ALL ABOUT RECTANGLE PATTERN & HOW TO TRADE IT !

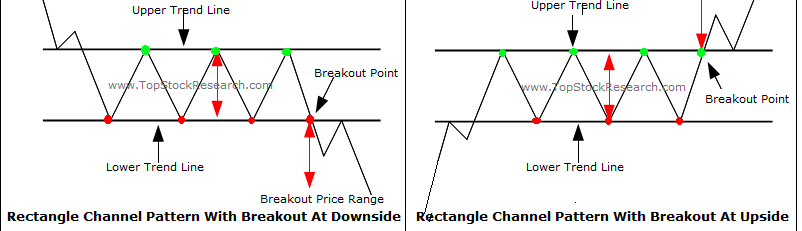

- Rectangle pattern consists of two horizontal line. One line acts as a support and other horizontal lines act as the resistance.

- Rectangle pattern forms when there is a range bound price movement between two horizontal lines.

- Rectangle pattern consists of two horizontal line. One line acts as a support and other horizontal lines act as the resistance.

- Rectangle pattern forms when there is a range bound price movement between two horizontal lines.

- Rectangle pattern is a two way pattern it can be used to take a bullish trade as well as bearish trade.

- While taking trade on the basis of rectangle pattern formed on the daily chart as well as weekly chart. Trader should always check the trend prior to the formation of rectangle on the same time frame.

- Prior trend should be an upward trend. If you are going to trade upper horizontal line breakout. It increases the success probability of the trade EXAMPLE

- Prior trend should be an downward trend. If you are going to trade lower horizontal line breakout. It increases the success probability of the trade. EXAMPLE

- Mistakes, generally we people do we take bullish trade on the basis of rectangle pattern while the prior trend is a downtrend. I generally found the success probability of that trade is low.

- I have tried to explain it in a very simple way.

- I have tried to explain it in a very simple way.

Read on Twitter

Read on Twitter