192% Growth SPAC

192% Growth SPAC

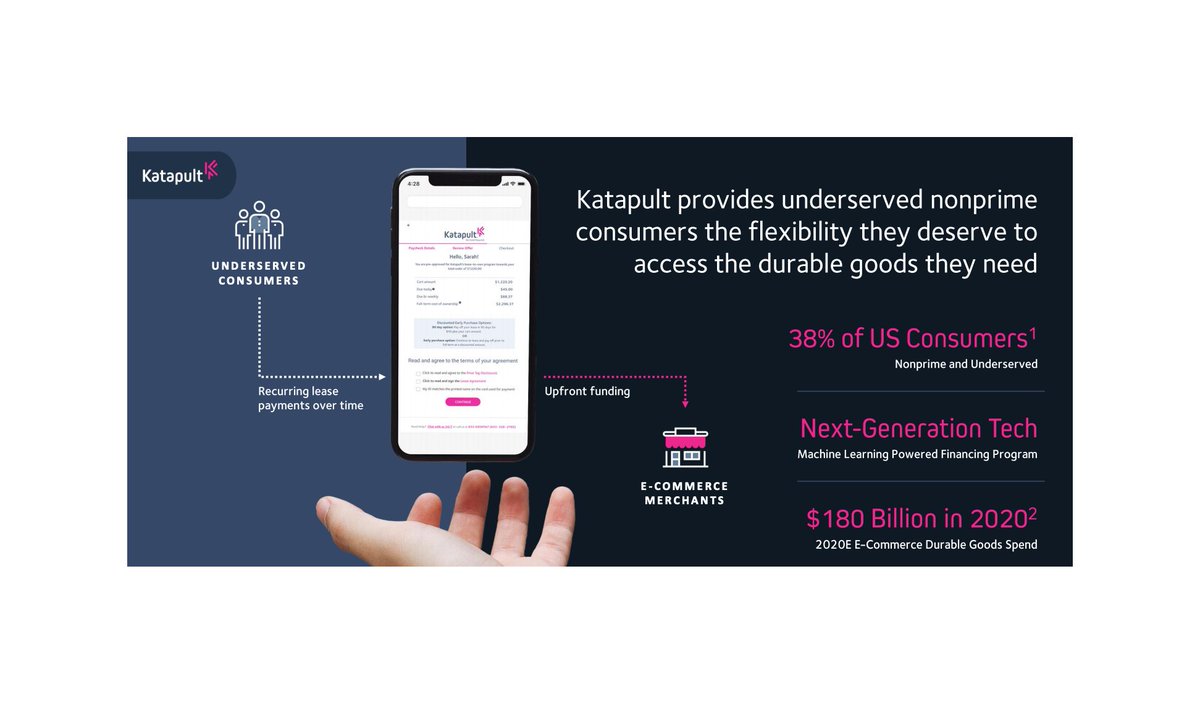

Katapult provides leasing solution for e-commerce websites

Katapult provides leasing solution for e-commerce websites It enables non-prime customers to lease durable goods online

It enables non-prime customers to lease durable goods online ALL founders left and $CURO owns 50% of Katapult

ALL founders left and $CURO owns 50% of Katapult What is hidden behind the $FSRV SPAC

What is hidden behind the $FSRV SPAC

Here is an EASY thread

Katapult was founded in 2012 and was initially called Zibby and operated by Cognical

By 2015, it had raised $ 10m in equity and debt from VC funds such as Tribeca Venture Partners and Blumberg Capital https://techcrunch.com/2014/11/18/cognical-provides-online-payment-options-for-the-underbanked/

By 2015, it had raised $ 10m in equity and debt from VC funds such as Tribeca Venture Partners and Blumberg Capital https://techcrunch.com/2014/11/18/cognical-provides-online-payment-options-for-the-underbanked/

By 2015, it had raised $ 10m in equity and debt from VC funds such as Tribeca Venture Partners and Blumberg Capital https://techcrunch.com/2014/11/18/cognical-provides-online-payment-options-for-the-underbanked/

By 2015, it had raised $ 10m in equity and debt from VC funds such as Tribeca Venture Partners and Blumberg Capital https://techcrunch.com/2014/11/18/cognical-provides-online-payment-options-for-the-underbanked/

Cognical was founded by

Brandon Wright - a Cornell MBA who later founded @payfully

Ashutosh Saxena - a PhD in AI from Stanford (awards: https://cs.stanford.edu/people/asaxena/index.html)

Chinedu Eleanya - a serial entrepreneur who later founded @GetMulberry which sells extended warranty to shoppers

Brandon Wright - a Cornell MBA who later founded @payfully

Ashutosh Saxena - a PhD in AI from Stanford (awards: https://cs.stanford.edu/people/asaxena/index.html)

