You're about to invest in the next biggest company to list on the stock exchange. You dream of a luxury island & a private jet - but you end up eating canned food instead.

Here's a guide to the insider secrets of IPOs [Thread]

Here's a guide to the insider secrets of IPOs [Thread]

Hold on, what is an IPO? Indian Police Officer?

No, it's an Initial Public Offering

It's when a private company issues stock to the public to raise capital. Facebook, Airbnb & Apple are IPO companies

It's not just US companies. I worked on IPOs in London, Johannesburg & Lagos

No, it's an Initial Public Offering

It's when a private company issues stock to the public to raise capital. Facebook, Airbnb & Apple are IPO companies

It's not just US companies. I worked on IPOs in London, Johannesburg & Lagos

"The Roadshow/ Marketing"

The IPO process can be long!

The company hires a few investment banks to go out & sell the story to investors. Think of it as a series of dates. Do you tell her you leave towels on the floor on the first date? No.

Investment banks sell the highlights

The IPO process can be long!

The company hires a few investment banks to go out & sell the story to investors. Think of it as a series of dates. Do you tell her you leave towels on the floor on the first date? No.

Investment banks sell the highlights

Pro-tip: NEVER invest into a company purely off the company roadshow materials. Having spent hours curating these docs - the wording is ALWAYS massaged.

Your go-to is the prospectus - the Bible for an IPO

Here's the Airbnb prospectus - check it out

https://www.sec.gov/Archives/edgar/data/1559720/000119312520294801/d81668ds1.htm

Your go-to is the prospectus - the Bible for an IPO

Here's the Airbnb prospectus - check it out

https://www.sec.gov/Archives/edgar/data/1559720/000119312520294801/d81668ds1.htm

What should I be looking for in the prospectus?

Just like your cheating ex - don't focus on what he's saying, focus on what isn't being said.

- Forecasts: always take these with a pinch of salt

- Key risks: dry but important

- Why we need the money: MOST IMPORTANT!

Just like your cheating ex - don't focus on what he's saying, focus on what isn't being said.

- Forecasts: always take these with a pinch of salt

- Key risks: dry but important

- Why we need the money: MOST IMPORTANT!

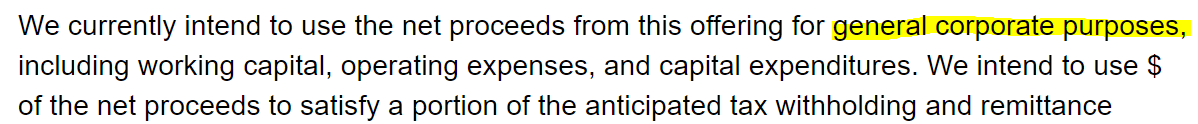

Whenever you see "use of proceeds will be used for general corporate purposes" just know someone is getting paid racks.

If there's a pipeline of acquisitions or a perfectly crafted growth plan - great! If the uses of capital are for day to day activities - it's worth pausing.

If there's a pipeline of acquisitions or a perfectly crafted growth plan - great! If the uses of capital are for day to day activities - it's worth pausing.

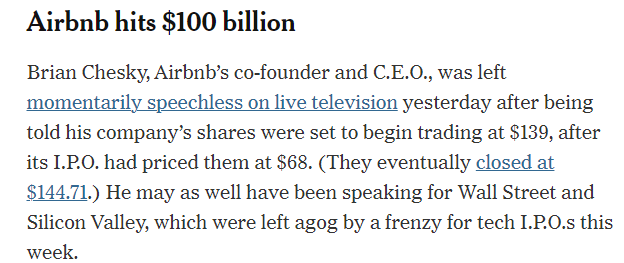

Let's take a look at the Airbnb IPO. UP OVER 100% ON IPO DAY!!

That's amazing! Surely everyone should be celebrating. This is what success looks like right? Management must be popping champagne.

No - this is a complete fuck up... read on

That's amazing! Surely everyone should be celebrating. This is what success looks like right? Management must be popping champagne.

No - this is a complete fuck up... read on

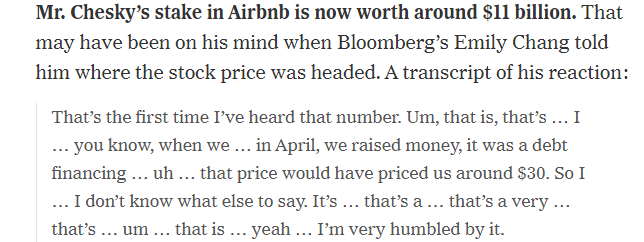

Whenever company prices rocket up on IPO it's called a "first day pop". Less flattering term is "money left on the table".

You hire me to sell your house. I sell it for $1m.

The same day the new buyer RE-SELLS your house to someone else for $2m.

You should be pissed off.

You hire me to sell your house. I sell it for $1m.

The same day the new buyer RE-SELLS your house to someone else for $2m.

You should be pissed off.

Why didn't you get $2m in the first place?!

(Besides investment banks getting it wrong...)

1. IPOs are generally underpriced to fill up the order book

2. Retail investors have fuelled the IPO pop

3. Companies price lower to avoid a failure

4. The market right now is HOT

(Besides investment banks getting it wrong...)

1. IPOs are generally underpriced to fill up the order book

2. Retail investors have fuelled the IPO pop

3. Companies price lower to avoid a failure

4. The market right now is HOT

1. IPOs are underpriced

Investment banks are also underwriters. This means if they don't sell their blocks of stock they have to pick it up themselves.

Wait, isn't that an incentive to underprice... sadly, yes

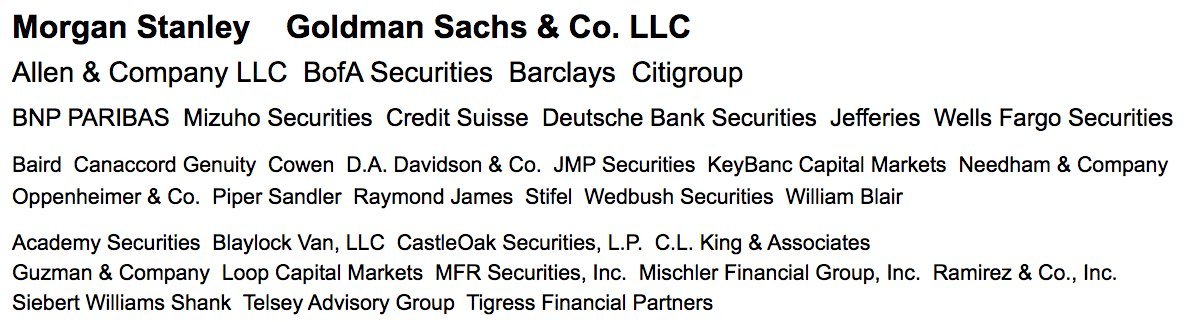

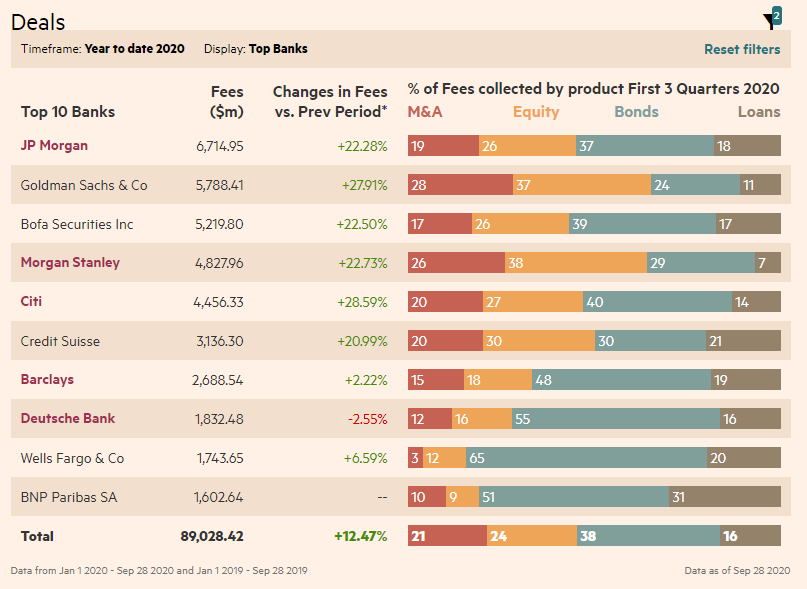

Here's all the banks on the Airbnb IPO - literally everyone

Investment banks are also underwriters. This means if they don't sell their blocks of stock they have to pick it up themselves.

Wait, isn't that an incentive to underprice... sadly, yes

Here's all the banks on the Airbnb IPO - literally everyone

2. Retail investors are driving demand

Managing the order book is tricky. You need to balance liquidity/ trading volume with price tension. Short term investors create price action at the expense of volatility.

Recently, retail investors are far more active & drive up demand.

Managing the order book is tricky. You need to balance liquidity/ trading volume with price tension. Short term investors create price action at the expense of volatility.

Recently, retail investors are far more active & drive up demand.

3. Companies don't want to fail

"Under promise/ over deliver"

Failed IPOs can happen for a number of reasons but most of all it's a fucked up signal to the market.

Many times it's not the companies fault, it's terrible timing resulting in valuation expectations not being met.

"Under promise/ over deliver"

Failed IPOs can happen for a number of reasons but most of all it's a fucked up signal to the market.

Many times it's not the companies fault, it's terrible timing resulting in valuation expectations not being met.

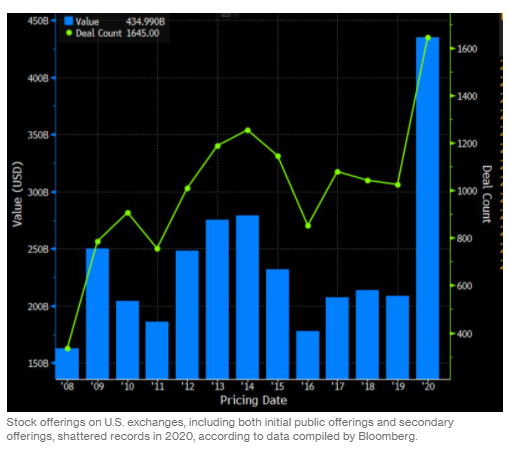

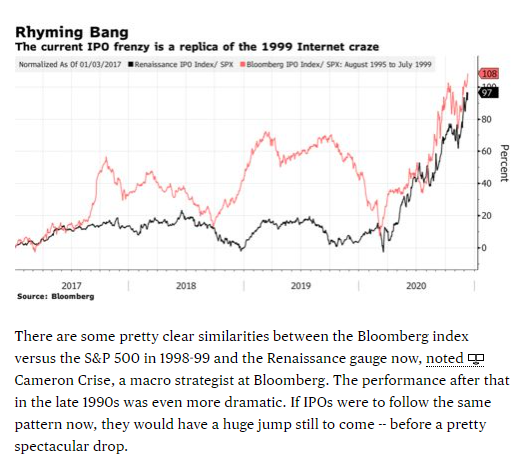

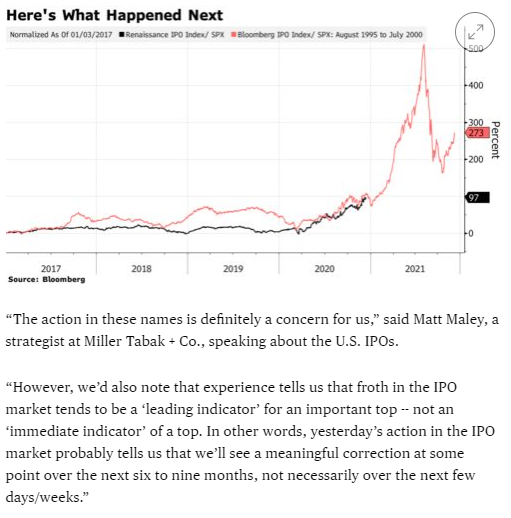

4. The IPO market is HOT

In a market fueled through Fed stimulus, stock splits and a deep disconnect of forward valuation multiples to the real economy - the market for equity issuances is attractive (albeit risky)

In short: stocks are fucking expensive right now

In a market fueled through Fed stimulus, stock splits and a deep disconnect of forward valuation multiples to the real economy - the market for equity issuances is attractive (albeit risky)

In short: stocks are fucking expensive right now

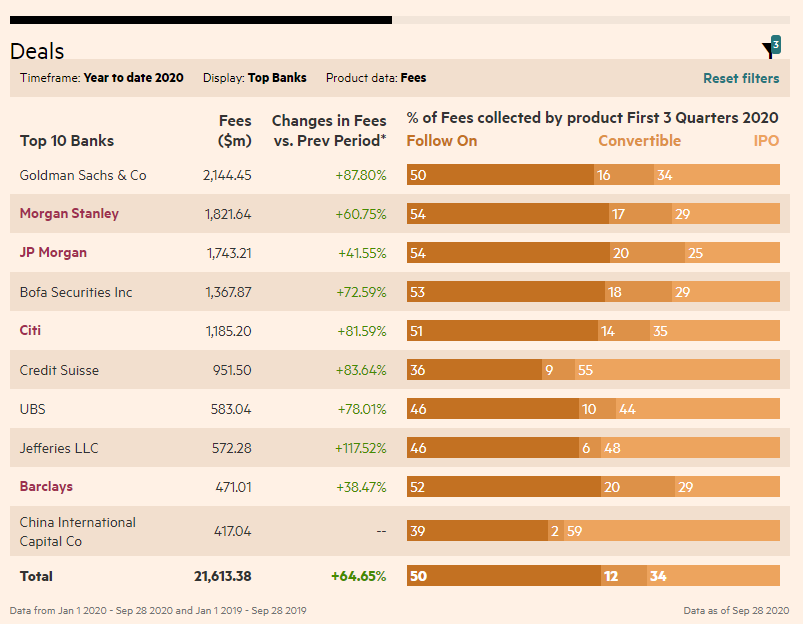

How much money do investment banks make from capital raising?

Nothing major - a few billion $

Underwriting fees in Hong Kong are as low as 2.5% on the size of the IPO but I have seen clients pay more than 4% on IPOs

There's A LOT of money out there but it is VERY competitive

Nothing major - a few billion $

Underwriting fees in Hong Kong are as low as 2.5% on the size of the IPO but I have seen clients pay more than 4% on IPOs

There's A LOT of money out there but it is VERY competitive

I'm still reading this thread... I want to be an investment banker listing companies and running IPOs!

Sure it's exciting to switch on Bloomberg & see your company trading or read about your IPO on the front page of the financial times BUT most of the IPO process is VERY dry...

Sure it's exciting to switch on Bloomberg & see your company trading or read about your IPO on the front page of the financial times BUT most of the IPO process is VERY dry...

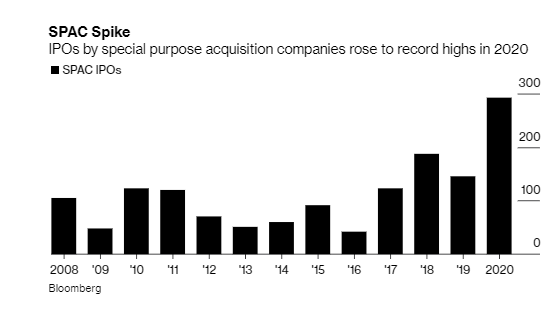

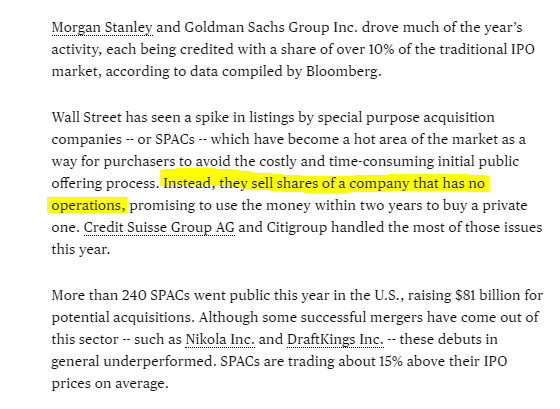

It's clear the IPO process is broken, how do we fix it?

Enter the wave of direct listings, hybrid listings & SPACs

A SPAC is basically an empty vehicle that lists on the exchange which promises to fill up passengers (companies) within a short space of time

Massive business!

Enter the wave of direct listings, hybrid listings & SPACs

A SPAC is basically an empty vehicle that lists on the exchange which promises to fill up passengers (companies) within a short space of time

Massive business!

Should I invest in companies that aren't making money?

Sure - but be VERY selective

Cash burn rates are very important especially when it ends up in higher leverage (debt) or more equity issuances

Traditional "value" investing has underperformed growth during this bull market

Sure - but be VERY selective

Cash burn rates are very important especially when it ends up in higher leverage (debt) or more equity issuances

Traditional "value" investing has underperformed growth during this bull market

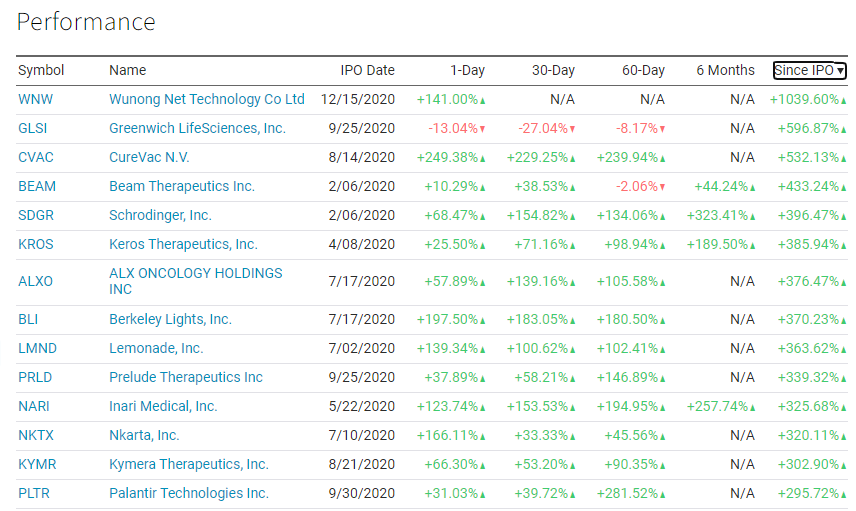

Can I always make money investing in an IPO?

No!

For every hot listing, there's another that doesn't get talked about which is a black hole that soaks up all your capital and returns less than nothing...

Here are a couple NASDAQ IPOs

No!

For every hot listing, there's another that doesn't get talked about which is a black hole that soaks up all your capital and returns less than nothing...

Here are a couple NASDAQ IPOs

I need to read more on IPOs - I need more!

here's another thread on IPOs which deals with Aramco https://twitter.com/iamkoshiek/status/1191083246714576896?s=20

here's another thread on IPOs which deals with Aramco https://twitter.com/iamkoshiek/status/1191083246714576896?s=20

If SOMEHOW you made it to the end! Shout-out, I appreciate you!!

For more IPO analysis & terrible jokes, feel free to join our Telegram channel:

https://t.me/BankerX

For more IPO analysis & terrible jokes, feel free to join our Telegram channel:

https://t.me/BankerX

Read on Twitter

Read on Twitter