$SKLZ +90% Growth SPAC

$SKLZ +90% Growth SPAC

eSports is set to grow by 30% each YEAR over 2019 - 2024 period (Goldman Sachs)

eSports is set to grow by 30% each YEAR over 2019 - 2024 period (Goldman Sachs) Skillz provides the engine that powers the mobile eSports format

Skillz provides the engine that powers the mobile eSports format Its GMW went from $ 20m in 2015 to $ 886m in 2019

Its GMW went from $ 20m in 2015 to $ 886m in 2019Here is an EASY thread

Skillz $SKLZ was founded in 2012 by Andrew Paradise and Casey Chafkin  It went public in December 2020

It went public in December 2020

Skillz provides a platform to turn any mobile game on iOS and Android into one you can play with other players (friends and strangers)

It went public in December 2020

It went public in December 2020Skillz provides a platform to turn any mobile game on iOS and Android into one you can play with other players (friends and strangers)

It thus turn any mobile game that integrates with its platform into an eSports platform where players can compete for points, prizes, cash… https://venturebeat.com/2020/12/17/skillz-starts-trading-as-a-public-company-as-mobile-esports-heats-up/

But how does it work?

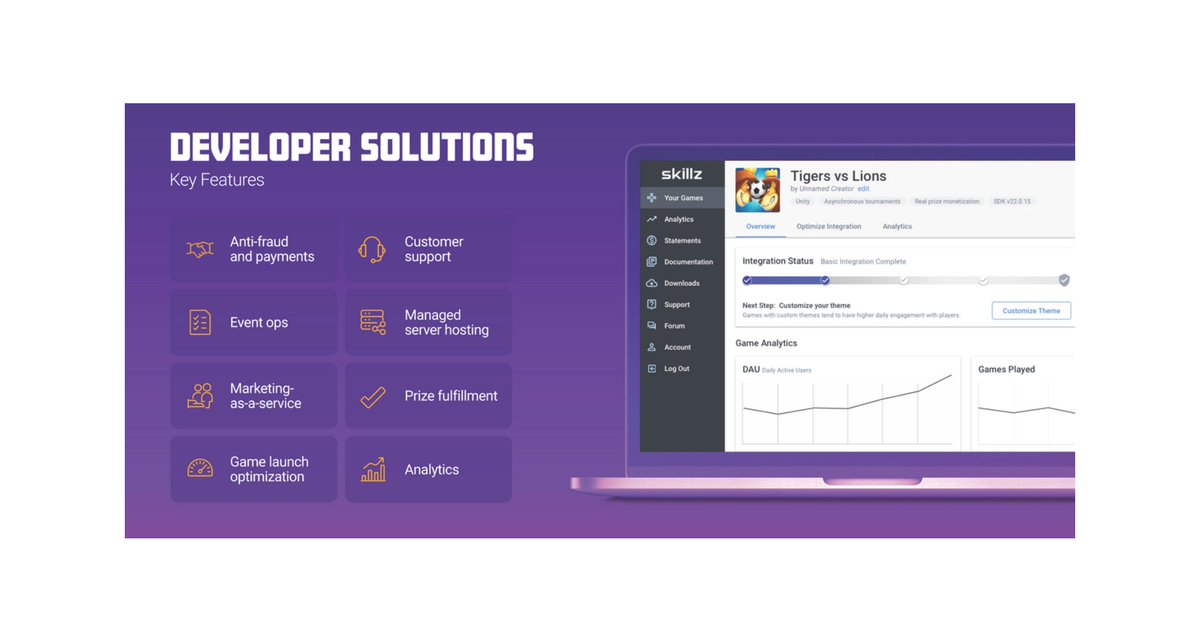

Developers need to download Skillz’ software development kit (SDK)

Developers need to download Skillz’ software development kit (SDK)

Using this SDK, the developers set up their tournaments on the Skillz tournament management system

Using this SDK, the developers set up their tournaments on the Skillz tournament management system

Gamers can log into their Skillz-powered games and compete with other players

Gamers can log into their Skillz-powered games and compete with other players

Developers need to download Skillz’ software development kit (SDK)

Developers need to download Skillz’ software development kit (SDK) Using this SDK, the developers set up their tournaments on the Skillz tournament management system

Using this SDK, the developers set up their tournaments on the Skillz tournament management system Gamers can log into their Skillz-powered games and compete with other players

Gamers can log into their Skillz-powered games and compete with other players

Who makes money?

