WARNING

These are my personal experiences.

They apply to those living in the United States.

If you live in a socialist country, I suggest you leave.

Anyone can read this, but you will be unable to take full advantage. Countries have different tax codes.

These are my personal experiences.

They apply to those living in the United States.

If you live in a socialist country, I suggest you leave.

Anyone can read this, but you will be unable to take full advantage. Countries have different tax codes.

STEP 1 - GET A JOB

You need to have a real job to take advantage.

Because without one, you will have no tax free money.

Level up your life to get there.

Make sure you get one with a 401K.

What to do even better?

Land a job with a 457. (more on this later)

You need to have a real job to take advantage.

Because without one, you will have no tax free money.

Level up your life to get there.

Make sure you get one with a 401K.

What to do even better?

Land a job with a 457. (more on this later)

STEP 2 - SLASH SPENDING

Cut waste like a madman

TV

Cable

Dining Out

Fancy Cars

Video Games

Starbucks (muh coffee)

Hollywood Propaganda

High-cost of living areas

Ditch all of it.

Live like a free man.

No one is entitled to retirement.

You have to earn it.

Cut waste like a madman

TV

Cable

Dining Out

Fancy Cars

Video Games

Starbucks (muh coffee)

Hollywood Propaganda

High-cost of living areas

Ditch all of it.

Live like a free man.

No one is entitled to retirement.

You have to earn it.

STEP 2 - SLASH

This step is essential.

My wife and I made 120K.

But we slashed our spending to 40K per year.

This means we only had to realize 40K per year in salary.

The other 80K was punted. We lived off 40K.

That means we paid $0 dollars in taxes.

How? Keep reading.

This step is essential.

My wife and I made 120K.

But we slashed our spending to 40K per year.

This means we only had to realize 40K per year in salary.

The other 80K was punted. We lived off 40K.

That means we paid $0 dollars in taxes.

How? Keep reading.

