My criticism of the ideal of universal $2,000 checks as COVID response has lit up the Twitter sphere.

I thought it important to clarify my argument, here: https://www.bloomberg.com/opinion/articles/2020-12-27/larry-summers-trump-pelosi-2-000-stimulus-checks-are-a-mistake via @bopinion

I thought it important to clarify my argument, here: https://www.bloomberg.com/opinion/articles/2020-12-27/larry-summers-trump-pelosi-2-000-stimulus-checks-are-a-mistake via @bopinion

To be clear, I am NOT opposing stimulus or favoring austerity. I have long argued that we are in an era of secular stag and need fiscal expansion

Recently I wrote with @jasonfurman in favor of aggressive fiscal policy in low-rate env, esp in emergencies

https://www.brookings.edu/wp-content/uploads/2020/11/furman-summers-fiscal-reconsideration-discussion-draft.pdf

Recently I wrote with @jasonfurman in favor of aggressive fiscal policy in low-rate env, esp in emergencies

https://www.brookings.edu/wp-content/uploads/2020/11/furman-summers-fiscal-reconsideration-discussion-draft.pdf

The question is whether spending $600B on a tax credit that reaches more than 85% of taxpayers makes good economic sense.

I believe it does not.

Data striking: employee compensation now only above $30B/mnth behind pre-COVID baseline. Relief bill will replace it 7x over.

I believe it does not.

Data striking: employee compensation now only above $30B/mnth behind pre-COVID baseline. Relief bill will replace it 7x over.

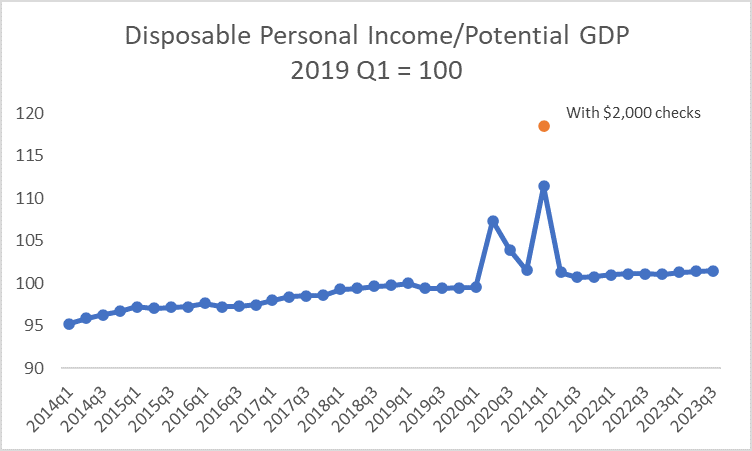

This figure shows that the $2,000 tax credit would take household income relative to the economy’s potential size into territory never seen before with an economy anywhere near normal.

To those who say $2,000 checks not optimal, but better than nothing: what is limiting principle? How about $10,000 checks? More?

Hard to justify support for near-universal giveaways when income losses fully replaced, w/ no liquidity problem for most. https://www.jpmorganchase.com/institute/research/household-income-spending/household-cash-balances-during-covid-19-a-distributional-perspective

Hard to justify support for near-universal giveaways when income losses fully replaced, w/ no liquidity problem for most. https://www.jpmorganchase.com/institute/research/household-income-spending/household-cash-balances-during-covid-19-a-distributional-perspective

Dems seizing this opportunity to pit Trump and McConnell against each other is fair and good politics. But if implemented, is bad economics.

@realDonaldTrump must immediately sign stimulus that took months to negotiate to avoid cutting off UI and pushing millions into poverty.

@realDonaldTrump must immediately sign stimulus that took months to negotiate to avoid cutting off UI and pushing millions into poverty.

Read on Twitter

Read on Twitter