122% Sales Growth & Profitable

122% Sales Growth & Profitable

The Japanese $SHOP $SQ and $ETSY merged into one platform

The Japanese $SHOP $SQ and $ETSY merged into one platform A smart website builder and payment tools for businesses and consumers

A smart website builder and payment tools for businesses and consumers Can it fight GLOBAL competition?

Can it fight GLOBAL competition?  Can it outgrow its DOMESTIC market?

Can it outgrow its DOMESTIC market?Here is a thread

Base Inc $4477.T was founded in 2012 in Japan  It went public on the Tokyo Stock Exchange in 2019

It went public on the Tokyo Stock Exchange in 2019

It is an e-commerce website builder and shopping app that branched out into digital payments in 2015

It went public on the Tokyo Stock Exchange in 2019

It went public on the Tokyo Stock Exchange in 2019It is an e-commerce website builder and shopping app that branched out into digital payments in 2015

Base has 5 products:

Online shop builder for businesses

Online shop builder for businesses

Online shopping app for consumers

Online shopping app for consumers

Fundraising platform

Fundraising platform

Online payments service

Online payments service

QR-code powered payment service

QR-code powered payment service

Online shop builder for businesses

Online shop builder for businesses Online shopping app for consumers

Online shopping app for consumers Fundraising platform

Fundraising platform Online payments service

Online payments service QR-code powered payment service

QR-code powered payment service

“BASE”

“BASE”  Online shop builder for businesses

Online shop builder for businessesThis is a Shopify alternative that enables anyone to build its online shop

Creating a web shop is easy as merchants can choose from existing templates, modify these and then integrate with a wide range of extensions

Creating a web shop is easy as merchants can choose from existing templates, modify these and then integrate with a wide range of extensions

Products can then also be accessed through Base’s Shopping app which counts 7m users and 1.2m shops

Products can then also be accessed through Base’s Shopping app which counts 7m users and 1.2m shops Setting up a Base-powered website is free (no set up costs or monthly charges)

Setting up a Base-powered website is free (no set up costs or monthly charges) The online payment function has been created in-house and is called “Base Easy Payment”

The online payment function has been created in-house and is called “Base Easy Payment”

Base takes a commission (6.6% of transaction value + $ 0.39) on each item sold

Base takes a commission (6.6% of transaction value + $ 0.39) on each item sold 3.6% of transaction value + 3% of service fee + 40 YEN ($ 0.39) as settlement fee https://www.smartkarma.com/home/daily-briefs/brief-japan-base-inc-ipo-excellent-customer-retention-justifies-high-promo-costs-and-more/

3.6% of transaction value + 3% of service fee + 40 YEN ($ 0.39) as settlement fee https://www.smartkarma.com/home/daily-briefs/brief-japan-base-inc-ipo-excellent-customer-retention-justifies-high-promo-costs-and-more/

Base seeks to serve SMBs and believes its “zero fixed costs” approach better serves its customers

Base seeks to serve SMBs and believes its “zero fixed costs” approach better serves its customers“[…] our shops can do so easily without initial cost, monthly cost. When actual products and services are sold, we are also able to receive revenue in the form of commission.”

“We believe that this allows us to maintain a fair relationship with the users” - Q3 2020 Report

https://contents.xj-storage.jp/xcontents/AS08546/edb55ac2/24e1/4b1e/b55c/a1556dccee10/20201114132918424s.pdf

https://contents.xj-storage.jp/xcontents/AS08546/edb55ac2/24e1/4b1e/b55c/a1556dccee10/20201114132918424s.pdf

“BASE APP” Online shopping app for consumers

“BASE APP” Online shopping app for consumersThis the smartphone app that regroups the products of all of Base’s merchants, it offers:

· Fashion items

· Interior Accessories

· Handmade accessories

· Entertainment / Hobby

· Cosmetics

· Home Appliance

· Smartphone

· Sports / Leisure

· Food / Beverages (including agricultural products and fresh foods)

· Smartphone

· Sports / Leisure

· Food / Beverages (including agricultural products and fresh foods)

How does it work?