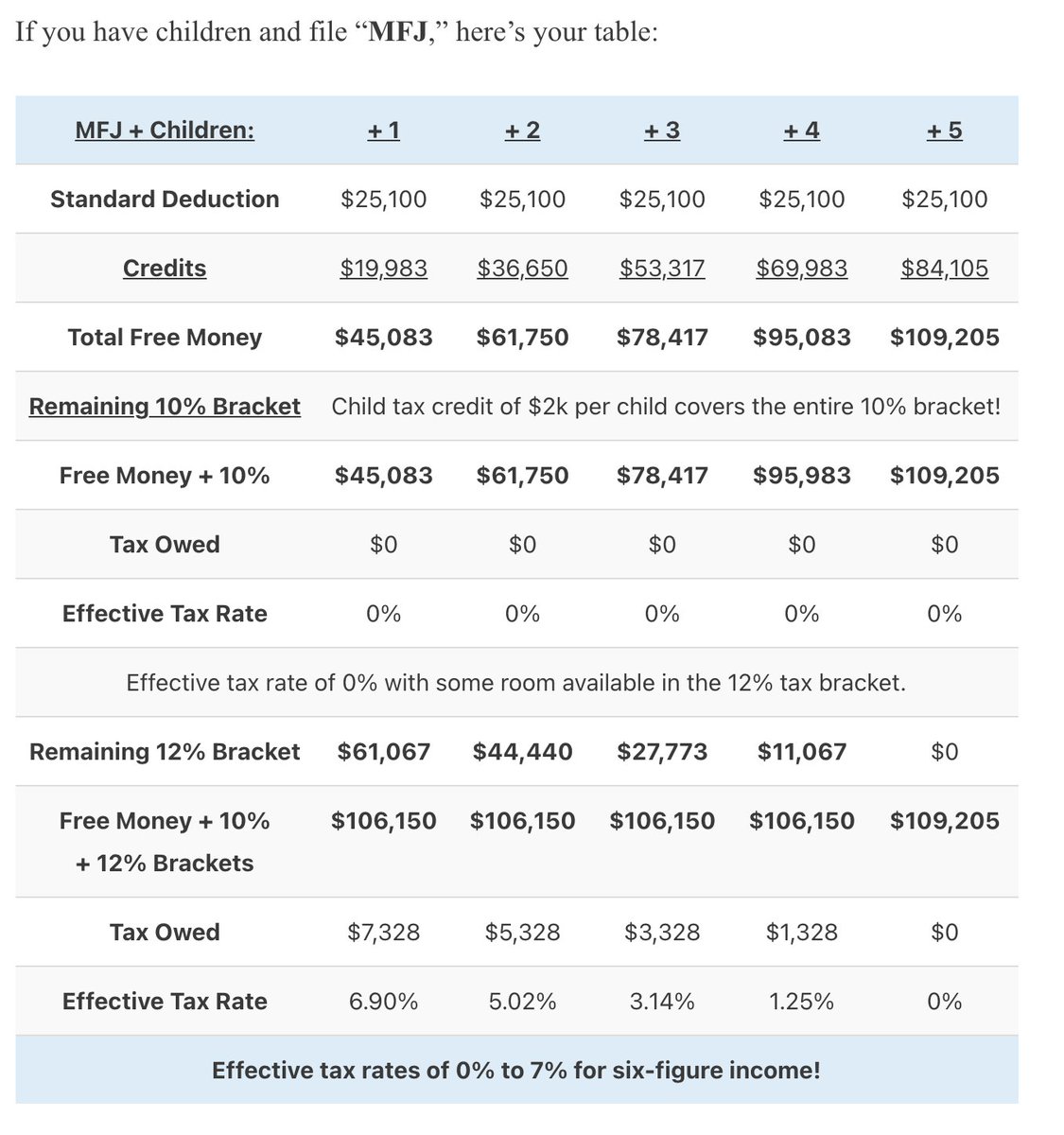

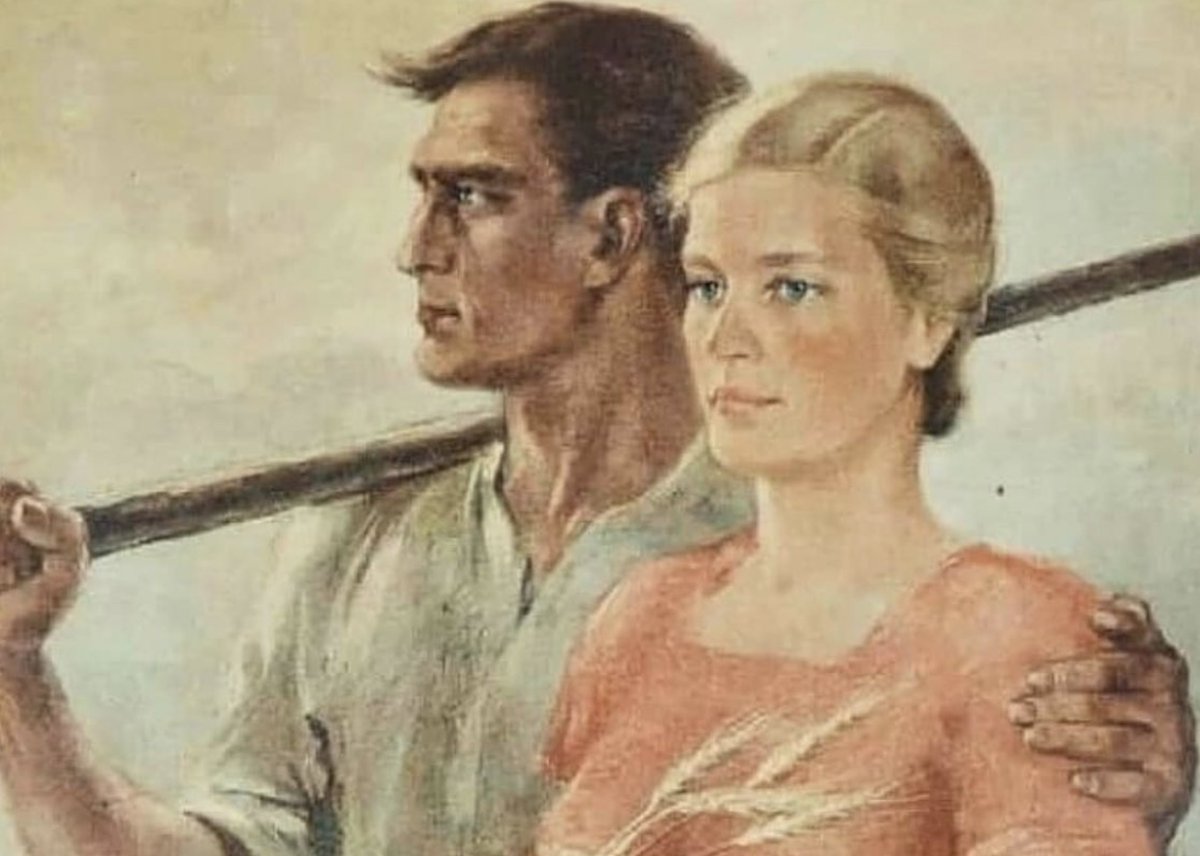

STEP 3 - Make Babies

This part is fun.

It also has great tax benefits.

If you are married with two kids your first 62K is tax-free.

0% PERCENT

No strings attached.

Chose an attractive partner when you are on this step.

"Aesthetics are Ethics"

-credit to @Ed_Mills_

This part is fun.

It also has great tax benefits.

If you are married with two kids your first 62K is tax-free.

0% PERCENT

No strings attached.

Chose an attractive partner when you are on this step.

"Aesthetics are Ethics"

-credit to @Ed_Mills_

STEP 4 - The 457

Praise the lord if you have this account.