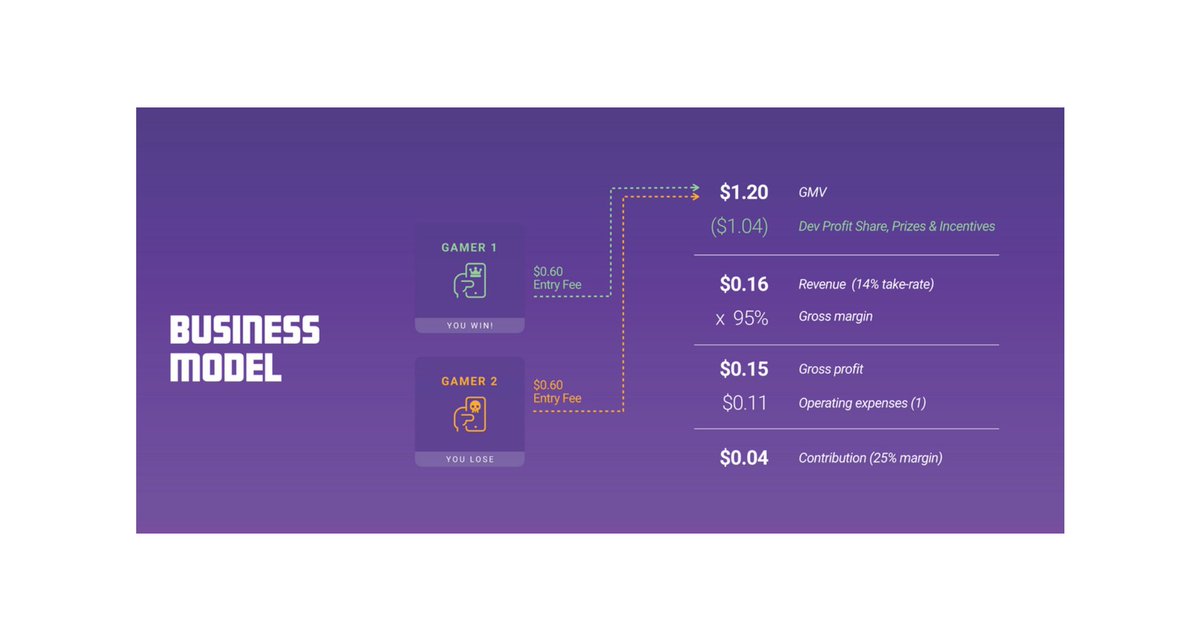

Players pay entry fees to compete in games

Players pay entry fees to compete in games

Winners take home their prizes

Winners take home their prizes

The game developer and Skillz split what’s left (50/50)

The game developer and Skillz split what’s left (50/50)

Players pay entry fees to compete in games

Players pay entry fees to compete in games Winners take home their prizes

Winners take home their prizes The game developer and Skillz split what’s left (50/50)

The game developer and Skillz split what’s left (50/50)

What’s more? Well Skillz has developed and offers a wide range of features to attract and retain gamers

