One last ad-tech thread to wrap up 2020. The Google anti-trust trial notes, at 130 pages make for an interesting read. Slightly surprised at how some of the wildest speculations may have turned out to be very conservative against what was actually happening.

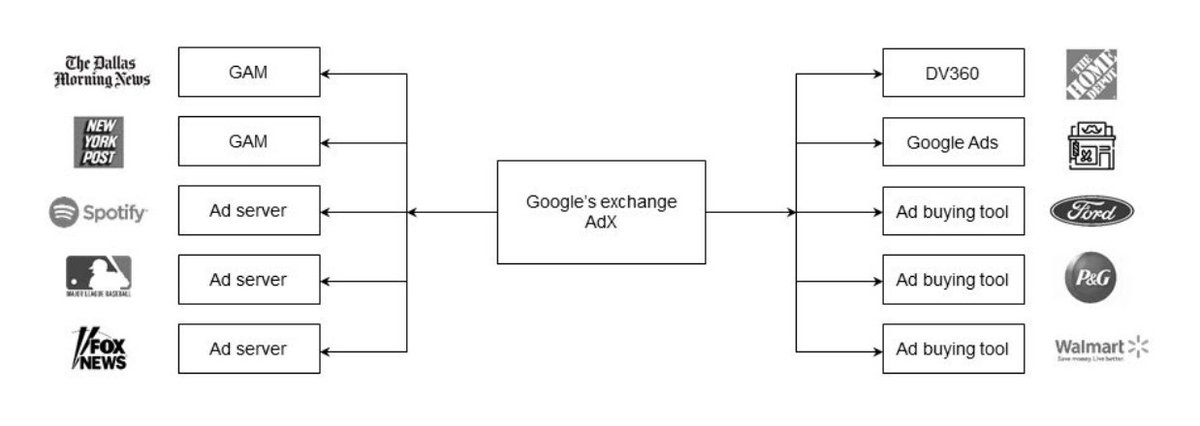

US regulators compare an ad exchange to the stock markets & why Google has an unfair advantage. In the world of advertising, Google plays the role of the facilitator (SSP) to the seller (publishers), marketplace (exchange) and an intermediary(DSP) to the buyer (advertisers) (1/n)

As visible in the above chart, Google provides multiple tools to publishers and advertisers: Double Click for publishers, Admob, DV360, Google Ad Manager, Google Display Network and most of it linked through AdX, their exchange through which publishers & advertisers transact(2/n)

The choice lies with each publisher/advertiser to choose tools independently and yet participate in the marketplace through Google Ad Exchange (AdX). How Google forces/disincentivizes each party from going outside their system forms a large part of the accusation (3/n)

Also, it is obviously expected that each of these platforms will act in the best interest of their respective clients and not in the interest of Google (at least to a great extent), but Google violated some of that trust and the details are honestly shocking (even to me) (4/n)

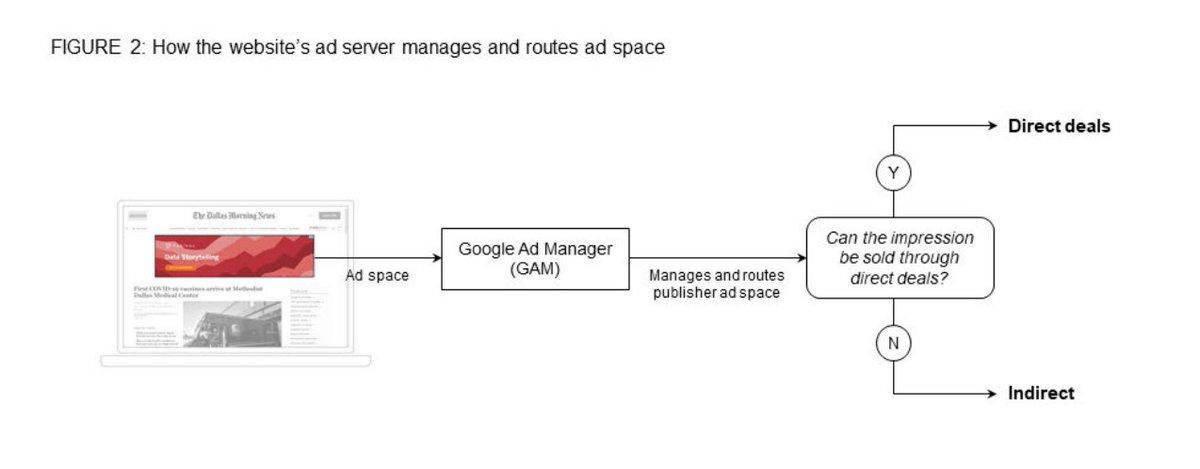

For eg. An algorithm that most publishers tend to choose as an option maximize their revenue (Dynamic allocation) on the publisher side tool actually biased auctions to give preference to Google and its buying tools in multiple ways to win a lion’s share of the inventory. (5/n).

Also, Google gained an advantage by using static prices for competitors while using real-time bids for their own tools (with pre-existing knowledge of price from the competition as you can guess). So kinda obvious that they were gaming the system by always bidding higher (6/n)

Google also side-stepped the audience reserved for direct sales campaigns, typically from premium audiences. Think Hotstar’s (for eg) sales teams reserving a particular audience for an advertiser (Female, 25+), but Google change the dynamics to gain preference for itself (7/n).

Again here, the reference drawn is to insider information and how Google would have gained this information only by playing a part across the ecosystem. It should have acted in the best interest of the client, but didn’t and made moves for their profit and so on (8/n)

The biggest one that has hogged headlines all around is the collusion with Facebook, mostly against an industry wide change Header Bidding(HB). This was a new transparent auction bidding mechanism that was designed to improve publisher ad revenues by introducing competition (9/n)

HB is equivalent of open auction with all buyers in public vs auctions in small closed group buyers in a previous world (waterfall) thus helping realize the true price of inventory. With this, preferential access and benefits of the integrated ecosystem for Google reduces (10/n)

Google did a combination of things through their alternative (Open Bidding) to counter this –charged publishers selling outside AdX, likely built in a last look, also possibly anonymized users/cookies for other exchanges and mandated that AdX be the intermediary for HB (11/n)

FB /Amazon (largest buyers) who did not have very deep integrations with the publisher ecosystem could use this to break Google’s control. FB aggressively came out in support of HB & stated how savings from intermediary fees would directly benefit publishers & advertisers (12/n)

As per the suit, Google cut a deal with FB to change FB’s stance to header bidding by throwing in a bunch of incentives for them across financial benefits, likely additional access to bid & user data, additional processing time for auctions as against competition (13/n)

As per the accusation at least, FB always knew Google was looking to cut a deal and they were just forcing Google’s hand by taking a very vocal stance pro HB. Google was obviously trying to protect its margins and profitability that would be hurt with increased competition (14/n)

Hence FB was also clear to extract more than their pound of flesh by ensuring their data wasn’t being used to bias auctions for Google while Google in return got commitment of spends from FB. They also got some minimum allocation of inventory through this deal likely (15/n)

With the 2 largest ad networks/media buyers on their side, Google was likely making publishers doubt their move to conventional HB. If this was not enough, they also started controlling data, analytics and other options to publishers who still chose to go down that path (16/n)

Many further tactics are touched upon,but best is Google apparently asking publishers to exclude exchanges from header bidding because of strain on Google servers  . Overall, they came out strongly against something that could have significantly improved publisher revenue (17/n)

. Overall, they came out strongly against something that could have significantly improved publisher revenue (17/n)

. Overall, they came out strongly against something that could have significantly improved publisher revenue (17/n)

. Overall, they came out strongly against something that could have significantly improved publisher revenue (17/n)

In the web world, the lawsuit also accuses that the Accelerated Mobile Pages (AMP) strategy was a way to circumvent header bidding by creating alternatives that don’t support HB and making that the default destination through their search monopoly (!). (18/n).

AMPs were overall changing the publisher experience being delivered to user and was also kicked off as an open-source effort, but clearly controlled by Google for the longest time. Also gave Google complete control over ads as well obviously (19/n).

Other tweaks from Google also ensured that they controlled a larger share of inventory – introduced a new “Unified Pricing” rule which meant all buyers had to have similar floors and thus sophisticated publishers who earlier used to set high floors to reduce Google’s share (20/n)

If all of this is on the publisher side, similar levers were being applied on the advertiser side too. Largest one is restricting YouTube inventory access through DV360, their DSP. To be fair, any large media owner with similar tools & reliance on ads is likely to do this (21/n)

If advertisers wanted to buy YT ads, you could only buy it through Google tools, thus reducing options for advertisers. Also denying exchanges access to a large media source for video ads. Thus providing no options to buyers & hence anti-competitive in instream video ads (22/n)

Central theme is how Google is acting in their own interest, as expected from businesses, but too much here? Hence, causing significant harm to consumers: Incremental cost from brands passed on or inability to monetize content for publishers leading to poor experience (23/n)

Some of the details revealed in the lawsuit are actually significantly brutal and damaging for Google and their image of being neutral and beneficial to everyone in the ecosystem. Surprised that not too much being spoken about it (or India tech is lagging on this chatter) (24/n)

In an ideal world, this will also mean publishers start pushing for more transparency, options, and ways to decouple from being reliant on Google. Advertisers actually don’t have much of a say – too much across Search, Youtube, Play store ads and data controlled by them (25/n).

India is yet to latch onto HB as much, but everything else about the algorithms favoring Google, lack of control to publishers, etc was still likely in play here too. Curious to hear from anyone on TL who has seen this in play (my comments will be seen as biased anyways) (26/n)

Also, interesting to think about some of the other moves that Google is making where it is present at different parts of the value chain - like deprecating 3rd party cookies on Chrome. Could there be something in the works there too to give them some advantage? Who knows  (27/n)

(27/n)

(27/n)

(27/n)

Like most things with Google, their software, tools are a cut above everyone else and show significantly better results. But, what some of this data reveals is that it is not all just cutting edge tech and AI etc. In some cases, just being a monopoly can change the game. (28/n)

The lawsuit is a 130 page document, what I have provided here are only highlights/simplified version of things that were of interest to me from a significantly redacted document (hence speculation in many places). You can see the full text here: https://www.texasattorneygeneral.gov/sites/default/files/images/admin/2020/Press/20201216%20COMPLAINT_REDACTED.pdf

There are experts in the US who have given a far more nuanced take on how each of this plays in with the monopoly and anti-trust angle as well. Read more here.

https://twitter.com/jason_kint/status/1339349312694837250

https://twitter.com/DinaSrinivasan/status/1275130696059609088

https://www.wsj.com/articles/google-facebook-agreed-to-team-up-against-possible-antitrust-action-draft-lawsuit-says-11608612219

https://twitter.com/jason_kint/status/1339349312694837250

https://twitter.com/DinaSrinivasan/status/1275130696059609088

https://www.wsj.com/articles/google-facebook-agreed-to-team-up-against-possible-antitrust-action-draft-lawsuit-says-11608612219

If you have gotten so far, Thank You for reading! Pardon oversimplifications and errors if any (let me know, happy to stand corrected). Reach out to me if you want to talk more, understand how you can work around some of this, and of course explore other alternatives  . Fin!

. Fin!

. Fin!

. Fin!

Also, usual disclaimers to friends in media if you are reading this, this is my personal take and breakdown of the lawsuit text, happy to talk to you if this is of any interest to you on more implications for the industry (and my employer). Thanks!

Some TLAs (mostly) and what they stand for with examples:

DSP - Demand Side Partner (Trade Desk, MediaMath )

SSP - Supply Side Partner (Mopub etc)

DV360 - Display & Video 360 (Google DSP)

GAM - Google Ads Manager.

GDN - Google Display Network.

DSP - Demand Side Partner (Trade Desk, MediaMath )

SSP - Supply Side Partner (Mopub etc)

DV360 - Display & Video 360 (Google DSP)

GAM - Google Ads Manager.

GDN - Google Display Network.

Read on Twitter

Read on Twitter