$MWK eCommerce 45% Growth

$MWK eCommerce 45% Growth

Uses its own DATA analytics tool to spot BEST selling products ONLINE

Uses its own DATA analytics tool to spot BEST selling products ONLINE Develops and sells these products through $AMZN

Develops and sells these products through $AMZN Plans to turn itself into a SaaS and open its SOFTWARE to third parties

Plans to turn itself into a SaaS and open its SOFTWARE to third partiesHere is an EASY thread

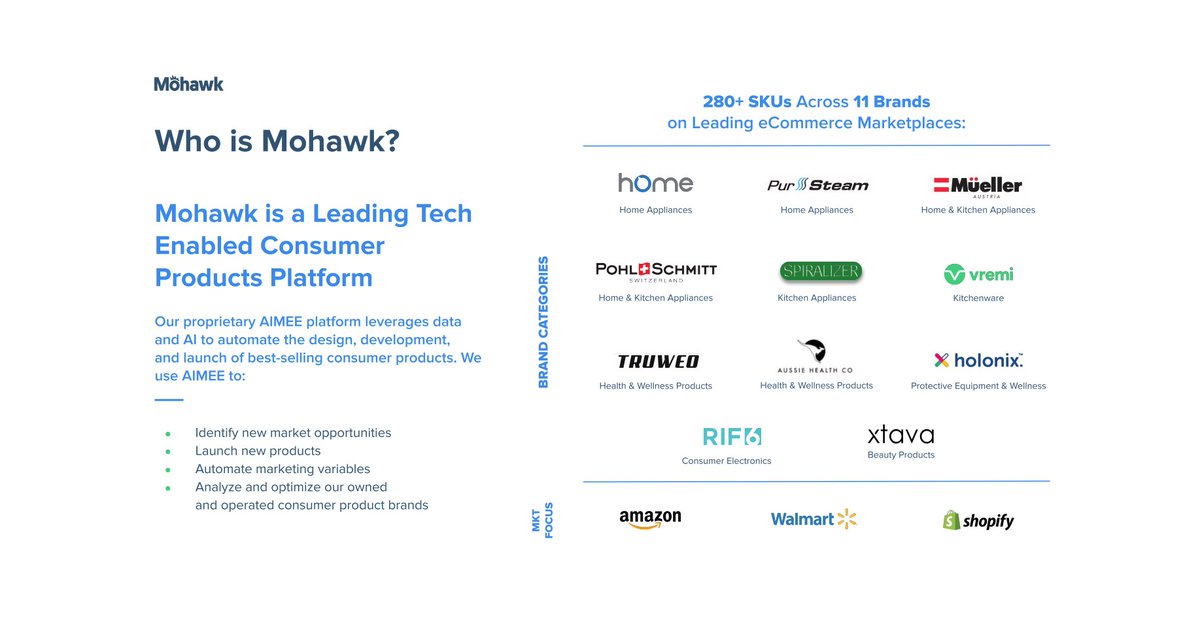

$MWK Mohawk Group was founded in 2014 and went public in 2019  $MWK sits at the crossroads of big data, eCommerce and Consumer Goods

$MWK sits at the crossroads of big data, eCommerce and Consumer Goods

In simple terms, it is a CPG (consumer packaged goods) company that develops and sells consumer products on Amazon and other eCommerce platforms

$MWK sits at the crossroads of big data, eCommerce and Consumer Goods

$MWK sits at the crossroads of big data, eCommerce and Consumer GoodsIn simple terms, it is a CPG (consumer packaged goods) company that develops and sells consumer products on Amazon and other eCommerce platforms

How is $MWK competitive?

