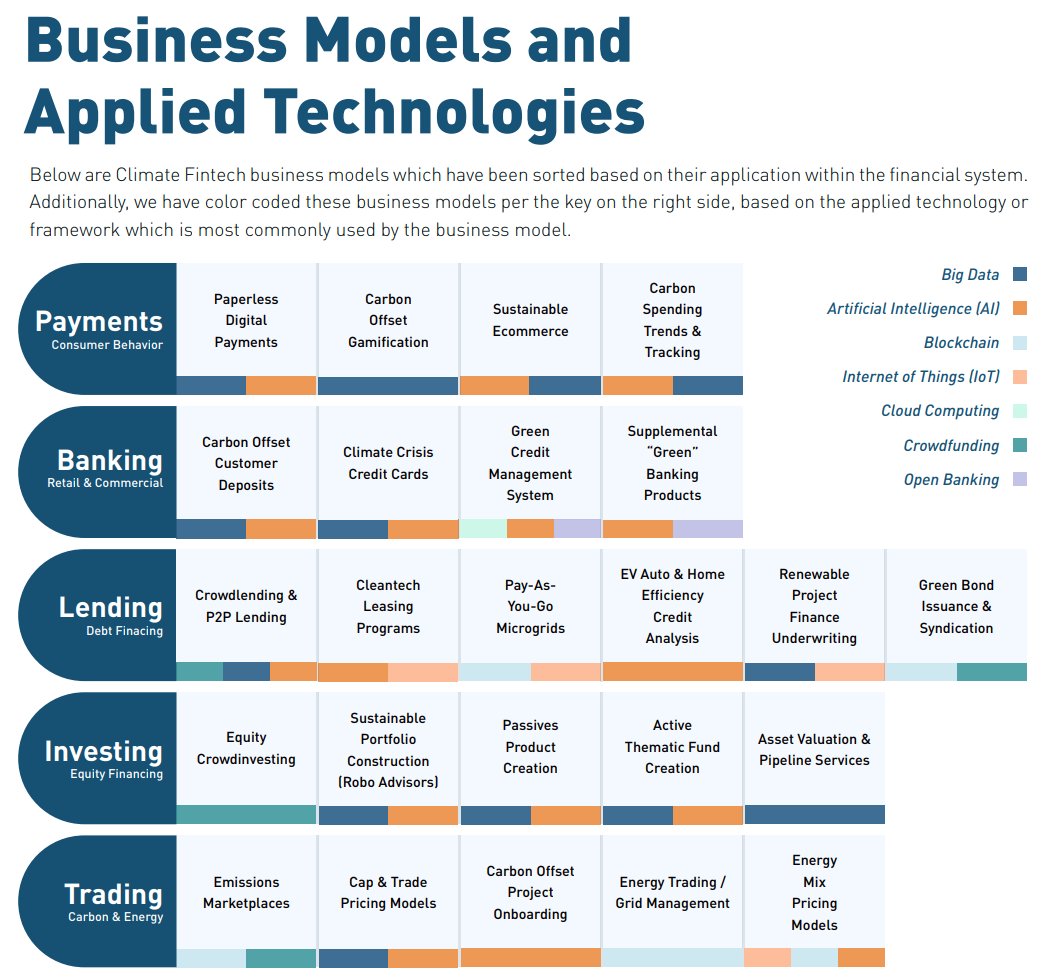

There’s a ton to build in climate fintech across dozens of use cases but it’s still difficult to understand key pain points and current technical, business, policy gaps.

There’s a ton to build in climate fintech across dozens of use cases but it’s still difficult to understand key pain points and current technical, business, policy gaps.

5/ What’s nice vs. need to have? What's the right sequencing? Which components unlock others?

@UNDFTaskForce and others are defining the opportunity set but we need more coordinated input from prospective ‘customers’ (corporates, asset managers, IGOs).

https://bit.ly/3ryjL3P

@UNDFTaskForce and others are defining the opportunity set but we need more coordinated input from prospective ‘customers’ (corporates, asset managers, IGOs).

https://bit.ly/3ryjL3P

6/ Point #3: A more cohesive, visible sustainability community within fintech is instrumental. Offline + online Schelling points are not yet defined.

7/ The fintech ecosystem has come together strongly for inclusion; how do we take our learnings and momentum from there and expand them to climate action ( #fintechequalitycoalition, @NYCFintechWomen)?

8/ Unlike with 'traditional' fintech there are no centers of gravity yet for the climate fintech ecosystem (Silicon Valley, London, Singapore; @fintechtoday_, @Cambrian_HQ).

There are good subchannels in a few spots ( @mcj, @NewEnergyNexus) but more community organizing is vital.

There are good subchannels in a few spots ( @mcj, @NewEnergyNexus) but more community organizing is vital.

9/ Point #4: Fintechs in the vanguard can pull others forward.

@Stripe, @Shopify, and many others are already doing their part. How do we catalyze a cross-industry collaborative effort to work together more closely?

@Stripe, @Shopify, and many others are already doing their part. How do we catalyze a cross-industry collaborative effort to work together more closely?

10/ How do we open source sustainability best practices and projects that are already working to get 100 more fintechs involved in 2021? cc’ @patrickc @tobi

https://stripe.com/climate

https://www.shopify.com/about/environment

https://stripe.com/climate

https://www.shopify.com/about/environment

11/ Point #5: No effort is too small; starting now is what matters (and bringing a few friends).

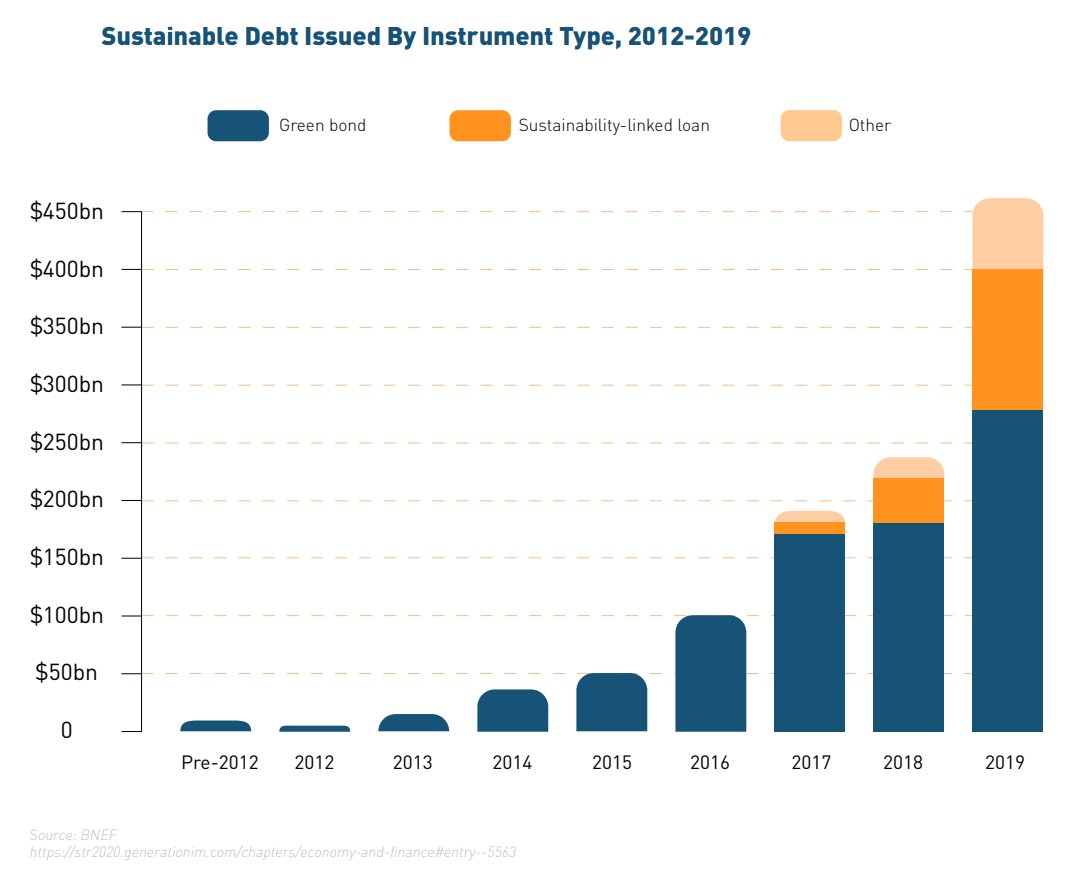

Climate action is going to be a multi-decadal challenge ***and*** opportunity the fintech community is uniquely positioned to augment and accelerate.

https://bit.ly/3ryjL3P

Climate action is going to be a multi-decadal challenge ***and*** opportunity the fintech community is uniquely positioned to augment and accelerate.

https://bit.ly/3ryjL3P

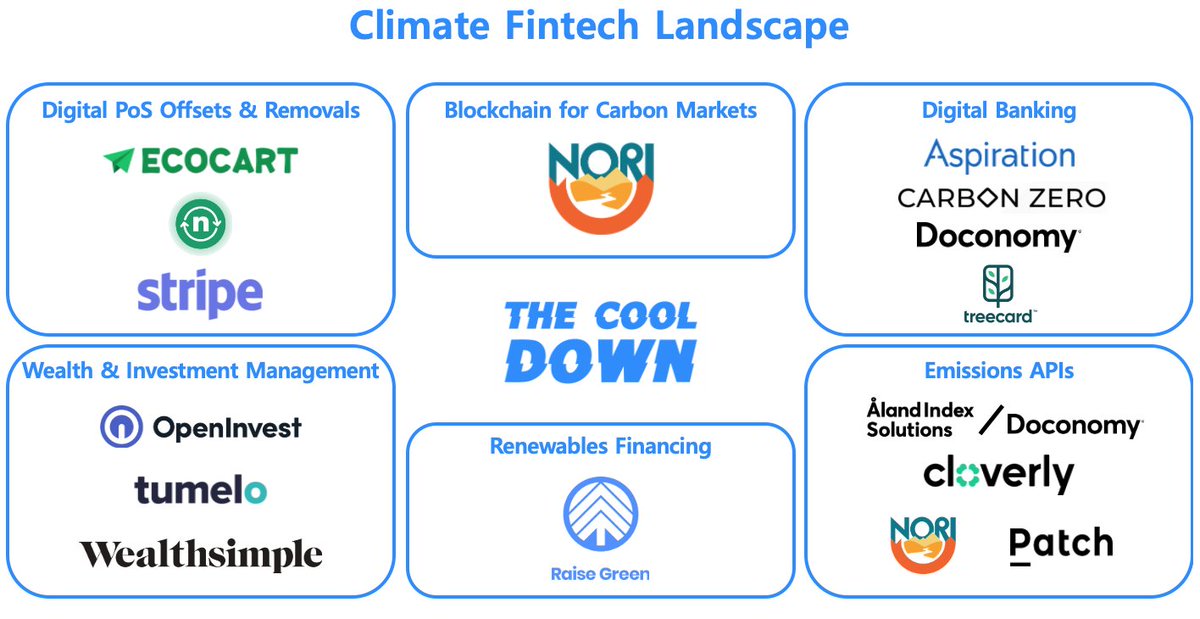

12/ My mini first step: including a few climate fintech aggregated resources below. I’m missing a lot so send me anything!

A. Resources: https://airtable.com/shrAikpTjr7KqOuiT

B. Companies: https://airtable.com/shryxRKtLCLHO2zmQ/tbl4U9LVtV8wSOXEI

C. Research: https://drive.google.com/drive/folders/1yuM7zQs21RLRjAoVhEW7w1hLGgxaiIBs

D. Twitter list: https://twitter.com/i/lists/1342160518304423945

A. Resources: https://airtable.com/shrAikpTjr7KqOuiT

B. Companies: https://airtable.com/shryxRKtLCLHO2zmQ/tbl4U9LVtV8wSOXEI

C. Research: https://drive.google.com/drive/folders/1yuM7zQs21RLRjAoVhEW7w1hLGgxaiIBs

D. Twitter list: https://twitter.com/i/lists/1342160518304423945

13/ Point #6: Many folks are already galvanizing the climate fintech conversation (tagging a few I could find below). There's a bunch more room at the table.

Sensing a potential socially-distanced get together at @money2020 next year year (or at another V-Sum @bpmilne?)

Sensing a potential socially-distanced get together at @money2020 next year year (or at another V-Sum @bpmilne?)

14/ Operators (please add more; v. aware of diversity gap):

@AndreiCherny, @billyparish, @BrianAAlderman, @chranderson, @dsaezgil, @hendrikbartel, @JoshLevin11, @landonbrand, @m_hoffm, @matthieusoule, @msjemmagreen, @orbuch, @RichMatsui, @RichMattison, @RichSorkin, @SamManaberi, @ShaulDavidUK

@AndreiCherny, @billyparish, @BrianAAlderman, @chranderson, @dsaezgil, @hendrikbartel, @JoshLevin11, @landonbrand, @m_hoffm, @matthieusoule, @msjemmagreen, @orbuch, @RichMatsui, @RichMattison, @RichSorkin, @SamManaberi, @ShaulDavidUK

15/ Investors (who else is investing in climate fintech?):

@albertwenger ( @usv), @jjacobs22 ( @mcjpod), @KushyKush, ( @NewEnergyNexus), @MarkWhitcroft ( @IlluminateFM), @morningdollar ( @commerzventures), @NicoleAnMo ( @TheRedsandGroup), @OctopusVentures

@albertwenger ( @usv), @jjacobs22 ( @mcjpod), @KushyKush, ( @NewEnergyNexus), @MarkWhitcroft ( @IlluminateFM), @morningdollar ( @commerzventures), @NicoleAnMo ( @TheRedsandGroup), @OctopusVentures

16/ IGOs + non-profits:

@climatefinlab, @FSB_TCFD, @GDFAlliance, @GFI_green, @NGFS_, @SASB, @UNDFTaskForce, @UNEP_FI

@climatefinlab, @FSB_TCFD, @GDFAlliance, @GFI_green, @NGFS_, @SASB, @UNDFTaskForce, @UNEP_FI

17/ FIN(tech) and onwards!

...yeah I’ll have to ask @NikMilanovic or @regulatorynerd how to do this properly next time

...yeah I’ll have to ask @NikMilanovic or @regulatorynerd how to do this properly next time

Read on Twitter

Read on Twitter