SPAC IS THE NEW BLACK: SPACs (Special Purpose Acquisition Companies) are all the rage these days. In this thread, I want to say a few things about SPACs that I learned in my research of the market. 1/15

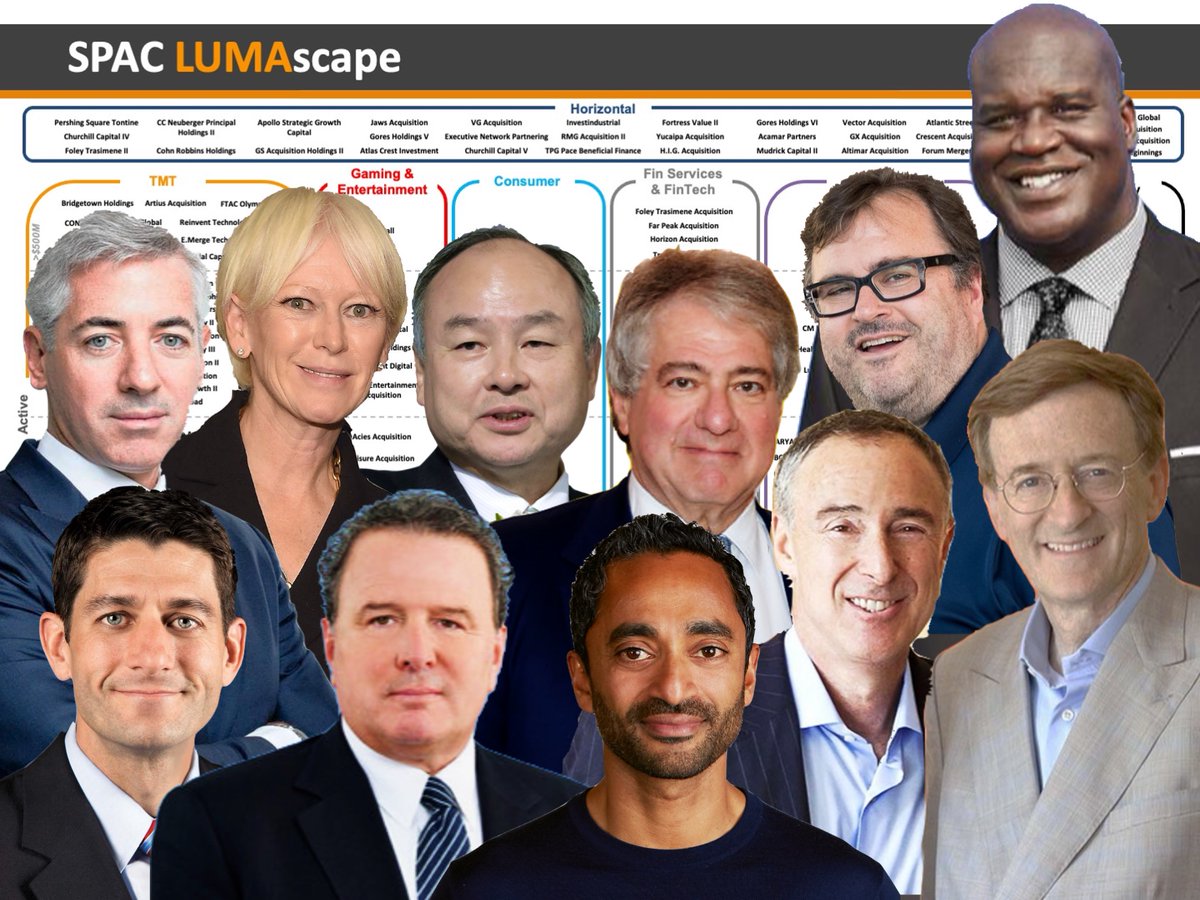

What was once an esoteric (and somewhat tawdry) financing vehicle has now come into the main in terms of quantity ($83 billion in IPOs in 2020) and quality (A-player names pursuing SPACs from name brand PE and VC funds to leading investors and advisors and even celebrities.) 2/15

Early and serial SPAC sponsors like Harry Sloan and Jeff Sagansky (Flying Eagle), Michael Klein (Churchill) and Chamath Palihapitiya (Hedosophia) have helped propel the SPAC phenomenon to new heights, not to mention tech gurus, former politicians and even famous athletes. 3/15

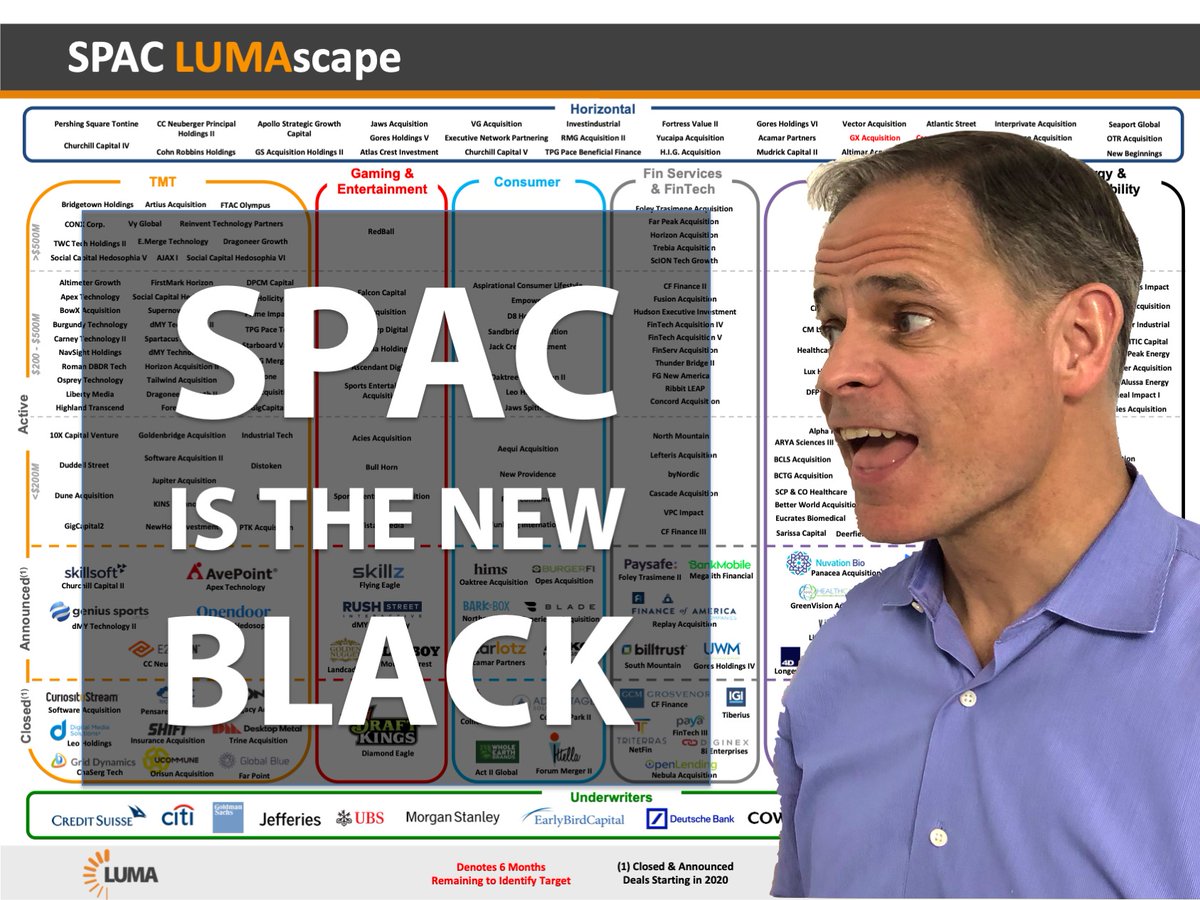

LUMA has created a SPAC LUMAscape that maps over 250 SPACs by stage across 8 verticals. This is the evergreen post that we will endeavor to keep updated (and welcome your feedback): https://lumapartners.com/content/lumascapes/spac-lumascape/ 4/15

A SPAC is a blank check company where investors back a sponsor group to find a suitable target to merge with (the de-SPACing) which is often accompanied by a PIPE (private investment into public equity) to further finance the target company. 5/15

The attractiveness of SPACs is clear: For the target, it is a vehicle for an accelerated IPO. For the SPAC sponsor, they receive 20% of the equity in the SPAC. Note that equity is a zero sum game so the 20% sponsor promote dilutes the target company shareholders. 6/15

This is why SPACs “lever up” their combinations so that the sponsor promote dilution is minimized. For example, a $200 million SPAC may merge with a $800 million target (the SPAC would own 25%) so that the sponsor promote dilution would be reduced to 5% (20% x 25%). 7/15

Sponsors “earn” their promote by funding listing expenses (UW fees and legal), completing the IPO and having the knowledge and connections necessary to find a suitable target (within 18-24 months). They also invest their own money in the SPAC to have “skin in the game”. 8/15

REMEMBER: SPACs are only suitable as an IPO hack for public-ready companies. SPACs are NOT appropriate for companies that otherwise should not be publicly listed (sub scale, volatile revenues, customer concentration, unsustainable margins, etc.). 9/15

SPAC investors have their units held in trust until the target is identified and then vote on the merger. If approved, their units are swapped for equity in the target. If they redeem, the SPAC will likely have to fill the financing shortfall with an additional PIPE. 10/15

Most SPAC investors are sophisticated and specialized institutions that "play" each SPAC to maximize their returns from listing to the merger. They are not necessarily long term investors. This is what makes the vote / redemption / PIPE process tricky and hard to predict. 11/15

The 2020 class of SPACs has over $65 billion of cash chasing $250+ billion of targets which suggests we may be headed for a market imbalance (Demand > Supply). It is likely that such scale will help commoditize the SPAC market which will reduce the upside for many sponsors. 12/15

REMEMBER: SPACs don’t compete for targets on price (since the deal will not be approved if the valuation is too high). Rather, they compete based on the amount of sponsor promote they are willing to share with the target. Also, the sponsor value-add is a key differentiator. 13/15

Sponsors who can truly add value with proprietary deal flow and strategic advice will be able to differentiate and preserve their promote. This is similar to how brands differentiate and sell for a premium over generic (money in this case). SPAC sponsors should market more! 14/15

Read on Twitter

Read on Twitter