#Review Alright probably time to reflect on some things learnt through my first 8 months trading live and set the goals/resolutions for next.

Still young, Still new, Still a lot to learn.

Still young, Still new, Still a lot to learn.

My main goal this year was to really focus on process and try build some good habits. See how the stats looked at the end of the year and figure out what I need to work on to get better.

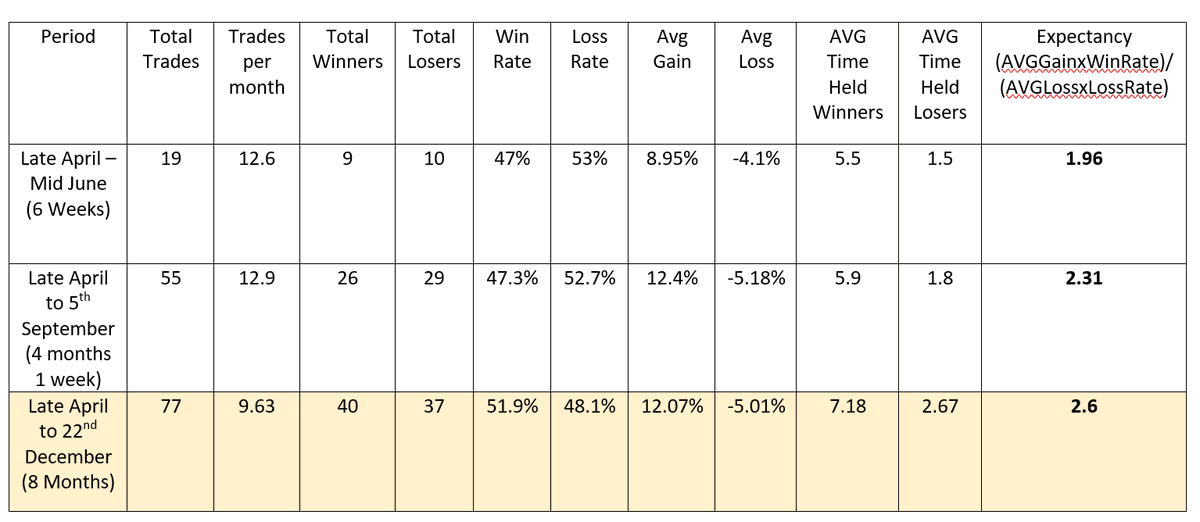

I finished the year with 77 trades in total (just ASX position trades) for an average gain around 12%, win rate around 52% and average loss around 5%. Giving an expectancy of 2.6. I did improve throughout the year which was good to see

I was trading pretty small position size for first year so portfolio results not super impressive or anything.

Given the market we had, I probably should've gotten more out of it. I certainly would've watched more trades that worked than actually took.

Given the market we had, I probably should've gotten more out of it. I certainly would've watched more trades that worked than actually took.

But looking back I've certainly achieved everything I set out for myself and happy with how I've developed and furthered my trading throughout the year.

Strategies are scalable, in terms of increasing position size. But that does come with increased risk per position. So to move forward with controlling risk based on the above stats. I need to be able to either turn over trades faster, or to be able to get more out of each trade.

Given I'm only a part timer and probably going to be stuck back in the 9-5 office next year. Not being at the screens as much. My choice is probably the latter and to try get more out of each trade.

Now in assessing a lot of my trades this year I am confident I've figured out how to do that. So lets visit some of the good & bad.

1) Some of the Good Trades.

These would be ones I say I managed the best. Not so much the best outcome.

These would be ones I say I managed the best. Not so much the best outcome.

The first decent one for me in the year was $PDI around a 50%ish gain in April.

High tight flag. Gold specs were going nuts at the time. On the big green day I sat with the trend for most of the day. Constantly reminding myself to let it trend. Clipped some and the next day

High tight flag. Gold specs were going nuts at the time. On the big green day I sat with the trend for most of the day. Constantly reminding myself to let it trend. Clipped some and the next day

That trade was significant as it gave me a bit of confidence to work back into the market. I found the post bear volatility really hard and I was pretty emotionally driven. I had to size right down to feel some level of comfort and build from there

The next one was a batch of trades being $Z1P, $SZL & $OPY. It was the first kinda sector move I latched onto and also managing trades going into earnings.

I learnt pretty quickly how strong sector moves can be and was fortunate to catch the bulk of it. Selling only part of a position really helped manage the trade. I trimmed some into the old high. I was at a decent gain going into earnings and decided to hold the rest

From memory the earnings date was the red down bar. Given the extent of $Z1P's run before that. You had to think that earnings would be mega mint or else its gonna be sold. As soon as it started to sell after open it was a sell all the position.

and clipped I think half the day before after letting the trend play out as insurance.

A few others in there as well but what's important is how many more trades I 100% stuffed up/failed at/could've been better.

Which leads me to

2) The bad trades/stuff ups

Which leads me to

2) The bad trades/stuff ups

My biggest % loss was just over 10% on $ELS

I didn't clip any into may19 res area at 72. I also forgot to set an alert for my stop price. I came back to the screen and sold at the days low two days after.

I didn't clip any into may19 res area at 72. I also forgot to set an alert for my stop price. I came back to the screen and sold at the days low two days after.

I set two new rules for myself after this trade. Always take some out at a previous resistance level (% of position dependent on strength of market) and don't let a winner become a loser.

It was just sloppy and carefree from me

It was just sloppy and carefree from me

Overall humbled by 10% being my biggest loss on a position. I think I did a pretty good job at honoring my stop throughout the year and was fortunate to not wake up to any gap downs

$NVX I butchered this. Got a decent entry. Panic'd on the one day reversal the day after thinking it was gonna turn to dog.

My stop technically was never hit. It also reset a few days after and I didn't but that either.

In theory. I should've caught at least some of this move

My stop technically was never hit. It also reset a few days after and I didn't but that either.

In theory. I should've caught at least some of this move

I did this on alot of names early in the year. Not giving trades room to breathe and honoring the stop. Some trades do just give a squat, and need more time to reset

$APX I bought as it went to all time highs in June. Got bored with it as it only really moved 1% days. and sold it on the down tick into the ma.

Reality is its at all time highs for a reason and holding the ma's. If I left it to play out there was a trend that could be caught

Reality is its at all time highs for a reason and holding the ma's. If I left it to play out there was a trend that could be caught

$3DP another I didn't let the trade breathe and sold it the same day as buying because I didn't like how it was going to close.

Stop never would've been hit and the trade worked

Stop never would've been hit and the trade worked

$PBH mega stuff up.

Sold all of it into the recent high before earnings.

as per rules from the $Z1P trade earlier.

Was at a gain so could've taken half out and let the other half play out from earnings. It was up 100% at one point that day

Sold all of it into the recent high before earnings.

as per rules from the $Z1P trade earlier.

Was at a gain so could've taken half out and let the other half play out from earnings. It was up 100% at one point that day

$LYC sold half into the previous all time high res area.

Then sold the other half at the low tick. Which was right on the ma, recent consolidation/support area. It trended hard after

Then sold the other half at the low tick. Which was right on the ma, recent consolidation/support area. It trended hard after

3) What to work on in 2021

There were plenty more stuff ups. The majority of my errors came from two things.

Not letting trades hit my stop/letting them breathe/play out

or just chopping them early (even if working) out of impatience/boredom.

There were plenty more stuff ups. The majority of my errors came from two things.

Not letting trades hit my stop/letting them breathe/play out

or just chopping them early (even if working) out of impatience/boredom.

So for 2021 pretty much need just to HODL more.

It no longer feels like seeing the trade is the issue. but more so managing it now

It no longer feels like seeing the trade is the issue. but more so managing it now

4) Some Key market rules/lessons/thoughts/observations & opinions.

Obviously this will be different for each trader and their style etc

Obviously this will be different for each trader and their style etc

a) You gotta track your trades.

Trading is about all about probability. To be successful you really want to win more than you lose. Ideally win rate is +ve and you win more in gain terms than lose.

that is an edge

Trading is about all about probability. To be successful you really want to win more than you lose. Ideally win rate is +ve and you win more in gain terms than lose.

that is an edge

if you don't really know what your overall stats look like its hard to benchmark individual trades against and dissect what you could have done better

and how your stats change against differing markets/conditions. So you know what periods you can deliver outperformance

In September I really tried to think through each kind of element/stats I guess and go what do I need to do to maximize expectancy

So to minimize that average loss I really make an effort to buy well and out of good areas with tight price action.

As well as always honoring a stop loss to not let a bad trade become a mega bad one

As well as always honoring a stop loss to not let a bad trade become a mega bad one

Win rate is something I feel I do have an element of control over as well. It comes from just trying to be selective and buy the best names that are most likey to work.

Really just try to stick to the hot sectors with the bid and the best setups within that.

Really just try to stick to the hot sectors with the bid and the best setups within that.

and then average gain is just one of those ones that's a management issue. being able to let the trend play out sitting through pullbacks.

always good to take a little bit of profit to secure that win rate. But I really need to let the bigger trends play out

always good to take a little bit of profit to secure that win rate. But I really need to let the bigger trends play out

if you get a good entry you gotta let it play out. This is a big focus for me next year.

back on win rate. if the markets shite. just wait. dont drop the quality of setups. The market is not going anywhere.

back on win rate. if the markets shite. just wait. dont drop the quality of setups. The market is not going anywhere.

if you don't know what your setups are/playbooked trades.

Definitely just start on small size and try dissect what has worked vs what doesn't. What was price doing in the leadup to the trade? what was volume doing?

Definitely just start on small size and try dissect what has worked vs what doesn't. What was price doing in the leadup to the trade? what was volume doing?

if you can understand basic support vs resistance and base vs trend you'll go a long way.

