As this came out, @CliffordAsness published https://www.aqr.com/Insights/Perspectives/A-Gut-Punch as typical, a more in depth piece on one aspect of mine, namely the pain and thus existence of a risk premium within factors. I approach the unique period of November bottom up, though, and focus on Momentum https://twitter.com/alphaarchitect/status/1341827317535035393

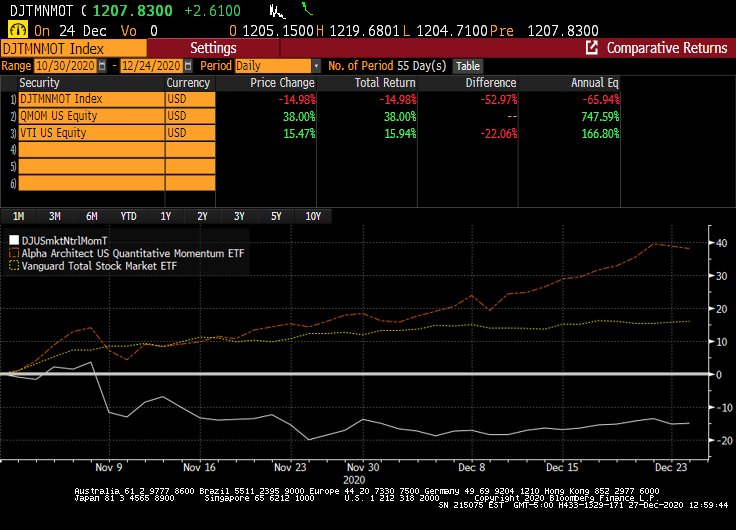

My point, which @choffstein made back in 2018 https://blog.thinknewfound.com/2018/05/separating-ingredients-and-recipe-in-factor-investing/, is that much of this stems from the returns differences within Momentum based on (serendipitous?) structure and timing. Just how unique is seen in $QMOM vs DJ's $ Neutral MOM Factor. ht @GestaltU

Much of the separation came on one day, November 9th, the day of Moderna and Pfizer's vaccine results. Those funds like $ARKK with "Innovation" stocks as well as oil and financial stocks both soared. Momentum funds usually can capture this, but not all did.

Read on Twitter

Read on Twitter