1. Huge thanks to the devs at @RealHxro for helping me pull data for TIX contracts - really grateful for the responsive team! This is one of the first times I've been able to build out relatively liquid vol curves not only for BTC/ETH but also for alts such as LINK, UNI, and YFI.

2. As a refresher, TIX contracts can be thought of as "cash-or-nothing" options. Here's a thread explaining the details of how these products work. https://twitter.com/samchepal/status/1327493648032948224

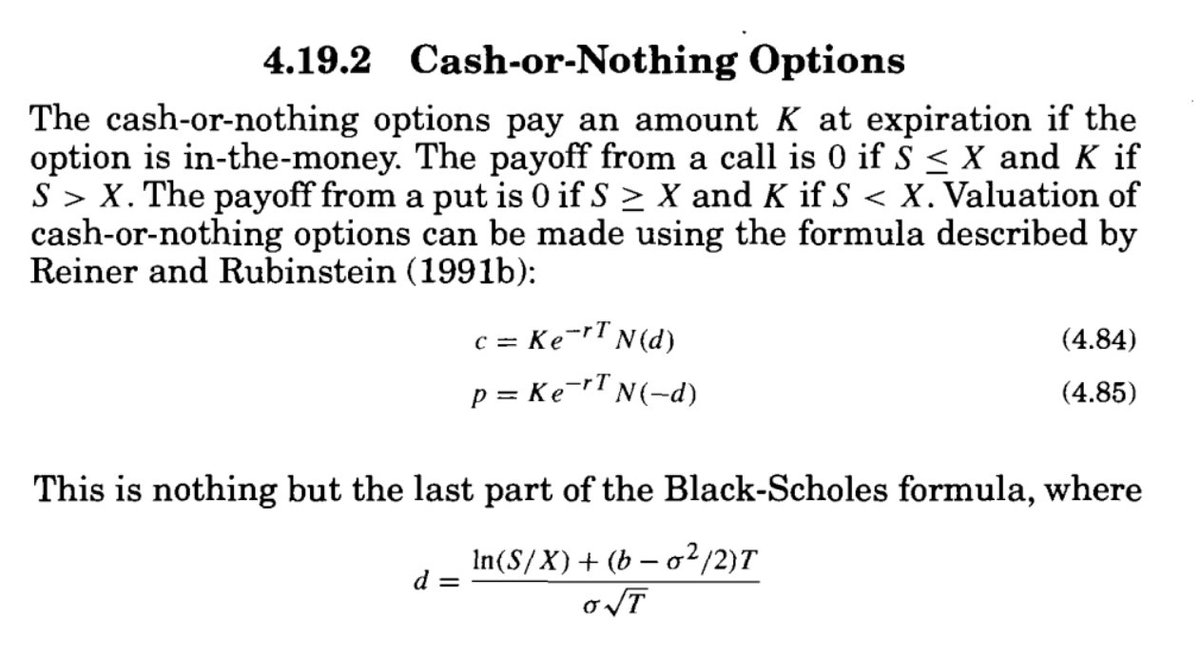

3. Pricing these options is fairly straightforward as it requires us to only look at the second term of the BSM model. In this case, N(d) represents the prob of option expiring ITM and multiplying by the payoff (K) gives us the EV of this bet. Math from @EGHaug's great book.

4. The dataset has all of the inputs except the vol term so we can build a function which will converge to the market IV. Similar to finding the IV for vanilla options, there isn't a nice closed-form solution so we need to use a numerical approach.

5. For example consider: BTC TIX 2021-01-29 ABOVE $18,500

Spot = 25,823

Strike = 18,500

Days Left = 33.5

Option Type = Call

Market Price = 0.922

We can iterate across 2000 IV values and see which IV gives us the closest value to the market-price. In this case it's ~ 68.9%.

Spot = 25,823

Strike = 18,500

Days Left = 33.5

Option Type = Call

Market Price = 0.922

We can iterate across 2000 IV values and see which IV gives us the closest value to the market-price. In this case it's ~ 68.9%.

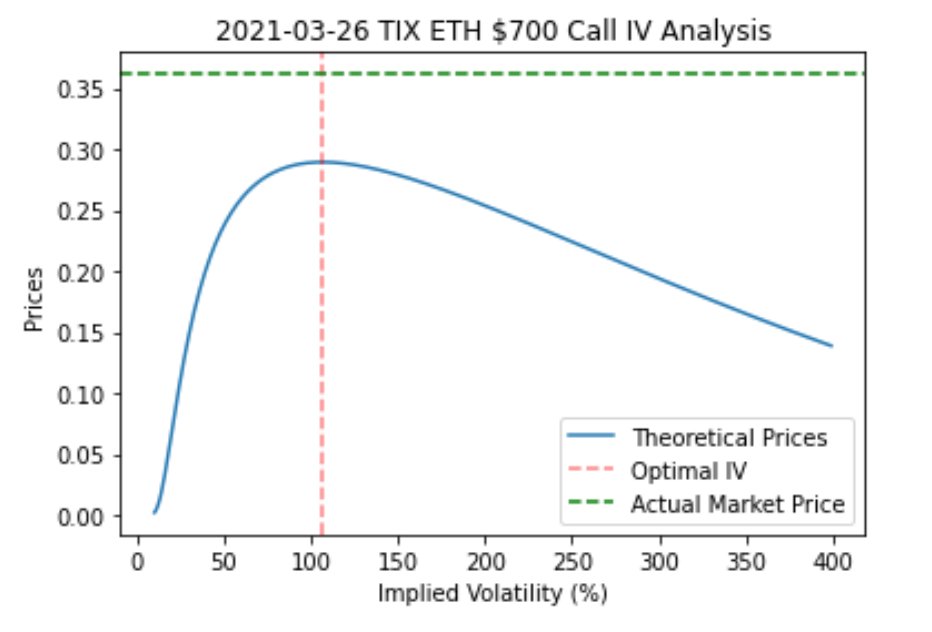

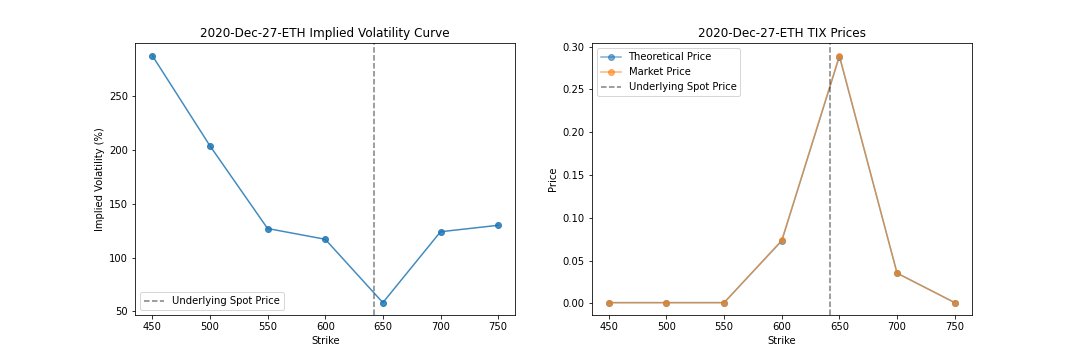

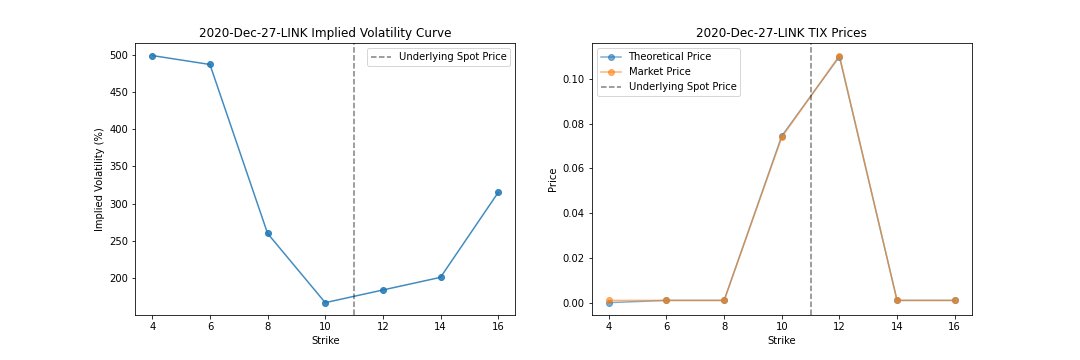

6. Despite iterating over a wide range of IV values, there were several instances where regardless of whichever IV value we chose, the model wasn't able to converge to the actual market-price. Example below...

7. The TIX mkt price is 0.36, however, after searching over various IVs, a vol of ~106% yields the closest possible price of 0.29. In this case we have a theoretical price of 0.29 vs market-price of 0.36. I'm guessing this is due to illiquidity which should smooth out over time.

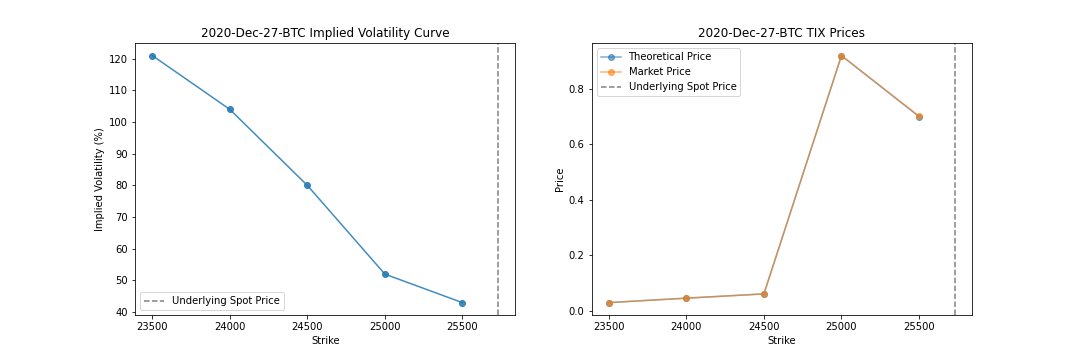

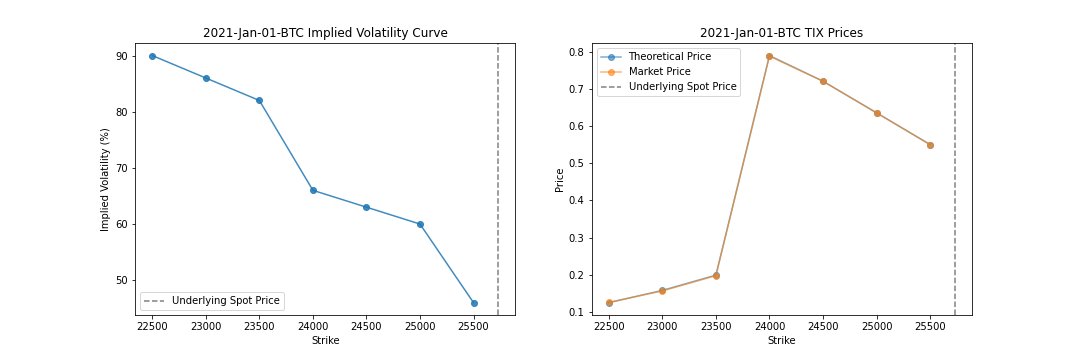

