1/ Back from the holiday break and that alts call from last week was (at least) a week too early. Gonna be more methodical about it this time around. This morning I formulated a couple conditions for weekly closes that I wanted to see on ETH/BTC, ETH.D, LTC/BTC, XMR/BTC and BTC.D

2/ ETH/BTC hit a level of historical importance which is the December 2017 alts capitulation low during the BTC ATH. I bounced hard and I was watching for a weekly swing failure pattern to form. The bounce was strong and it closed above a significant level but failed the sfp.

3/ If that level on ETH/BTC holds it would turn the whole price action below 0.023 into a giant bear trap which would of course hold very bullish implications going forward. A bit too early to tell if that's going to be the case.

4/ I was watching out for an SFP on ETH.D too although applying such a price action concept to a dominance chart might be a bit of a stretch. ETH.D, however, did close back in the range it held firmly since July which I interpret as a an indication of strength.

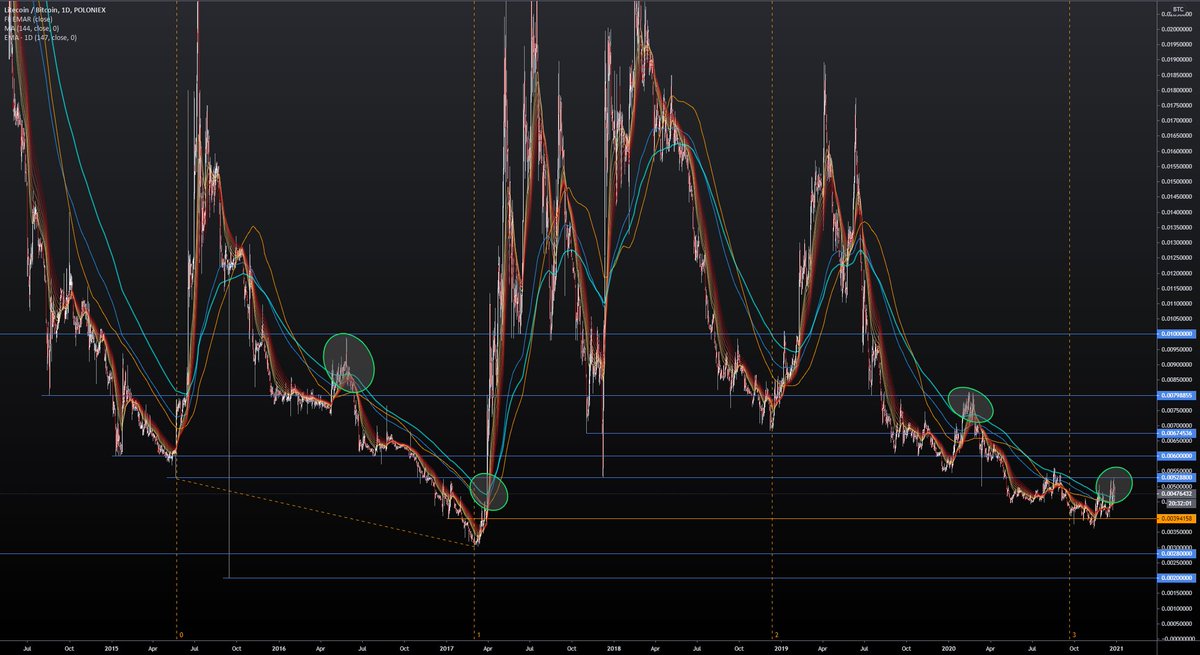

5/ What made me think alts were getting ready last week was the LTC/BTC chart which has been showing signs of a potential reversal for a while now. here on the htf the consolidation above the 200EMA caught my attention. Note the 2016/17 similarities with the two pokes.

6/ The volume coming in here on LTC keeps increasing and it is trying to flip the May low as support. If that holds we have a good chance of putting in the start of an uptrend.

7/ Now some elements that do not speak in favor of alts being quite ready yet. One of the alts that started perform against BTC in Dec again was XMR. It had a strong year and this morning I was rooting for it to print an SFP when it broke it's accumulation range. It failed.

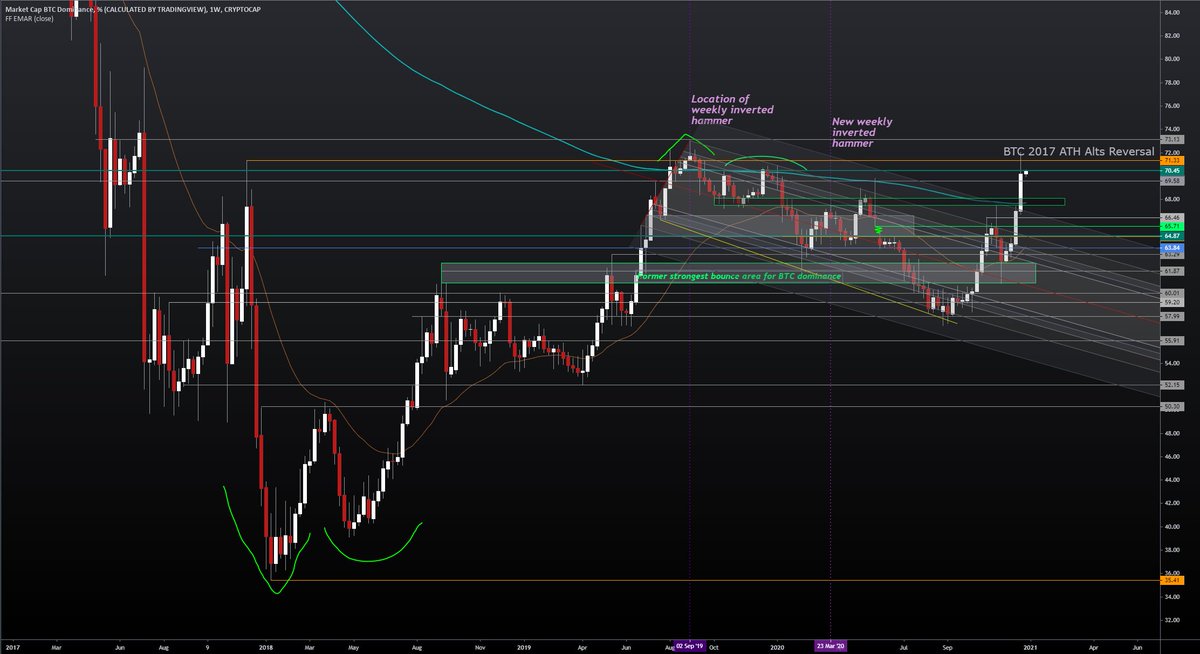

8/ Similar to ETH/BTC, BTC Dominance also touched its 2017 BTC all time high/alts reversal level today. The weekly candle shows a nice long wick but in of itself doesn't look outright bearish. The daily looks a bit more promising but the tops since 2019 all required a 2nd poke:

9/ It's likely that a steeper BTC dump is required to kickstart a rally but if it happens I wouldn't get too scared. It's easy to forget that a lot of alts are in very bullish trends against USD themselves. Not as bullish as BTC but still healthy. Some are ready to play catch up

Read on Twitter

Read on Twitter