Chinedu Eleanya - a serial entrepreneur who later founded @GetMulberry which sells extended warranty to shoppers

Zibby was a “Lease-To-Own” service designed for durable goods & products (furniture, appliances, electronics)

When customers purchase an item online, Zibby retains the rights to this item

When customers purchase an item online, Zibby retains the rights to this item

When customers purchase an item online, Zibby retains the rights to this item

When customers purchase an item online, Zibby retains the rights to this item

Zibby rents the item to the customer

Zibby rents the item to the customer  The customer can decide to purchase the full ownership rights of the item at any time

The customer can decide to purchase the full ownership rights of the item at any timeThis model proved successful and Zibby was incubated by Cornell

Zibby was designed for non-prime customers as the founders identified that:

64m shoppers in the US need access to credit but have no credit history

64m shoppers in the US need access to credit but have no credit history

34% of Americans between 18 and 49 do not have credit cards

34% of Americans between 18 and 49 do not have credit cards

Around 46% of Americans have a credit score under 700

Around 46% of Americans have a credit score under 700

64m shoppers in the US need access to credit but have no credit history

64m shoppers in the US need access to credit but have no credit history 34% of Americans between 18 and 49 do not have credit cards

34% of Americans between 18 and 49 do not have credit cards Around 46% of Americans have a credit score under 700

Around 46% of Americans have a credit score under 700

“We're giving them a means to acquire expensive products they couldn't otherwise afford […] Refrigerators to keep food cold and beds for kids to sleep in.” - Brandon Wright

Taken from https://news.cornell.edu/stories/2015/02/cornell-startup-helps-unbanked-buy-online

https://news.cornell.edu/stories/2015/02/cornell-startup-helps-unbanked-buy-online

Taken from

https://news.cornell.edu/stories/2015/02/cornell-startup-helps-unbanked-buy-online

https://news.cornell.edu/stories/2015/02/cornell-startup-helps-unbanked-buy-online

Chinedu Eleanya and Ashutosh Saxena created the Zibby tool by feeding their models with a database of past loans

Along with information on the borrowers (address, financial records, device type they use)

Along with information on the borrowers (address, financial records, device type they use)

The computer then finds patterns and returns “default probabilities”

The computer then finds patterns and returns “default probabilities”

Along with information on the borrowers (address, financial records, device type they use)

Along with information on the borrowers (address, financial records, device type they use) The computer then finds patterns and returns “default probabilities”

The computer then finds patterns and returns “default probabilities”

Great! But what is Zibby now?

Zibby changed it name to Katapult

Zibby changed it name to Katapult

Founders left and Orlando Zayas became CEO in 2017 (previously at GE and Wells Fargo)

Founders left and Orlando Zayas became CEO in 2017 (previously at GE and Wells Fargo)

Kariss Cupito came in as CFO (previously at Tempoe)

Kariss Cupito came in as CFO (previously at Tempoe)

Zibby changed it name to Katapult

Zibby changed it name to Katapult Founders left and Orlando Zayas became CEO in 2017 (previously at GE and Wells Fargo)

Founders left and Orlando Zayas became CEO in 2017 (previously at GE and Wells Fargo) Kariss Cupito came in as CFO (previously at Tempoe)

Kariss Cupito came in as CFO (previously at Tempoe)

On the business side, Katapult is the same as Zibby

It provides leasing solutions (up to $ 3,500) for durable goods to underserved non-prime customers

It provides leasing solutions (up to $ 3,500) for durable goods to underserved non-prime customers

It is integrated with Wayfair, Lenovo, Affirm, $SHOP, Magento and BigCommerce

It is integrated with Wayfair, Lenovo, Affirm, $SHOP, Magento and BigCommerce

It works both in-store and online

It works both in-store and online

It provides leasing solutions (up to $ 3,500) for durable goods to underserved non-prime customers

It provides leasing solutions (up to $ 3,500) for durable goods to underserved non-prime customers It is integrated with Wayfair, Lenovo, Affirm, $SHOP, Magento and BigCommerce

It is integrated with Wayfair, Lenovo, Affirm, $SHOP, Magento and BigCommerce It works both in-store and online

It works both in-store and online

Katapult now counts 150 merchants on its platform and enjoys a NPS of 47

For comparison, American Express has a NPS of 55 and Apple scores 68

For comparison, American Express has a NPS of 55 and Apple scores 68

https://blog.hubspot.com/service/what-is-a-good-net-promoter-score

For comparison, American Express has a NPS of 55 and Apple scores 68

For comparison, American Express has a NPS of 55 and Apple scores 68https://blog.hubspot.com/service/what-is-a-good-net-promoter-score

When taking into account partner integrations, it could add over 6,500 merchants

These have at least $ 5m in sales in the relevant goods segments

These have at least $ 5m in sales in the relevant goods segments

These have at least $ 5m in sales in the relevant goods segments

These have at least $ 5m in sales in the relevant goods segments

But how does it make money?

