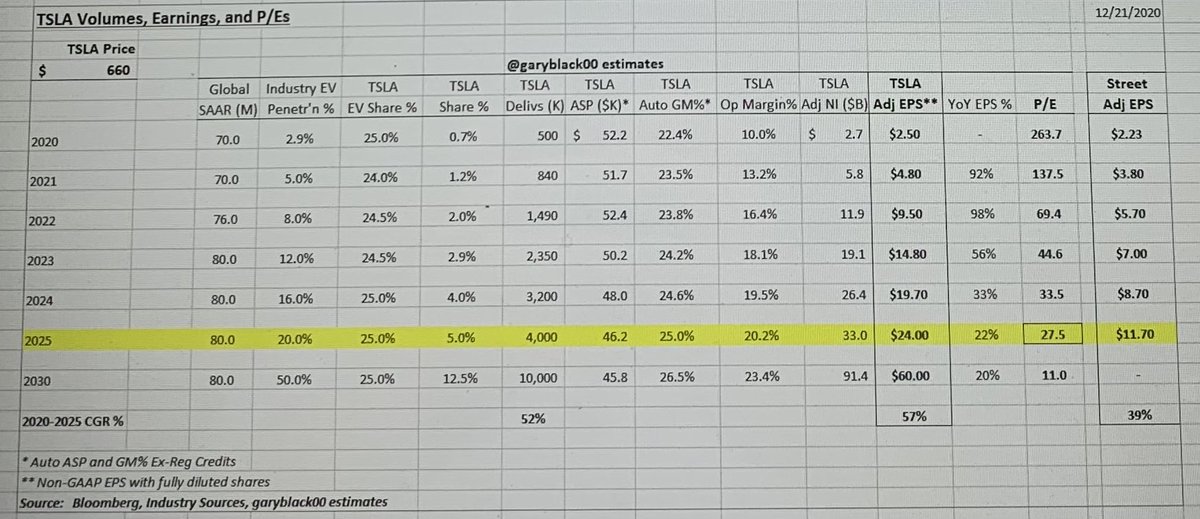

$TSLA is an asset with a value that can be quantified. Given a long EV runway (3% adoption now, 20% by 2025), and TSLA’s current 25% EV share, investors can forecast 2025 EPS ($24), attach a P/E ratio (50x) to get a 2025 value ($1,200). At a 9.5% disct rt, TSLA worth $830 today.

2/ $TSLA stock rose 669% YTD because Model Y launched globally, Shanghai opened, and Berlin/Austin are doubling capacity. This caused forward EPS ests to soar, which pushed TSLA sharply higher. S&P inclusion and TSLA’s 5:1 stock split served as catalysts to highlight TSLA value.

3/ For $TSLA to move higher, three key metrics - EV adoption, $TSLA EV share, auto gross margins - have to beat expectations. Biden’s EV plan could signif accelerate EV adoption. Model Y global expansion, mfg capacity doubling, and CyTruck could sharply increase TSLA EV share.

4/ My $TSLA $830 PT in 6-12 mos assumes 2025 global EV adoption of 20%, and TSLA takes 25% EV share. By 2025, I expect TSLA to deliver 4M vehicles, producing $24 EPS. If data comes out that EV adoption is likely to grow to 30% by 2025 (1.5x), my 6-12 mo PT would be $1,245 (1.5x).

5/ Contrary to media reports and analysts who rigidly value $TSLA as an auto stock, $TSLA is not expensive on most valuation metrics. No ptf mgr values growth stocks on current yr earnings. TSLA trades at 69x FY’22 EPS, or 1.2x 5-yr forward EPS growth of 57%. Only $FB is cheaper.

Read on Twitter

Read on Twitter