$SDGR Time for another small  :

:

Disclaimer: I'm long $SDGR since near IPO and plan to hold it for many years to come. It's currently my largest holding in my High Conviction Portfolio.

Let's begin

:

:Disclaimer: I'm long $SDGR since near IPO and plan to hold it for many years to come. It's currently my largest holding in my High Conviction Portfolio.

Let's begin

Investment Thesis:

Investment Thesis: I believe $SDGR's computational drug discovery software is disrupting the biopharma landscape and leading the way in converting the industry to a computational based approach.

Secondly, $SDGR is leveraging their software platform to build an in-house Drug Discovery Program. This was recently validated with a deal worth potentially 2.7B$ with Bristol Myers. $SDGR has only a 5.8B$ market value, to put this news in context. https://www.fiercebiotech.com/medtech/schrodinger-s-house-pipeline-helps-fetch-2-7b-molecule-discovery-deal-bms

Secondly, $SDGR is leveraging their software platform to build an in-house Drug Discovery Program. This was recently validated with a deal worth potentially 2.7B$ with Bristol Myers. $SDGR has only a 5.8B$ market value, to put this news in context. https://www.fiercebiotech.com/medtech/schrodinger-s-house-pipeline-helps-fetch-2-7b-molecule-discovery-deal-bms

Opportunities/Catalysts:

Opportunities/Catalysts:I believe that this recent with BMS will further validate their in-house pipeline and potentially open the door for more large scale deals.

Also, $SDGR raised 346.5mm$ in August 2020, only a few months after their IPO in Feb 2020.

The main reason behind this raise I believe was to further push their in-house pipeline in order to validate it even more and potentially land more BMS type collaboration deals.

The main reason behind this raise I believe was to further push their in-house pipeline in order to validate it even more and potentially land more BMS type collaboration deals.As of last Q, they had ~600mm in cash on hand with no LT debt. https://ir.schrodinger.com/news-releases/news-release-details/schrodinger-announces-closing-public-offering

Potential Earnings Model (Source: BMO)

Potential Earnings Model (Source: BMO)As you can see below, currently the Software Side is the main "bread winner" but the Drug Discovery side is expected to bring in as much revenue as Software by 2022 with almost double the Top Line Growth.

THIS is the opportunity

THIS is the opportunity

The market hasn't fully valued $SDGR as a two-headed monster in my opinion and only viewed it as a biotech software company.

This is fair, given that the bulk of the revenue are still on the software side.

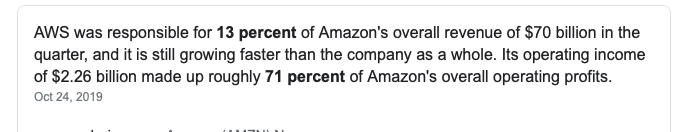

The best example I can think of is $AMZN.

The best example I can think of is $AMZN.While everyone focused for 20+ years on their online marketplace, very few focused on Amazon Web Services(AWS) which now makes up the bulk of the operating income of the company.

I believe the same is happening with $SDGR.

While the Market has been mainly focusing on their Software business, $SDGR has been able to leverage this to propel their own in-house drug development business and strike deals with some of the top Pharma companies in the world

While the Market has been mainly focusing on their Software business, $SDGR has been able to leverage this to propel their own in-house drug development business and strike deals with some of the top Pharma companies in the world

$SDGR also has a Material Science division. This division feels also like a potential diamond in the rough.

$SDGR also has a Material Science division. This division feels also like a potential diamond in the rough. I've alluded in past tweets how $QS's (Gates backed company) recent success in battery revolution could be potentially working with $SDGR.

The be clear, this information has NOT been confirmed anywhere, however given that both firms are Gates backed ventures and $SDGR has signed a 3 year agreement with Gates Ventures to use their tech to improve battery performance, one has to think this is a possibility.

The be clear, this information has NOT been confirmed anywhere, however given that both firms are Gates backed ventures and $SDGR has signed a 3 year agreement with Gates Ventures to use their tech to improve battery performance, one has to think this is a possibility.

$SDGR is at a very important juncture going into 2021+

Their software biz is growing steadily

The Drug Dev. is being validated and expanding exponentially

Biopharmas want to save time, money and be more efficient in D.D.

Their listing couldn't be more timely.

Long $SDGR

Their software biz is growing steadily

The Drug Dev. is being validated and expanding exponentially

Biopharmas want to save time, money and be more efficient in D.D.

Their listing couldn't be more timely.

Long $SDGR

CC:

@mukund

@GrowthStockDoc

@jablamsky

@SWMichTrader

@LuoshengPeng

@clueless_1337

@JonahLupton

@TheMarkCooke

@howardlindzon

@GrowthStockInv1

@BrianFeroldi

@JoeySolitro

@Arquitect3

@mukund

@GrowthStockDoc

@jablamsky

@SWMichTrader

@LuoshengPeng

@clueless_1337

@JonahLupton

@TheMarkCooke

@howardlindzon

@GrowthStockInv1

@BrianFeroldi

@JoeySolitro

@Arquitect3

Read on Twitter

Read on Twitter