Looking Back to Look Forward:

Like many, in March 2020 I started feeling very concerned about so many people losing their jobs , not having enough saved to cover basic needs like rent & food for even a month or 2.

And like many wonderful UAE residents, I too did my

Like many, in March 2020 I started feeling very concerned about so many people losing their jobs , not having enough saved to cover basic needs like rent & food for even a month or 2.

And like many wonderful UAE residents, I too did my

best to support with  .

.

However, they say give a gal , & she will eat one day; teach a gal to

, & she will eat one day; teach a gal to  & she'll eat every day.

& she'll eat every day.

So partly to quell my anxiety but mostly to help the avg. hardworking person learn how to invest, I started blogging about investing.

.

.However, they say give a gal

, & she will eat one day; teach a gal to

, & she will eat one day; teach a gal to  & she'll eat every day.

& she'll eat every day.So partly to quell my anxiety but mostly to help the avg. hardworking person learn how to invest, I started blogging about investing.

If you're new to investing or want a refresher, here is how you can catch up. A short course in blogs & videos.

Lesson 1: Why should you invest?

Well, if we’ve learned anything from this pandemic, it’s the importance of saving for uncertainties.

@ 2 charts below H/T @SamRo

@ 2 charts below H/T @SamRo

Lesson 1: Why should you invest?

Well, if we’ve learned anything from this pandemic, it’s the importance of saving for uncertainties.

@ 2 charts below H/T @SamRo

@ 2 charts below H/T @SamRo

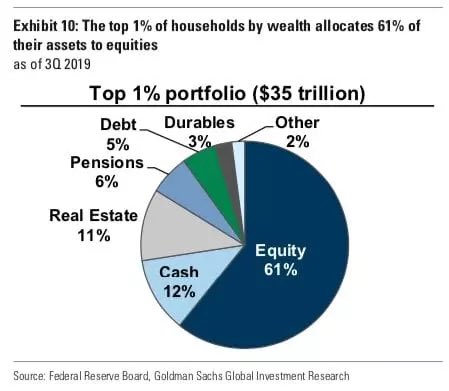

The top 1% holds 61% of their wealth in Equities & only 11% in Real Estate , 12% in

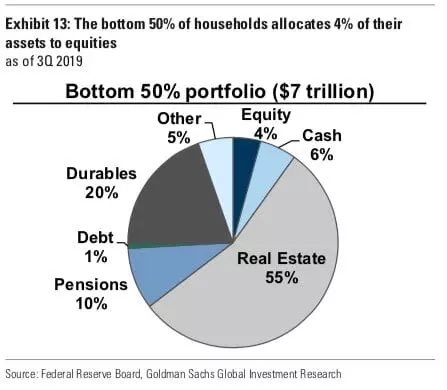

Bottom 50% hold 55% in Real Estate, only 6% & 4% in Equity.

& 4% in Equity.

So, the top 1% have liquid assets that have compounding effect to grow

compounding effect to grow  .

.

I explain more here: https://shaheedasays.com/investing/investing-in-the-time-of-covid19/

Bottom 50% hold 55% in Real Estate, only 6%

& 4% in Equity.

& 4% in Equity.So, the top 1% have liquid assets that have

compounding effect to grow

compounding effect to grow  .

. I explain more here: https://shaheedasays.com/investing/investing-in-the-time-of-covid19/

Lesson 2: Budgeting & How To Save

Yes, you want that fancy car, fancy address or clothes, shoes, bags for that extra Instagram shoot. Certainly have fun but remember less is more.

Here’s how I saved 32% of my income in my mid-twenties AFTER taxes. https://shaheedasays.com/investing/how-i-saved-32-of-my-income/

Yes, you want that fancy car, fancy address or clothes, shoes, bags for that extra Instagram shoot. Certainly have fun but remember less is more.

Here’s how I saved 32% of my income in my mid-twenties AFTER taxes. https://shaheedasays.com/investing/how-i-saved-32-of-my-income/

Lesson 3: Time & Compounding Impact

Now that you’re a master & budgeting & saving, here are basic fundamentals of investing.

Time In The Market

Dollar Cost Averaging (Buy Low, Sell High)

Read this to learn more: https://shaheedasays.com/investing/time-all-i-have-is-time/

Now that you’re a master & budgeting & saving, here are basic fundamentals of investing.

