A lot has been said about $TSLA's future returns given its monster 20X move from the 2019 "restructuring story" Adam Jones bottom.

A valid point is brought up by the bears: Tesla could execute to perfection and the stock could **still** drop sizably.

Long but easy thread.

A valid point is brought up by the bears: Tesla could execute to perfection and the stock could **still** drop sizably.

Long but easy thread.

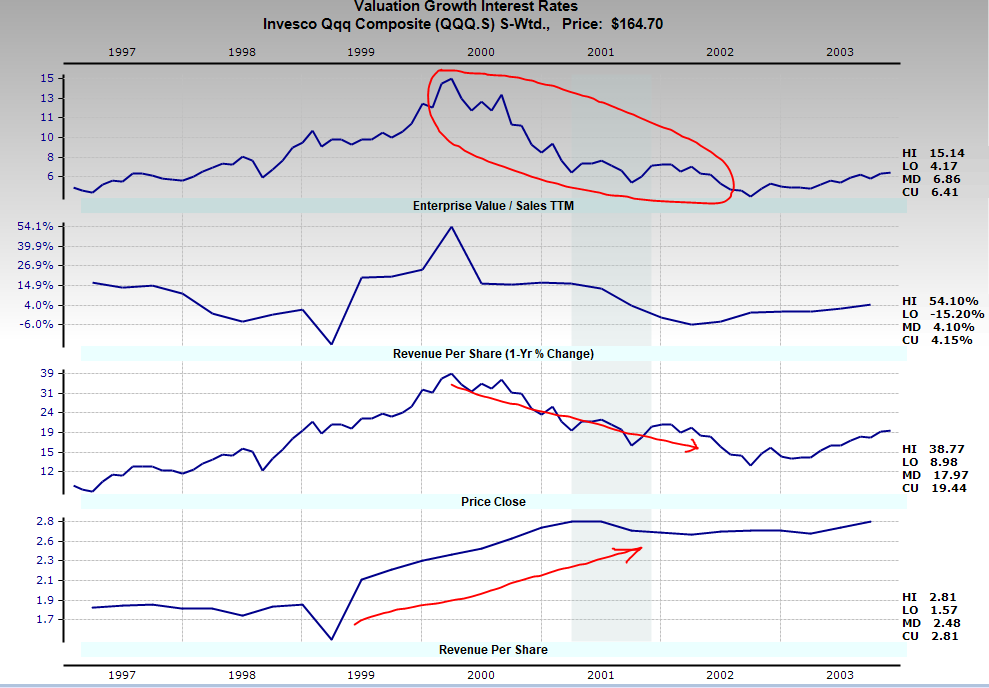

Comparisons have been drawn of the current environment to the late 1990s bubble period, in which both legitimate and illegitimate stocks experienced euphoric valuations. Microsoft, Cisco, Amazon, and Apple all appreciated significantly along with worthless dot-com busts.

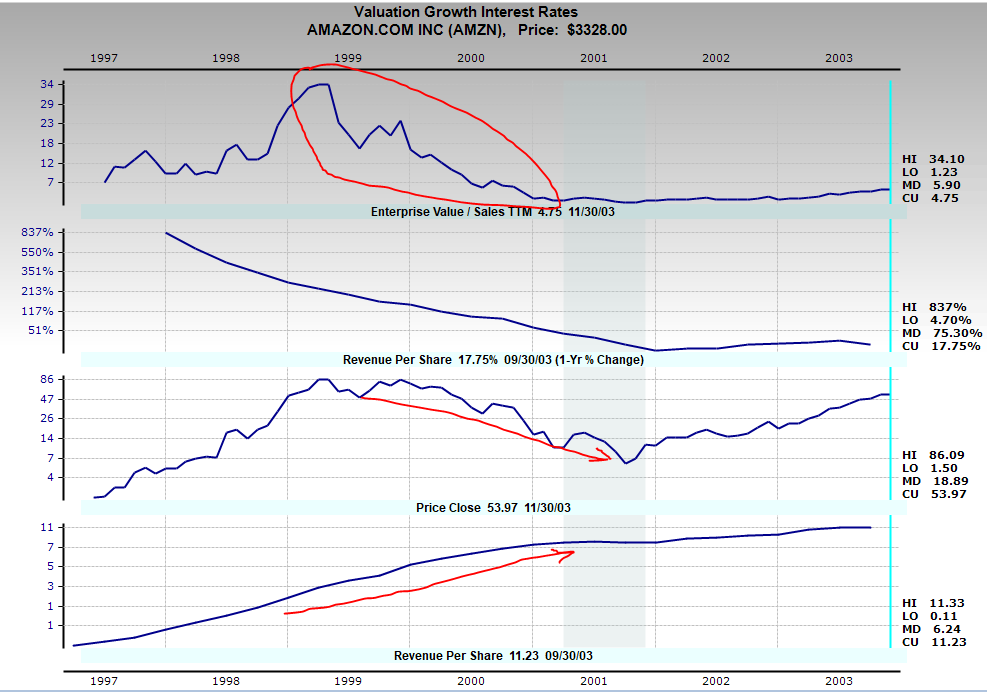

As you can see in the chart above, a primary driver of Nasdaq returns weren't its revenue growth, but rather its valuation multiple expansion. Companies in the $QQQ experienced a euphoric rise, as did worthless stocks like http://Pets.com , multiplying several times over.

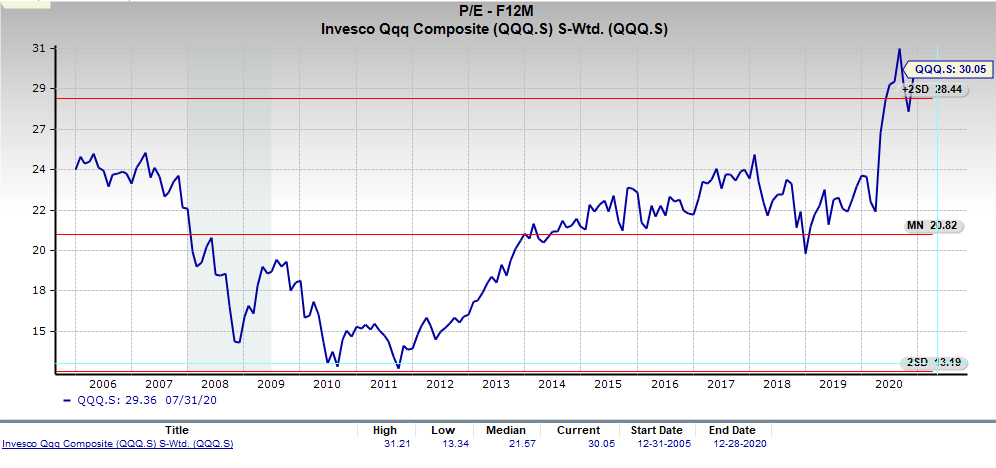

This is very reminiscent of the current environment, where you see extremely valuable and legitimate stocks like $AAPL and $AMZN (in fact, the entire $QQQ wtd avg) currently trading at > 2-standard deviations over 15-yr fwd P/E multiple averages:

At the same time, you have companies with questionable business models ( $NKLA) and companies years away from generating revenue ( $QS) along with other interesting stocks trading at atmospheric sales multiples ( $SHOP 37x, $LMND 54x, $SNOW 81x).

Valuation multiples are a function of several factors: fundamental factors such as growth and returns on capital, as well as macro factors which can be conceptualized & quantified by the 'equity risk premium': the expected return on risky assets in excess of risk-free Treasuries.

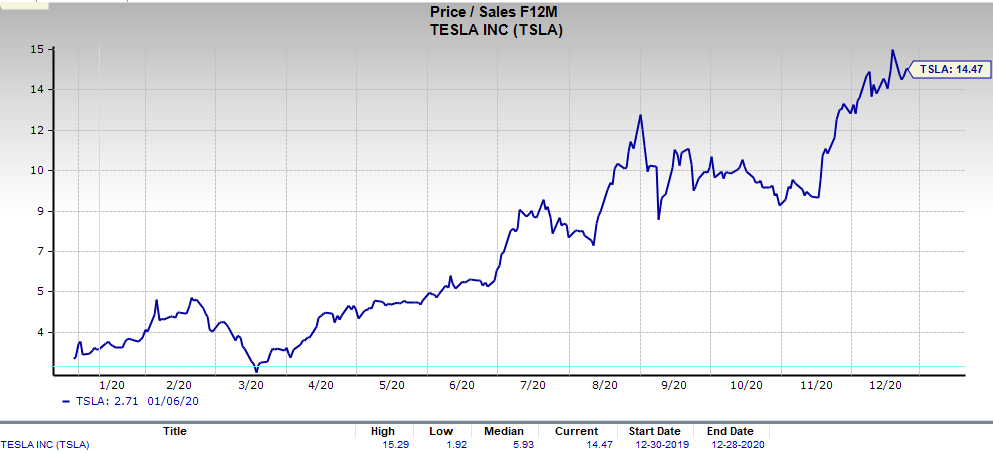

Similarly, a large contributor to Tesla's stock returns is - you guessed it - valuation multiple expansion in addition to fundamental growth.

Tesla's fwd P/Sales multiple grew from 2.5X a year ago to now 14.5X, a 480% expansion.

Tesla's fwd P/Sales multiple grew from 2.5X a year ago to now 14.5X, a 480% expansion.

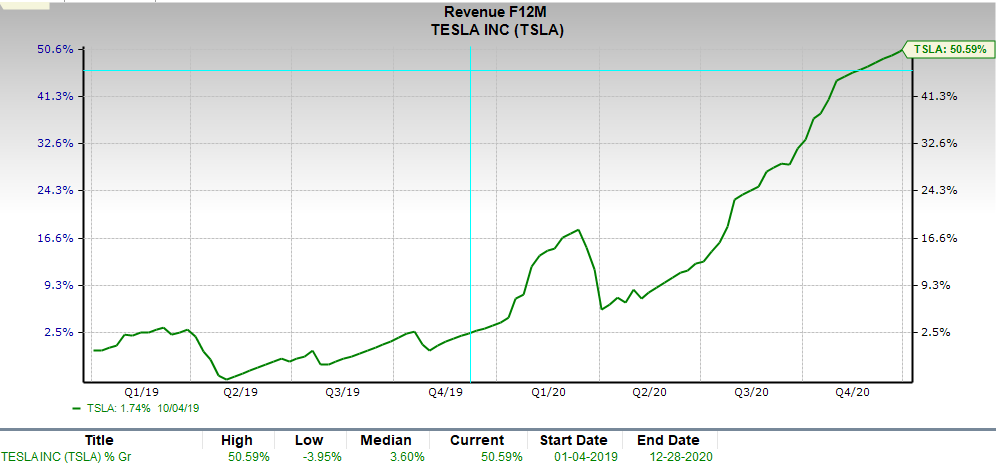

While at the same time, forward revenues have grown by 50%.

The compounding effect of 480% P/Sales multiple expansion * (1 + 50% sales growth) = 7.2X, which roughly explains $TSLA's 1-yr return.

The compounding effect of 480% P/Sales multiple expansion * (1 + 50% sales growth) = 7.2X, which roughly explains $TSLA's 1-yr return.

This means that a primary contributor (though not all) of $TSLA's returns YTD can be explained not by topline growth but by a combination of:

1) stock was artificially depressed at the starting point with record high short interest, pricing in some probability of bankruptcy;

1) stock was artificially depressed at the starting point with record high short interest, pricing in some probability of bankruptcy;

2) market decisively rebuking bankruptcy fears + repricing it for the real probability of increasing scale & profitability

3) market possibly overshooting to the upside in a red hot market as dozens (possibly 100s) other stocks experience similar record valuations.

3) market possibly overshooting to the upside in a red hot market as dozens (possibly 100s) other stocks experience similar record valuations.

So to circle back to the original point: the late 1990s era showed us that both legitimate AND illegitimate (and ultimately bankrupt) companies traded at sky high valuations, multiple standard deviations above the norm, just like we're seeing today...

The illegitimate stocks went bust. The ones left standing continued to perform extremely well fundamentally - Cisco, Microsoft, Amazon, and many others.

But despite executing well through the bursting of the bubble, their shares were pounded into the ground.

But despite executing well through the bursting of the bubble, their shares were pounded into the ground.

$AMZN, for example, continued to compound top-line at an extraordinary rate, going from $2.60 revenues per share at the market peak in 1999 to $8.10 at the market bottom in 2001, a ridiculous 76% revenue CAGR. But the stock still got flatlined because the sales multiple reversed.

Dozens of other examples like this exist: Cisco $CSCO, $AAPL, $MSFT and many more - very profitable companies that changed their world in their own ways while they delivered strong fundamental results, but saw their stock prices flatline for a number of years post-2000.

What does all this mean? In a nutshell, this could repeat in 2021 (or maybe later?): valuations reach a point of exhaustion after which the equity risk premium appreciates dramatically. This can have the real effect of crushing multiples even if fundamental execution is strong.

The only way a stock can therefore absorb a drop in multiples is if it produces equally strong fundamental growth.

So if Tesla can triple its EPS from 2020 to 2022, it could absorb up to a 66% P/E compression, in which case the stock would remain flat over that period.

So if Tesla can triple its EPS from 2020 to 2022, it could absorb up to a 66% P/E compression, in which case the stock would remain flat over that period.

Much depends on macro factors. If you're a long term $TSLA investor (>5 yrs), this shouldn't matter. But just to prepare folks for what might sound shocking: Tesla could become one of the most profitable cos in the world, yet see the stock flat to even down over the mid-term.

Read on Twitter

Read on Twitter