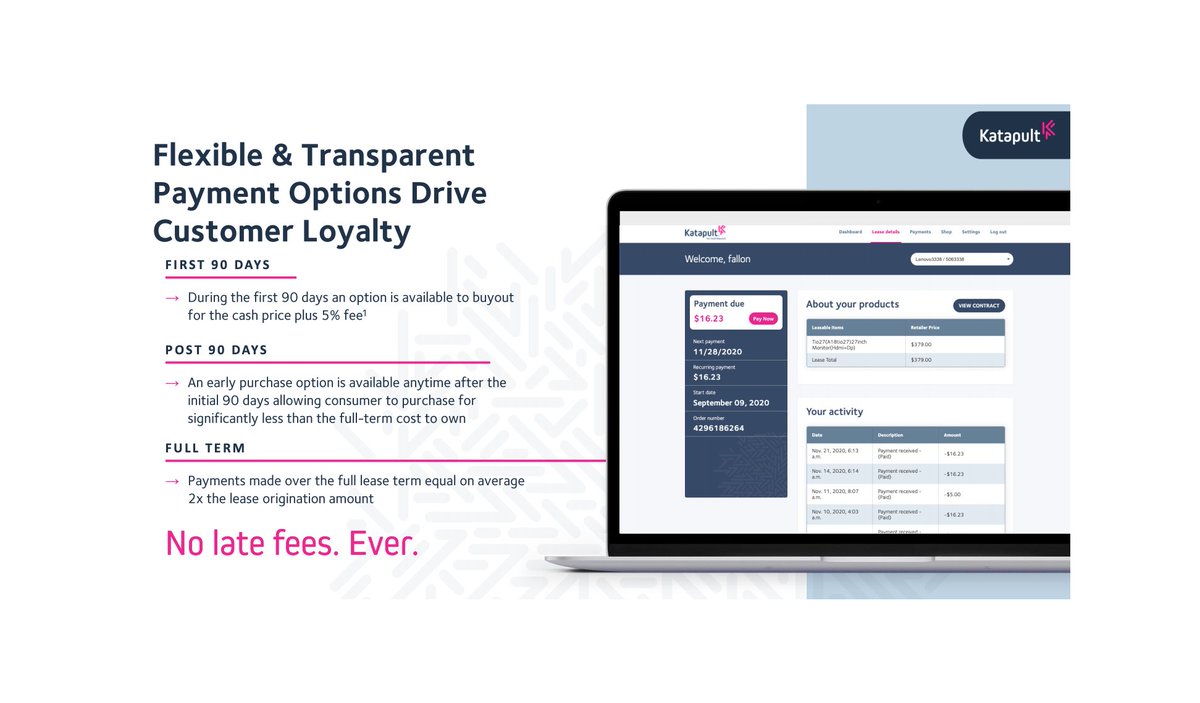

Customers have to pay a $45 loan origination fee

Customers have to pay a $45 loan origination fee

Customers can buy out their item during the first 90 days for an additional 5% fee

Customers can buy out their item during the first 90 days for an additional 5% fee

If customers go through the full term, they will have paid twice the item’s price

If customers go through the full term, they will have paid twice the item’s price

Customers have to pay a $45 loan origination fee

Customers have to pay a $45 loan origination fee Customers can buy out their item during the first 90 days for an additional 5% fee

Customers can buy out their item during the first 90 days for an additional 5% fee If customers go through the full term, they will have paid twice the item’s price

If customers go through the full term, they will have paid twice the item’s price

While Katapult is a leasing company and not a “Buy Now Pay Later” company, here is how the BNPL market is set to evolve:

According to Kaleido Intelligence, market is set to rise to $ 680B by 2025, up 92% from $ 353B

According to Kaleido Intelligence, market is set to rise to $ 680B by 2025, up 92% from $ 353B

According to Kaleido Intelligence, market is set to rise to $ 680B by 2025, up 92% from $ 353B

According to Kaleido Intelligence, market is set to rise to $ 680B by 2025, up 92% from $ 353B

Driven by higher e-commerce penetration and younger demographics’ higher preference for BNPL solutions https://www.businesswire.com/news/home/20200922005066/en/Buy-Now-Pay-Later-Digital-Spend-Led-by-Klarna-PayPal-Afterpay-to-Double-by-2025-Reaching-680-Billion---Kaleido-Intelligence

