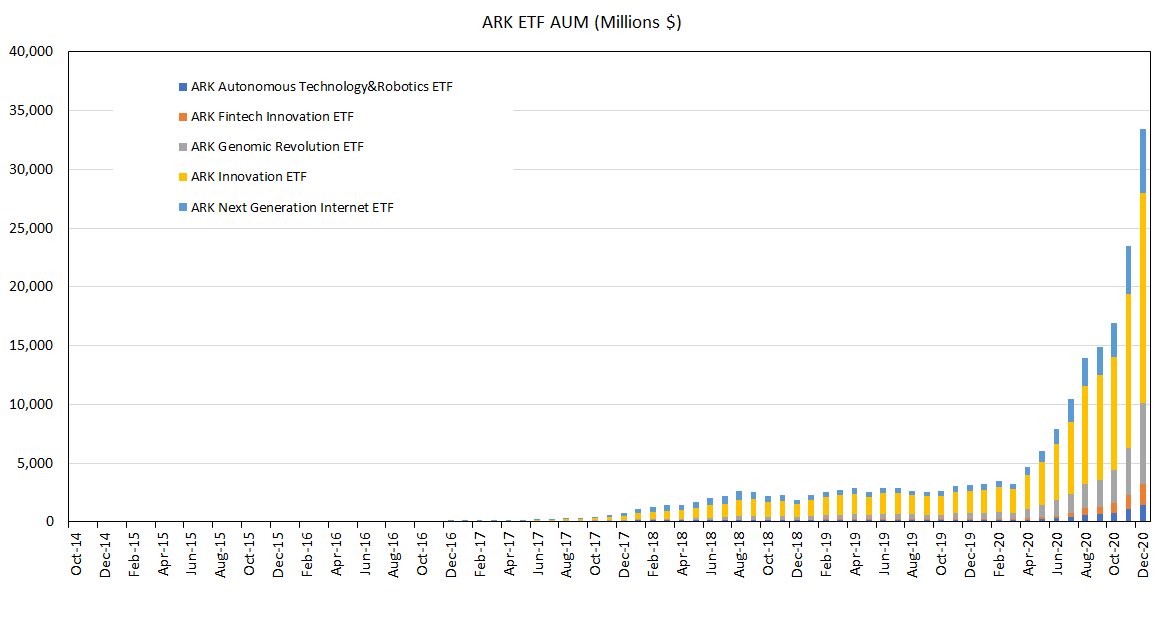

Despite some tweets that may seem hyperbolic, I think most people are underestimating how much the ~$18B year-to-date (~$10B of which are quarter-to-date) flows have impacted the valuation of their holdings.

$ARKG shows the reflexivity... $6.9B AUM (< $500M at year end) with $3B of flows THIS QUARTER.

It holds 5 stocks < $500M cap (a 0.25% weight in $PSTI is ~10% of the company and ~20% of $ARCT.

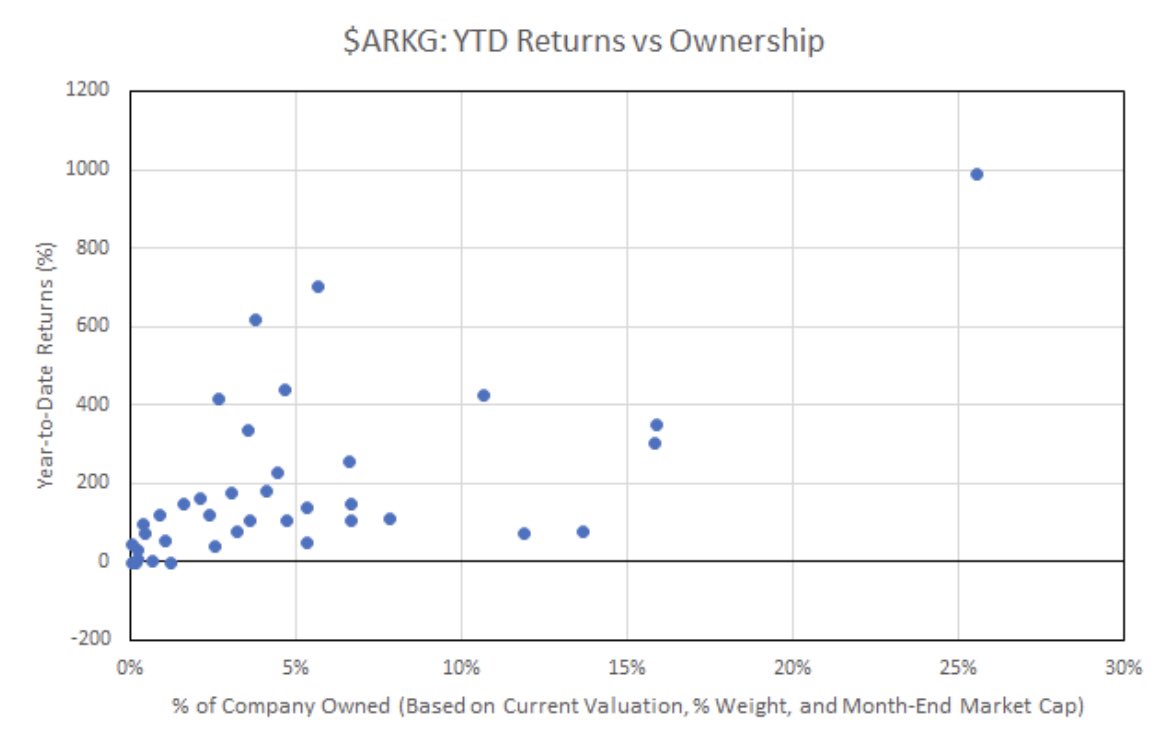

YTD returns vs how much they own of each (only 5 stocks with negative returns).

It holds 5 stocks < $500M cap (a 0.25% weight in $PSTI is ~10% of the company and ~20% of $ARCT.

YTD returns vs how much they own of each (only 5 stocks with negative returns).

slightly overstates ownership as I could only pull company market caps as of 11/30 (and they’ve grown since... so ownership is actually smaller by the returns of the stocks this month). Close enough for this.

slightly overstates ownership as I could only pull company market caps as of 11/30 (and they’ve grown since... so ownership is actually smaller by the returns of the stocks this month). Close enough for this.

Read on Twitter

Read on Twitter