$MWK scrapes the web and gathers data from leading eCommerce sites throughs APIs

$MWK scrapes the web and gathers data from leading eCommerce sites throughs APIs

It then knows what product are selling BEST (margins, turnover, customer satisfaction, market trends)

It then knows what product are selling BEST (margins, turnover, customer satisfaction, market trends)

$MWK scrapes the web and gathers data from leading eCommerce sites throughs APIs

$MWK scrapes the web and gathers data from leading eCommerce sites throughs APIs It then knows what product are selling BEST (margins, turnover, customer satisfaction, market trends)

It then knows what product are selling BEST (margins, turnover, customer satisfaction, market trends)

$MWK develops these products and sells these through various eCommerce platforms

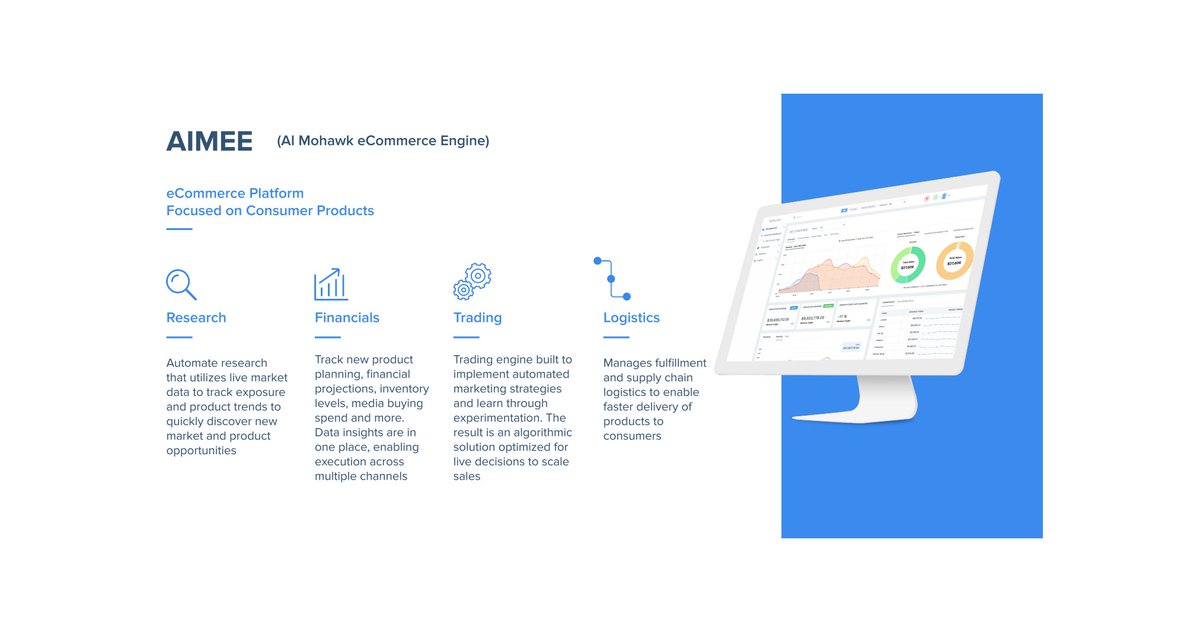

$MWK develops these products and sells these through various eCommerce platforms Sales, marketing and pricing are also optimised using their internal data analytics tool “AIMEE”

