more thoughts on z $HEGIC outlook and price

again, I'm not a trader, but why is numba down 60% in a month?

because progress isn't linear:

again, I'm not a trader, but why is numba down 60% in a month?

because progress isn't linear:

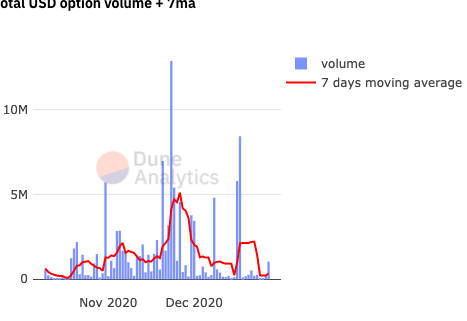

After $1m vol today, 7dma = $334k, down from $5.1m 7dma in late November when token was 2.5x higher. In late November, $HEGIC was selling 70-85 calls/day and 25-45 puts. Today was 29 calls and 8 puts.

So there are less options getting sold now and the avg option size is smaller

So there are less options getting sold now and the avg option size is smaller

IDK why. $$ volume is a whales' game and z whales are buying less whale $HEGIC options this week than they were last month. HEGIC IV prices aren't significantly more expensive and there isn't a superior DEX alternative. Deribit KYC and geographic restrictions haven't changed.

There's also less WBTC and ETH staked in HEGIC, with 2.25k eth and 15 wbtc withdrawn today. 436 wbtc got withdrawn on 12/19, >20% of the pool.

Two possible reactions:

a) GROWTH IS DEAD FOREVERZ THIS IS XRPBSVIOTA VOM PUKE VOM RUG DUMP!

That's basically what the market says.

Two possible reactions:

a) GROWTH IS DEAD FOREVERZ THIS IS XRPBSVIOTA VOM PUKE VOM RUG DUMP!

That's basically what the market says.

b) product is 10 weeks old, actually works, already distributed $1m fees, still #1 contender to win absolutely gigantic inevitable market, interesting integrations like $ZLOT and $WHITE, trustworthy devs, growing brand, TVL=$41m btc+$42m eth+$14m hegic, 52% APY to staked tokens,

26% APY in 6 months (7/21) if assume no growth+all 117.8m outstanding rhegic become staked hegic. All sounds pretty great! But volume chart still ugly.

Crypto market wants: MF S-CURVE IN MOTION BABY STRAIGHT UP AND 2 DA RIIGHT!

But that's not how life, growth, evolution work.

Crypto market wants: MF S-CURVE IN MOTION BABY STRAIGHT UP AND 2 DA RIIGHT!

But that's not how life, growth, evolution work.

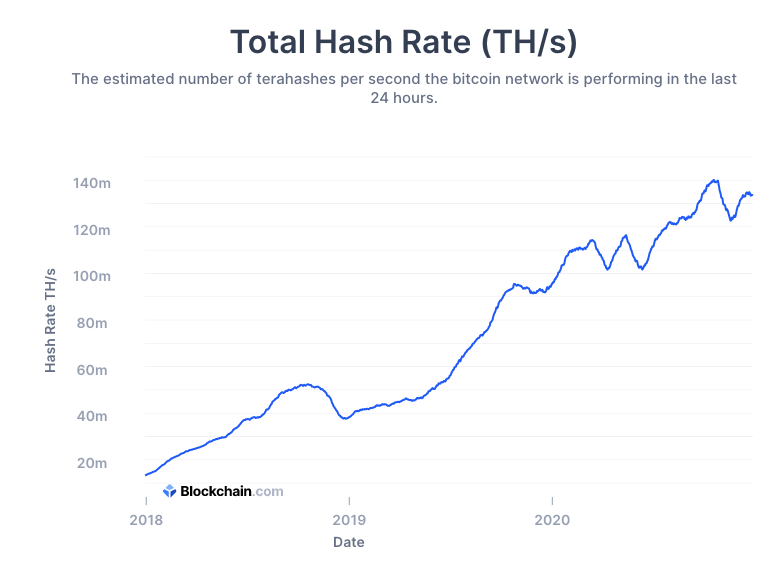

Big brain investors didn't sell btc when its TH/s went down.

So, ask not, "Are $HEGIC [or pick any emerging smallcap token] fees/volume/price up today and this week?"

but, "Is this more, less, or equally likely to become the huge winner in its huge category in 1-2 years?"

So, ask not, "Are $HEGIC [or pick any emerging smallcap token] fees/volume/price up today and this week?"

but, "Is this more, less, or equally likely to become the huge winner in its huge category in 1-2 years?"

Next week's $HEGIC volume is totally unpredictable unless you're a whale buying and not buying z options.

Next December's #1 options DEX isn't totally predictable either, but it's a lot more predictable for most of us than next week's volume. Focus on big questions for 10-100x.

Next December's #1 options DEX isn't totally predictable either, but it's a lot more predictable for most of us than next week's volume. Focus on big questions for 10-100x.

(I also have a theory that any token paying out >100% APY in kind on deposits of different tokens (like $HEGIC on WBTC/ETH staking or $SUSHI for Onsen) for extended duration will temporarily trade lower than it otherwise should due to many investors buying the staking/yield/pool

tokens instead of the currency token (HEGIC or SUSHI). Patients investors shouldn't worry about this because when the yields eventually fall (as LP deposits via Gresham's Law flow from shitcoin ponzis to higher quality payouts) currency tokens will reprice upwards hard and fast.)

Second addendum: My $HEGIC LP yield in HEGIC/day is +60% over last few weeks. It's great. Idgaf if you unstake more wbtc to play more 100x xrp futures, anon. I thank you.

Read on Twitter

Read on Twitter