Driven by higher e-commerce penetration and younger demographics’ higher preference for BNPL solutions https://www.businesswire.com/news/home/20200922005066/en/Buy-Now-Pay-Later-Digital-Spend-Led-by-Klarna-PayPal-Afterpay-to-Double-by-2025-Reaching-680-Billion---Kaleido-Intelligence

According to Forbes, around 7% of Americans have made a BNPL purchase this year

According to Forbes, around 7% of Americans have made a BNPL purchase this year Representing $ 24B in sales in 2020 versus $ 20B in 2019

Representing $ 24B in sales in 2020 versus $ 20B in 2019 With growth in BNPL being driven by millennials and high-income earners

With growth in BNPL being driven by millennials and high-income earners  https://www.forbes.com/sites/ronshevlin/2020/11/22/the-24-billion-buy-now-pay-later-battle/

https://www.forbes.com/sites/ronshevlin/2020/11/22/the-24-billion-buy-now-pay-later-battle/

According to Worldpay, BNPL is the fastest growing e-commerce payment method globally

According to Worldpay, BNPL is the fastest growing e-commerce payment method globally

In the US, BNPL is set to account for 3% of all e-commerce payments by 2023 - up form 1% today

In the US, BNPL is set to account for 3% of all e-commerce payments by 2023 - up form 1% today

In the EMEA, BNPL already accounts for 6% of all e-commerce payments and set to reach 10% by 2023

In the EMEA, BNPL already accounts for 6% of all e-commerce payments and set to reach 10% by 2023https://worldpay.globalpaymentsreport.com/

BNPL is not without risks as

Over the past 2 years, 43% of BNPL users have been late with a payment

Over the past 2 years, 43% of BNPL users have been late with a payment

66% were late because they lost track of the payments, 33% because they could not pay

66% were late because they lost track of the payments, 33% because they could not pay

More than 50% have seen their credit card limits decrease in the past year

More than 50% have seen their credit card limits decrease in the past year

Over the past 2 years, 43% of BNPL users have been late with a payment

Over the past 2 years, 43% of BNPL users have been late with a payment 66% were late because they lost track of the payments, 33% because they could not pay

66% were late because they lost track of the payments, 33% because they could not pay More than 50% have seen their credit card limits decrease in the past year

More than 50% have seen their credit card limits decrease in the past year

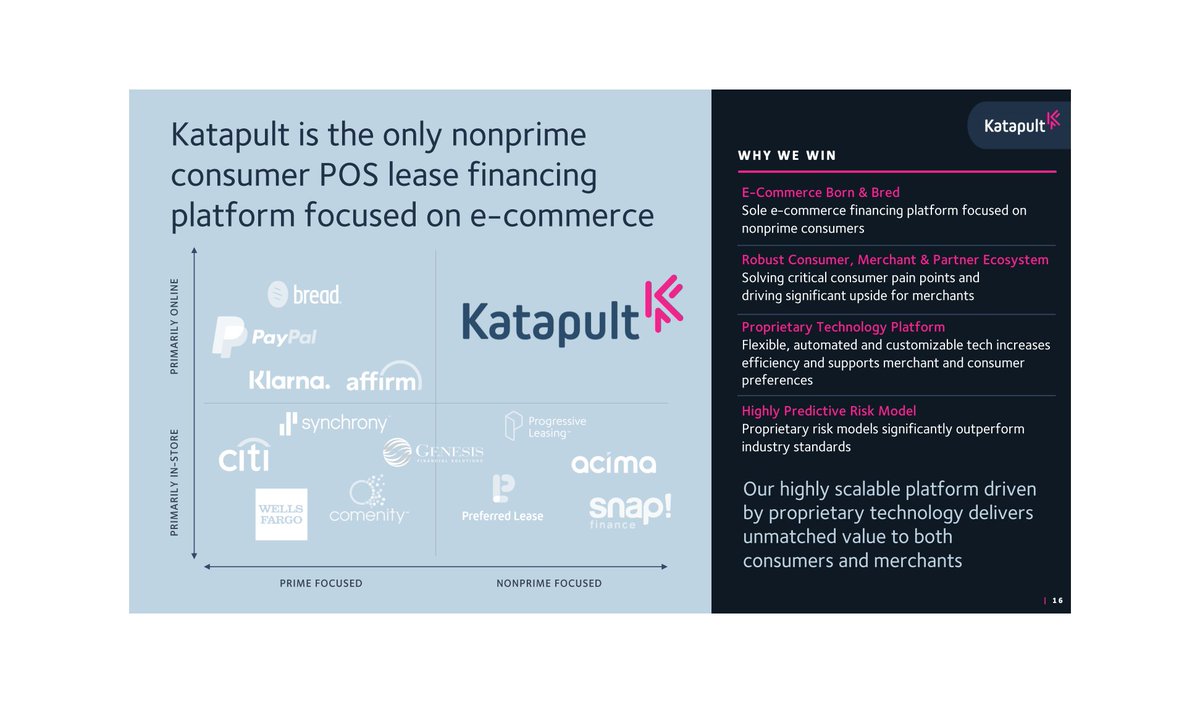

Katapult is a “Lease-to-own”, not a BNPL

Shows similarities with Affirm, AfterPay and Klarna as it pop ups at the check-out, works with minimal customer input and provides instant approval

Shows similarities with Affirm, AfterPay and Klarna as it pop ups at the check-out, works with minimal customer input and provides instant approval

Expansion of online Buy Now Pay Later tools could be used as a proxy for Katapult

Expansion of online Buy Now Pay Later tools could be used as a proxy for Katapult

Shows similarities with Affirm, AfterPay and Klarna as it pop ups at the check-out, works with minimal customer input and provides instant approval

Shows similarities with Affirm, AfterPay and Klarna as it pop ups at the check-out, works with minimal customer input and provides instant approval Expansion of online Buy Now Pay Later tools could be used as a proxy for Katapult

Expansion of online Buy Now Pay Later tools could be used as a proxy for Katapult

Key difference is that Katapult caters to non-prime customers, a market in which it is virtually alone

Key difference is that Katapult caters to non-prime customers, a market in which it is virtually alone

“[…] many people need credit but can’t access it. Or, if they do, they're unwilling to put their credit scores at risk. This represents a significant segment of customers who are all-too-often ignored by retailers” by Jia Wertz for Fobrbes https://www.forbes.com/sites/jiawertz/2020/04/28/lease-to-own-integral-e-commerce-growth-strategy/

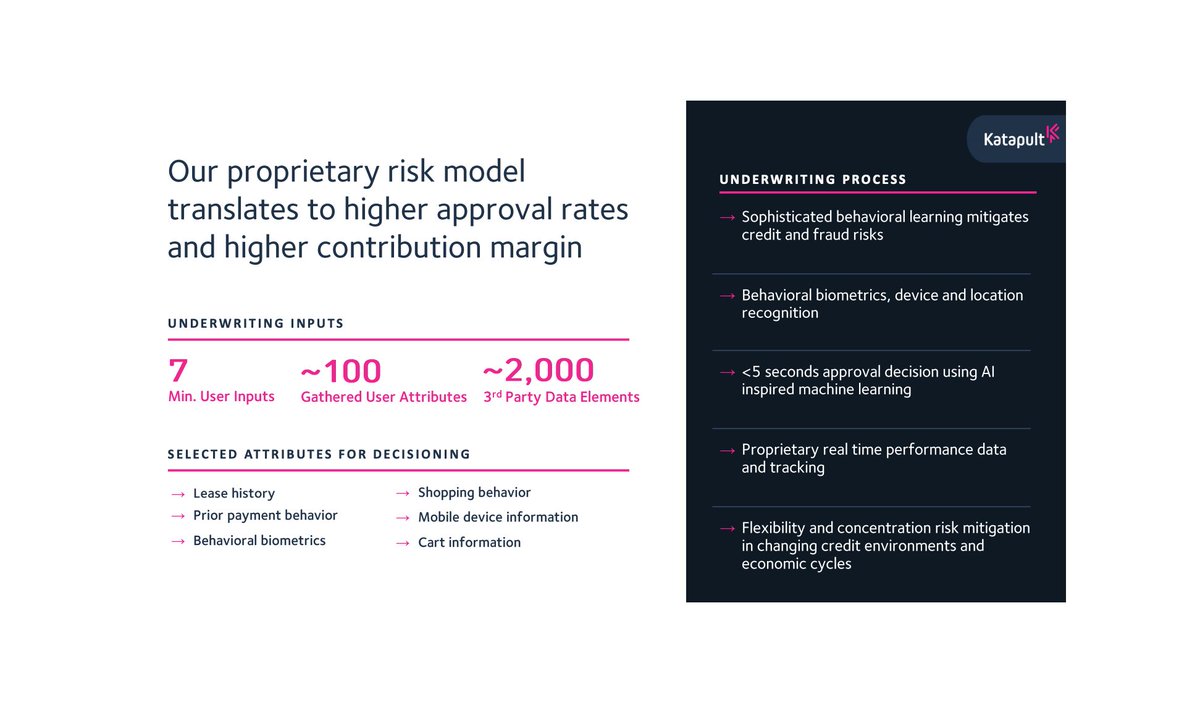

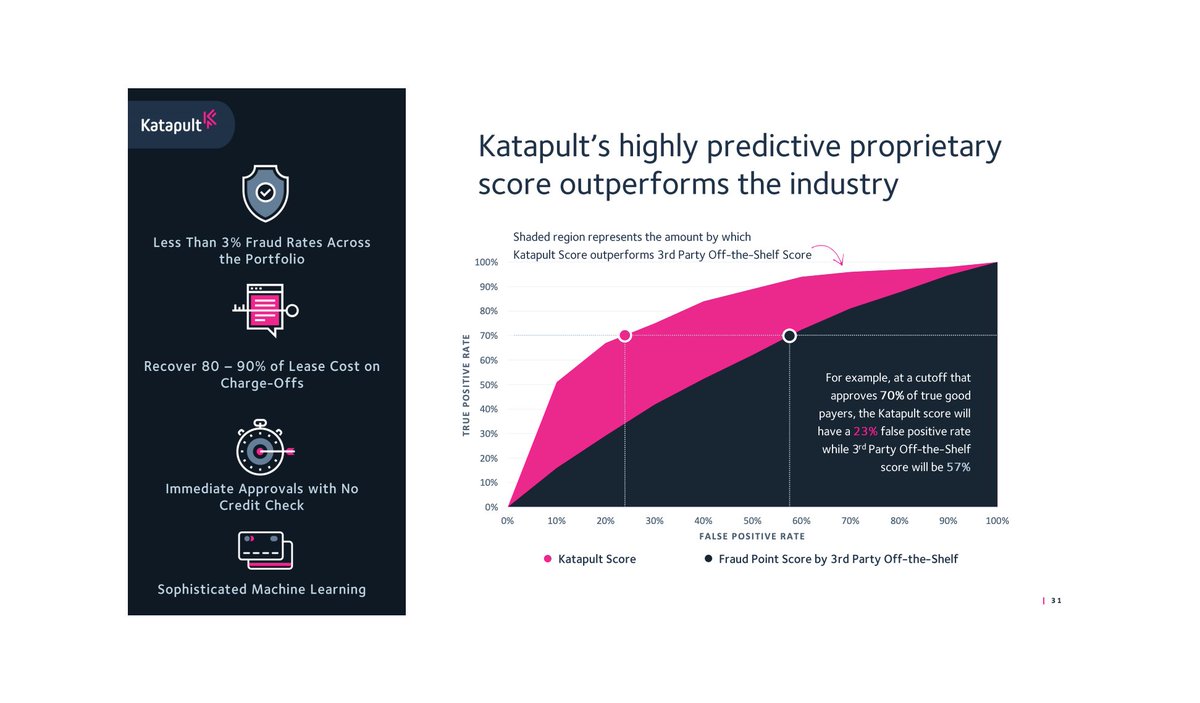

How does Katapult plans to win in its market? Well, this is all about data

It claims to get a better True Positive / False Positive for identifying good payers

It claims to get a better True Positive / False Positive for identifying good payers

It can thus lease to more customers, given that it is able to spot good payers better than its competitors

It can thus lease to more customers, given that it is able to spot good payers better than its competitors

It claims to get a better True Positive / False Positive for identifying good payers