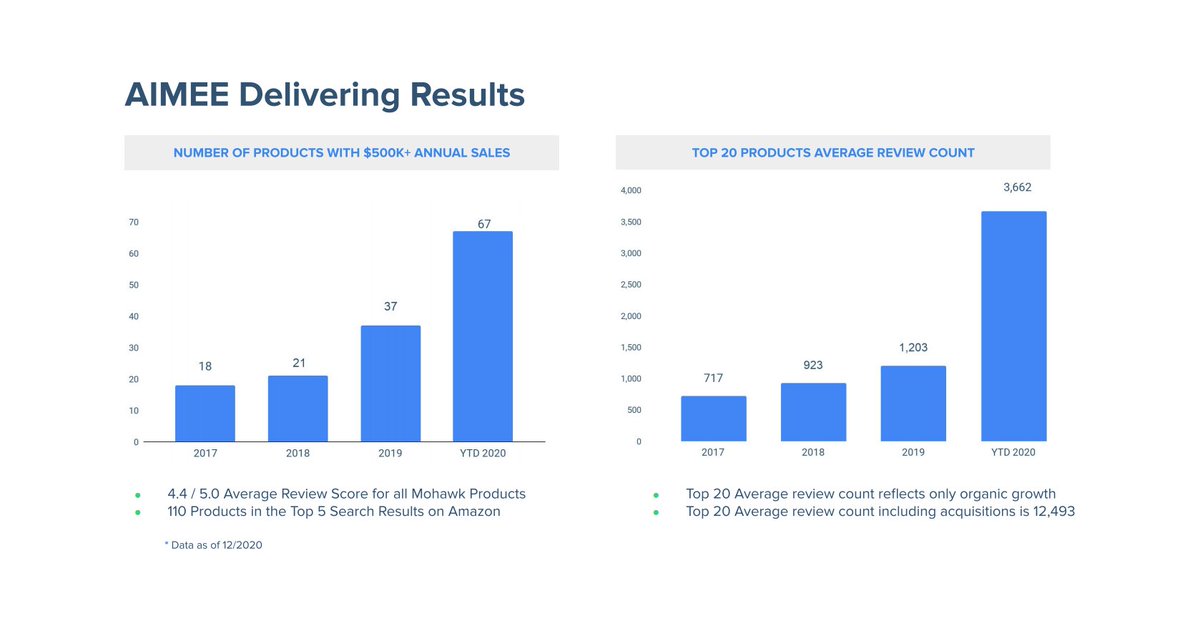

Sales, marketing and pricing are also optimised using their internal data analytics tool “AIMEE”

$MWK is in fact a 2-headed venture

Consumer goods

Consumer goods

Mohawk has developed 5 and acquired 6 brands and sells these on most eCommerce platforms

· Home, kitchen & environmental appliances

· Beauty related products

· Consumer electronics

· Health & Wellness products

Consumer goods

Consumer goodsMohawk has developed 5 and acquired 6 brands and sells these on most eCommerce platforms

· Home, kitchen & environmental appliances

· Beauty related products

· Consumer electronics

· Health & Wellness products

Mohawk sells over 280 SKUs but doesn’t manufacture these, it just knows what sells well thanks to its data analytics

It then manufacture these through contract manufacturers, import and sell on e-commerce marketplaces

It then manufacture these through contract manufacturers, import and sell on e-commerce marketplaces

Almost all of their sales are made through Amazon

Almost all of their sales are made through Amazon

It then manufacture these through contract manufacturers, import and sell on e-commerce marketplaces

It then manufacture these through contract manufacturers, import and sell on e-commerce marketplaces Almost all of their sales are made through Amazon

Almost all of their sales are made through Amazon

Data analysis tool: “AIMEE”

Data analysis tool: “AIMEE”This stands for “AI Mohawk eCommerce Engine”

AIMEE sources data from various e-commerce platforms, the internet and publicly available data

AIMEE sources data from various e-commerce platforms, the internet and publicly available data

AIMEE is integrated with marketplaces in the U.S., including Amazon, Walmart, Shopify and eBay

Allowing it to estimate trends, performance and consumer sentiment on products and searches within e-commerce platforms

Allowing it to estimate trends, performance and consumer sentiment on products and searches within e-commerce platforms

Allowing it to estimate trends, performance and consumer sentiment on products and searches within e-commerce platforms

Allowing it to estimate trends, performance and consumer sentiment on products and searches within e-commerce platforms

In 2018, $MWK started offering access to third party brands to its AIMEE platform

In 2018, $MWK started offering access to third party brands to its AIMEE platform Turning the AIMEE product into an SaaS business

Turning the AIMEE product into an SaaS business But why is AIMEE a valuable tool?

