Thread:

Markets are cyclical. Today, stocks trade at record high valuations while commodities are historically cheap in relation. Comparable conditions were present with the 1972 Nifty Fifty and 2000 Dotcom bubbles.

Markets are cyclical. Today, stocks trade at record high valuations while commodities are historically cheap in relation. Comparable conditions were present with the 1972 Nifty Fifty and 2000 Dotcom bubbles.

As capital seeks to redeploy towards the highest growth and lowest valuation opportunities, analytically minded investors should be rotating, if not stampeding, out of expensive deflation-era growth equities and fixed income securities and into cheap hard assets.

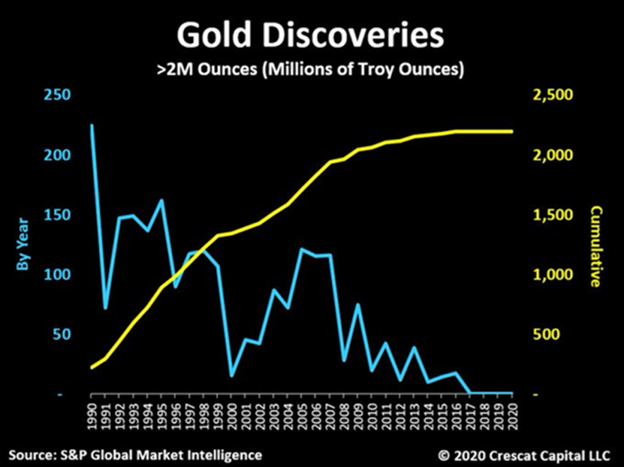

When it comes to scarce commodities, we favor gold and silver first and foremost, the monetary metals that are among the most supply constrained resources on the planet. The # of major new gold discoveries by year, > 2M ozs, has been in a declining secular trend for 30 years.

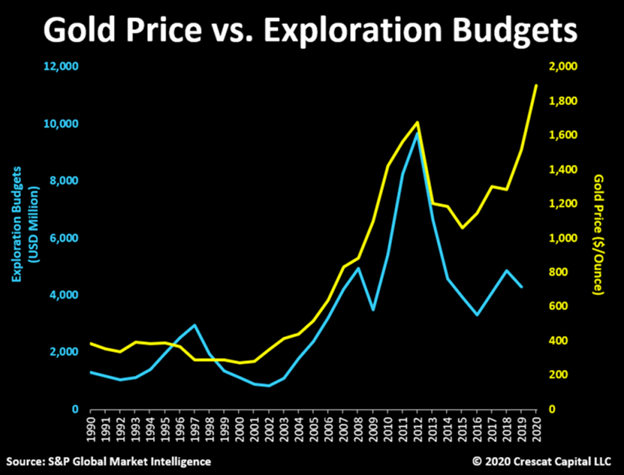

Gold mining exploration expense industrywide, down sharply since 2012, has been one of the issues adding to the supply problems today.

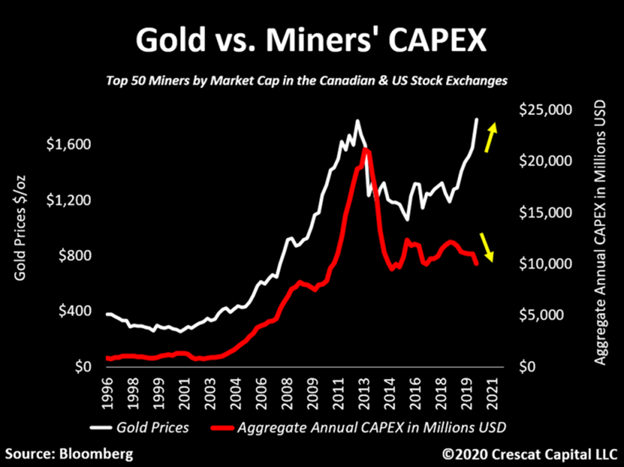

Since 2012, there has also been a declining trend of capital expenditures toward developing new mines.