It claims to get a better True Positive / False Positive for identifying good payers It can thus lease to more customers, given that it is able to spot good payers better than its competitors

It can thus lease to more customers, given that it is able to spot good payers better than its competitors

And it only gets better with more customers as these provide more data on their turn

Katapult already disposes of over 500,000 lease-to-won transaction records

Katapult already disposes of over 500,000 lease-to-won transaction records

Enabling it to further expand its products offering, customer base and merchant integrations

Enabling it to further expand its products offering, customer base and merchant integrations

Katapult already disposes of over 500,000 lease-to-won transaction records

Katapult already disposes of over 500,000 lease-to-won transaction records Enabling it to further expand its products offering, customer base and merchant integrations

Enabling it to further expand its products offering, customer base and merchant integrations

But of course, Katapult is NOT alone in its market

$OSTK partnered with Progressive Leading to launch its lease-to-own service

Customers can lease up to 3m items for payment of $ 49

Customers can lease up to 3m items for payment of $ 49

Customers need approval to apply but don’t need credit https://www.retaildive.com/news/overstock-launches-lease-to-own-service/532830/

Customers need approval to apply but don’t need credit https://www.retaildive.com/news/overstock-launches-lease-to-own-service/532830/

$OSTK partnered with Progressive Leading to launch its lease-to-own service

Customers can lease up to 3m items for payment of $ 49

Customers can lease up to 3m items for payment of $ 49  Customers need approval to apply but don’t need credit https://www.retaildive.com/news/overstock-launches-lease-to-own-service/532830/

Customers need approval to apply but don’t need credit https://www.retaildive.com/news/overstock-launches-lease-to-own-service/532830/