How does it work?· BASE staff selects products from 1 million stores

· Special features are updated weekly, including seasonal items and popular products

· Users can pay for products with Base’s “PAY ID” or use any other payment method

“YELL Bank” Fundraising platform

“YELL Bank” Fundraising platformBase seeks to increase the number of SMBs that create their own website and start selling using Base’s tools

It therefor created its own fundraising platform for Base online shops

Using store data, it forecasts the future sales and funding requirement of a shop

Using store data, it forecasts the future sales and funding requirement of a shop It then provides the required funds to the shop and takes the future sales as a collateral

It then provides the required funds to the shop and takes the future sales as a collateral Rates go from 1 to 15% depending on the volume lent and seller’s profile

Rates go from 1 to 15% depending on the volume lent and seller’s profile

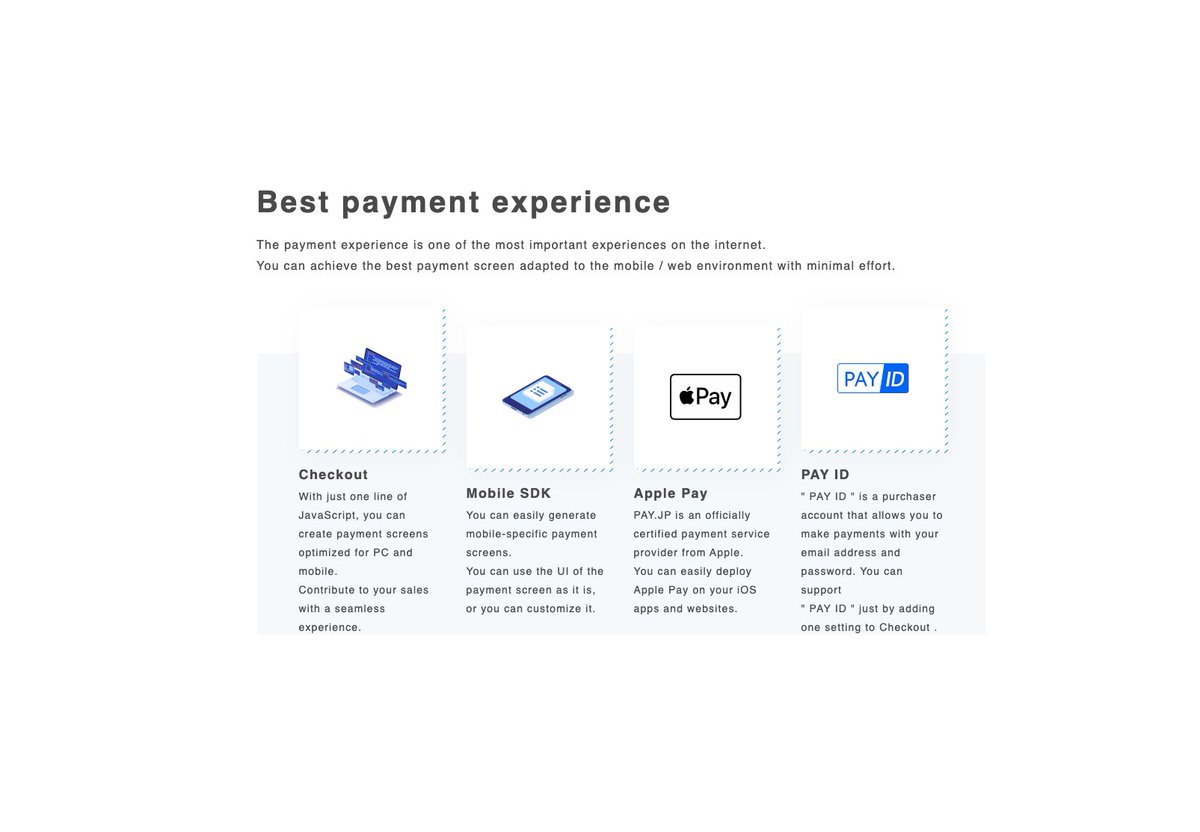

“ http://PAY.JP ” Online payments service

“ http://PAY.JP ” Online payments serviceEnables developers to quickly add payment solutions to their website and start accepting payments

It support credit card payments, works with Apple Pay and Pay ID (Base’s “digital wallet”)

It support credit card payments, works with Apple Pay and Pay ID (Base’s “digital wallet”)

In short, it competes with PayPal, Stripe but also with the recently launched Amazon Pay

