Thought I would share some errors from this year & associated learnings. To start with, here is one I prepared earlier on #NSF, with key learning is I should have identified COVID impacted industries faster & cut losses on #NSF before ultimate June sale. https://twitter.com/1James1n1/status/1276446876573761536?s=20

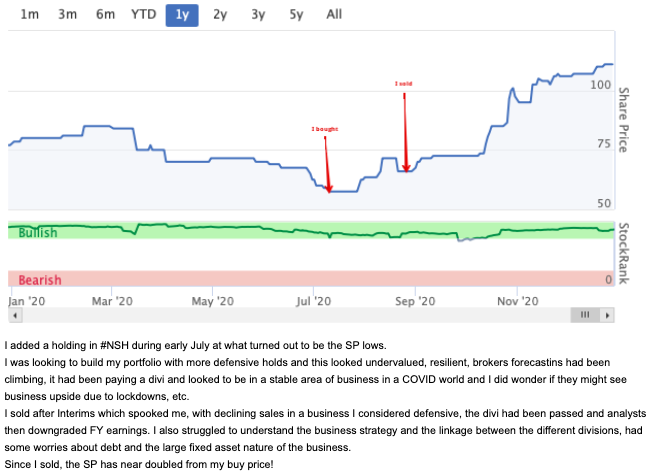

No 2 is a buy, then sale when I struggled to convince myself of my holding in #NSH. The SP has since nearly doubled from my July buy price!

No 3. I sold #KETL at the start of the COVID crisis (at 176p) due to concerns over the proportion of their manufacturing in Asia and then forgot to buy back in later. I think its a solid business and keep an eye out for a re-entry app.

No. 4. I held #MMX when they announced that they had revenue recognition issues in Oct & sold on the day for a 26% loss. Among lessons learned is to understand revenue recognition complexity.

Read on Twitter

Read on Twitter