Time In The Market

Dollar Cost Averaging (Buy Low, Sell High)

Read this to learn more: https://shaheedasays.com/investing/time-all-i-have-is-time/

Lesson 4: Thanks to $TSLA, $BTC, etc., Diversification has become a dirty word & not in the naughty way

If you’re new to investing in the stock market, index funds (naturally diversified) funds are a good way to start until you get the hang of things. https://shaheedasays.com/investing/why-index-funds-are-good-for-new-investors/

If you’re new to investing in the stock market, index funds (naturally diversified) funds are a good way to start until you get the hang of things. https://shaheedasays.com/investing/why-index-funds-are-good-for-new-investors/

Lesson 5: Once you get the hang of investing, and you may want to ride the wave  with a few individual stocks.

with a few individual stocks.

But how do you know which to pick?

You must learn to read the financial statements & mgmt reports.

5a: https://shaheedasays.com/investing/3-tricks-to-reading-income-statements/

with a few individual stocks.

with a few individual stocks.But how do you know which to pick?

You must learn to read the financial statements & mgmt reports.

5a: https://shaheedasays.com/investing/3-tricks-to-reading-income-statements/

How to read a balance sheet https://shaheedasays.com/investing/3-tricks-to-read-a-balance-sheet/

How to read a Cashflow statement https://shaheedasays.com/investing/3-tricks-to-read-a-cashflow-statement/

Lesson 7: Now that you know all about financial statements, how do you quickly assess a stock’s performance?

Can we do that looking at the stock table or chart from yahoo finance website? https://shaheedasays.com/investing/how-to-read-a-stock-table/

Can we do that looking at the stock table or chart from yahoo finance website? https://shaheedasays.com/investing/how-to-read-a-stock-table/

Lesson 8: Now that you know all about financial statements, how do you compare stocks so you can pick the best as per your analysis?

I compared sports stocks like Nike, Lululemon, FitBit, Adidas etc in this blog. https://shaheedasays.com/investing/how-to-compare-stocks/

I compared sports stocks like Nike, Lululemon, FitBit, Adidas etc in this blog. https://shaheedasays.com/investing/how-to-compare-stocks/

Lesson 9: You feel confident and ready to invest but which broker should you choose? What questions should you ask your broker? https://shaheedasays.com/investing/10-questions-to-ask-your-broker-trading-platform/

Lesson 10: How to compare brokerage firms?

I’ve compared 9 brokerage platforms in this blog so you can choose one that meets your needs. https://shaheedasays.com/investing/comparing-brokerage-trading-platforms-part-2/

I’ve compared 9 brokerage platforms in this blog so you can choose one that meets your needs. https://shaheedasays.com/investing/comparing-brokerage-trading-platforms-part-2/

Lesson 11: As you start investing you will definitely see the impact of market volatility. It maybe tempting for you to cash out or sell everything in a panic when your portfolio is down.

In this blog I show why holding is better than frequent trading. https://shaheedasays.com/investing/is-buffett-washed-up/

In this blog I show why holding is better than frequent trading. https://shaheedasays.com/investing/is-buffett-washed-up/

Lesson 12: As you plan your investments and retirement, I built this nifty calculator so you can figure out how much you need to invest every year to get your goal amount for retirement. Check it out. It’s fun. https://shaheedasays.com/investing/retirement-calculator/

Lesson 13: If you are also keen on investing in Bonds ( buying Government or Corporate Debt) so that you get a fixed amount in interest every year, I briefly explain Bonds & Bond funds here. https://shaheedasays.com/category/investing/

Lesson 14: if you want to learn how to analyze different sectors or industries, I illustrate the same using Snowflake’s $SNOW’s phenomenal IPO & looking at cloud computing stocks. https://shaheedasays.com/investing/which-cloud-computing-stock-should-we-buy/

Lesson 15: if you’ve been excited about recent mind blowing IPO’s, then I’ve read Airbnb’s S1 statements (all 200+ pages) and wrote about it. I expected it to be a $100 B company and it already is.

But the value investor in me hesitates to buy now. https://shaheedasays.com/investing/is-airbnb-the-hottest-ipo-of-2020/

But the value investor in me hesitates to buy now. https://shaheedasays.com/investing/is-airbnb-the-hottest-ipo-of-2020/

so much for supporting me in 2020 dear twitter friends.

so much for supporting me in 2020 dear twitter friends.In 2021, I hope to share with you my thoughts on Cybersecurity stocks, Gaming stocks, and crypto and more of what you want to know.

Happy Happy New Year!

Read on Twitter

Read on Twitter