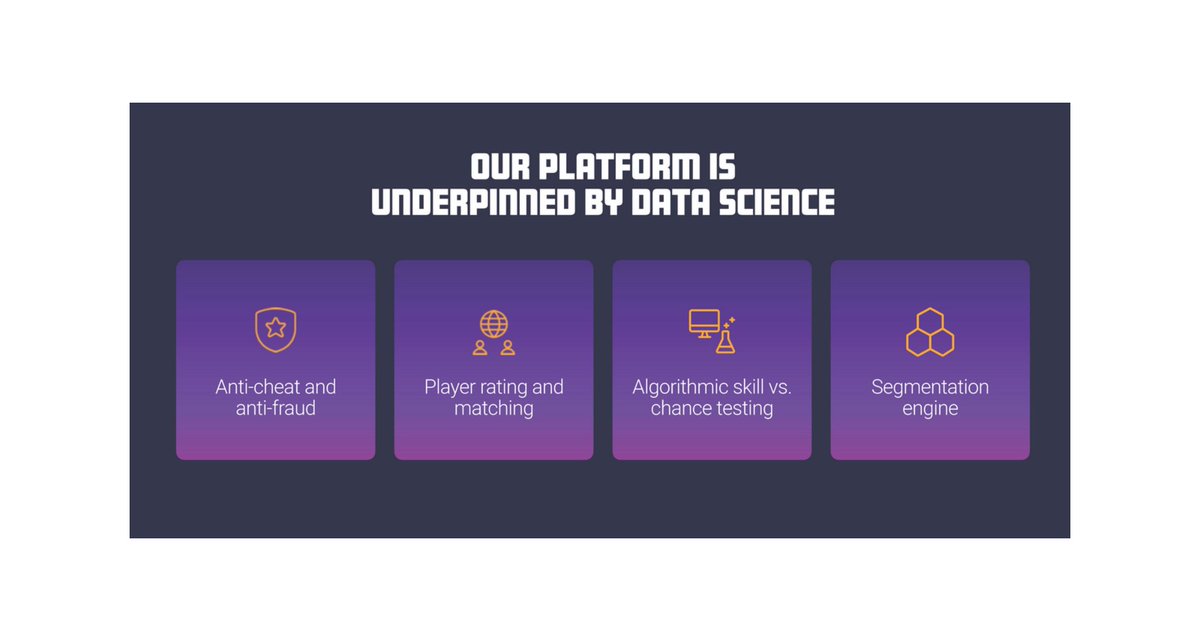

Player matching based on their skill level

Player matching based on their skill level

Anti-cheat / anti-fraud protections and support

Anti-cheat / anti-fraud protections and support

Social sharing and content discovery features

Social sharing and content discovery features

Player matching based on their skill level

Player matching based on their skill level Anti-cheat / anti-fraud protections and support

Anti-cheat / anti-fraud protections and support Social sharing and content discovery features

Social sharing and content discovery features

Delivering results for game developers and gamers

Average time players spend each day on Skillz is twice the industry average and player retention is 24% higher

Average time players spend each day on Skillz is twice the industry average and player retention is 24% higher

Skillz counts over 30m players and 20k game developers

Skillz counts over 30m players and 20k game developers

Of these, 2.7m are active monthly users

Of these, 2.7m are active monthly users

Average time players spend each day on Skillz is twice the industry average and player retention is 24% higher

Average time players spend each day on Skillz is twice the industry average and player retention is 24% higher Skillz counts over 30m players and 20k game developers

Skillz counts over 30m players and 20k game developers Of these, 2.7m are active monthly users

Of these, 2.7m are active monthly users

More than 3.5m tournaments take place each day, distributing $ 60m in prizes each month

More than 3.5m tournaments take place each day, distributing $ 60m in prizes each month Skillz expects to power 2B tournaments in 2020, including 500m paid entry tournaments

Skillz expects to power 2B tournaments in 2020, including 500m paid entry tournaments

Great! But how does that translate into SALES?

Great! But how does that translate into SALES?In 2015, Skillz brought in $ 20m in entry fees

In 2016, Skillz brought in $ 56m in entry fees

In May 2017, Skillz hit $ 100m revenue run rate (RRR)

In February 2018, it hit $ 200m RRR

In September 2018, it hit $ 400m RRR

Supported by steady player growth

9m in June 2016

9m in June 2016

12m in May 2017

12m in May 2017

15m in April 2018

15m in April 2018

18m in September 2018

18m in September 2018

9m in June 2016

9m in June 2016 12m in May 2017

12m in May 2017 15m in April 2018

15m in April 2018 18m in September 2018

18m in September 2018

“Every six months or so, the projections are growing, […] The speed with which esports is growing in mind-blowing.” - $SKLZ CEO by Dean Takahashi

Taken from https://venturebeat.com/2017/05/02/skillz-hits-100-million-revenue-run-rate-with-mobile-esports-platform/

https://venturebeat.com/2017/05/02/skillz-hits-100-million-revenue-run-rate-with-mobile-esports-platform/

Taken from

https://venturebeat.com/2017/05/02/skillz-hits-100-million-revenue-run-rate-with-mobile-esports-platform/

https://venturebeat.com/2017/05/02/skillz-hits-100-million-revenue-run-rate-with-mobile-esports-platform/

What about the market?

According to Goldman Sachs, eSports revenue is set to reach $ 3B by 2022

According to Goldman Sachs, eSports revenue is set to reach $ 3B by 2022

With prize pools expected to grew by a CAGR of 30% over the 2019 - 2024 period https://venturebeat.com/2018/09/18/skillz-hits-400-million-revenue-run-rate-with-mobile-esports-platform/

With prize pools expected to grew by a CAGR of 30% over the 2019 - 2024 period https://venturebeat.com/2018/09/18/skillz-hits-400-million-revenue-run-rate-with-mobile-esports-platform/

According to Goldman Sachs, eSports revenue is set to reach $ 3B by 2022

According to Goldman Sachs, eSports revenue is set to reach $ 3B by 2022 With prize pools expected to grew by a CAGR of 30% over the 2019 - 2024 period https://venturebeat.com/2018/09/18/skillz-hits-400-million-revenue-run-rate-with-mobile-esports-platform/

With prize pools expected to grew by a CAGR of 30% over the 2019 - 2024 period https://venturebeat.com/2018/09/18/skillz-hits-400-million-revenue-run-rate-with-mobile-esports-platform/

According to Research And Markets, the eSports market is set to grew by a CAGR of 20% over the 2020 - 2025 period and reach $3B

According to Research And Markets, the eSports market is set to grew by a CAGR of 20% over the 2020 - 2025 period and reach $3B Driven by the growing popularity of eSports on a global level and increasing game publishers support https://www.researchandmarkets.com/reports/4792907/global-esports-market-forecast-up-to-2025

Driven by the growing popularity of eSports on a global level and increasing game publishers support https://www.researchandmarkets.com/reports/4792907/global-esports-market-forecast-up-to-2025

According to Research And Markets, the global mobile gaming market is set to grow by 14% a year over the 2020 - 2025 period

According to Research And Markets, the global mobile gaming market is set to grow by 14% a year over the 2020 - 2025 period Driven by higher smartphone penetration, decline in costs of mobile internet and innovations (e.g cloud gaming & AR) https://www.researchandmarkets.com/reports/5176393/mobile-gaming-market-growth-trends-and

Driven by higher smartphone penetration, decline in costs of mobile internet and innovations (e.g cloud gaming & AR) https://www.researchandmarkets.com/reports/5176393/mobile-gaming-market-growth-trends-and

According to Statista, mobile games in the USA reached $ 18.3B in 2020 - up 19.5% YoY

According to Statista, mobile games in the USA reached $ 18.3B in 2020 - up 19.5% YoY Revenue is expected to grow annually by 10% over the 2020 - 2025 period and reach $ 29.6B

Revenue is expected to grow annually by 10% over the 2020 - 2025 period and reach $ 29.6B Driven by growing user penetration from 46% in 2020 to 53% in 2025 https://www.statista.com/outlook/211/109/mobile-games/united-states

Driven by growing user penetration from 46% in 2020 to 53% in 2025 https://www.statista.com/outlook/211/109/mobile-games/united-states

This market is booming! Here is what Skillz’s CEO has to say:

“The Skillz platform capitalizes on the phenomenal growth of esports, […]

“The Skillz platform capitalizes on the phenomenal growth of esports, […]

“The Skillz platform capitalizes on the phenomenal growth of esports, […]

“The Skillz platform capitalizes on the phenomenal growth of esports, […]