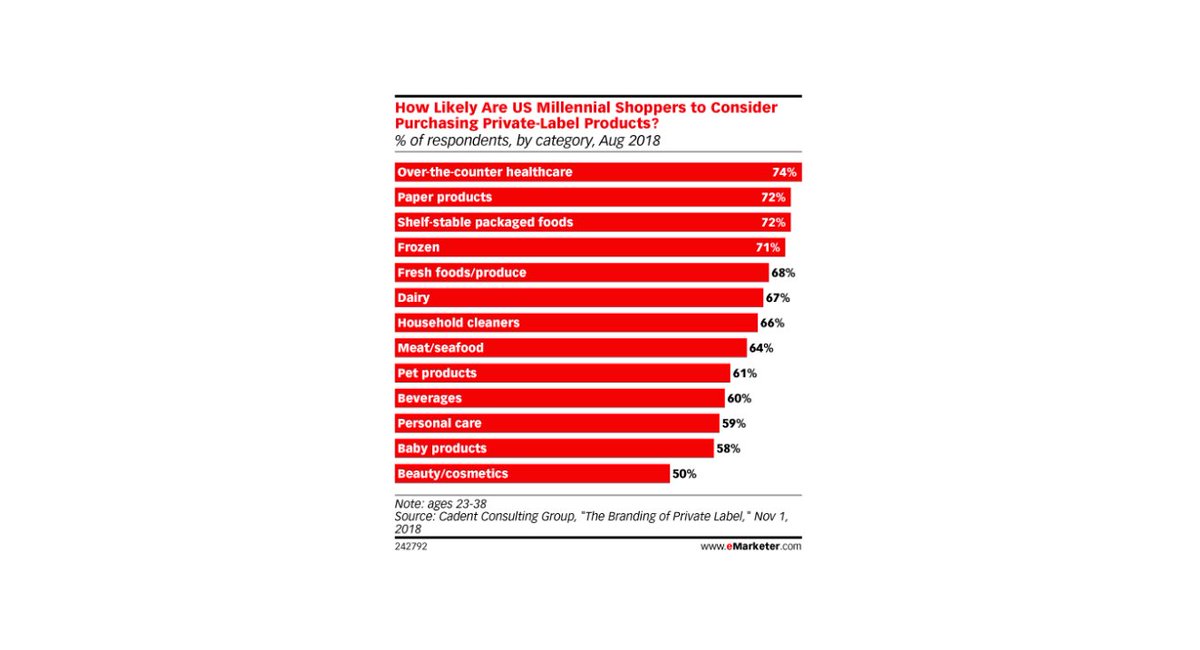

But why is AIMEE a valuable tool?  Isn’t it so that customers are attached to the brands they know?

Isn’t it so that customers are attached to the brands they know?

Customer habits CHANGE:

51% of millennials have no real preference between private labels & national brands

51% of millennials have no real preference between private labels & national brands

Only 22% of searches on Amazon include a brand name

Only 22% of searches on Amazon include a brand name

When shopping online, 75% of US consumers said that they look for the products with best ratings & reviews

When shopping online, 75% of US consumers said that they look for the products with best ratings & reviews

51% of millennials have no real preference between private labels & national brands

51% of millennials have no real preference between private labels & national brands Only 22% of searches on Amazon include a brand name

Only 22% of searches on Amazon include a brand name When shopping online, 75% of US consumers said that they look for the products with best ratings & reviews

When shopping online, 75% of US consumers said that they look for the products with best ratings & reviews

So $MWK is in a good spot as they understood that:

Customers look for products to solve their needs - not brands

Customers look for products to solve their needs - not brands

Customers use reviews and ratings to guide their purchases

Customers use reviews and ratings to guide their purchases

Some items sell more than other (higher turnover)

Some items sell more than other (higher turnover)

Customers look for products to solve their needs - not brands

Customers look for products to solve their needs - not brands Customers use reviews and ratings to guide their purchases

Customers use reviews and ratings to guide their purchases Some items sell more than other (higher turnover)

Some items sell more than other (higher turnover)

In fact, $AMZN is doing the same

It sold 22,600 private label products across 111 of its own brands in May 2020

It sold 22,600 private label products across 111 of its own brands in May 2020

Up from 6,800 products in June 2018

Up from 6,800 products in June 2018

On average, the Amazon private label products score 4.3 stars out of 5 https://www.digitalcommerce360.com/2020/05/20/amazon-triples-its-private%E2%80%91label-product-offerings-in-2-years/

