Gather around Trees!

I shall weave you a web of roots.

Some have seen this all before.

Many have not.

My DMs are open; reach out and counter these points publicly or privately.

I just ask that this thread is referenced moving forward.

DYOR; NFA. https://ripple.com/insights/5-questions-for-st-louis-fed-economist-david-andolfatto/

I shall weave you a web of roots.

Some have seen this all before.

Many have not.

My DMs are open; reach out and counter these points publicly or privately.

I just ask that this thread is referenced moving forward.

DYOR; NFA. https://ripple.com/insights/5-questions-for-st-louis-fed-economist-david-andolfatto/

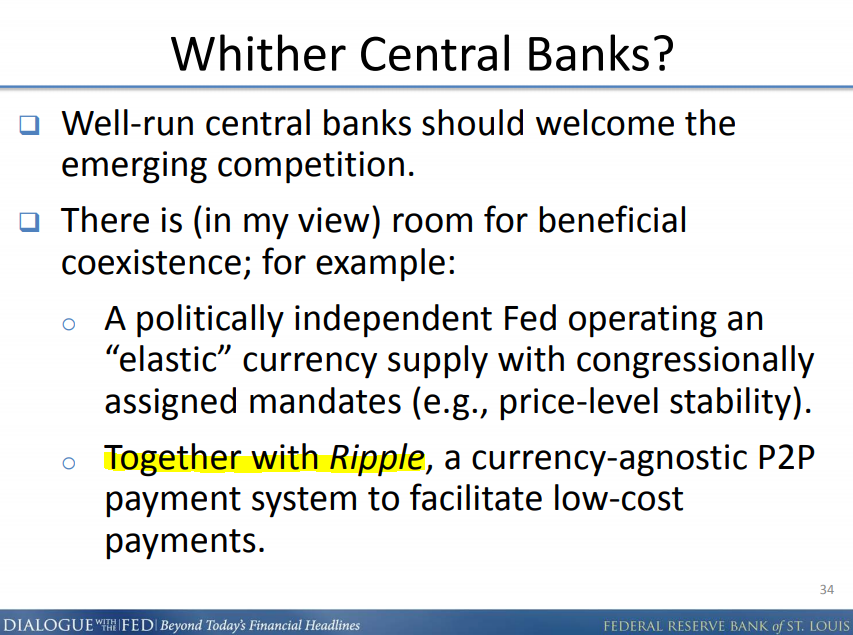

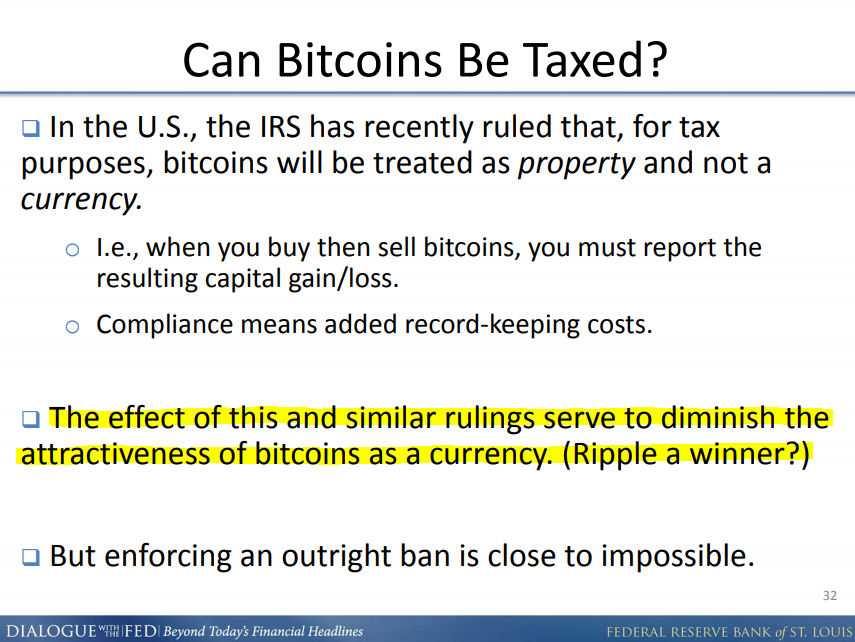

In 2014, 10 days before the previous link was published on Ripple's website, David Andolfatto gave a presentation in St. Louis:

This presentation is not easy to find.

'beneficial coexistence'...'A politically independent FED'...'Together with Ripple'.

https://web.archive.org/web/20140409044505/https://www.stlouisfed.org/dialogue-with-the-fed/assets/Bitcoin-3-31-14.pdf

This presentation is not easy to find.

'beneficial coexistence'...'A politically independent FED'...'Together with Ripple'.

https://web.archive.org/web/20140409044505/https://www.stlouisfed.org/dialogue-with-the-fed/assets/Bitcoin-3-31-14.pdf

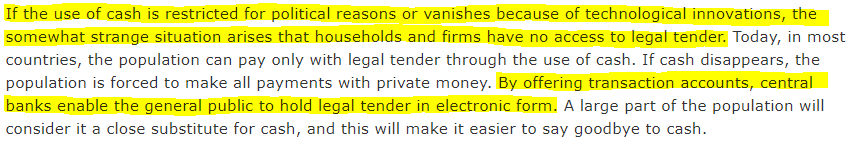

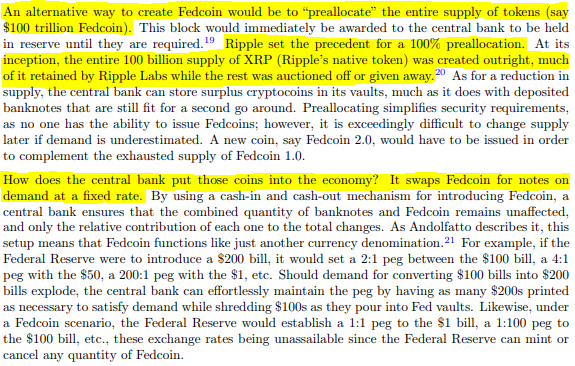

What other research exists from this regional FED office?

This:

https://research.stlouisfed.org/publications/review/2018/02/13/the-case-for-central-bank-electronic-money-and-the-non-case-for-central-bank-cryptocurrencies/

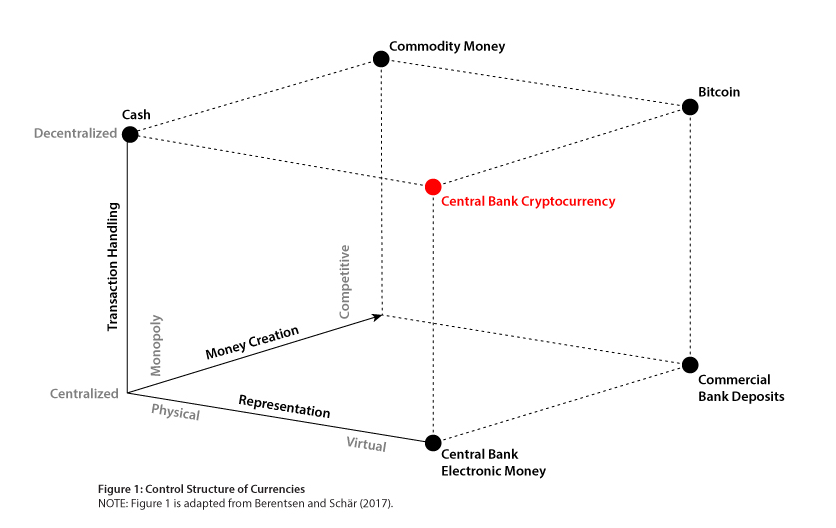

'The special feature of cryptocurrencies is that they combine the transactional advantages of virtual money with the systemic independence of decentralized transaction processing...'

BTC.

This:

https://research.stlouisfed.org/publications/review/2018/02/13/the-case-for-central-bank-electronic-money-and-the-non-case-for-central-bank-cryptocurrencies/

'The special feature of cryptocurrencies is that they combine the transactional advantages of virtual money with the systemic independence of decentralized transaction processing...'

BTC.

'...In practice, however, a few large miners dominate the mining process... competition has become fierce and only large mining farms with highly specialized hardware and access to cheap electricity can still make a profit from mining (Berentsen and Schär, 2018)'.

Back to David:

Back to David:

Another solution is needed. BTC resembles 'commodity money' and is hyper competitive which limits its liquidity in times of stress.

What about XRP as a solution?

A thread from early 2019 regarding lending via XRP enabled QE run through central banks:

https://twitter.com/PonderJaunt/status/1088923048260993024?s=20

What about XRP as a solution?

A thread from early 2019 regarding lending via XRP enabled QE run through central banks:

https://twitter.com/PonderJaunt/status/1088923048260993024?s=20

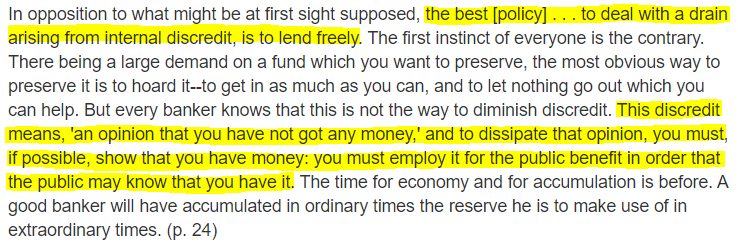

Ben Bernanke on liquidity provision theory. You know that name by now, but note this specific statement:

https://www.federalreserve.gov/newsevents/speech/bernanke20080513.htm

'I should note that the Bank of England in his time was a hybrid institution-it was privately owned by shareholders, but it also had a public role...'

https://www.federalreserve.gov/newsevents/speech/bernanke20080513.htm

'I should note that the Bank of England in his time was a hybrid institution-it was privately owned by shareholders, but it also had a public role...'

'...To fulfill its public role, the Bank of England did not in all cases maximize its profits; notably, it held a larger share of its assets in liquid form than did other banks, thereby foregoing some return.'

Sounds unique! https://ripple.com/insights/ripple-escrows-55-billion-xrp-for-supply-predictability/

Sounds unique! https://ripple.com/insights/ripple-escrows-55-billion-xrp-for-supply-predictability/

Bernanke is referencing,

'Lombard Street: A Description of the Money Market'

By Walter Bagehot.

https://www.econlib.org/library/Bagehot/bagLom.html?chapter_num=5#book-reader

Motive is key. What was the motive behind the XRP Escrow? The SEC claims to know the answer; can they prove iT?

'Lombard Street: A Description of the Money Market'

By Walter Bagehot.

https://www.econlib.org/library/Bagehot/bagLom.html?chapter_num=5#book-reader

Motive is key. What was the motive behind the XRP Escrow? The SEC claims to know the answer; can they prove iT?

Bernanke continues:

'A central bank may be able to eliminate, or at least attenuate, adverse outcomes by making cash loans secured by borrowers' illiquid but sound assets...'

Which assets can the FED access in 2020 based on the CARES act in the US?

https://www.federalreserve.gov/funding-credit-liquidity-and-loan-facilities.htm

'A central bank may be able to eliminate, or at least attenuate, adverse outcomes by making cash loans secured by borrowers' illiquid but sound assets...'

Which assets can the FED access in 2020 based on the CARES act in the US?

https://www.federalreserve.gov/funding-credit-liquidity-and-loan-facilities.htm

Bernanke spoke at Ripple's Swell in '17-'18.

Ripple in 2017: https://ripple.com/insights/federal-reserve-task-force-ripple-improves-speed-transparency-global-payments/

Ripple in 2018: https://ripple.com/insights/how-the-us-and-eu-central-banks-view-the-future-of-cbdcs/

Ripple in 2020: https://ripple.com/line-of-credit

Where is Ben from 2017-2020?

Reflecting on over 30 years of Japanese monetary policy.

Ripple in 2017: https://ripple.com/insights/federal-reserve-task-force-ripple-improves-speed-transparency-global-payments/

Ripple in 2018: https://ripple.com/insights/how-the-us-and-eu-central-banks-view-the-future-of-cbdcs/

Ripple in 2020: https://ripple.com/line-of-credit

Where is Ben from 2017-2020?

Reflecting on over 30 years of Japanese monetary policy.

Bernanke also joined with Yellen recently in 2020 to give a few statements regarding stimulus lending from the FED. Besides this statement, Yellen was picked to head the Treasury in 2021.

[Ponder you are losing me get to the point!] https://www.brookings.edu/blog/up-front/2020/07/17/former-fed-chairs-bernanke-and-yellen-testified-on-covid-19-and-response-to-economic-crisis/

[Ponder you are losing me get to the point!] https://www.brookings.edu/blog/up-front/2020/07/17/former-fed-chairs-bernanke-and-yellen-testified-on-covid-19-and-response-to-economic-crisis/

Here's my point:

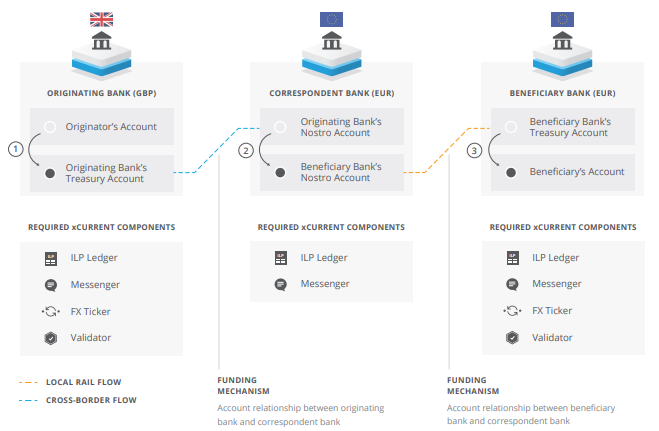

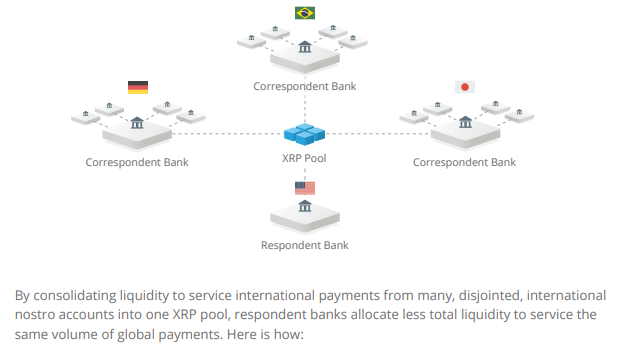

Since 2013, @Ripple engaged with central banks to provide exact toolsets needed to allow expansion of their policy frameworks to counteract a unique global liquidity crisis. All while allowing global correspondent banks to plug directly into that new framework.

Since 2013, @Ripple engaged with central banks to provide exact toolsets needed to allow expansion of their policy frameworks to counteract a unique global liquidity crisis. All while allowing global correspondent banks to plug directly into that new framework.

This has been going on for years. Central banks need new tools. If by creating these tools they overstep their own mandates - Hands slap their wrists.

The SEC is showing a uniquely heavy finger of a 'Hidden Hand'.

But what might be up their sleeves? https://www.coindesk.com/former-sec-chair-represents-ripple-xrp-lawsuit

The SEC is showing a uniquely heavy finger of a 'Hidden Hand'.

But what might be up their sleeves? https://www.coindesk.com/former-sec-chair-represents-ripple-xrp-lawsuit

I have personally witnessed a systematic and structured attack on everything @Ripple has ever attempted to accomplish since its inception.

And it took every punch with a coy smile. The recent SEC '5-finger Death punch' is actually an offhand jab. https://ripple.com/insights/interoperability-will-determine-cbdc-winners-and-losers/

And it took every punch with a coy smile. The recent SEC '5-finger Death punch' is actually an offhand jab. https://ripple.com/insights/interoperability-will-determine-cbdc-winners-and-losers/

You can believe all the memes you want. You can listen to all the arguments you choose too. The SEC better have some very good arguments - but until their day in court comes, let the market decide.

Vote with your wallets, and stay liquid fellow Ents. You know who you are.

Vote with your wallets, and stay liquid fellow Ents. You know who you are.

Never forget to sharpen the blades that were already forged for you.

We must Build Back Better. Make the Ledger Great Again.

Run Nodes, Trade the DEX, Reach Consensus.

Survive. Be excellent to each other. Goonies never say die. https://xrpl.org/decentralized-exchange.html

We must Build Back Better. Make the Ledger Great Again.

Run Nodes, Trade the DEX, Reach Consensus.

Survive. Be excellent to each other. Goonies never say die. https://xrpl.org/decentralized-exchange.html

THREAD UPDATE:

No one reached out to counter any of these points lol.

No one reached out to counter any of these points lol.

Read on Twitter

Read on Twitter