...We are the first company to democratize esports for players and game developers, and the first company to do it at scale.” by Dean Takahashi for Venture Beat

https://venturebeat.com/2018/09/18/skillz-hits-400-million-revenue-run-rate-with-mobile-esports-platform/

https://venturebeat.com/2018/09/18/skillz-hits-400-million-revenue-run-rate-with-mobile-esports-platform/

“Mobile gaming keeps growing at crazy rates. It is now half of the total gaming market, but it was less than a fifth in 2012 when we started.” by Dean Takahashi for Venture Beat

“Mobile gaming keeps growing at crazy rates. It is now half of the total gaming market, but it was less than a fifth in 2012 when we started.” by Dean Takahashi for Venture Beat

Great numbers! But who is leading this company?

CEO: Andrew Paradise, founded AisleBuyer and sold it to Intuit for 80 to $ 100m. Also founded Double Picture and sold it to MPA in 2010

CEO: Andrew Paradise, founded AisleBuyer and sold it to Intuit for 80 to $ 100m. Also founded Double Picture and sold it to MPA in 2010

Advisory board: Trip Hawkins, the co-founder of Electronic Arts

Advisory board: Trip Hawkins, the co-founder of Electronic Arts

CEO: Andrew Paradise, founded AisleBuyer and sold it to Intuit for 80 to $ 100m. Also founded Double Picture and sold it to MPA in 2010

CEO: Andrew Paradise, founded AisleBuyer and sold it to Intuit for 80 to $ 100m. Also founded Double Picture and sold it to MPA in 2010 Advisory board: Trip Hawkins, the co-founder of Electronic Arts

Advisory board: Trip Hawkins, the co-founder of Electronic Arts

$FEAC Lead: Harry Sloan, who lead the $DKNG SPAC, was the CEO and Chairman of MGM and built SBS Broadcasting into the second largest broadcaster in Europe

$FEAC Lead: Harry Sloan, who lead the $DKNG SPAC, was the CEO and Chairman of MGM and built SBS Broadcasting into the second largest broadcaster in EuropeHere is what Trip Hawkins had to say on Skillz back in 2016

“there has to be a set of platform features to let players have accounts set up the way they need, be able to communicate and broadcast or be broadcast,...

...make payments, manage transactions and receive prizes. That’s where Skillz has a head start.” by Lora Kolodny for TechCrunch

https://techcrunch.com/2016/06/15/skillz-is-the-biggest-e-sports-company-gamers-have-never-heard-of/

https://techcrunch.com/2016/06/15/skillz-is-the-biggest-e-sports-company-gamers-have-never-heard-of/

What about alternatives? Well, $SKLZ is a pioneer in its own genre

Initially, many people were sceptical at the idea of “mobile eSports”

Initially, many people were sceptical at the idea of “mobile eSports”

It was thought that only dedicated gamers (on PC and consoles) would be attracted to this format

It was thought that only dedicated gamers (on PC and consoles) would be attracted to this format

Initially, many people were sceptical at the idea of “mobile eSports”

Initially, many people were sceptical at the idea of “mobile eSports” It was thought that only dedicated gamers (on PC and consoles) would be attracted to this format

It was thought that only dedicated gamers (on PC and consoles) would be attracted to this format

But mobile gaming took on and supported $SKLZ extraordinary growth, as Venture Beat reports

But mobile gaming took on and supported $SKLZ extraordinary growth, as Venture Beat reports“By 2018, Skillz had hit a $400 million run rate. Rivals like Sony and Amazon took Skillz on, but they faltered.” by Dean Takahashi for Venture Beat

Great! This means

Skillz has experienced rapid growth since its launch growing its GMV from $ 20m in 2015 to $ 886m in 2019

Skillz has experienced rapid growth since its launch growing its GMV from $ 20m in 2015 to $ 886m in 2019

The market for mobile gaming and eSports is growing fast, driven by increasing user penetration, reduction in internet costs and innovations

The market for mobile gaming and eSports is growing fast, driven by increasing user penetration, reduction in internet costs and innovations

Skillz has experienced rapid growth since its launch growing its GMV from $ 20m in 2015 to $ 886m in 2019

Skillz has experienced rapid growth since its launch growing its GMV from $ 20m in 2015 to $ 886m in 2019 The market for mobile gaming and eSports is growing fast, driven by increasing user penetration, reduction in internet costs and innovations

The market for mobile gaming and eSports is growing fast, driven by increasing user penetration, reduction in internet costs and innovations

Its management has a strong entrepreneurial, corporate and gaming track record

Its management has a strong entrepreneurial, corporate and gaming track record It virtually invented its own format has competition chose to focus on the PC and consoles segment

It virtually invented its own format has competition chose to focus on the PC and consoles segment

Financials Check

Financials Check

Gross Marketplace Volume (GMV) grew 76% to $ 411m in Q3 ’20 versus $ 234m a year earlier

Gross Marketplace Volume (GMV) grew 76% to $ 411m in Q3 ’20 versus $ 234m a year earlier Net sales grew 92% YoY in Q3 ’20 to $ 60m with net sales YTD reaching $ 162m (up 91% YoY)

Net sales grew 92% YoY in Q3 ’20 to $ 60m with net sales YTD reaching $ 162m (up 91% YoY)

Gross margins stood at 95% (constant YoY) and gross profit increased by 92% to $ 56.9m versus $ 29.6m a year earlier

Gross margins stood at 95% (constant YoY) and gross profit increased by 92% to $ 56.9m versus $ 29.6m a year earlier Sales and marketing expenses grew 151% to $ 73m

Sales and marketing expenses grew 151% to $ 73m Loss from operations reached $ 28m up from a loss of $ 7m a year earlier

Loss from operations reached $ 28m up from a loss of $ 7m a year earlier

Current assets stood at $ 66.8m versus $ 40.1m in current liabilities and has no LT debt

Current assets stood at $ 66.8m versus $ 40.1m in current liabilities and has no LT debtThrough the $FEAC merger, Skillz got around $ 240m in net proceeds and has not debt

The company raised $ 848m through the SPAC, of which $ 608m went to early-stage investors

The company raised $ 848m through the SPAC, of which $ 608m went to early-stage investors

Around $ 690m came from the SPAC and $ 158m from follow-on investors

Around $ 690m came from the SPAC and $ 158m from follow-on investors

THE BOTTOM LINE

THE BOTTOM LINE

Skillz quickly saw the potential for eSports in the mobile gaming market and its exploded as the format attracted bot players and developers

Skillz quickly saw the potential for eSports in the mobile gaming market and its exploded as the format attracted bot players and developers Skillz quickly understood that players of varying experience want to play online - not only advanced players

Skillz quickly understood that players of varying experience want to play online - not only advanced players

It therefore developed a range of data-driven tools to match players and monitor cheating

It therefore developed a range of data-driven tools to match players and monitor cheating Translating into high player retention (24% above industry average), above average revenue per user (ARPU of $ 6.3 vs $ 1.7 for $ZNGA and $GLUU) and longer time spent on games

Translating into high player retention (24% above industry average), above average revenue per user (ARPU of $ 6.3 vs $ 1.7 for $ZNGA and $GLUU) and longer time spent on games

Sales are growing at above 90% YoY growth rates all while gross margins expand - but growth is partially driven by large increases in marketing spending

Sales are growing at above 90% YoY growth rates all while gross margins expand - but growth is partially driven by large increases in marketing spending

Game developers might build their own eSports solutions in-house and build their own “leagues” in order to retain players in their ecosystem

Game developers might build their own eSports solutions in-house and build their own “leagues” in order to retain players in their ecosystem Skillz large increase in marketing spend may reflect slowing customer interest as the economy re-opens

Skillz large increase in marketing spend may reflect slowing customer interest as the economy re-opens

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Venture Beat

✑ Reuters

✑ TechCrunch

✑ Forbes

Sources

✑ Investor presentation

✑ Company website

✑ Venture Beat

✑ Reuters

✑ TechCrunch

✑ Forbes

✑ Goldman Sachs

✑ Statista

✑ Research And Markets

✑ Statista

✑ Research And Markets

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter