A reminder to self and whomsoever needs it. (1/8)

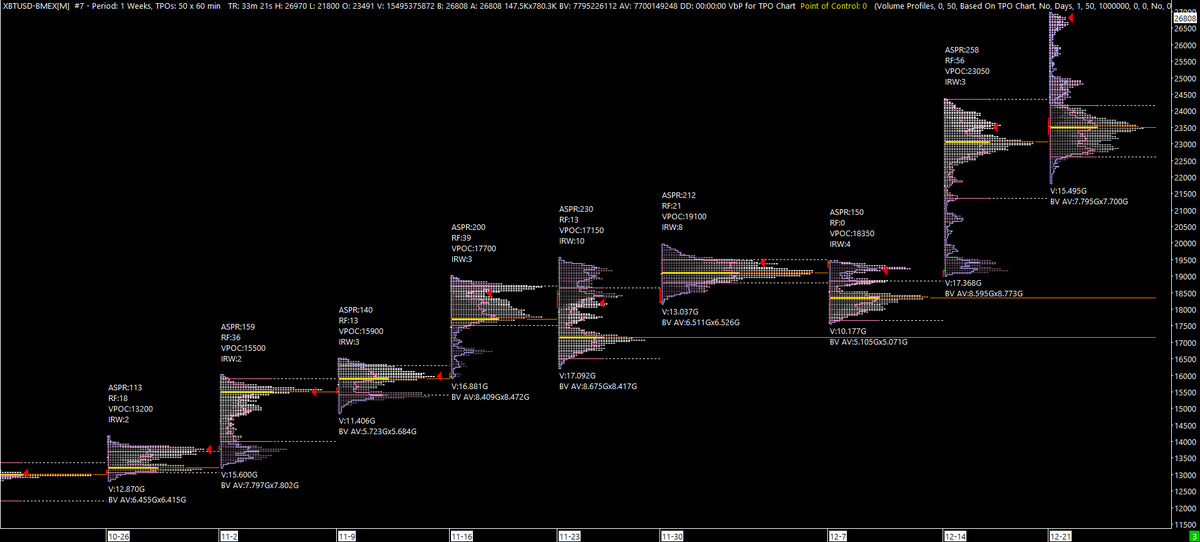

If you trade the Market Profile, one of the premises is to use the Profile to recognise "market generated information".

To recognise, in an unbiased way, what they market is conveying.

#BTC

If you trade the Market Profile, one of the premises is to use the Profile to recognise "market generated information".

To recognise, in an unbiased way, what they market is conveying.

#BTC

Bracketing vs Trending markets. (2/8)

There is a time to play mean reversion play, and there is time to follow the trend. It's about maximising alpha(returns) and maximising efficiency.

Bracketing/trending, Balance/Imbalance, Efficient/Inefficient.

There is a time to play mean reversion play, and there is time to follow the trend. It's about maximising alpha(returns) and maximising efficiency.

Bracketing/trending, Balance/Imbalance, Efficient/Inefficient.

These reflect on the auction process. (3/8)

The greatest edge, in my humble opinion, that a trader can cultivate is to recognise and adapt. Apart to a changing market dynamics.

The greatest edge, in my humble opinion, that a trader can cultivate is to recognise and adapt. Apart to a changing market dynamics.

(4/8)

In the past two weeks, the markets have be trending. Strongly. Wildly inefficient, with fat tails, in price discovery. Searching for a fair value. On the macro structure.

In the past two weeks, the markets have be trending. Strongly. Wildly inefficient, with fat tails, in price discovery. Searching for a fair value. On the macro structure.

(5/8)

Playing trend following strategies, leveraging up, would have give one maximum time in the market. Allowing one to capitalise on these %age moves to maximum extent.

Playing trend following strategies, leveraging up, would have give one maximum time in the market. Allowing one to capitalise on these %age moves to maximum extent.

(6/8)

Playing mean reversion, with no attention to the market generated information, especially to the sell side, has been a poor EV practice. More so over the past 2 weeks.

Playing mean reversion, with no attention to the market generated information, especially to the sell side, has been a poor EV practice. More so over the past 2 weeks.

(7/8)

There will be time for fading the edges, but right now is certainly not the time to pick pennies in front a steamroller.

There will be time for fading the edges, but right now is certainly not the time to pick pennies in front a steamroller.

(8/8)

I had been prioritising, fallaciously albeit, to take mean reversion shorts. To "hedge" on my swing and positional plays. Only for my win rate on shorts to fall to abysmal levels.

In such an environment, I reckon options (puts) would be the logical way to go about hedging.

I had been prioritising, fallaciously albeit, to take mean reversion shorts. To "hedge" on my swing and positional plays. Only for my win rate on shorts to fall to abysmal levels.

In such an environment, I reckon options (puts) would be the logical way to go about hedging.

(9/8)

If your a still adopting mean reversion strategies, and that too on the downside, as your main position. Well...

God bless your soul.

If your a still adopting mean reversion strategies, and that too on the downside, as your main position. Well...

God bless your soul.

Read on Twitter

Read on Twitter