A quick thread on Ethereum for anybody that's new here.

ETH is currently nowhere near the ATH, and is still down 81.6% from the weekly ETH/BTC ATH. Additionally, the ETH/BTC price has never closed above the 200 week EMA, and is currently crashing below the 50 & 100 EMA's.

ETH is currently nowhere near the ATH, and is still down 81.6% from the weekly ETH/BTC ATH. Additionally, the ETH/BTC price has never closed above the 200 week EMA, and is currently crashing below the 50 & 100 EMA's.

In contrast, BTC/USD has never fallen below the 200 week EMA, and is currently 134.1% of its previous ATH from 2017.

Furthermore, ETH is not sound money. It doesn't have a supply cap and the existing supply can't be properly audited. It's an unproven experiment built on promises that it will invent a sustainable architecture in the future and that use cases will emerge. https://twitter.com/VitalikButerin/status/1329297577439760384?s=20

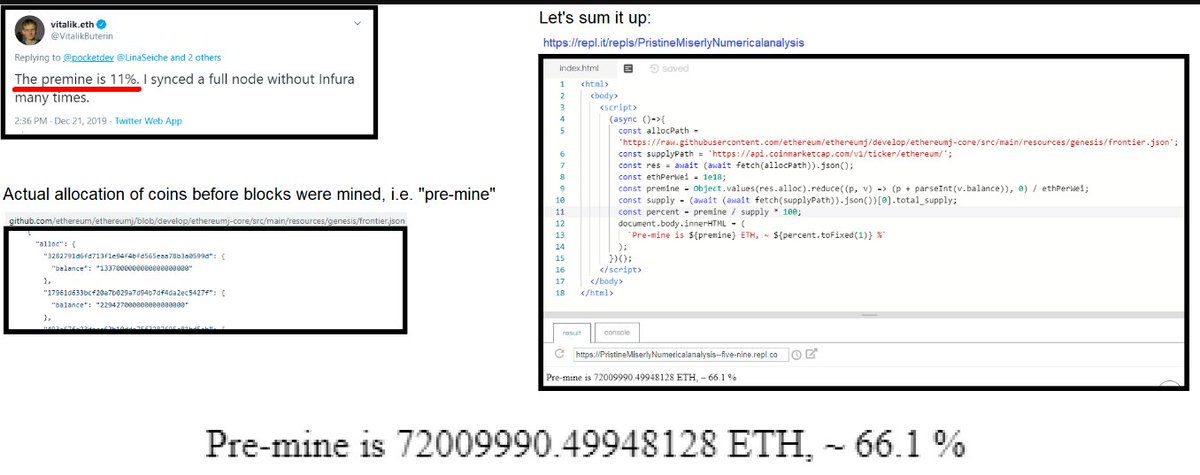

In fact, when Ethereum was initially created, the vast majority of the supply was issued out of thin air as a pre-mine to enrich its founders. This is not a fair distribution, and is fundamentally opposed to the proof of work issuance used by Bitcoin. https://medium.com/@nic__carter/in-support-of-the-proof-of-work-un-fair-launch-cd6e8f06358f

Currently Ethereum is transitioning to ETH 2.0 which abandons proof-of-work altogether, and implements proof-of-stake as its new consensus mechanism. This is a reckless shift in network governance which removes the settlement/immutability assurances of POW https://medium.com/@tuurdemeester/critique-of-buterins-a-proof-of-stake-design-philosophy-49fc9ebb36c6

Speaking of reckless, Ethereum has a history of moving fast and breaking things. This is simply not acceptable on the base layer of a network that should be designed to store, transport, and compute value with maximum assurance. This was the reaction to their accidental hard fork

There remain numerous criticisms of Ethereum's architecture. Simply put, if it's not trivially easy for non-technical users to run their own full node, the network cannot achieve sufficient decentralization to achieve trust-minimized consensus. https://hugonguyen.medium.com/why-ethereum-architecture-is-flawed-d4eefd15db3e

Due to its size and complexity, most users are unable to run their own Ethereum full node and therefore can't validate the rules for themselves. This deteriorates the main value proposition of decentralized consensus due to a lack of social scalability. http://unenumerated.blogspot.com/2017/02/money-blockchains-and-social-scalability.html

In summary, Ethereum is antithetical to the trust-minimized values offered by Bitcoin. It isn't sound money and isn't scalable in its current form. While it's possible that use cases will emerge in the future, the technology isn't practical today and is simply speculative.

For further reading, here is another thread explaining why durability is critical for collectibles to become a robust long-term store of value, how Bitcoin achieves this, and why Bitcoin is technically superior to its "competitors". https://twitter.com/Stein___/status/1283878935957307394?s=20

Read on Twitter

Read on Twitter