Why $TSLA will likely go to $800.

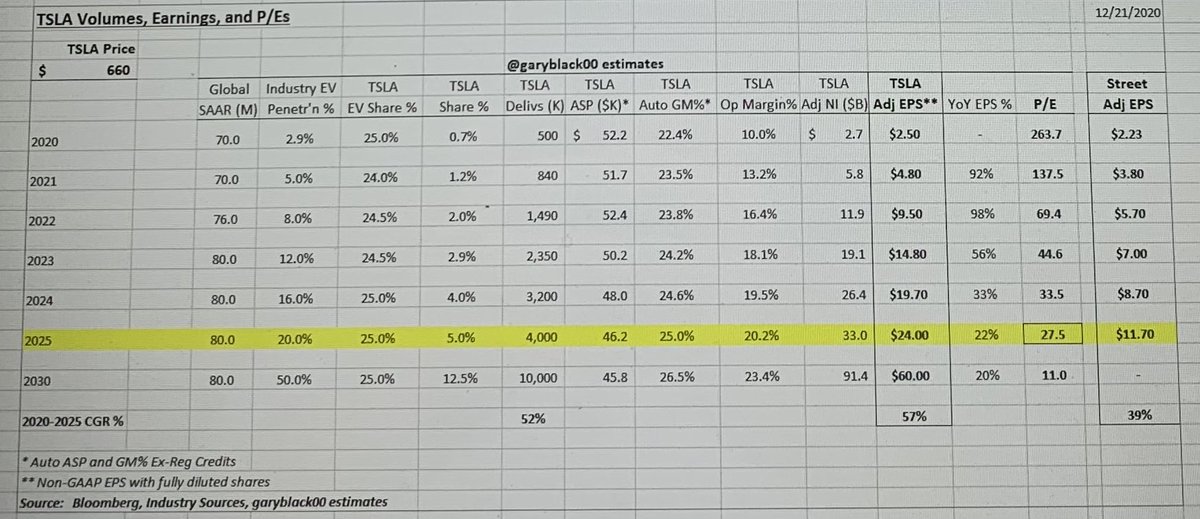

1/ Given long EV runway - 3% adoption today going to 20% by 2025 - and holding TSLA’s current 25% EV share, I can easily get to 2025 EPS of $24, attach a P/E ratio of 50x, and get 2025 value of $1200. At a 9.5% disct rt, TSLA is worth $830 today.

1/ Given long EV runway - 3% adoption today going to 20% by 2025 - and holding TSLA’s current 25% EV share, I can easily get to 2025 EPS of $24, attach a P/E ratio of 50x, and get 2025 value of $1200. At a 9.5% disct rt, TSLA is worth $830 today.

2/ $TSLA stock is +670% YTD, as Model Y doubled US TAM, MIC tripled China delivs, and Berlin/Austin began, which doubles capacity. TSLA vol growth accelerated from 40% to 55%, and FY’21-25 EPS ests incr 60-100%. S&P inclusion/stock split were catalysts that closed TSLA value gap.

3/ For $TSLA to move higher in 2021, three key metrics - EV adoption, TSLA EV share, and Auto GM % - have to beat expectations. Biden’s EV plan will accelerate US EV adoption. Model Y global expansion, Europe delivs increasing 2-3x, and CyTruck launch will grow TSLA EV share.

4/ My $TSLA $830 PT in 6-12 mos assumes 2025 global EV adoption of 20%, and TSLA takes 25% EV share. By 2025, I expect TSLA to deliver 4M veh/yr, producing $24 EPS. If data emerges that EV adoption can accelerate to 30% by 2025 (vs 20%), my 6-12mo PT would go to $1,300 (vs $830).

5/ Contrary to media reports and analysts who blindly value $TSLA as an auto stock, $TSLA is not expensive on most valuation metrics. No ptf mgr values growth stocks on current yr earnings. TSLA trades at 69x FY’22 EPS, or 1.2x 5-yr forward EPS growth of 57%. Only $FB is cheaper.

6/ Early ‘21 catalysts will push $TSLA toward my $830 PT:

i) 4Q vols of 181K should beat Street 172K est, led by China and Model Y (1/4)

ii) CyTrck update, FSD MRR, and MIC Y start (1/15)

iii) Biden inaugural/proposed $7500 EV credit

iv) FY’21 vol guide 840K vs 777K Street (1/27)

i) 4Q vols of 181K should beat Street 172K est, led by China and Model Y (1/4)

ii) CyTrck update, FSD MRR, and MIC Y start (1/15)

iii) Biden inaugural/proposed $7500 EV credit

iv) FY’21 vol guide 840K vs 777K Street (1/27)

Read on Twitter

Read on Twitter