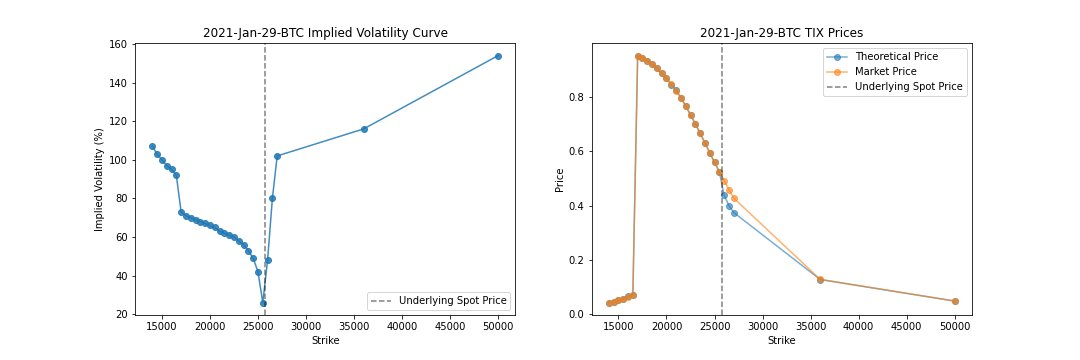

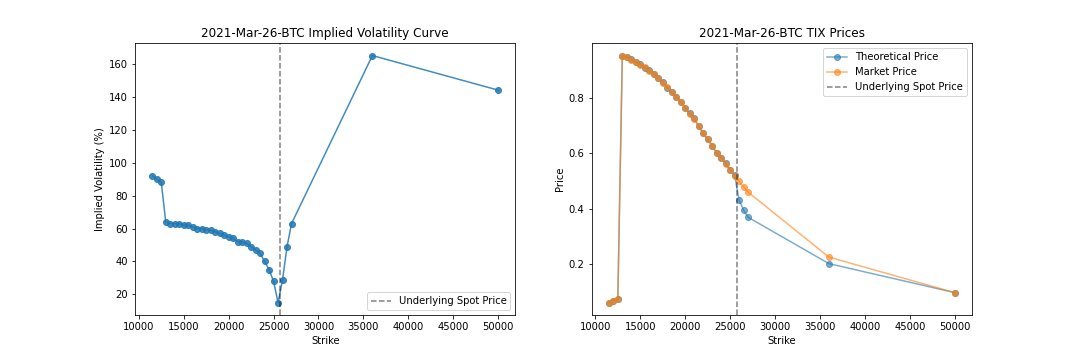

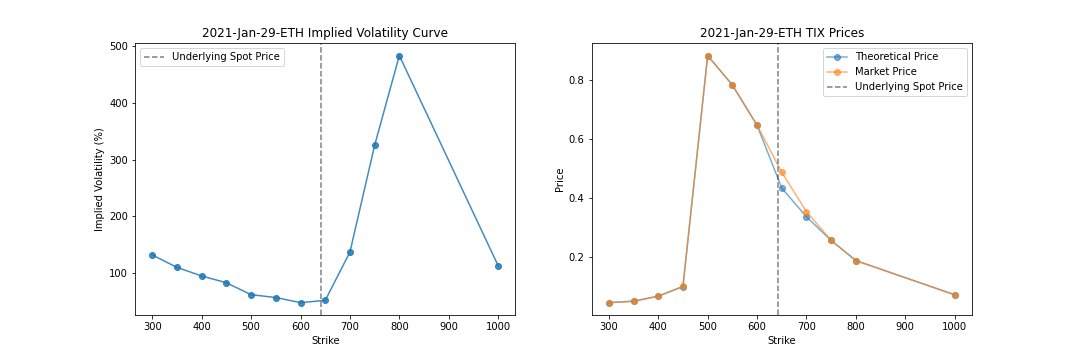

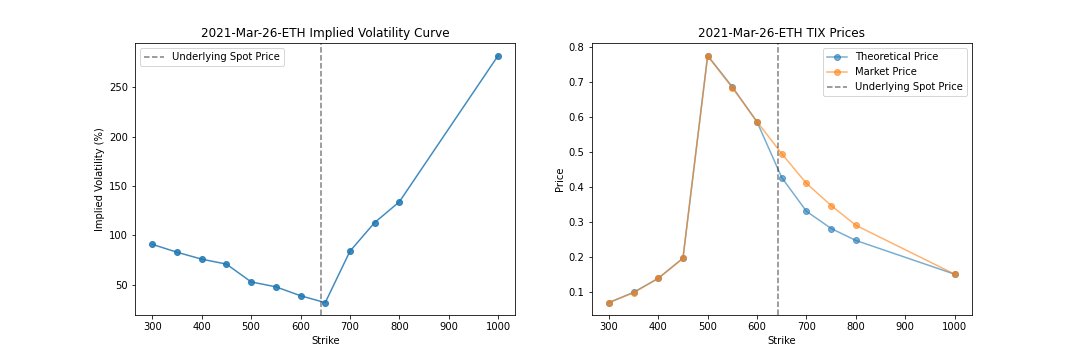

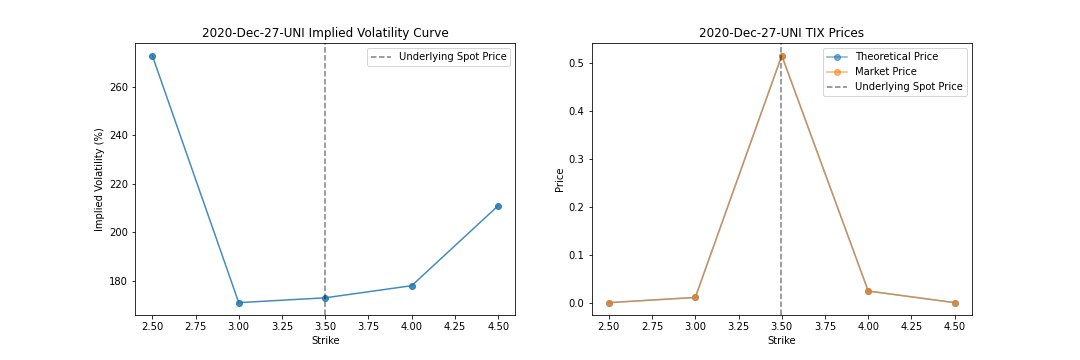

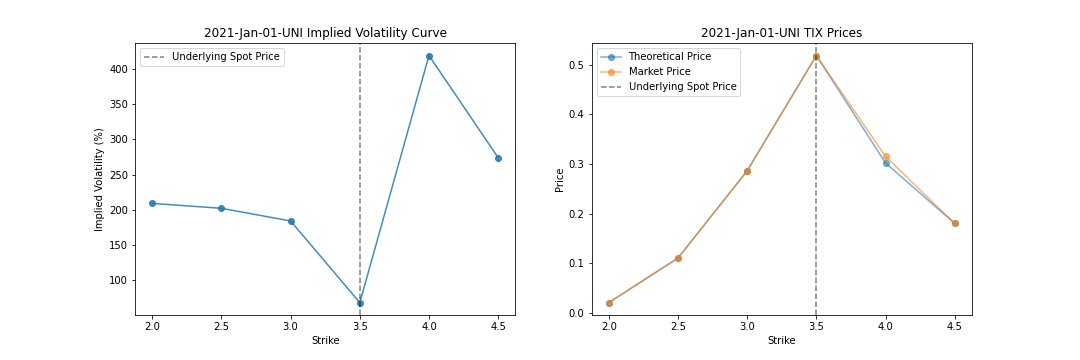

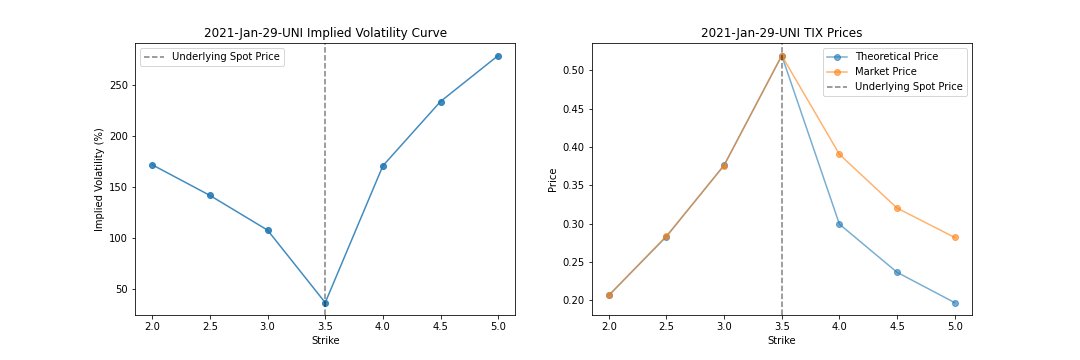

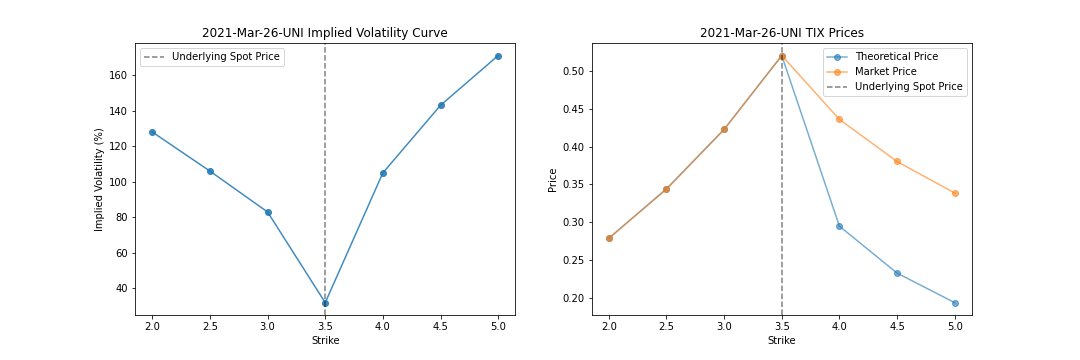

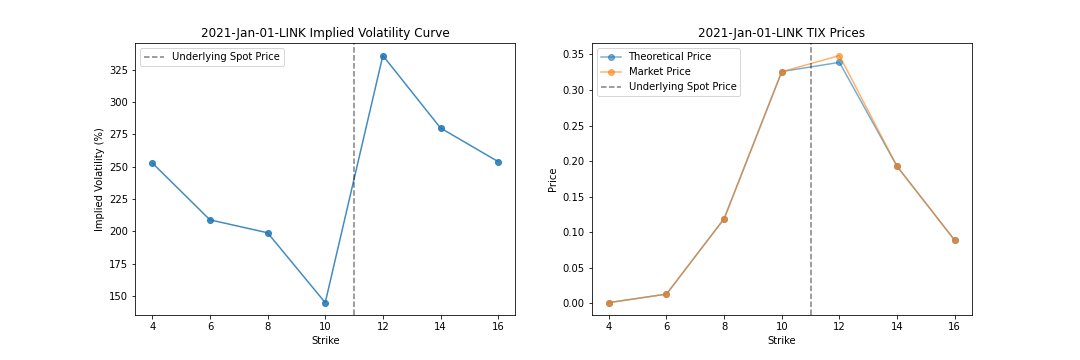

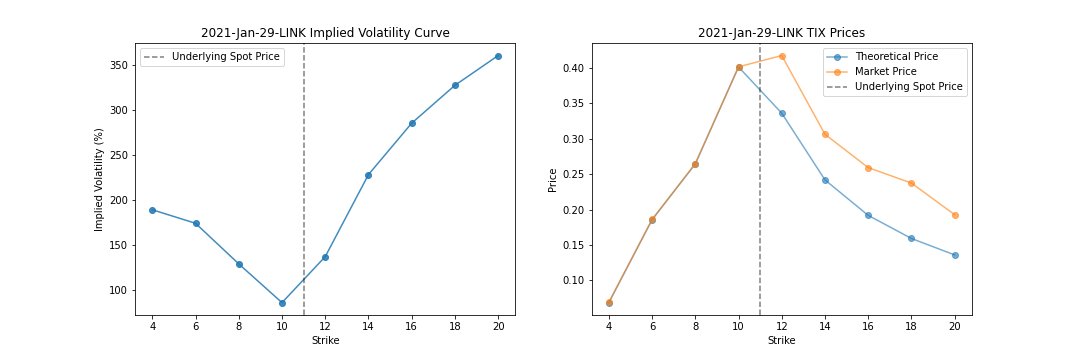

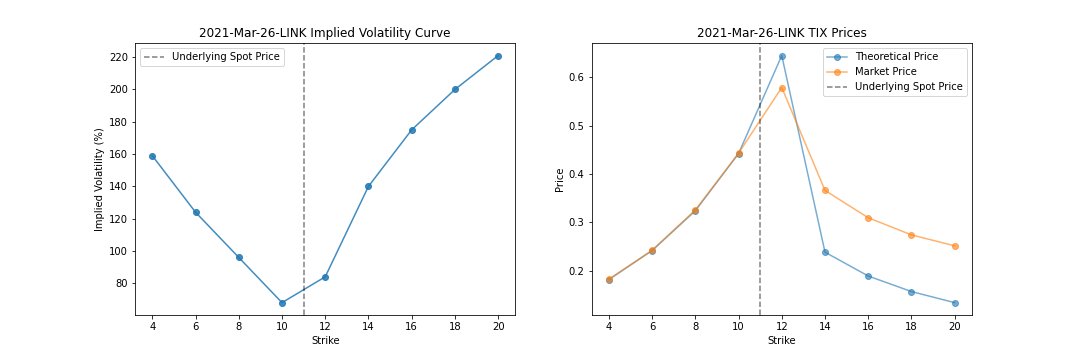

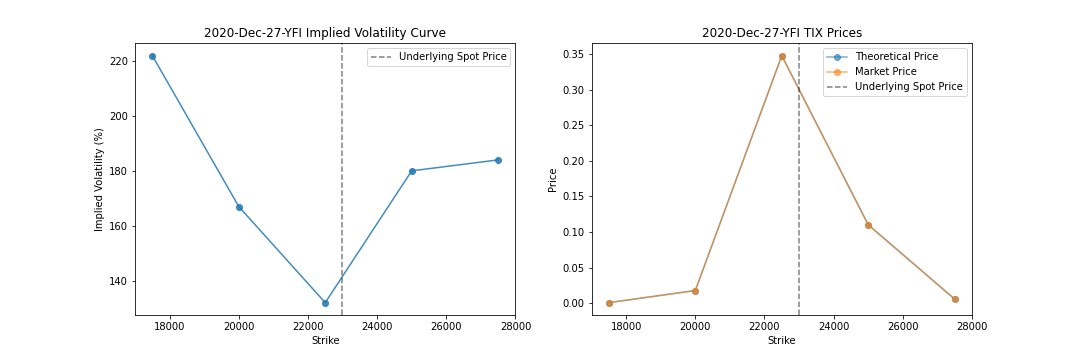

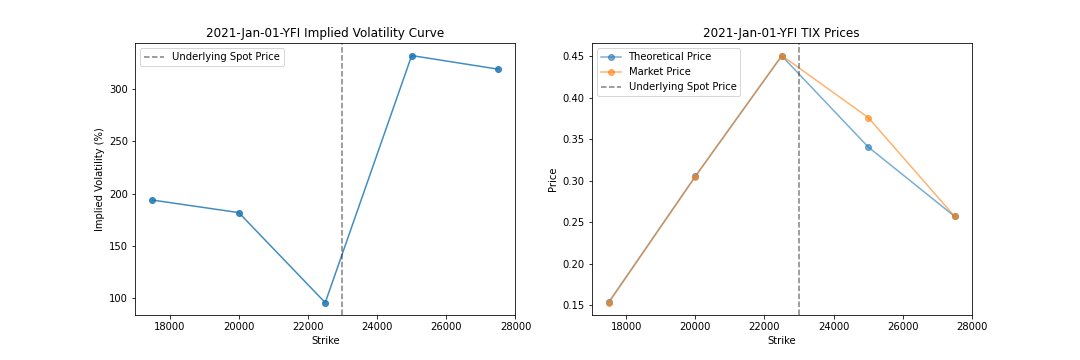

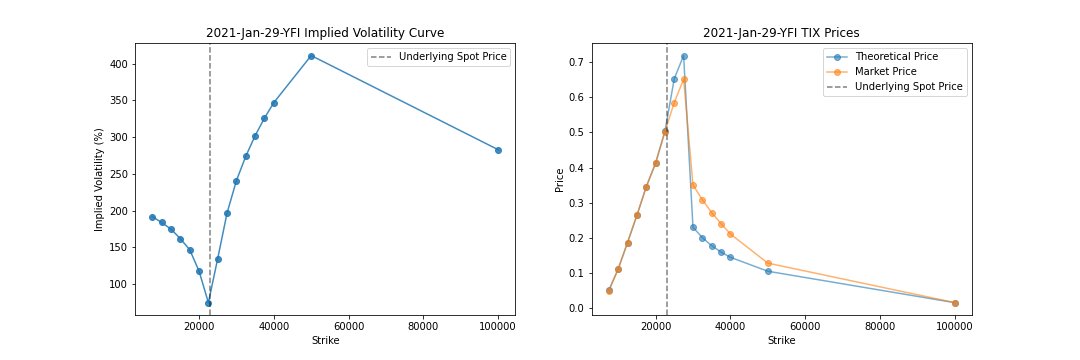

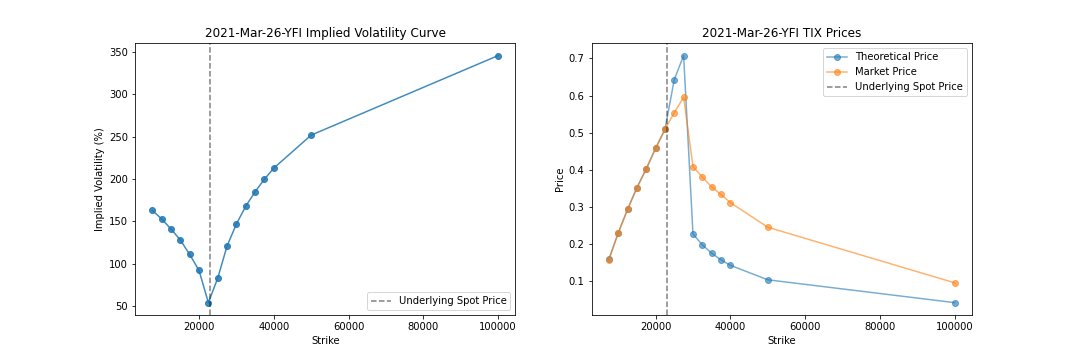

8. We can run this same analysis for all of the TIX contracts across all maturities.

Let's start with BTC.

Let's start with BTC.

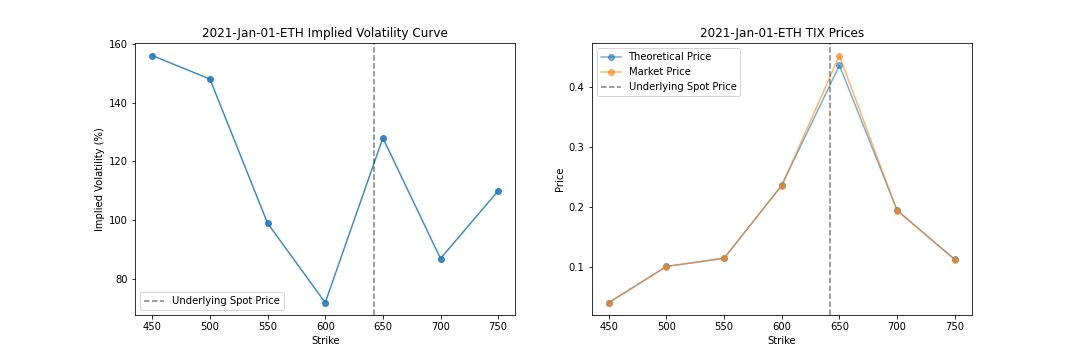

13. We can see that short-term TIX contracts are fairly well priced but there may be some opportunities to trade/arb farther-dated contracts (especially in the alt-coins) given the wider difference between theoretical vs. market price.

14. The key thing here is how we can hedge the risk of buying/selling this binary option. Theoretically, we could use a tight call-spread to replicate the binary but we need more granularity in strikes on @DeribitExchange to make this an accurate hedge.

15. Any thoughts on how you would think about trading this? Also - any ideas on the reason for the difference between theoretical vs market prices? @robbylevy @saah1lk @GammaHamma22

16. As new market-makers enter this space and these products become more liquid, I'd expect the differences will converge closer to zero. Nevertheless, it's cool to see @RealHxro is a first-mover in light exotics for alts - haven't seen this before until now!

17. Disclosure: @ledger_prime is an investor in @RealHxro.

Read on Twitter

Read on Twitter