Financials Check

Financials Check

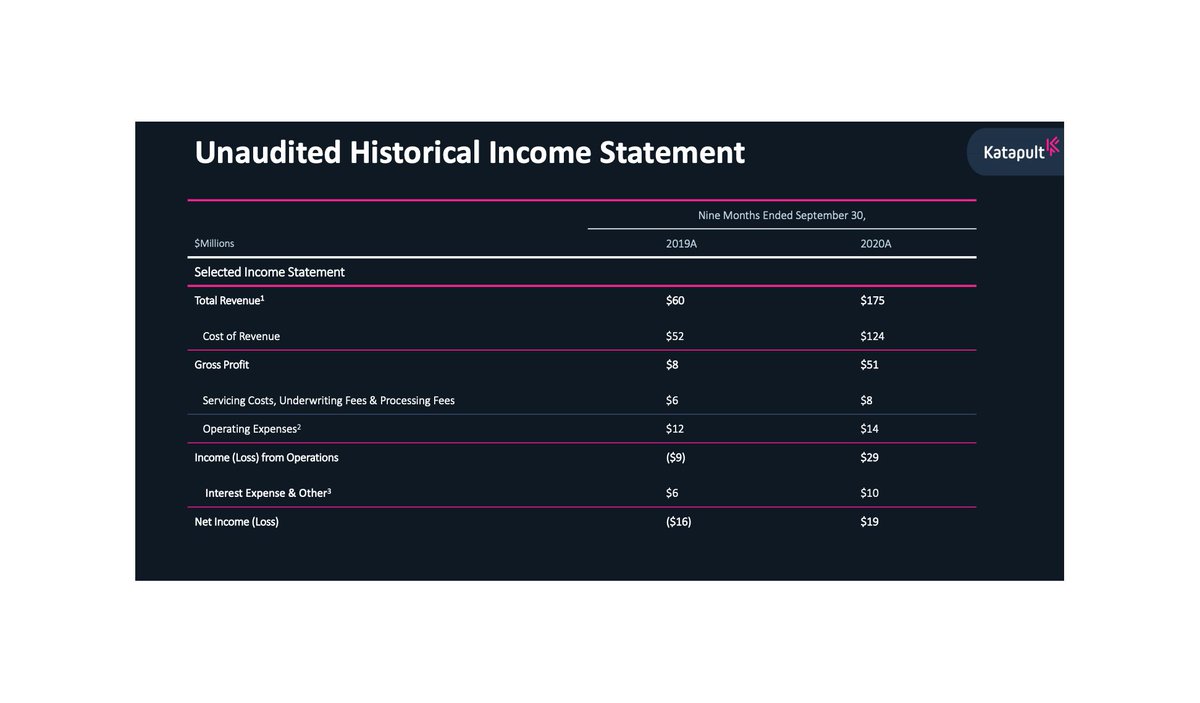

Note: period is 9 months ended September 30

Total revenue grew 192% YoY to $ 175m the 2020 period up from 60m in the previous period

Total revenue grew 192% YoY to $ 175m the 2020 period up from 60m in the previous period Gross margins stood at 29% up from 13% in the previous period

Gross margins stood at 29% up from 13% in the previous period

Gross profit increased by 540% to $ 51m versus $ 8m a year earlier

Gross profit increased by 540% to $ 51m versus $ 8m a year earlier Operating expenses grew 16% to $ 14m from $ 12m

Operating expenses grew 16% to $ 14m from $ 12m Income from operations reached $ 29m up from a loss of $ 9m a year earlier

Income from operations reached $ 29m up from a loss of $ 9m a year earlier Company expects a year end cash position of $ 60m by year end