On average, the Amazon private label products score 4.3 stars out of 5 https://www.digitalcommerce360.com/2020/05/20/amazon-triples-its-private%E2%80%91label-product-offerings-in-2-years/

It sold 22,600 private label products across 111 of its own brands in May 2020

It sold 22,600 private label products across 111 of its own brands in May 2020 Up from 6,800 products in June 2018

Up from 6,800 products in June 2018 On average, the Amazon private label products score 4.3 stars out of 5 https://www.digitalcommerce360.com/2020/05/20/amazon-triples-its-private%E2%80%91label-product-offerings-in-2-years/

On average, the Amazon private label products score 4.3 stars out of 5 https://www.digitalcommerce360.com/2020/05/20/amazon-triples-its-private%E2%80%91label-product-offerings-in-2-years/

Great! How the overall market doing?

According to eMarketer and Statista, global eCommerce sales stood at $ 4.4T in 2020 and are set to rise to $ 8.1T by 2025

According to eMarketer and Statista, global eCommerce sales stood at $ 4.4T in 2020 and are set to rise to $ 8.1T by 2025

Driven by wider eCommerce adoption, increasing mobile phone penetration and improving infrastructure

Driven by wider eCommerce adoption, increasing mobile phone penetration and improving infrastructure

According to eMarketer and Statista, global eCommerce sales stood at $ 4.4T in 2020 and are set to rise to $ 8.1T by 2025

According to eMarketer and Statista, global eCommerce sales stood at $ 4.4T in 2020 and are set to rise to $ 8.1T by 2025 Driven by wider eCommerce adoption, increasing mobile phone penetration and improving infrastructure

Driven by wider eCommerce adoption, increasing mobile phone penetration and improving infrastructure

According the eMarketer, US retail eCommerce sales are set to grow from $ 600B in 2019 to $ 1.2B by 2024

According the eMarketer, US retail eCommerce sales are set to grow from $ 600B in 2019 to $ 1.2B by 2024 Boosted by a 32% increase over the 2019 - 2020 period due to the pandemic

Boosted by a 32% increase over the 2019 - 2020 period due to the pandemic

eCommerce sales reached 14.4% of total sales in 2020 and will climb to 20.6% by 2024

eCommerce sales reached 14.4% of total sales in 2020 and will climb to 20.6% by 2024“For one, many stores, particularly department stores, may close permanently. Secondly, we believe consumer shopping behaviors will permanently change.” https://www.emarketer.com/content/us-ecommerce-growth-jumps-more-than-30-accelerating-online-shopping-shift-by-nearly-2-years

Leading eCommerce players also gained market share in 2022

Top 10 eCommerce players accounted for 57.9% of sales in 2019, this now stands at 63.2%

Top 10 eCommerce players accounted for 57.9% of sales in 2019, this now stands at 63.2%

$AMZN accounted for around 23% of total sales in Q3 2020, a slight decrease versus Q2 where is got 24% of sales

$AMZN accounted for around 23% of total sales in Q3 2020, a slight decrease versus Q2 where is got 24% of sales

Top 10 eCommerce players accounted for 57.9% of sales in 2019, this now stands at 63.2%

Top 10 eCommerce players accounted for 57.9% of sales in 2019, this now stands at 63.2% $AMZN accounted for around 23% of total sales in Q3 2020, a slight decrease versus Q2 where is got 24% of sales

$AMZN accounted for around 23% of total sales in Q3 2020, a slight decrease versus Q2 where is got 24% of sales

Here is the full take from Digital Commerce 360  https://www.digitalcommerce360.com/2020/11/03/amazons-share-of-us-online-retail-revenue-dips-slightly-in-q3/

https://www.digitalcommerce360.com/2020/11/03/amazons-share-of-us-online-retail-revenue-dips-slightly-in-q3/

https://www.digitalcommerce360.com/2020/11/03/amazons-share-of-us-online-retail-revenue-dips-slightly-in-q3/

https://www.digitalcommerce360.com/2020/11/03/amazons-share-of-us-online-retail-revenue-dips-slightly-in-q3/

Great! But is Mohawk any better than other CPG companies?

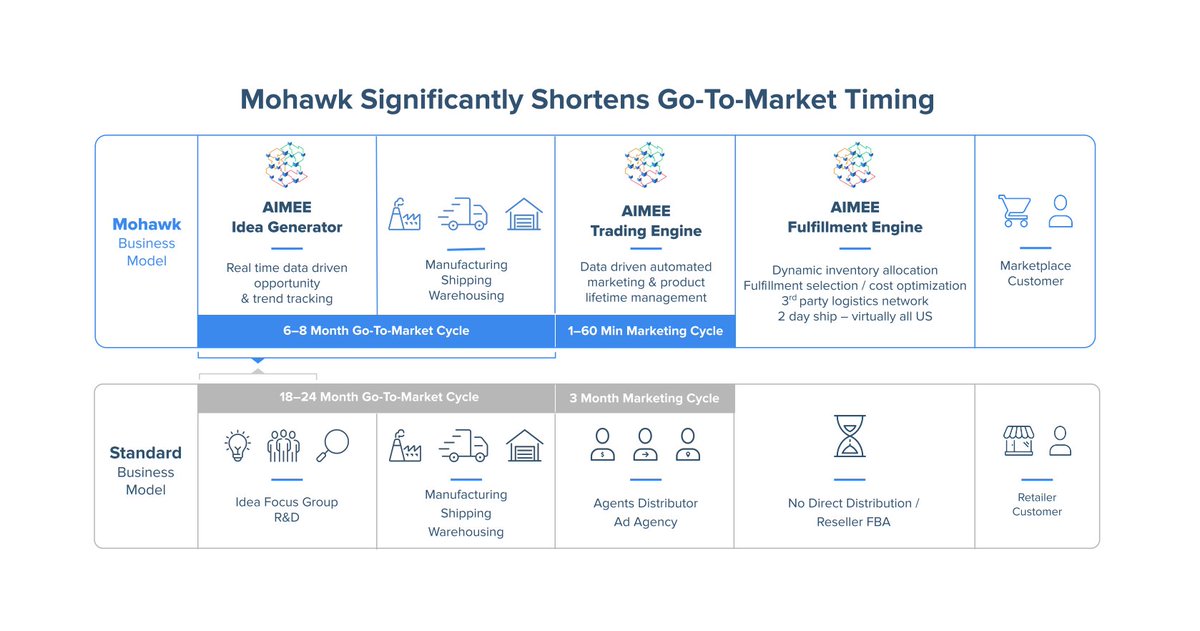

$MWK ’s go-to-market takes 6 to 8 months versus 1.5 to 2 years for conventional CPGs

$MWK ’s go-to-market takes 6 to 8 months versus 1.5 to 2 years for conventional CPGs

Marketing and sales are data driven and automated versus manual agency work for conventional CPGs

Marketing and sales are data driven and automated versus manual agency work for conventional CPGs

$MWK ’s go-to-market takes 6 to 8 months versus 1.5 to 2 years for conventional CPGs

$MWK ’s go-to-market takes 6 to 8 months versus 1.5 to 2 years for conventional CPGs Marketing and sales are data driven and automated versus manual agency work for conventional CPGs

Marketing and sales are data driven and automated versus manual agency work for conventional CPGs

Mohawk’s data driven approach also enables it find best selling merchants

And buy these over as these lack the technology and scalability $MWK has built over time

And buy these over as these lack the technology and scalability $MWK has built over time

$MWK is then only buying the listings, IP, assets and manufacturers relationships

$MWK is then only buying the listings, IP, assets and manufacturers relationships

And buy these over as these lack the technology and scalability $MWK has built over time

And buy these over as these lack the technology and scalability $MWK has built over time $MWK is then only buying the listings, IP, assets and manufacturers relationships

$MWK is then only buying the listings, IP, assets and manufacturers relationships

What are the results?