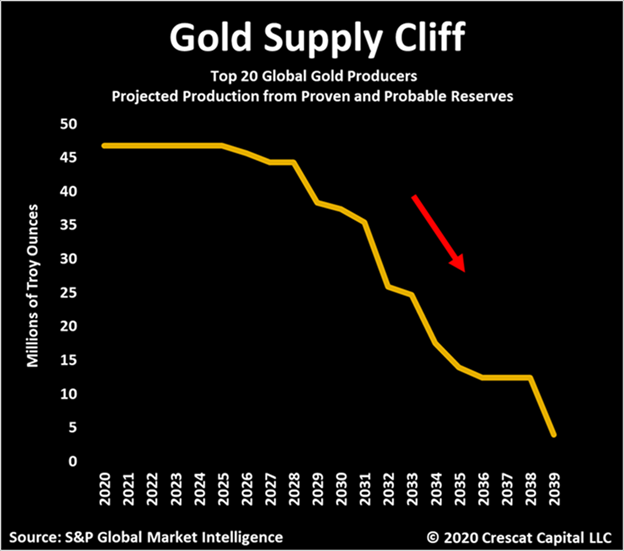

The majors have underinvested in replacing their reserves creating an historic supply cliff for the industry.

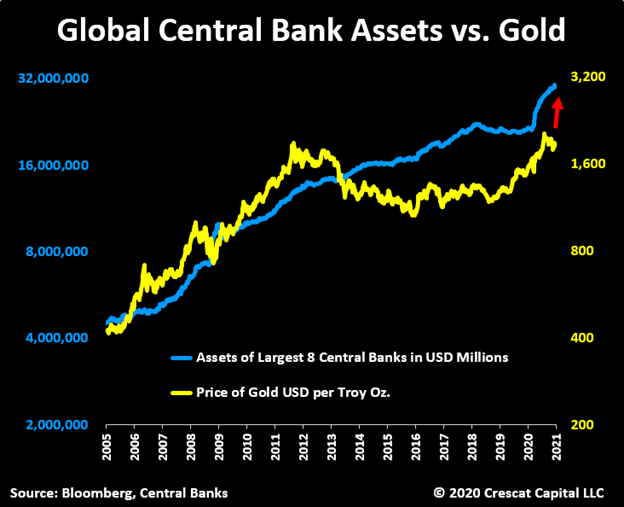

On the demand side, gold and silver are seeing a surge of investor interest with global central bank balance sheet expansion now widely embraced. Money printing is the only viable policy way out of the otherwise deflationary global debt burden, at a record 365% of worldwide GDP.

Rising inflation expectations also boost demand for precious metals. The Fed has given itself the green light to err on the side of inflation by “temporarily” exceeding its 2% inflation target, abandoning one side of its dual mandate to favor the other side, full employment.

The recent plunge lower in real yields (inverted in the chart below) is a function of rising inflation expectations combined with central bank suppressed interest rates. Real yields have already diverged from the price of gold signaling an impending move upward in the metal.

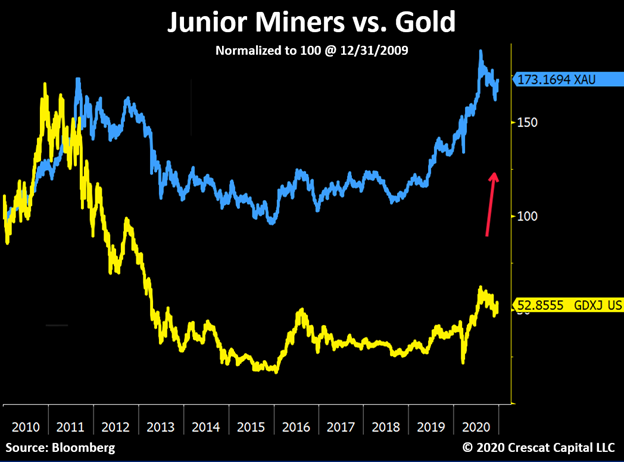

The gold mining majors and mid-tiers underinvesting in the last decade making it one of the strongest free cash flow growth industries in the market today.

The gold producers need to replace their reserves and are in great shape to invest their soaring free cash flow on acquisitions. Their targets are the premier exploration companies controlling large, high grade deposits. In our view, that were the big appreciation potential lies.

Crescat has built an activist portfolio of over 50 highly selective companies where we are among the largest shareholders. Several of them are outperforming bitcoin YTD. Our companies control a targeted 200 million gold equivalent ounces.

Eskay Mining, drilling gold and silver in the Golden Triangle of BC, is one of our holdings. Crescat led 3 rounds of funding for $ESK.CV in 2020 to help Hennigh, Monecke, and DeDecker find what they believe is the extension of the famously profitable Eskay Creek mine.

Thanks for reading my thread.

Read and learn more here:

https://www.crescat.net/december-research-letter/ https://www.crescat.net/

Read and learn more here:

https://www.crescat.net/december-research-letter/ https://www.crescat.net/

Read on Twitter

Read on Twitter