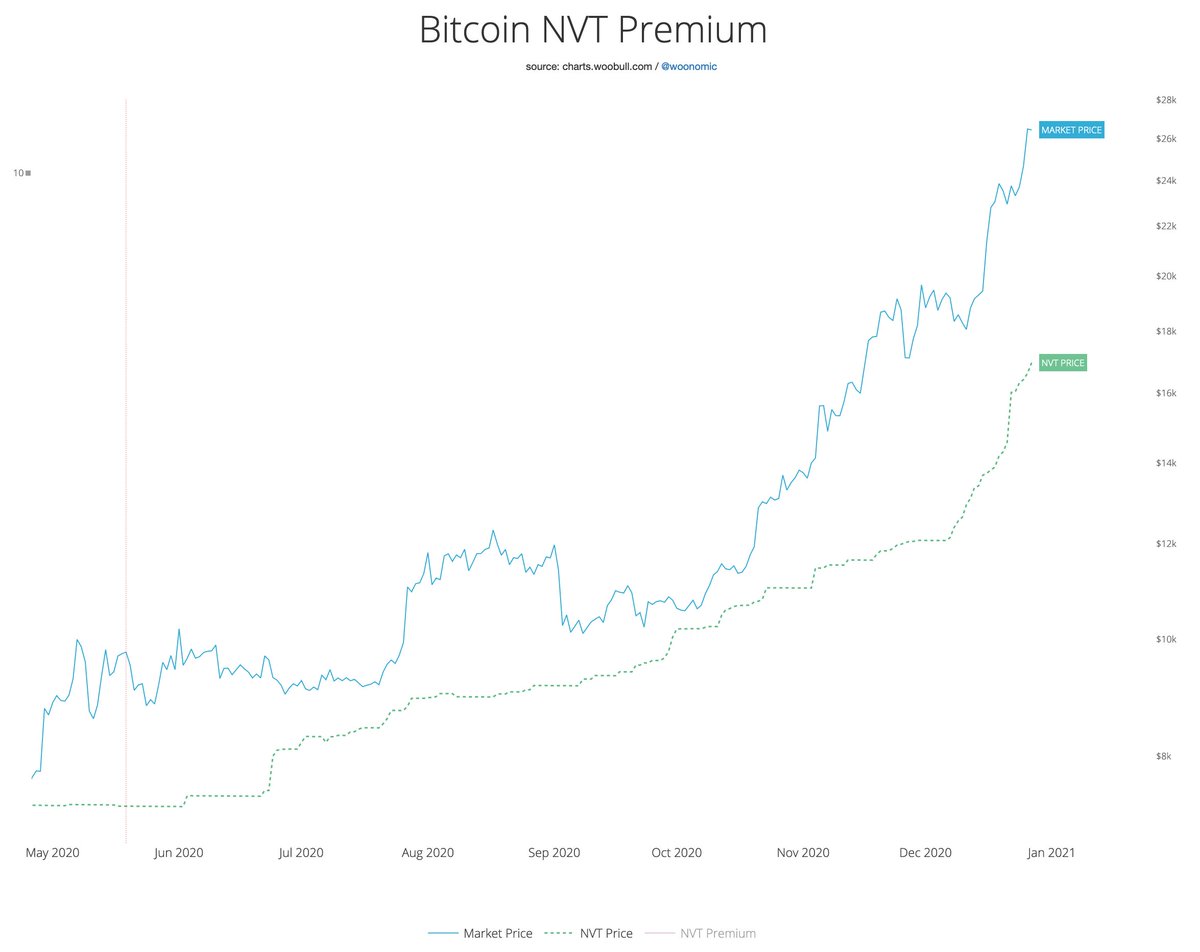

This rally to 28k was strongly supported by spot buying. It's not a zone where I would expect a blow-off top. It's no more overheated than when we consolidated at 22k-24k.

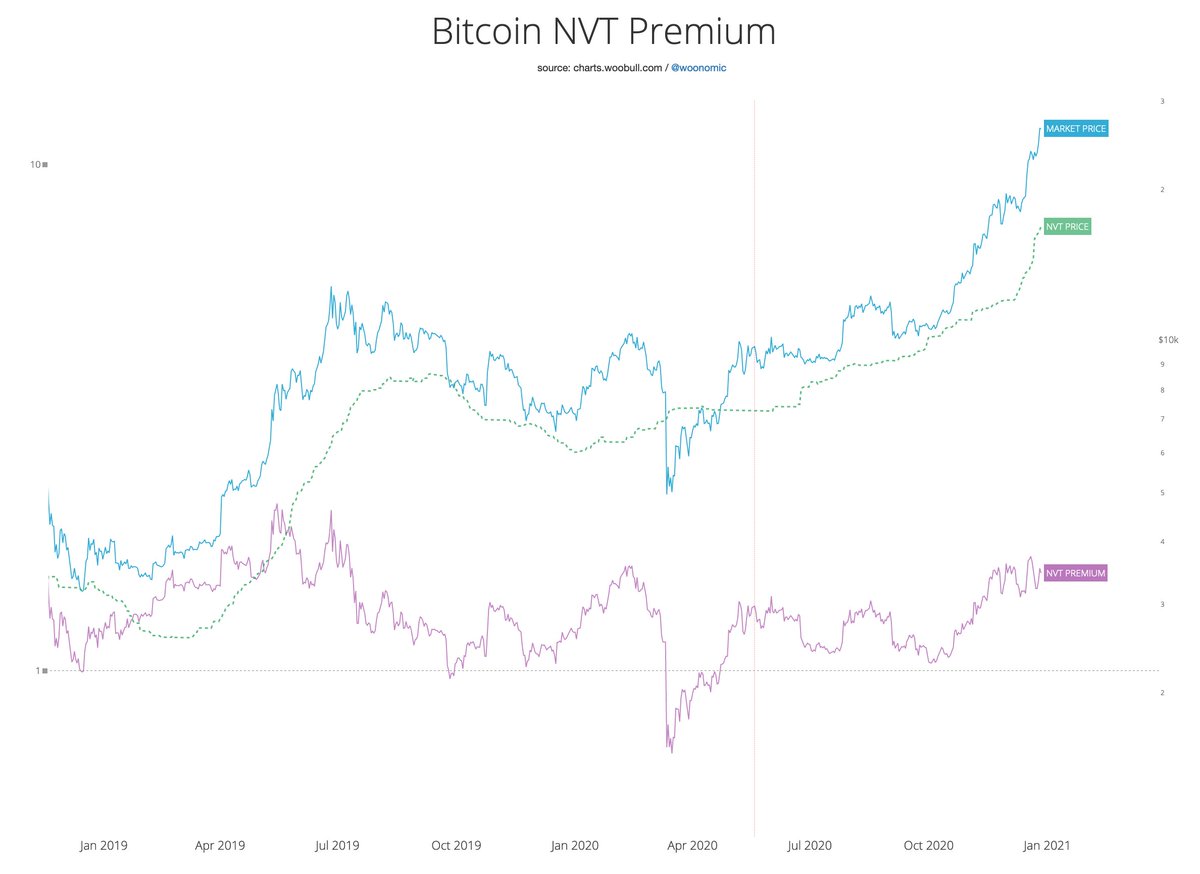

NVT Premium can be read as an estimate of how overheated we are above "long term investor valuation".

NVT Premium can be read as an estimate of how overheated we are above "long term investor valuation".

NVT Price can be used as an estimate of the price floor supported by long term investors. It's 17k and rising fast. Lately the best speculative sellers have managed is 10% above this, so IMO it's unlikely we'll see prices below 20k again.

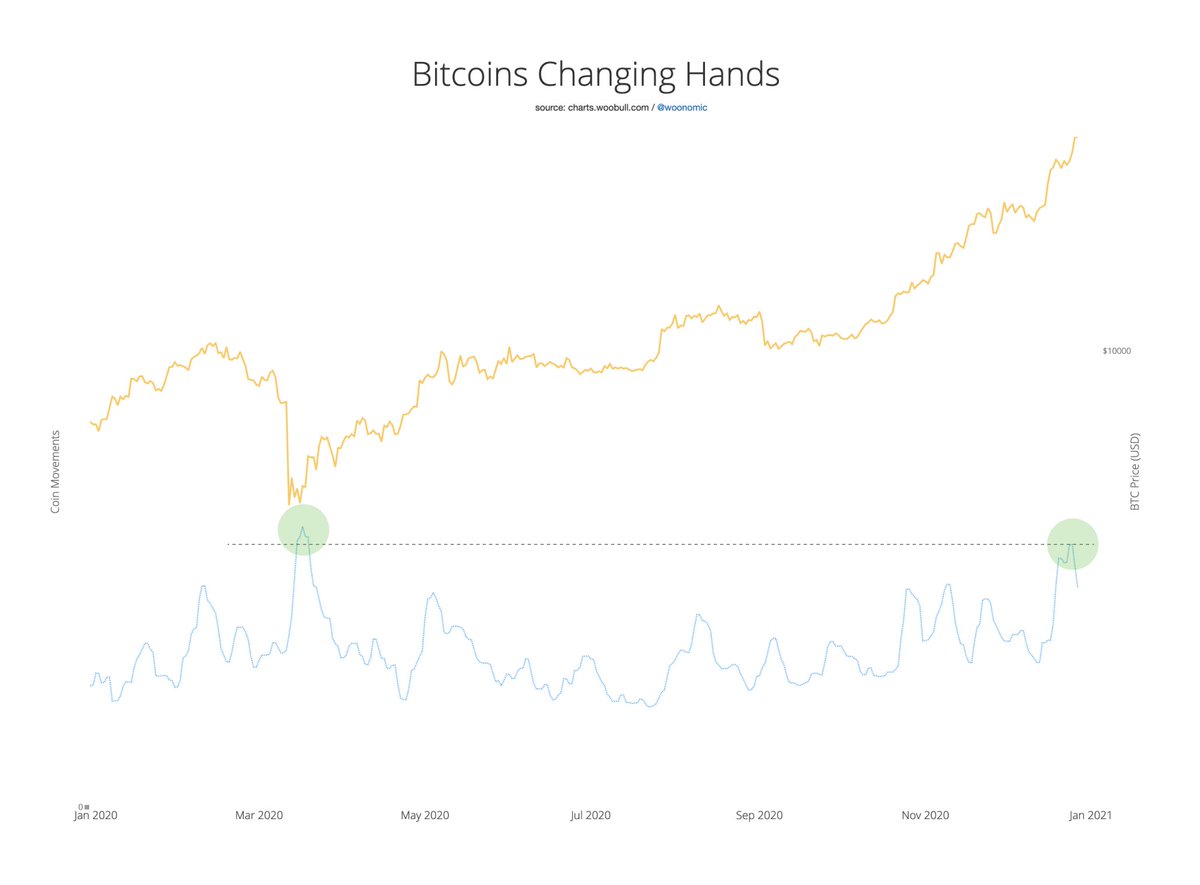

Here's a chart to give you an idea of the investor activity during this latest rally. Quite close to the buying activity that was responsible for snapping up the COVID white swan bottom.

(That buying impulse took BTC from $5k to $9k.)

(That buying impulse took BTC from $5k to $9k.)

With the current structure of investor demand, looks like we're in a band where 20% pull backs are the worst we may get instead of 30%-40% which we saw in the last cycle (late 2016-2017). Of course this may change as things heat up, but it's a fair rule of thumb IMO right now.

Read on Twitter

Read on Twitter