$MWK now has 67 products with over $ 500k in annual sales

$MWK now has 67 products with over $ 500k in annual sales

Remember Amazon’s 4.3 ratings on their own products? Well $MWK got 4.4/5 on average (for all of its products)

Remember Amazon’s 4.3 ratings on their own products? Well $MWK got 4.4/5 on average (for all of its products)

110 out of its +280 products are in the top 5 search results on $AMZN

110 out of its +280 products are in the top 5 search results on $AMZN

$MWK now has 67 products with over $ 500k in annual sales

$MWK now has 67 products with over $ 500k in annual sales Remember Amazon’s 4.3 ratings on their own products? Well $MWK got 4.4/5 on average (for all of its products)

Remember Amazon’s 4.3 ratings on their own products? Well $MWK got 4.4/5 on average (for all of its products) 110 out of its +280 products are in the top 5 search results on $AMZN

110 out of its +280 products are in the top 5 search results on $AMZN

What’s next for $MWK ?

Optimise product economics by lowering manufacturing and logistical costs as sales volume grow

Optimise product economics by lowering manufacturing and logistical costs as sales volume grow

Chase higher value products in order to generate higher GMs

Chase higher value products in order to generate higher GMs

Monetise AIMEE platform to allow access to third party brands (was scheduled for Q4 2019)

Monetise AIMEE platform to allow access to third party brands (was scheduled for Q4 2019)

Optimise product economics by lowering manufacturing and logistical costs as sales volume grow

Optimise product economics by lowering manufacturing and logistical costs as sales volume grow Chase higher value products in order to generate higher GMs

Chase higher value products in order to generate higher GMs Monetise AIMEE platform to allow access to third party brands (was scheduled for Q4 2019)

Monetise AIMEE platform to allow access to third party brands (was scheduled for Q4 2019)

Financials Check

Financials Check

Net revenue grew 45% YoY in Q3 ’20 to $ 59m versus $ 40.6m a year earlier

Net revenue grew 45% YoY in Q3 ’20 to $ 59m versus $ 40.6m a year earlier Gross margins expanded to 47.8% versus 43.2% a year earlier

Gross margins expanded to 47.8% versus 43.2% a year earlier Net loss of $ 800k versus a loss of $ 15m a year earlier

Net loss of $ 800k versus a loss of $ 15m a year earlier Curr. assets at $ 89m versus $ 47m in curr. liab.

Curr. assets at $ 89m versus $ 47m in curr. liab.

THE BOTTOM LINE

THE BOTTOM LINE

Mohawk is building a smart CPG player, driven by data and sales rather than marketing and branding

Mohawk is building a smart CPG player, driven by data and sales rather than marketing and branding It is fully taking advantage of the shift to private labels as consumers favour reviews and ratings over known-brands

It is fully taking advantage of the shift to private labels as consumers favour reviews and ratings over known-brands

Sales are growing fast and it manages to find additional growth by acquiring competitors at around 3 to 4 times TTM EBITDA

Sales are growing fast and it manages to find additional growth by acquiring competitors at around 3 to 4 times TTM EBITDA On top of growing sales, it also manages to collect good reviews for its product and has over 33% of its products in the TOP 5 searches on Amazon

On top of growing sales, it also manages to collect good reviews for its product and has over 33% of its products in the TOP 5 searches on Amazon

$MWK is reliant on the data it collects from leading eCommerce websites

$MWK is reliant on the data it collects from leading eCommerce websites It is also overly reliant on Amazon, which might take steps to reduce Mohawk’s products rankings / appeal

It is also overly reliant on Amazon, which might take steps to reduce Mohawk’s products rankings / appeal

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Digital Commerce 360

✑ Statista

✑ eMarketer

✑ Crunchbase

Sources

✑ Investor presentation

✑ Company website

✑ Digital Commerce 360

✑ Statista

✑ eMarketer

✑ Crunchbase

✑ Marker

✑ Business Insider

✑ JungleScout

✑ Business Insider

✑ JungleScout

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter