1/4

A Strategy:

1. Assume I have 20 lakhs.

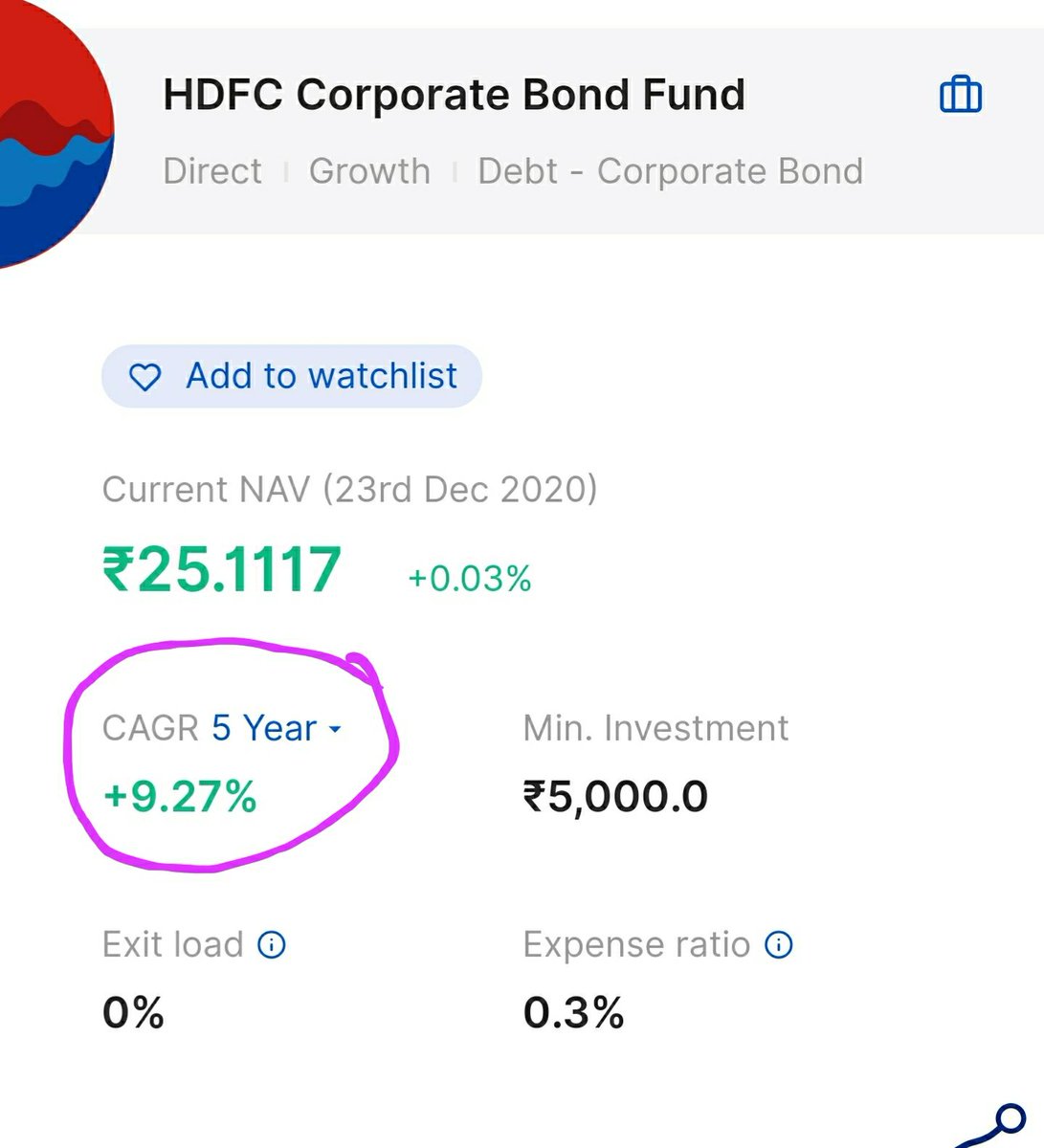

2. I invested in debt fund, Hdfc corporate bond fund which gave 9.27% CAGR in last 5 years.

3. Took colletaral after 7.5% haircut, so have 18.5 lakhs margin to trade.

4. I trade only on expiry.

A Strategy:

1. Assume I have 20 lakhs.

2. I invested in debt fund, Hdfc corporate bond fund which gave 9.27% CAGR in last 5 years.

3. Took colletaral after 7.5% haircut, so have 18.5 lakhs margin to trade.

4. I trade only on expiry.

2/4

5. I trade negligible risk options. For example, 24000 PE today was trading at Rs 2 and liquid too. For Banknifty to hit 24000, it should hit 2 lower circuits which we all know is impossible.

6. Depending on day's trend and OI data, I sell very very far OTM on that day.

5. I trade negligible risk options. For example, 24000 PE today was trading at Rs 2 and liquid too. For Banknifty to hit 24000, it should hit 2 lower circuits which we all know is impossible.

6. Depending on day's trend and OI data, I sell very very far OTM on that day.

3/4

7. I can sell 1500 quantity with available margin. 1500*2 = 3000

8. Yearly 52 expiries. 52*3000 = 1.56 lakhs = 7.8% returns.

9. So total returns will be 7.8+9.2 =17% per annum which are excellent returns. Even if I sell very very far options that are 1rs, still can get 13%.

7. I can sell 1500 quantity with available margin. 1500*2 = 3000

8. Yearly 52 expiries. 52*3000 = 1.56 lakhs = 7.8% returns.

9. So total returns will be 7.8+9.2 =17% per annum which are excellent returns. Even if I sell very very far options that are 1rs, still can get 13%.

4/4

I know intraday margin will be removed from next year.

Assuming that margin is not removed, What are the issues and risks in this strategy? Getting 13-17% almost risk free looking good on paper.

@itjegan @SarangSood @sanjufunda @jitendrajain

Need your expert opinion.

I know intraday margin will be removed from next year.

Assuming that margin is not removed, What are the issues and risks in this strategy? Getting 13-17% almost risk free looking good on paper.

@itjegan @SarangSood @sanjufunda @jitendrajain

Need your expert opinion.

Read on Twitter

Read on Twitter