1/

Get a cup of Bru coffee.

Today I will help you understand a simple implied growth calculator to find a stock buy level. Let's get started.

(A short thread)

Get a cup of Bru coffee.

Today I will help you understand a simple implied growth calculator to find a stock buy level. Let's get started.

(A short thread)

2/

As you might know, The value of a stock is the present value of its lifetime cash flows.

For the long term buy and hold investor, the real cash flow from the stock is dividend income over its lifetime.

As you might know, The value of a stock is the present value of its lifetime cash flows.

For the long term buy and hold investor, the real cash flow from the stock is dividend income over its lifetime.

3/

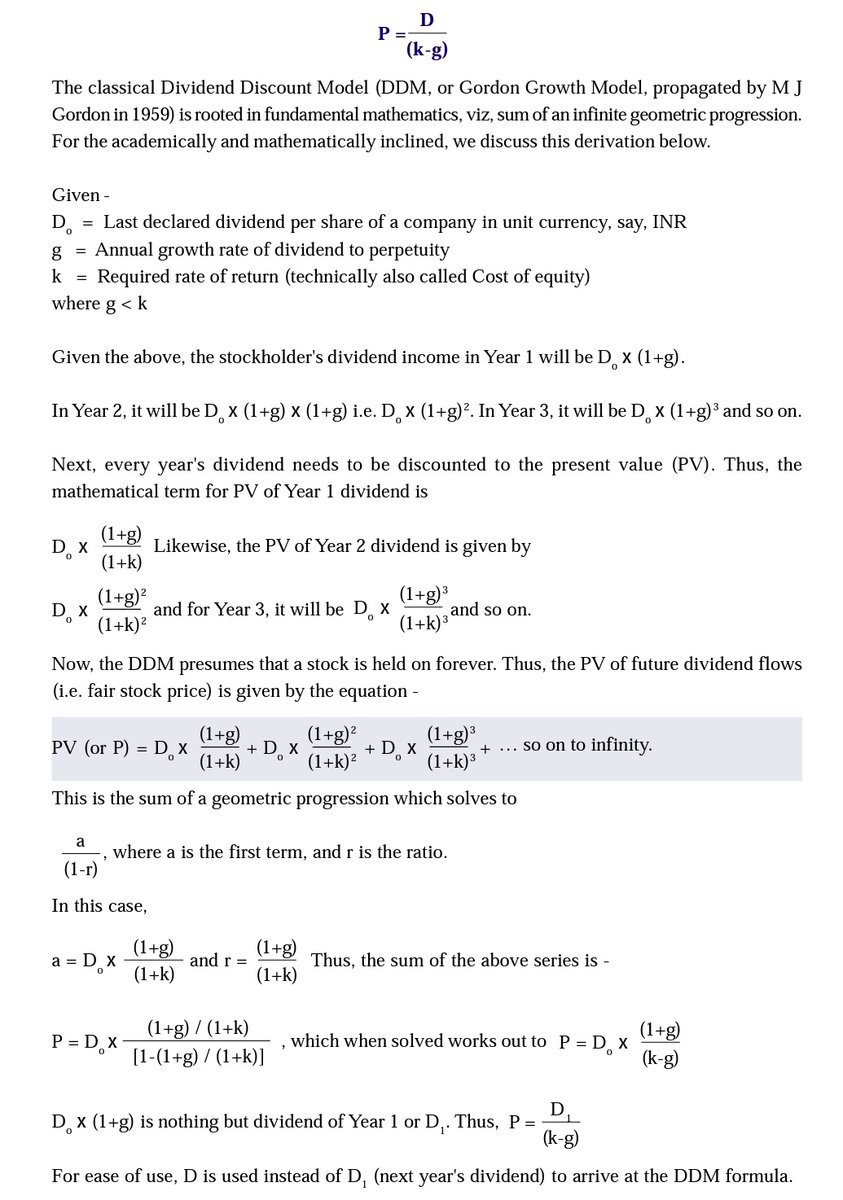

In 1959, M J Gordon proposed a formula for this. The formula is

Value = D/(r-g)

Whereas

D = Expected dividends.

r = Required rate of return.

g = Dividend growth rate in perpetuity.

A detailed derivation of the formula is given at the end.

In 1959, M J Gordon proposed a formula for this. The formula is

Value = D/(r-g)

Whereas

D = Expected dividends.

r = Required rate of return.

g = Dividend growth rate in perpetuity.

A detailed derivation of the formula is given at the end.

4/

Now, let's be honest, it is next to impossible to predict the growth rate in perpetuity for a firm.

So we twist the formula a little bit. Rather than finding out value, we find the *implied growth rate* This helps us to make deals with Mr. Market.

Now, let's be honest, it is next to impossible to predict the growth rate in perpetuity for a firm.

So we twist the formula a little bit. Rather than finding out value, we find the *implied growth rate* This helps us to make deals with Mr. Market.

5/

Here is some math:

Value = D/(r-g)

r-g = D/value

D/value is nothing but dividend yield, so we substitute the same.

r-g = Dividend yield

g = r-Dividend yield

*Implied growth = Required rate of return - Dividend yield*

Here is some math:

Value = D/(r-g)

r-g = D/value

D/value is nothing but dividend yield, so we substitute the same.

r-g = Dividend yield

g = r-Dividend yield

*Implied growth = Required rate of return - Dividend yield*

6/

Since we got implied growth formula, we can use it in some real-life firms.

Let's take Hind Unilever as a case study. The stock is trading at 83 x of FY 20 earnings. A traditional PE investor right away calls it overvalued.

Since we got implied growth formula, we can use it in some real-life firms.

Let's take Hind Unilever as a case study. The stock is trading at 83 x of FY 20 earnings. A traditional PE investor right away calls it overvalued.

7/

However, taking an r of 10% and a dividend yield of around 1%, the implied growth comes at 9% in perpetuity.

You have to make a bet here. If you think that the firm dividends grow at that rate forever, you buy or else you avoid.

However, taking an r of 10% and a dividend yield of around 1%, the implied growth comes at 9% in perpetuity.

You have to make a bet here. If you think that the firm dividends grow at that rate forever, you buy or else you avoid.

8/

Let's take another example ITC Ltd. Assuming an r of 10% and a dividend yield of 5%, the implied growth comes at 5%.

Whereas the long-term dividend growth rate for ITC Ltd is 13%. So it looks like the stock is undervalued for some reason.

Let's take another example ITC Ltd. Assuming an r of 10% and a dividend yield of 5%, the implied growth comes at 5%.

Whereas the long-term dividend growth rate for ITC Ltd is 13%. So it looks like the stock is undervalued for some reason.

9/

Also, not all firms pay dividends. So you can use free cash flow in place of dividends.

And take an average number to reduce outlier risk.

Do note that r is not some magical number. So feel free to use your own required rate of return.

Also, not all firms pay dividends. So you can use free cash flow in place of dividends.

And take an average number to reduce outlier risk.

Do note that r is not some magical number. So feel free to use your own required rate of return.

Read on Twitter

Read on Twitter