For anyone who is curious whether actively managed funds benchmarked to the $SPX are buying $TSLA, keep an eye on $GSLC - the Goldman Sachs ActiveBeta ETF.

This is an 'enhanced index' ETF which basically invests in most of the S&P 500 holdings but modifies the weighting depending on how well each stock scores according to several fundamental factors such as earnings growth, ROE, volatility, leverage risk, etc.

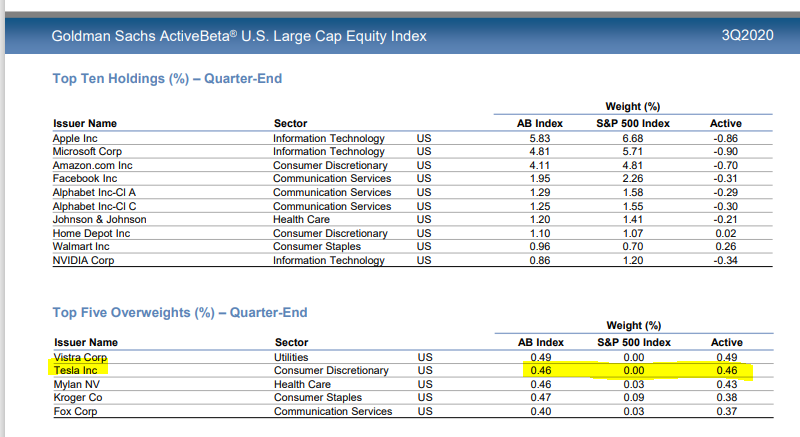

$GSLC actually front-ran the $SPX inclusion announcement, choosing to buy $TSLA as of end of Q3 2020, well in advance of the Nov 17 announcement by S&P Dow Jones Indices, as per their quarterly performance attribution report here: https://www.gsam.com/content/gsam/us/en/advisors/fund-center/etf-fund-finder/goldman-sachs-activebeta-u-s--large-cap-equity-etf.html#activeTab=holdings

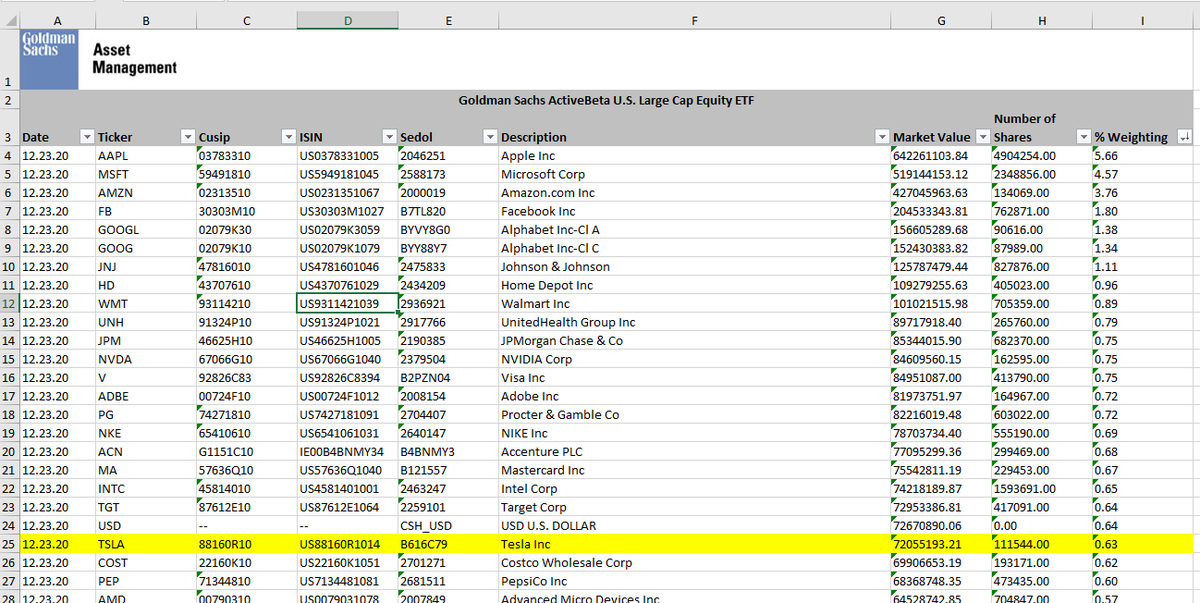

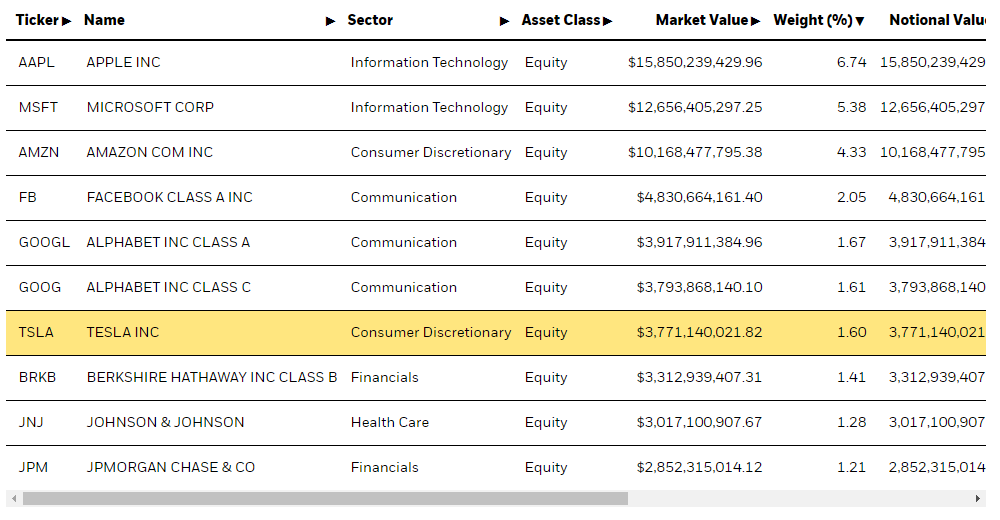

However, as of 23 Dec, they are still significantly underweight $TSLA vs the $SPX, keeping it at a 0.63% weighting (see first tweet) vs 1.6% as per the iShares $IVV fund.

This confirms my belief that active managers are not likely to enter $TSLA in a meaningful way for a while.

This confirms my belief that active managers are not likely to enter $TSLA in a meaningful way for a while.

Most managers build an 'investable universe' from which to make stock selections. These screens are usually based on EPS, which Tesla does not have a terribly long history of. I think it will take 1-3 more years of positive EPS before this even starts to happen.

Read on Twitter

Read on Twitter