It is a LIFE HACK and no one talks about it.

This is offered primarily to government employees.

Some companies do offer it though.

Big bonus if they do.

If you can find a gig that has it consider yourself MADE.

Praise the lord if you have this account.

It is a LIFE HACK and no one talks about it.

This is offered primarily to government employees.

Some companies do offer it though.

Big bonus if they do.

If you can find a gig that has it consider yourself MADE.

STEP 4 - The 457

Why is this so good?

1. It stacks WITH a 401K and Trad IRA.

A married couple can stash 91K a year tax-free.

2. You defer your taxes and can withdraw at ANY age. All you need to do is leave your job.

Once you have a couple million.

This becomes a piggy bank.

Why is this so good?

1. It stacks WITH a 401K and Trad IRA.

A married couple can stash 91K a year tax-free.

2. You defer your taxes and can withdraw at ANY age. All you need to do is leave your job.

Once you have a couple million.

This becomes a piggy bank.

STEP 5- The 401K

This is a basic investment vehicle.

Most only have this. USE IT.

Employers often match contributions.

Fund this to the MAX.

If you only have access to a 401K you can stash 39K.

Once this is fully funded go to a Trad IRA.

Then you can stash 52K in total.

This is a basic investment vehicle.

Most only have this. USE IT.

Employers often match contributions.

Fund this to the MAX.

If you only have access to a 401K you can stash 39K.

Once this is fully funded go to a Trad IRA.

Then you can stash 52K in total.

Step 5 - The 401K

MT: But some “guru” told me you can’t access 401K money until you 60 years old.

WRONG

You can convert a 401K into a 72T.

The 401K turns into a massive passive income stream.

NO PENALTY

This is why I laugh at dividend guys.

Understand?

MT: But some “guru” told me you can’t access 401K money until you 60 years old.

WRONG

You can convert a 401K into a 72T.

The 401K turns into a massive passive income stream.

NO PENALTY

This is why I laugh at dividend guys.

Understand?

Step 6 - Brokerage Accounts

The Capital Gains is 0% for income under 80K.

And I just told you how to get there.

Fund an account with extra cash.

I once paid 0% on a 20K profit trade made in $TQQQ.

Tax-free gambling and I get to live in a first-world country.

God Bless America

The Capital Gains is 0% for income under 80K.

And I just told you how to get there.

Fund an account with extra cash.

I once paid 0% on a 20K profit trade made in $TQQQ.

Tax-free gambling and I get to live in a first-world country.

God Bless America

Step 7 - Start a Twitter Account /Post French Impressionist Paintings.

You legitimately have done NO work and you are rich.

You are living the dream.

A married couple can do this in 5 to 7 years.

Age 30. No worries. Living the good life.

Now you can post memes all day.

You legitimately have done NO work and you are rich.

You are living the dream.

A married couple can do this in 5 to 7 years.

Age 30. No worries. Living the good life.

Now you can post memes all day.

IMPORTANT

1. Avoid Roth IRAs

2. Low-ratio funds only

3. Leave your job if they have bad plans

BONUS: Saver’s Tax Credit gives you 2K more in credits. US Gov pays you to save. This is not factored into my calculations.

AoP has now made you a millionaire.

Cue the dumb comments.

1. Avoid Roth IRAs

2. Low-ratio funds only

3. Leave your job if they have bad plans

BONUS: Saver’s Tax Credit gives you 2K more in credits. US Gov pays you to save. This is not factored into my calculations.

AoP has now made you a millionaire.

Cue the dumb comments.

If you love this thread please share it with an RT.

You can find the more complete version on my blog https://www.aestheticsareethics.com/blog/seven-steps-to-pay-0-a-year-in-taxesnbsp

https://www.aestheticsareethics.com/blog/seven-steps-to-pay-0-a-year-in-taxesnbsp

If you want to learn how to create, have fun, make $$$, all while getting a ton of follows then get Create 24/7

https://gumroad.com/l/twitterunlocked

You can find the more complete version on my blog

https://www.aestheticsareethics.com/blog/seven-steps-to-pay-0-a-year-in-taxesnbsp

https://www.aestheticsareethics.com/blog/seven-steps-to-pay-0-a-year-in-taxesnbspIf you want to learn how to create, have fun, make $$$, all while getting a ton of follows then get Create 24/7

https://gumroad.com/l/twitterunlocked

*Why avoid the Roth?

The problem with the Roth is that you cannot immediately take advantage of the tax breaks.

Yes, you get the gains for free BUT when you are older.

Will you have children or a mortgage when 60? NO

You will need less money if you are smart.

The problem with the Roth is that you cannot immediately take advantage of the tax breaks.

Yes, you get the gains for free BUT when you are older.

Will you have children or a mortgage when 60? NO

You will need less money if you are smart.

Read on Twitter

Read on Twitter