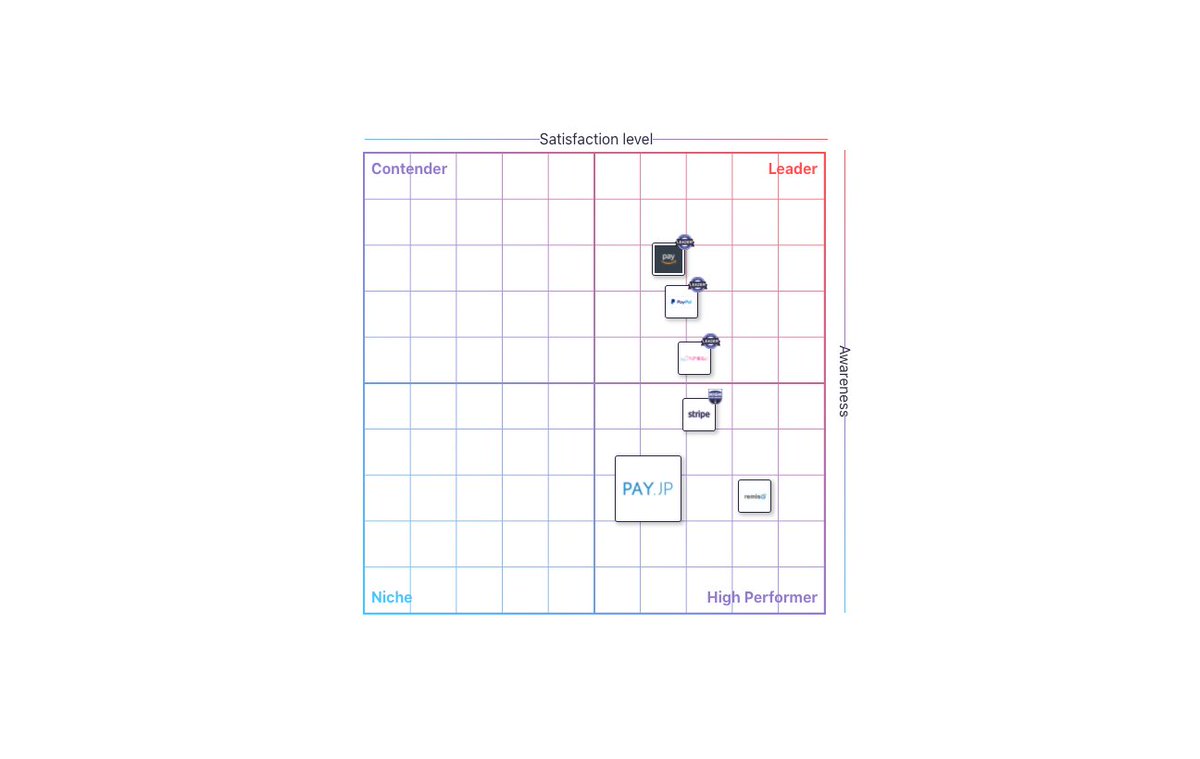

http://PAY.JP is not to best known solution according to the http://ITReview.jp quadrant for online payments

http://PAY.JP is not to best known solution according to the http://ITReview.jp quadrant for online payments

And it lags its peers in terms of ratings and number of reviews according to http://ITReview.jp

PayPal has 3.8 stars / 5 and scores 46 reviews

PayPal has 3.8 stars / 5 and scores 46 reviews

AmazonPay has 3.6 stars / 5 and scores 27 reviews

AmazonPay has 3.6 stars / 5 and scores 27 reviews

PayPal has 3.8 stars / 5 and scores 46 reviews

PayPal has 3.8 stars / 5 and scores 46 reviews AmazonPay has 3.6 stars / 5 and scores 27 reviews

AmazonPay has 3.6 stars / 5 and scores 27 reviews

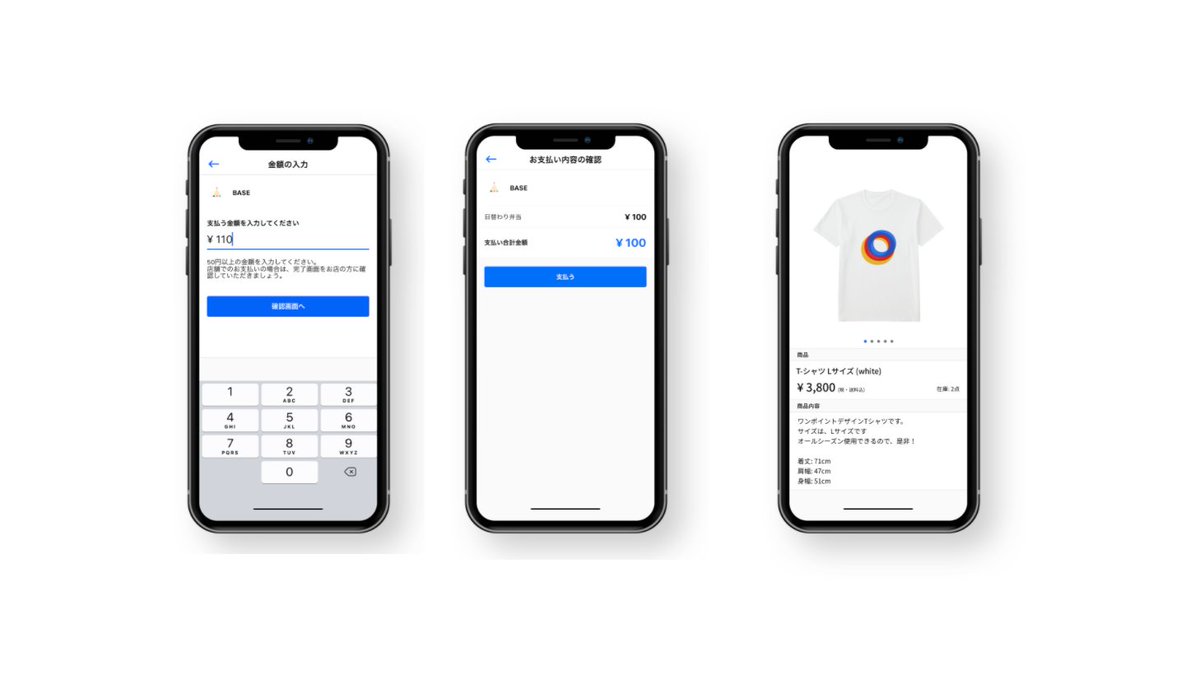

“PAY ID” QR-code powered payment service

“PAY ID” QR-code powered payment service This is Base’s digital wallet solution: consumers sign up once by entering their personal details and credit card (Visa or Mastercard)

This is Base’s digital wallet solution: consumers sign up once by entering their personal details and credit card (Visa or Mastercard) They can then use the service to pay for items both online and offline

They can then use the service to pay for items both online and offline

Base Inc can thus best be understood as a mix of Shopify and Stripe / Square

It enables entrepreneurs to easily build their online web shop

It enables entrepreneurs to easily build their online web shop

It has developed / acquired a suit of digital payments solution for businesses and consumers

It has developed / acquired a suit of digital payments solution for businesses and consumers

It enables entrepreneurs to easily build their online web shop

It enables entrepreneurs to easily build their online web shop It has developed / acquired a suit of digital payments solution for businesses and consumers

It has developed / acquired a suit of digital payments solution for businesses and consumers

It provides financing solutions to Base businesses

It provides financing solutions to Base businesses It’s strong focus on SMBs ensures that lots of its merchants proposes arts and crafts - similar to $ETSY

It’s strong focus on SMBs ensures that lots of its merchants proposes arts and crafts - similar to $ETSY

What about the market?

According to Statista, eCommerce sales in Japan reached $ 105B in 2020, an 18.8% increase YoY

According to Statista, eCommerce sales in Japan reached $ 105B in 2020, an 18.8% increase YoY

These are set to reach $ 143B by 2025, for a CAGR of 6.5%

These are set to reach $ 143B by 2025, for a CAGR of 6.5%

User penetration is at 77% and expected to reach 91% by 2025 https://www.statista.com/outlook/243/121/ecommerce/japan

User penetration is at 77% and expected to reach 91% by 2025 https://www.statista.com/outlook/243/121/ecommerce/japan

According to Statista, eCommerce sales in Japan reached $ 105B in 2020, an 18.8% increase YoY

According to Statista, eCommerce sales in Japan reached $ 105B in 2020, an 18.8% increase YoY These are set to reach $ 143B by 2025, for a CAGR of 6.5%

These are set to reach $ 143B by 2025, for a CAGR of 6.5% User penetration is at 77% and expected to reach 91% by 2025 https://www.statista.com/outlook/243/121/ecommerce/japan

User penetration is at 77% and expected to reach 91% by 2025 https://www.statista.com/outlook/243/121/ecommerce/japan

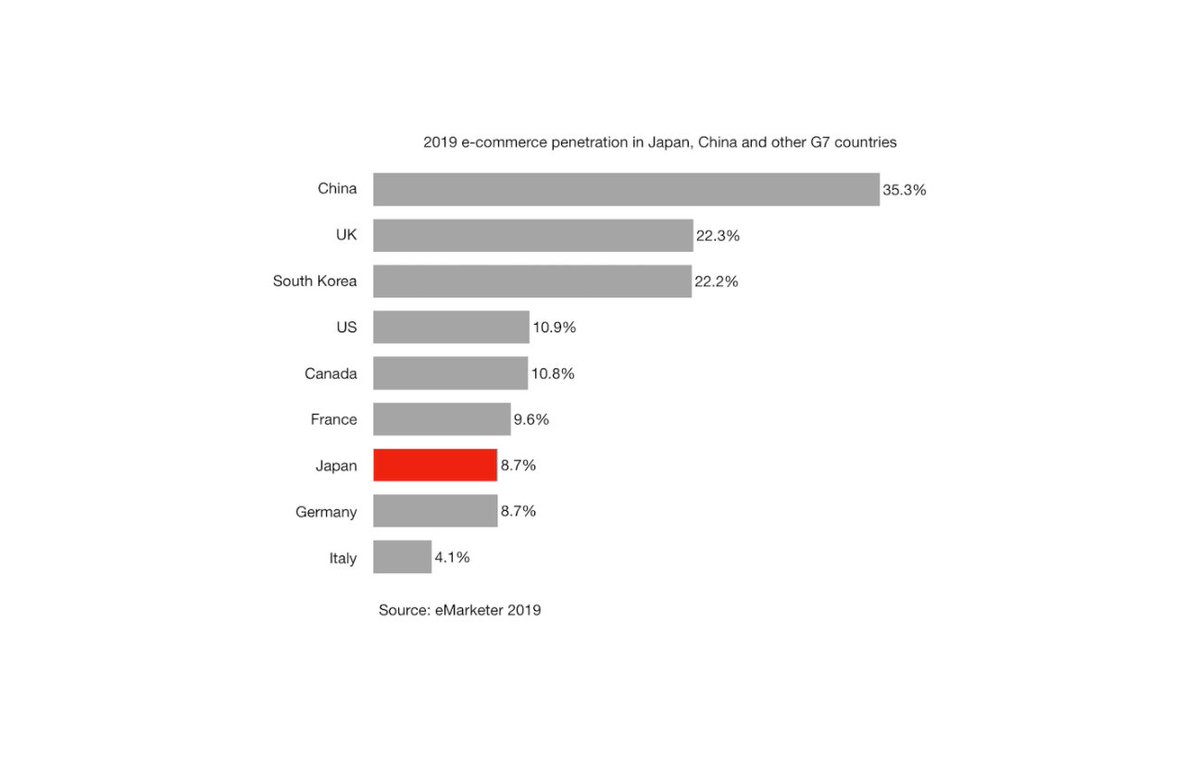

eMarketer reports that eCommerce penetration* in Japan stood at 8.7% in 2019

eMarketer reports that eCommerce penetration* in Japan stood at 8.7% in 2019 Versus 22.2% for South Korea, 11% for the US and 35% for China

Versus 22.2% for South Korea, 11% for the US and 35% for China* Note: eCommerce penetration is the share of retail eCommerce sales as percentage of total retail sales

So the market is slightly growing and there is room left for further eCommerce expansion

How is Base doing in this market?

How is Base doing in this market?

Can it capture the market on its own?

Can it capture the market on its own?

Or should it be worry of the Shopify, BigCommerce and Wix of this world?

Or should it be worry of the Shopify, BigCommerce and Wix of this world?

How is Base doing in this market?

How is Base doing in this market?  Can it capture the market on its own?

Can it capture the market on its own?  Or should it be worry of the Shopify, BigCommerce and Wix of this world?

Or should it be worry of the Shopify, BigCommerce and Wix of this world?

This is what JP Morgan has to say

“In Japan, domestic brands have the advantage of serving a single-language nation.”

Foreign Policy (the magazine) reports that 30% of Japanese speak English (versus 60% for Germany) https://foreignpolicy.com/2020/05/26/japan-doesnt-want-to-become-another-casualty-of-english/

Foreign Policy (the magazine) reports that 30% of Japanese speak English (versus 60% for Germany) https://foreignpolicy.com/2020/05/26/japan-doesnt-want-to-become-another-casualty-of-english/

“In Japan, domestic brands have the advantage of serving a single-language nation.”

Foreign Policy (the magazine) reports that 30% of Japanese speak English (versus 60% for Germany) https://foreignpolicy.com/2020/05/26/japan-doesnt-want-to-become-another-casualty-of-english/

Foreign Policy (the magazine) reports that 30% of Japanese speak English (versus 60% for Germany) https://foreignpolicy.com/2020/05/26/japan-doesnt-want-to-become-another-casualty-of-english/

JP Morgan further argues

“Investing in and offering Japanese language-enabled e-commerce platforms is essential in order to reach Japanese online shoppers.”

“Investing in and offering Japanese language-enabled e-commerce platforms is essential in order to reach Japanese online shoppers.”

This is driven by consumer preferences

“International merchants should also be aware that e-commerce web page layout and design for Japanese sites can look different to ecommerce site designs preferred in the U.S. and Europe.”

“International merchants should also be aware that e-commerce web page layout and design for Japanese sites can look different to ecommerce site designs preferred in the U.S. and Europe.”

Here is the full report  https://www.jpmorgan.com/europe/merchant-services/insights/reports/japan

https://www.jpmorgan.com/europe/merchant-services/insights/reports/japan

https://www.jpmorgan.com/europe/merchant-services/insights/reports/japan

https://www.jpmorgan.com/europe/merchant-services/insights/reports/japan

How does that apply to Base?

Here are the number of website visits according to Similarweb

Base got 10.25m visits in November 2020 with an average visit duration of 3:30 minutes

Base got 10.25m visits in November 2020 with an average visit duration of 3:30 minutes

Here are the number of website visits according to Similarweb

Base got 10.25m visits in November 2020 with an average visit duration of 3:30 minutes

Base got 10.25m visits in November 2020 with an average visit duration of 3:30 minutes

http://Stores.jp got 7.9m visits in November 2020 with an average visit duration of 2:33 minutes

http://Stores.jp got 7.9m visits in November 2020 with an average visit duration of 2:33 minutes $SHOP got 379k visits in November 2020 with an average visit duration of 0:59 minutes

$SHOP got 379k visits in November 2020 with an average visit duration of 0:59 minutes

But that doesn’t mean Shopify is nowhere

Since April 2020, Shopify merchants can start selling on Rakuten (one of Japan’s leading eCommerce website)

“[…] making it possible for Shopify merchants to easily add Rakuten Ichiba as a new sales channel and expand their market”

Since April 2020, Shopify merchants can start selling on Rakuten (one of Japan’s leading eCommerce website)

“[…] making it possible for Shopify merchants to easily add Rakuten Ichiba as a new sales channel and expand their market”

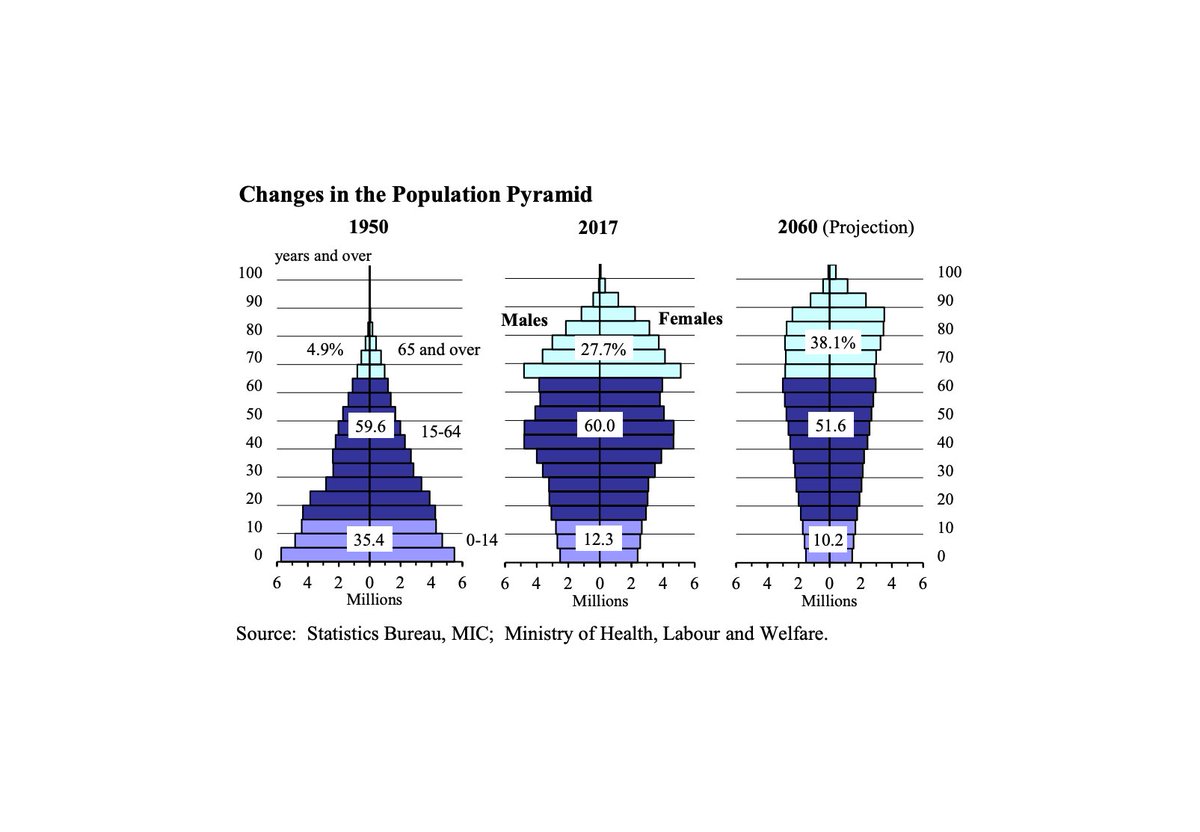

Last stop  Japan demographics

Japan demographics

· 65 and older now make 28.4% of the Japanese population

· People aged 15 to 64 make up 59.5% of the population, or 75m people

Due to ageing population, the IMF forecasts that Japan’s GDP could take a 25% hit over the next 4 decades

Due to ageing population, the IMF forecasts that Japan’s GDP could take a 25% hit over the next 4 decades

Japan demographics

Japan demographics· 65 and older now make 28.4% of the Japanese population

· People aged 15 to 64 make up 59.5% of the population, or 75m people

Due to ageing population, the IMF forecasts that Japan’s GDP could take a 25% hit over the next 4 decades

Due to ageing population, the IMF forecasts that Japan’s GDP could take a 25% hit over the next 4 decades

Financials Check

Financials Check

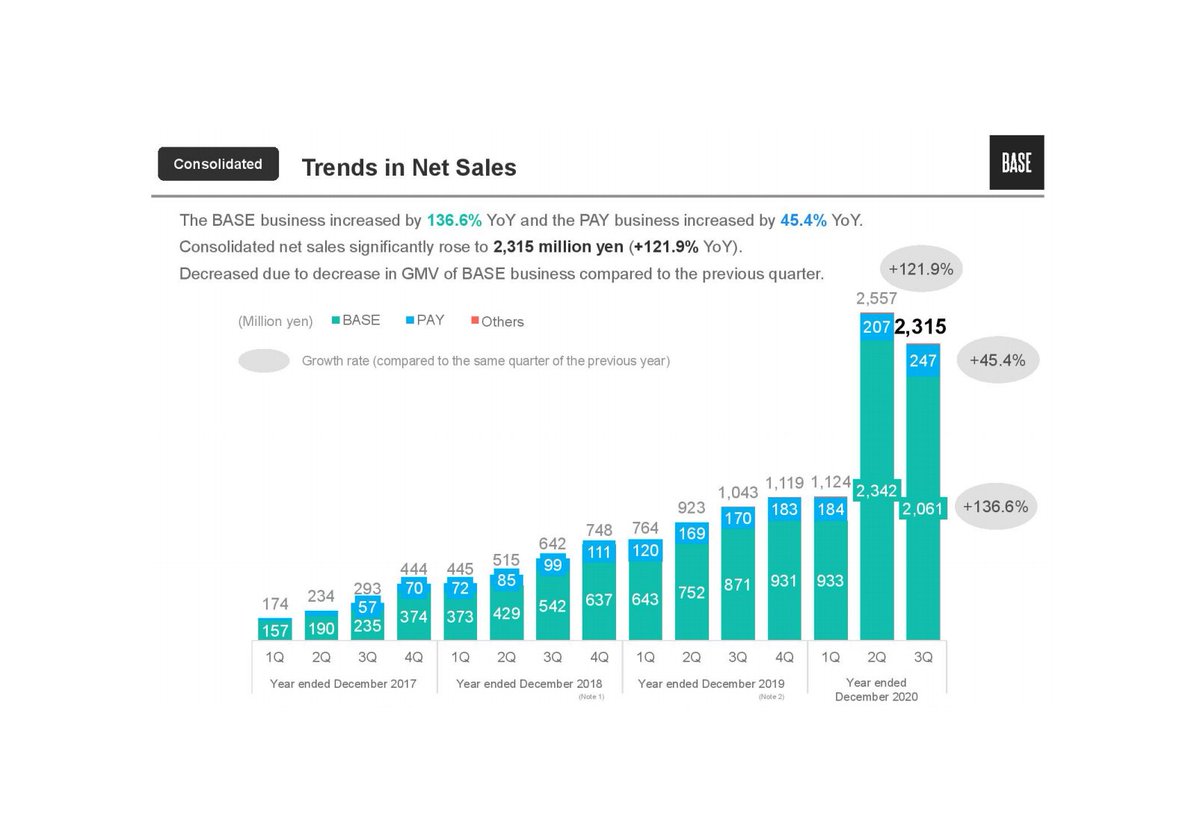

Net sales grew 122% YoY in Q3 ’20 to YEN 2.3B

Net sales grew 122% YoY in Q3 ’20 to YEN 2.3B In the BASE business (online shops), number of new shops opened increased 107% while GMV increased by 125% YoY

In the BASE business (online shops), number of new shops opened increased 107% while GMV increased by 125% YoY In the PAY business ( http://PAY.JP and PAY ID), GMV increased by 49% YoY

In the PAY business ( http://PAY.JP and PAY ID), GMV increased by 49% YoY

Gross profit grew 129% YoY to YEN 1.4B, representing gross margins of 61%

Gross profit grew 129% YoY to YEN 1.4B, representing gross margins of 61% SG&A expenses grew by only 14% YoY and operating profit reached YEN 534m versus a loss of YEN 144m a year earlier

SG&A expenses grew by only 14% YoY and operating profit reached YEN 534m versus a loss of YEN 144m a year earlier Current assets stood at YEN 14.6B versus YEN 10.9B in current liabilities

Current assets stood at YEN 14.6B versus YEN 10.9B in current liabilities

THE BOTTOM LINE

THE BOTTOM LINE

Headroom for further eCommerce penetration as eCommerce sales as percentage of total sales are still low in Japan versus neighbouring countries

Headroom for further eCommerce penetration as eCommerce sales as percentage of total sales are still low in Japan versus neighbouring countries

Base is the leading website builder in Japan, a market with domestic preferences which naturally raise barriers to entry for international competitors

Base is the leading website builder in Japan, a market with domestic preferences which naturally raise barriers to entry for international competitors It is expanding its reach and customer retention by becoming the “shopping supper-app” with internal payment solutions

It is expanding its reach and customer retention by becoming the “shopping supper-app” with internal payment solutions

Base’s payment solutions are not leading the market in terms of quality and user experience, it may thus be replaced by more focussed players such as Stripe and PayPal

Base’s payment solutions are not leading the market in terms of quality and user experience, it may thus be replaced by more focussed players such as Stripe and PayPal Weak demographic prospects may offset the eCommerce penetration gains in the long run

Weak demographic prospects may offset the eCommerce penetration gains in the long run

International potential might be limited as international competition already strongly established abroad, it might have a hard time expanding abroad

International potential might be limited as international competition already strongly established abroad, it might have a hard time expanding abroad

Global players are not standing still and making inroads in the Japanese market, as exemplified by Amazon’s successful entry into eCommerce and now digital payments and Shopify’s deal with Rakuten

Global players are not standing still and making inroads in the Japanese market, as exemplified by Amazon’s successful entry into eCommerce and now digital payments and Shopify’s deal with Rakuten

We have started a starter stake in Base Inc $4477.T

We have started a starter stake in Base Inc $4477.T  We believe Base is well placed to stay the leading website builder in Japan all while expanding its financing and shopping features

We believe Base is well placed to stay the leading website builder in Japan all while expanding its financing and shopping features

Strong barriers to entry slow down the rise of global players, giving Base an upper-hand

Strong barriers to entry slow down the rise of global players, giving Base an upper-hand This translates into outstanding financials (growth, gross margins and operating margins)

This translates into outstanding financials (growth, gross margins and operating margins)

We will cut of Base’s lead in website builder evaporates or if it fails to grow its shopping app / financing facilities

We will cut of Base’s lead in website builder evaporates or if it fails to grow its shopping app / financing facilities $RKT is on our watchlist

$RKT is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Tech In Asia

✑ Statista

✑ IT Review Japan

Sources

✑ Investor presentation

✑ Company website

✑ Tech In Asia

✑ Statista

✑ IT Review Japan

✑ Store Leads

✑ JP Morgan

✑ Foreign Policy

✑ Nikkei Asia

✑ Japanese Statistics Bureau

✑ JP Morgan

✑ Foreign Policy

✑ Nikkei Asia

✑ Japanese Statistics Bureau

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter