I thought I might post on how I invest. Its not rocket science but there seems to be some confusion around how I outperform the market. Grab a tequila or a store bought coffee (anyone that makes their coffee at home stop reading now) please enjoy or laugh as the mood takes you

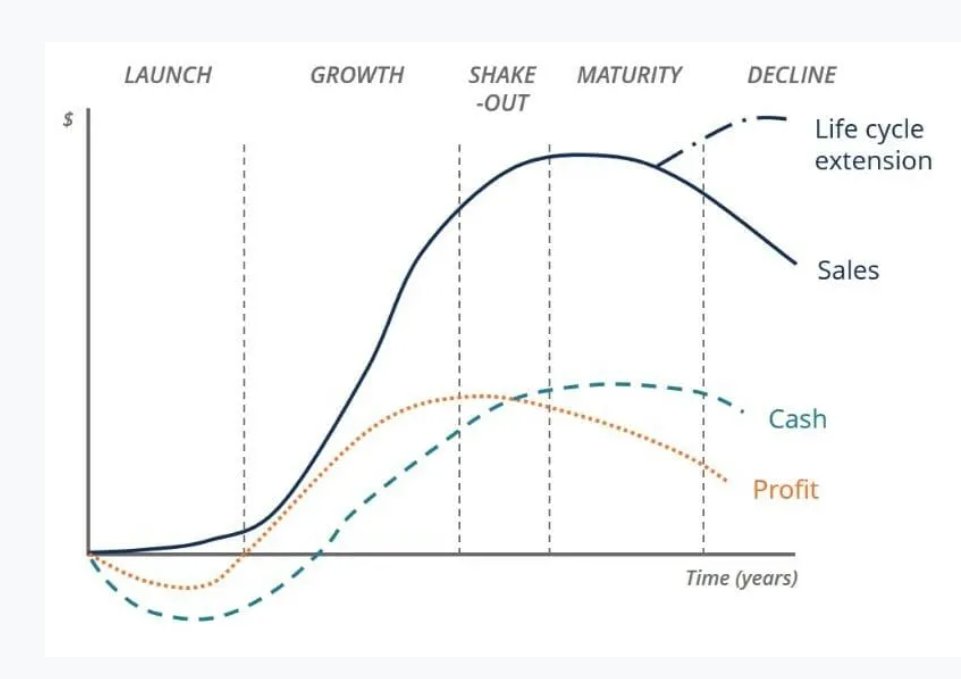

As I say this is not rocket science. Basically I am only looking to buy and then sell in the early growth stage of a new business. In simple terms I'm looking to buy as early in the growth stage as possible & sell as late as possible before sales and profit slow.

So how do I find these stocks? The best place to start is to read all 4C reports as they come out & keep records of new companies where revenues increase significantly from the previous quarter. You need to be careful at this point because companies earnings can be seasonal..

I tend to avoid companies who claim seasonality is hitting their revenues. I take this path as I believe if a company's product is really being embraced by consumers in the early months the exponential growth should swamp any seasonal effects. As the company matures...

this may well be a valid reason but keep in mind I am ONLY looking for the early stage growth... So why do I invest in this manner? Firstly because I found that I am good at understanding new products and markets but mostly I choose to invest...

only in the early growth stage because this is where the big increases in price comes in the shortest period of time. My research shows it is also a pattern that is repeated time and again by new companies under all market conditions. Of course just because the pattern repeats..

doesn't mean that investing in the manner i do doesn't have its risks. The main problem with being an early growth stage investor is MANAGEMENT! Once a company starts growing at a rapid rate it really depends on the quality of the management if they can control..

the runaway train. Overwhelming demand has caused many companies 2 fail when they are unable to ramp up to meet demand or product quality declines to the ruin of the company's reputation. Also with rapid success comes the temptation of greed and delusions of grandeur..

within the management team, along with infighting and blame games when growth targets are not met. These pressures can also result in management misleading the market into believing that targets have been met, hoping they will be made up in the next quarter.

I could go on but I am sure you will recognize these problems in many small ASX companies. So while the rewards are high so are the risks. So high that most of the companies I invest in at the early growth stage will fail to live up to their potential ..

From my records early growth lasts from 12-18 months after that time I will have mostly sold & moved onto a new growth story. Occasionally you will come across a great company such as afterpay which captures a worldwide market & continues to grow at high rates & the ride lasts...

longer but these companies are rare. As such it is important that I need to be on top of everything happening within the company along with its chosen market so I recognise any problems before the market does and I am able to exit before other holders do..

Occasionally I am blindsided by bad news and as such I factor in a percentage of my holdings going to zero. While this is a rare event it does happen. This is why I need to ensure I capture the upside when everything goes right and the share price movement is on my side. The End

Read on Twitter

Read on Twitter