Company expects a year end cash position of $ 60m by year end

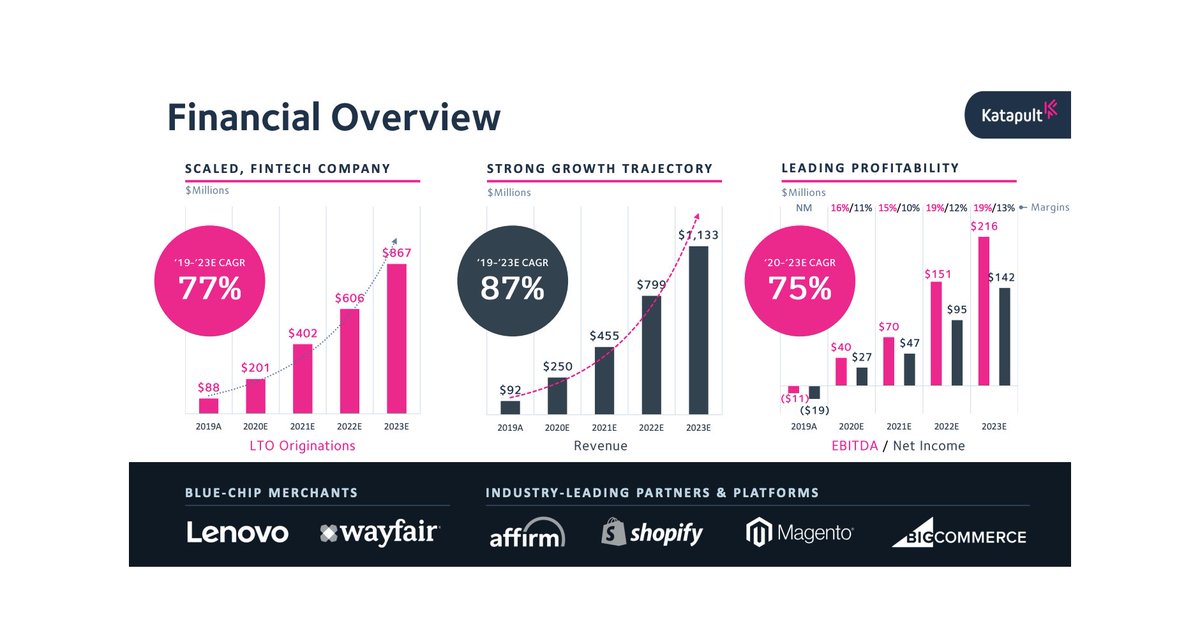

What about its financial forecasts?

It expects sales of $ 1,133m by 2023 for a CAGR of 87% over the 2019 - 2023 period

It expects sales of $ 1,133m by 2023 for a CAGR of 87% over the 2019 - 2023 period

Generate a Net Income of $ 27m in 2020 for 11% Net Margins

Generate a Net Income of $ 27m in 2020 for 11% Net Margins

Net income set to grow 75% each year over 2020 - 2023 to $ 142m

Net income set to grow 75% each year over 2020 - 2023 to $ 142m

It expects sales of $ 1,133m by 2023 for a CAGR of 87% over the 2019 - 2023 period

It expects sales of $ 1,133m by 2023 for a CAGR of 87% over the 2019 - 2023 period Generate a Net Income of $ 27m in 2020 for 11% Net Margins

Generate a Net Income of $ 27m in 2020 for 11% Net Margins Net income set to grow 75% each year over 2020 - 2023 to $ 142m

Net income set to grow 75% each year over 2020 - 2023 to $ 142m

THE BOTTOM LINE

THE BOTTOM LINE

Katapult is a hyper growth company, originally founded by a strong team of machine learning experts and MBAs

Katapult is a hyper growth company, originally founded by a strong team of machine learning experts and MBAs The “Buy Now Pay Later” market is growing & beneficial to Katapult as the pandemic moved all shopping online (including durable goods)

The “Buy Now Pay Later” market is growing & beneficial to Katapult as the pandemic moved all shopping online (including durable goods)

The company boasts outstanding growth metrics and manage to keep its operating expenses almost constant year over year

The company boasts outstanding growth metrics and manage to keep its operating expenses almost constant year over year All of Katapult’s founder left and Tony Lauro (previously at Capital One, JP Morgan Chase) only stayed from 2016 to 2017

All of Katapult’s founder left and Tony Lauro (previously at Capital One, JP Morgan Chase) only stayed from 2016 to 2017

Tony Lauro (per LinkedIn) stated that he: “improved financial projections to realize company was in urgent need of cash”

Tony Lauro (per LinkedIn) stated that he: “improved financial projections to realize company was in urgent need of cash” $CURO now owns 50% of Katapult and is set to get $ 125m from the merge with its Katapult stake decreasing to 21%

$CURO now owns 50% of Katapult and is set to get $ 125m from the merge with its Katapult stake decreasing to 21%https://www.businesswire.com/news/home/20201218005409/en/CURO-Group-Holdings-Corp.-Positioned-to-Benefit-from-Katapult%E2%80%99s-Announced-Merger-with-FinServ-Acquisition-Corp.

Katapult’s currently owns the lease-to-own market, but can easily be displaced by larger BNPL players once these decide to serve non-prime customers

Katapult’s currently owns the lease-to-own market, but can easily be displaced by larger BNPL players once these decide to serve non-prime customers We stay on the sidelines for now, we will review as more information on Katapult’s cash situation and ownership emerges

We stay on the sidelines for now, we will review as more information on Katapult’s cash situation and ownership emerges

$DHER.DE is on our watchlist

$DHER.DE is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Crunchbase

✑ Techcrunch

✑ Cornell News

✑ Kaleido Intelligence

✑ Worldpay

✑ Forbes

✑ Hubspot

✑ Furniture Today

✑ Retail Dive

✑ Kaleido Intelligence

✑ Worldpay

✑ Forbes

✑ Hubspot

✑ Furniture Today

✑ Retail Dive

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter