Today, I want to touch on a subject that I have been wanting to write about for a long time but could not find the time.

As far as I have observed, central exchanges cause their users who trade futures or margins to become liquid, deliberately or by not taking any precautions.

As far as I have observed, central exchanges cause their users who trade futures or margins to become liquid, deliberately or by not taking any precautions.

Since futures and margin trading are a game played against the exchanges, the Exchange wins if users lose.

So, at such a point, why would exchanges want users not to lose?

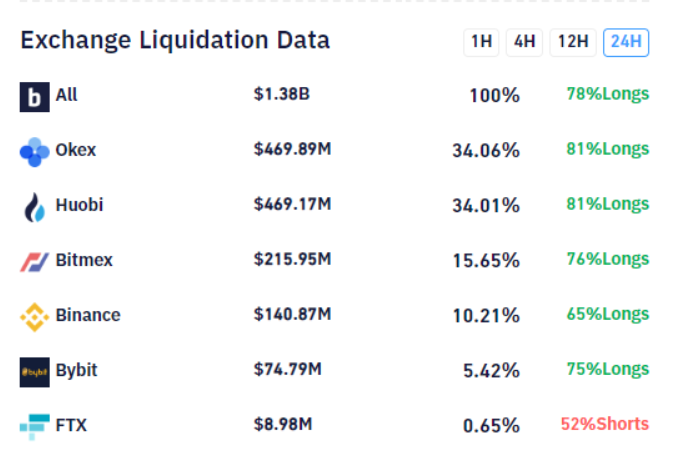

It happens very often in the examples you see below.

So, at such a point, why would exchanges want users not to lose?

It happens very often in the examples you see below.

Again, in the chart you see below, you can see there is a lower wick on Binance's Bitcoin price. Many users are losing millions of dollars because of the lower or upper wicks in this way.

Exchanges list futures and margin trades for almost every popular project, causing users to lose money continually. They are acting this way also harms the crypto ecosystem. Because of greedy businesses, many users are losing all their money and leaving the ecosystem for good.

So how can we prevent this? Of course, by changing the exchange, we use.

#Powetrade, $PTF explained in the article they wrote a while ago how to protect liquidated users unfairly

#Powetrade, $PTF explained in the article they wrote a while ago how to protect liquidated users unfairly

Basically: "They are implementing trading bands based on the index price, Orders can't trade outside of that band compared to the rest of the market. Eg, if some tries to move the price %30 on their exchange or nowhere else- it won't be possible"

Read on Twitter

Read on Twitter