Don't flood the screens with indicators. there's no need. Most are just some derivative of price and or volume

Don't flood the screens with indicators. there's no need. Most are just some derivative of price and or volume

b) on some psych/mindset stuff

Emotional capital is paramount.

you're going to make 1000's of trades in your lifetime. you need to be able avoid/limit the possibility of huge losses and the grief associated with. I've done it. its not fun.

Emotional capital is paramount.

you're going to make 1000's of trades in your lifetime. you need to be able avoid/limit the possibility of huge losses and the grief associated with. I've done it. its not fun.

you need to be able to ignore the coulda, shoulda, woulda done this with a trade.

Learn what you can from it. Move on. Take the next best one. having a strong mindset will allow you to find the next trade

Learn what you can from it. Move on. Take the next best one. having a strong mindset will allow you to find the next trade

Markets change incredibly quickly. You have to be flexible and consider all the possibilities. Opinions/bias's change often. Again, I think mindset and prep is paramount to do this.

To limit a lot of the emotion I found with trading this year. I really had to plan my trade and trade my plan.

Once I knew what setups I was going to take in advance of them happening. What to buy/why i'm buying it and what do i expect of the trade. Suddenly it all got easier

Once I knew what setups I was going to take in advance of them happening. What to buy/why i'm buying it and what do i expect of the trade. Suddenly it all got easier

you learn to just accept the $$$ risk and trust that your edge will play out. It takes alot of the emotion out of it. and the risk of stuffing things up is less

c) definitely another big theme this year is to just ignore the noise and it fits several contexts

I look at a lot of index's as well and I always panic'd out of stocks on a market down day. Especially if it was the asia or euro session because it always got picked up again by the US session.

Index's are very different to stocks. treat them separately.

Index's are very different to stocks. treat them separately.

Try not to listen to and or compare yourself to anything associated with lambo's & ego's.

Reality is trading is damn hard and frustrating. As soon as I make several trades in a row. You start to think you're good, size up and suddenly the market humbles you again.

Reality is trading is damn hard and frustrating. As soon as I make several trades in a row. You start to think you're good, size up and suddenly the market humbles you again.

I think the best people go about quietly and are incredibly humble. They probably work incredibly hard at their own game and don't have time for other things

Also, ignore the noise and just block out other peoples opinions in general. You're here to master/develop you're own game and not be dependent on others.

If your sole investment strategy is to buy something because someone told you its the Saudi Arabia of Lithium.

Goodluck. I've done it and lost decent amounts doing it. You might get lucky now and then but eventually you will probably take the L if you cant control risk.

Goodluck. I've done it and lost decent amounts doing it. You might get lucky now and then but eventually you will probably take the L if you cant control risk.

18 year old me 3-4 years ago was spending way more time refreshing the Hotcopper threads of speculative stuff I was holding than swiping right on tinder. and i did alot of right swipes!

if your there just to get reassurance from others. to be attached to a stock. to an idea of bags.

I don't think its the right path.

Not to say all FA investing and specs are bad. There are some incredibly talented people that do it.

Just stay objective and don't fall in love

I don't think its the right path.

Not to say all FA investing and specs are bad. There are some incredibly talented people that do it.

Just stay objective and don't fall in love

d) other market related thoughts from said year.

be dumb follow price, react to it and dont assume.

buy things that go up. momentum begets more momentum

be dumb follow price, react to it and dont assume.

buy things that go up. momentum begets more momentum

Levels of follow through from setups felt like the internal gauge for whether to go hard or take a step back in the market. Participate when things work.

oh yeah try not to look at PnL. As soon as i did i started to fantasize too much about dollars and lost focus on process.

5) now to wrap up with my goals for 2021

I really want to smash out a bunch more trading #books to further learning and add to the below thread. https://twitter.com/bradtheinvestor/status/1279003071578648576

Get my trading expectancy above 3

Track all trades in new spready

Track all trades in new spready

Other life #goals for next year

lower the golf handicap by 5+ shots or so. Currently 28-29. 20 would be nice.

Learn some piano and or guitar

get involved in some kind of volunteering

Journal and do more meditation

lower the golf handicap by 5+ shots or so. Currently 28-29. 20 would be nice.

Learn some piano and or guitar

get involved in some kind of volunteering

Journal and do more meditation

and then lastly. Go hard at the fitness.

neglected it a bit with lockdowns this year.

running 1000km's within the year would be pretty cool. as well as 200+ sessions in the gym.

Will try to track all that in this thread as a #goals thread. as lame as that sounds

neglected it a bit with lockdowns this year.

running 1000km's within the year would be pretty cool. as well as 200+ sessions in the gym.

Will try to track all that in this thread as a #goals thread. as lame as that sounds

Alright my 3hr thread spam is done. I'm off to sink bevs. Happy new year to everyone. Will have a look at some charts on the weekend. If any good back next week. Otherwise the following.

Read on Twitter

Read on Twitter