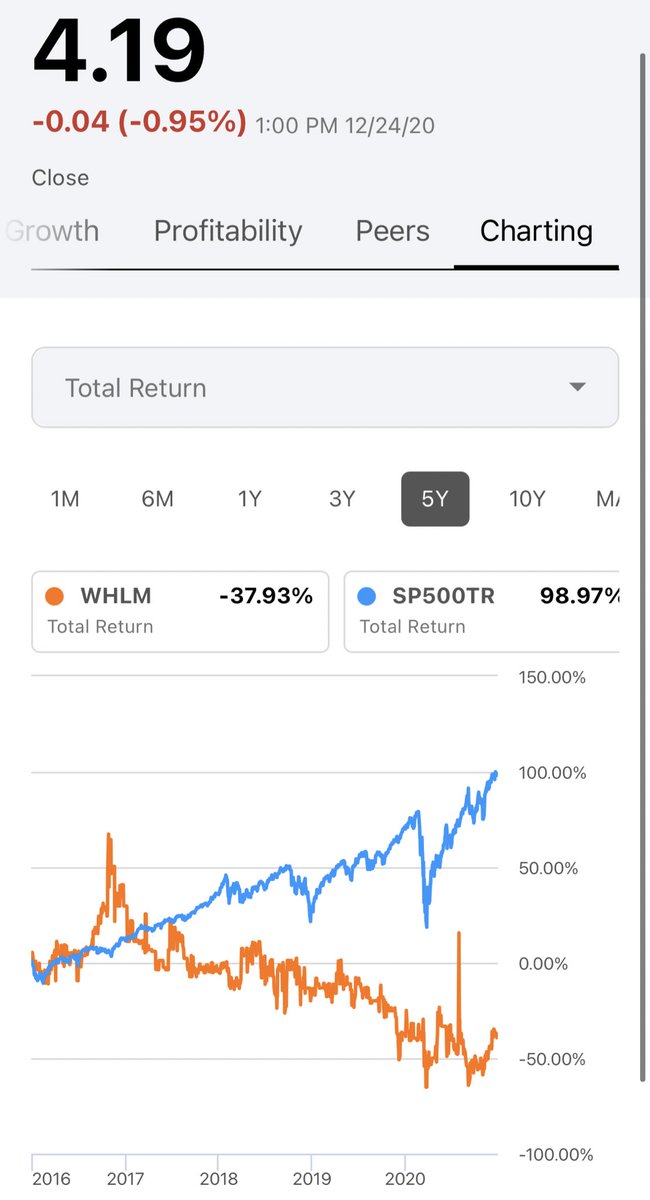

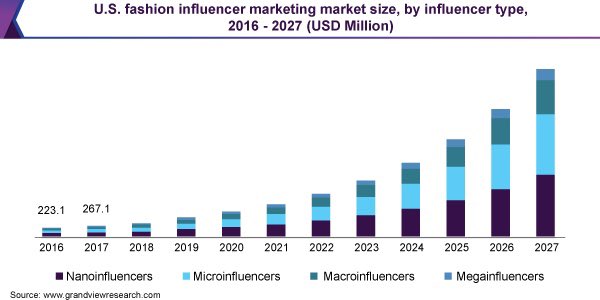

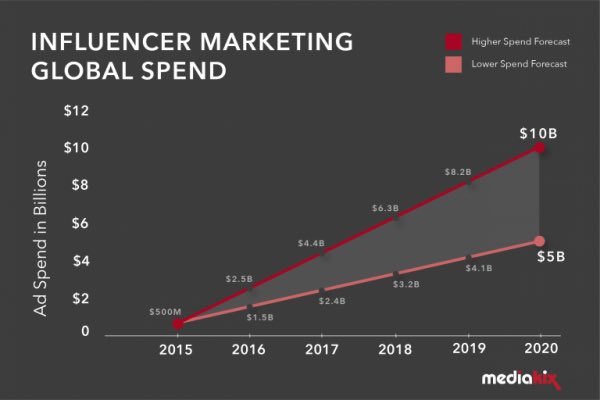

1/ Wilhelmina $WHLM is a perfect example of a microcap that is being inefficiently valued by the market. It is too small for the public markets and should aggressively expand into influencer marketing or engage in a sale/merger process in order to maximize value for shareholders.

2/ Buying $WHLM equity in the ~$4.00 range represents attractive risk/reward as you are creating the company at a discount to normalized, post COVID-19 value, have downside protection of liquid assets/brand equity and the optionality of a catalyst such as a sale or merger.

3/ Founded in 1967 by Dutch supermodel Wilhelmina Cooper, the company evolved into a well-known global industry leader. After being privately owned for ~40 years, $WHLM reverse merged into a public shell controlled by current Chairman & Major Shareholder Mark Schwarz in 2009.

4/ In recent years, revenue has remained stagnant w/ 27% gross margins (rev-model costs) & ~$2mm in Adj. EBITDA. $WHLM is the only publicly traded agency, but even taking a meaningful discount to Endeavor’s planned IPO EV/Revenue of 3.0x implies significant upside in the equity.

5/ Risks: No focus/complacency with trophy asset from Majority owner, management turnover, elongated post COVID-19 recovery in advertising, illiquid stock, competitive threat from startups that are more well versed in the social media influencer space (see @viralnationinc)

6/ the “Wilhelmina” brand is highly valuable and sought after. For example, Ralph Bartel, founder of @Travelzoo has built an ~18% stake. I believe the brand hasn’t been utilized nearly enough (especially in the social influencer marketing space)...

Link: https://pagesix.com/2018/05/09/big-shot-shareholders-going-after-wilhelmina-models/

Link: https://pagesix.com/2018/05/09/big-shot-shareholders-going-after-wilhelmina-models/

Read on Twitter

Read on Twitter