1/ Here's a thread on Stripe: the IPO that hasn't happened.

Stripe was founded as a payments company with the corporate goal being "to increase the GDP of the Internet". The mission is to build economic infrastructure for the internet focusing on payments and business formation.

Stripe was founded as a payments company with the corporate goal being "to increase the GDP of the Internet". The mission is to build economic infrastructure for the internet focusing on payments and business formation.

2/ Stripe was founded by two Irish brothers, Patrick and John Collison. In freshman year at MIT, Patrick founded Auctomatic. 10 months later it was bought by Live Current Media for $5mm. John was at Harvard, and started working with Patrick on a payments project in 2010.

3/ Y-Combinator became involved, and YC founder Ross Boucher joined future Stripe. The goal was to build a payments platform un-encumbered by gateways, banks and CC processors. They realized how difficult it was to rely on 3rd parties and insourced everything. Hard task.

4/ At the time it could take weeks for a business to set up merchant accounts, they had to deal with multiple levels of fees, CC associations and paper-loving banks. Paypal and Google Checkout existed, but offered difficult user experiences, in effect they were trying to create

5/ their own user relationships. Stripe had no interest in this model. They wanted the product to be unencumbered by network friction and partner incentives. Sounds simple in theory. They realized why few had tried to tackle this problem. It's hard.

6/ What's crazy is that Stripe grew initially through word of mouth. People were sick of legacy systems. They almost named the company 'Forge'. That would have been an ugly mistake. After all, payments is not jsut about ease of use, but security.

7/ in 2011, Stripe took $2mm from Thiel, Musk, Sequoia, Andreesen Horowitz. The PayPal founders were keenly aware of the problems facing the payments ecosystem that they thought Stripe could address. Sequoia came in for $18mm in a Series A round in 2012, valuing Stripe at $100mm.

8/ One can consider the 2011-2015 period the payments API development era for Stripe. With a focus on the US, Stripe refined the payments API for US card payments, and added ACH and BTC functionality in 2015.

9/ From 2015-17, Stripe added more payment methods like WeChatPay, Alipay, iDEAL. This was also when Stripe started adding complementary services like Atlas - a service that lets startups incorporate in Delaware, enabling access to US bank accounts, US share issuance, and onshore

10/ directors. This was even extended to Cuba in 2018!. Also that year, Stripe launched a billing product for businesses, pulling invoice data seamlessly into corp infrastructure (think accounting software and CRMs). This was important for enterprise level clients.

10.5/ In 2016 Stripe rolled out Radar- an AI/ML-based service that runs with the core payments API to identify and block fraud. Stripe was early in bringing the new gen of biometrics and new 2 FA tech. This was offered free, with a paid enterprise version in '18 (think NET model)

11/ 2018 also saw the launch of a credit card business, Stripe Terminal - a POS solution for smaller retailers, and a unified payments API. The core businesses was still payments, and there was always need for improvement and more interconnectedness.

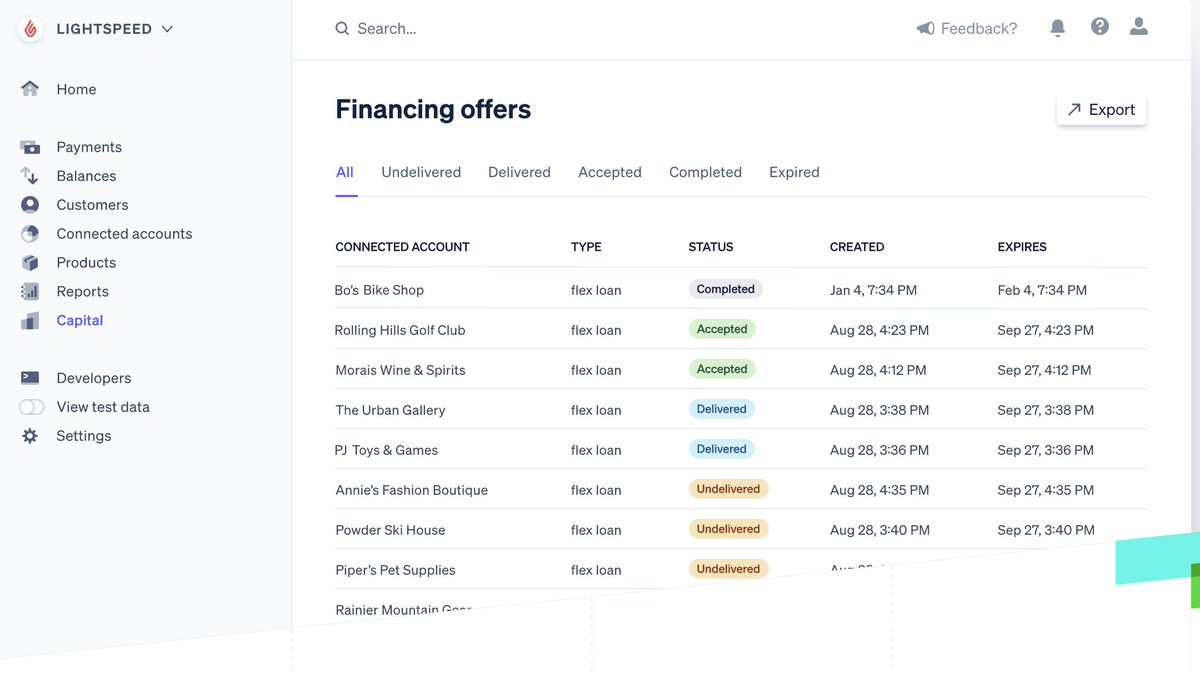

12/ in 2020, like Square, Stripe launched a lending line - "Stripe Capital" - a lending API that lets businesses offer financing to customers. It seems pretty slick, though I've never used it. This has differentiated SQ and Stripe further from Paypal and Lightspeed.

13/ We'll get into competitors in a bit, but first, the revenue model. Stripe charges 2.9% plus $0.30 per transaction as a base rate. This hasn't changed since the early days. Though the enterprise business is smaller but growing, I imagine there are e-level deals.

14/ SQ charges ~ the same, but is more focused on B&M, without (probably) the same back-end architecture that Stripe built over the years. Stripe's solution is more payment-method agnostic than SQ, and more developer friendly (UI toolkits etc).

15/ For SMB e-commerce, PayPal was the incumbent, but as just a gateway, merchants accounts need to be set up outside the system. PayPal doesn't offer the developer, reporting, or security tools that Stripe does. It seems kinda dead tbh.

16/ So where does Stripe go from here? They'll continue to build the lending platform, the POS product has synergies with the network. They've made some acquisitions over the years, but recently made a splash buying Nigeria's Paystack, "the Stripe of Africa".

17/ Collison claims e-comm growth in Africa of 30% /a. In the last 20 months, Stripe has added 17 countries to its platform. Stripe has been steadfast sayingn that it won't simply acquire to increase its footprint, there needs to be a strong tech/segment fit into its ecosystem.

18/ Very recently, Stripe indicated it planned to ramp up expansion efforts in Asia - China, Japan, India and SE Asia. Growth rates in Asia-Pac in non-cash transactions are growing at ~25%. Looks like a good area to grow.

So what is this business worth?

So what is this business worth?

19/ As with private-era PLTR, we really dont know much about the financials. Here's what we do now: about 15 months ago we knew that Stripe processed "hundreds of billions in transactions a year". We also can look at the COVID era growth rate of competitor revenue streams.

20/ And we know the basic revenue model (though this gets harder with more enterprise and ancillary service rev). In Sept '19, "hundreds of billions" must have meant at least $200B. Let's call the 2.9% plus $0.30 fee 3% for simplicity. And then reduce it by 33% for enterprise,

21/ conservatism, etc. That's $4B in revenue. Lets look at SQ revenue growth the last number of quarters:

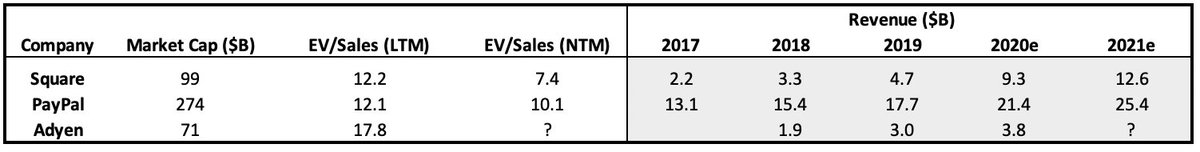

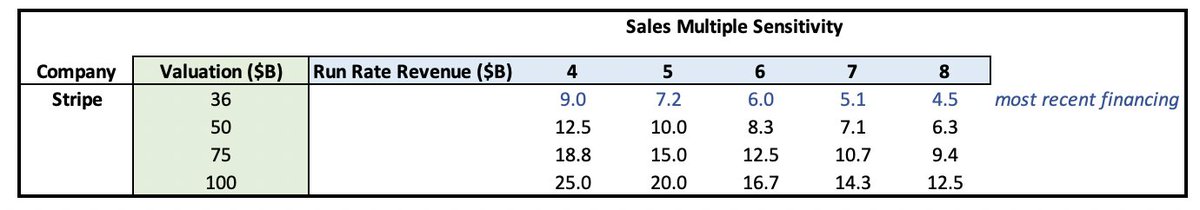

22/ Those are some huge growth rates. Stripe run-rate revenue could absolutely be 2x from Q3/19. Something like $5-$8 B in run rate revs seems reasonable. What do comps trade at? We've talked about SQ and PYPL, but let's add Adyen. They have a similar business model,

23/ Don't have all the bells and whistles, but are mostly enterprise focused (potentially lower growth) with only 3,500 customers vs Stripe's 2mm. Here's your comp table:

24/ We all know about growth multiples right now... SQ and PYPL are trading at about 12x trailing, and significantly less on run rate (maybe 9x and 11x, respectively). The most recent Stripe financing round was for $600mm in April, valuign Stripe at $36B. Not bad.

(Continuing..

(Continuing..

25/ The world of payments activity and valuations has changed a lot since then. BTW, here are the last funding rounds for Stripe.

26/ A recent Bloomberg article cited a Stripe valuation “more than $70 billion or significantly higher, at as much as $100 billion.” Yikes. That's 2 PLTRs. Let's take a log off the fire and assume a lower spectrum of outcomes,

28/ Even at $8B in revs and $100B valuation, this isn't completely crazy. I mean, growth valuations ARE crazy, but in light of what's happening, it seems 'cheap' at $50B. The bottom line is that as a private co., we really have no idea what the financials look like.

29/ Is it possible they do $10B in 2021 revs? Sure. $5B, I suppose, but that seems wildly unlikely. So why haven't they listed yet?  No one knows. The best explanation is a rumour for another large private (up) round, possibly capital for a major foray into Asia.

No one knows. The best explanation is a rumour for another large private (up) round, possibly capital for a major foray into Asia.

No one knows. The best explanation is a rumour for another large private (up) round, possibly capital for a major foray into Asia.

No one knows. The best explanation is a rumour for another large private (up) round, possibly capital for a major foray into Asia.

30/ DASH is now valued at $46B and Qualtrics may come at $14B out of SAP. $70-$100B seems insane. But digging into Stripe a bit makes $50-$70B seem a little less cuckoo, at least in the context of the multiples out there.

31/ We don't know much about under the hood financials. We do know that Stripe is pretty unique in their tech suite, and their success in so far disrupting the payments and banking space. Regulatory is likely a lynchpin of fintech and defi in the future, and Stripe

32/ (from what we can see) appears to be a capable partner for businesses facing a labrinthye future landscape of security, regulation, and payment variables.

Thanks for reading!

/end/

Thanks for reading!

/end/

Read on Twitter

Read on Twitter