BTC crossed ATHs last week

Yet ETH still sitting -50% below its previous record

If that has you down, I got you covered

Here are 10 Ethereum charts that already hit ATHs in 2020

Yet ETH still sitting -50% below its previous record

If that has you down, I got you covered

Here are 10 Ethereum charts that already hit ATHs in 2020

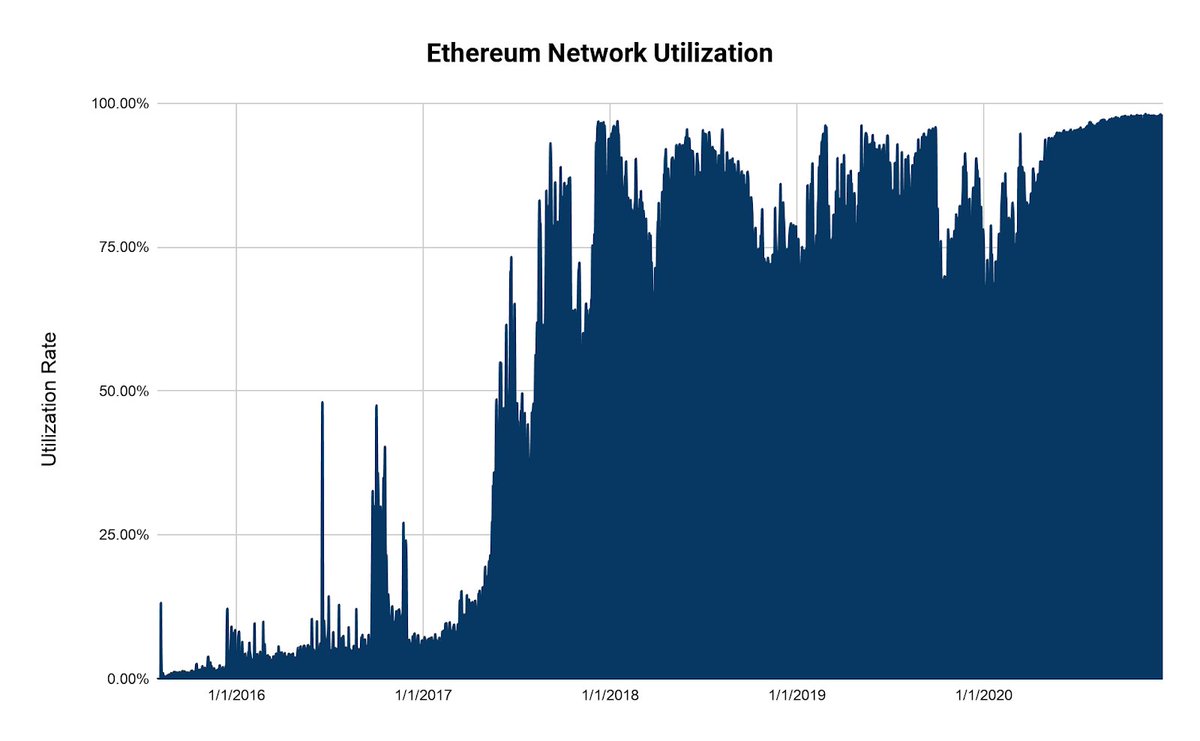

1. Utilization Rate

This is arguably one of the most fundamental metrics

It translates to the demand for blockspace and whether or not people are willing to use the ledger as a settlement layer

Good thing Etheruem is maxed out. There's too much demand to use the network

This is arguably one of the most fundamental metrics

It translates to the demand for blockspace and whether or not people are willing to use the ledger as a settlement layer

Good thing Etheruem is maxed out. There's too much demand to use the network

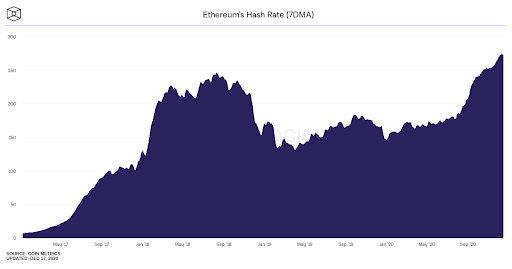

2. Hash Rate

Despite the upcoming transition to PoS, Ethereum's hash rate is hitting new highs.

Currently sitting at 270 TH/s, the network is as secure as ever

Miners look to get their last remaining ETH before their hardware is bricked with the eventual migration to Eth2

Despite the upcoming transition to PoS, Ethereum's hash rate is hitting new highs.

Currently sitting at 270 TH/s, the network is as secure as ever

Miners look to get their last remaining ETH before their hardware is bricked with the eventual migration to Eth2

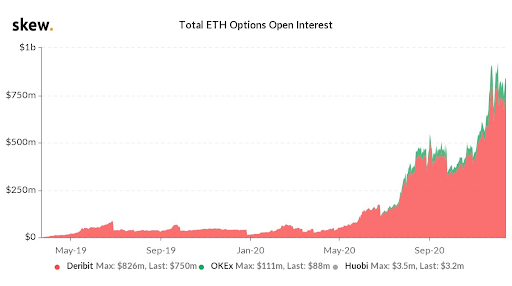

3. ETH Open Interest

Open interest is the amount of total outstanding options. And this number is approaching $1B

While it's still relatively small in the grand scheme of things, the growth in options provides more tools for miners and others to hedge exposure to volatility

Open interest is the amount of total outstanding options. And this number is approaching $1B

While it's still relatively small in the grand scheme of things, the growth in options provides more tools for miners and others to hedge exposure to volatility

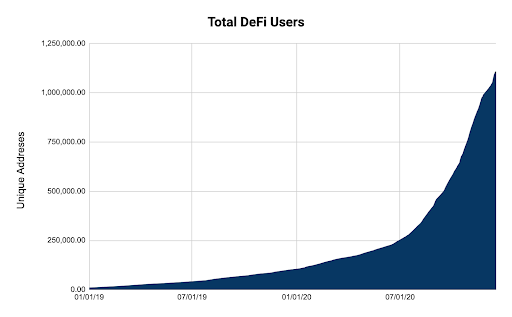

4. DeFi Users

After starting the year with ~100K users (i.e. unique wallets), the graph went fully parabolic due to the yield farming mania this past summer

We've now surpassed over 1M users

How long until 1B?

After starting the year with ~100K users (i.e. unique wallets), the graph went fully parabolic due to the yield farming mania this past summer

We've now surpassed over 1M users

How long until 1B?

5. Total Value Locked

Similarly, TVL reached new highs of $15B+ as capital poured into the space from the yield farming mania

Everyone was chasing astronomical yields

All you had to do was click a few buttons & you were earning magnitudes higher than anything in TradFi

Similarly, TVL reached new highs of $15B+ as capital poured into the space from the yield farming mania

Everyone was chasing astronomical yields

All you had to do was click a few buttons & you were earning magnitudes higher than anything in TradFi

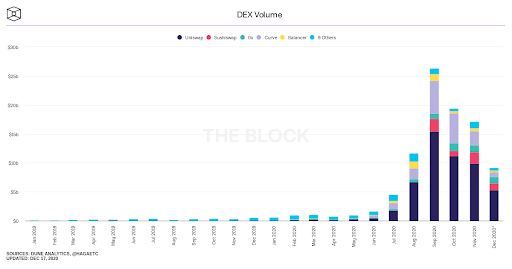

6. DEX Volumes

DEXs like Uniswap, Curve, and Balancer were key players this year

The sector finally started to realize its potential and compete with centralized exchanges.

DEX market share rose to 15% of centralized exchanges and monthly volumes soared to over $25B

DEXs like Uniswap, Curve, and Balancer were key players this year

The sector finally started to realize its potential and compete with centralized exchanges.

DEX market share rose to 15% of centralized exchanges and monthly volumes soared to over $25B

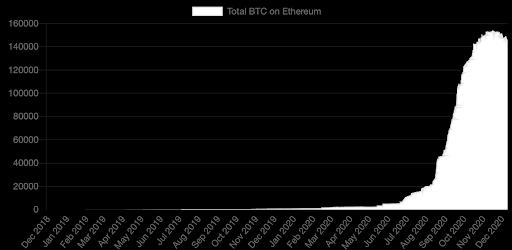

7. BTC on Ethereum

There’s now over $3.3B BTC circulating Ethereum, representing 0.675% of all BTC in existence

People just couldn't sit idle on their BTC anymore. The yields on Ethereum were too good to resist.

This trend is prob not slowing down...1% of BTC supply soon?

There’s now over $3.3B BTC circulating Ethereum, representing 0.675% of all BTC in existence

People just couldn't sit idle on their BTC anymore. The yields on Ethereum were too good to resist.

This trend is prob not slowing down...1% of BTC supply soon?

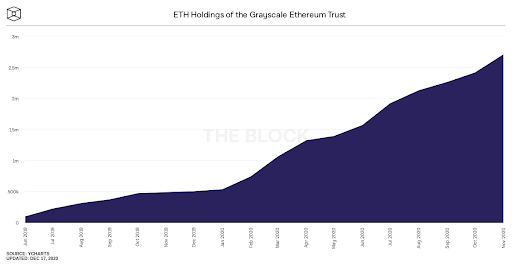

8. ETH in Grayscale

Grayscale is becoming a blackhole for crypto assets

Not only do they hold ~2.5% of all BTC, but they've grown their ETH position to 2.3% of the supply or over ~2.5M ETH

Grayscale is becoming a blackhole for crypto assets

Not only do they hold ~2.5% of all BTC, but they've grown their ETH position to 2.3% of the supply or over ~2.5M ETH

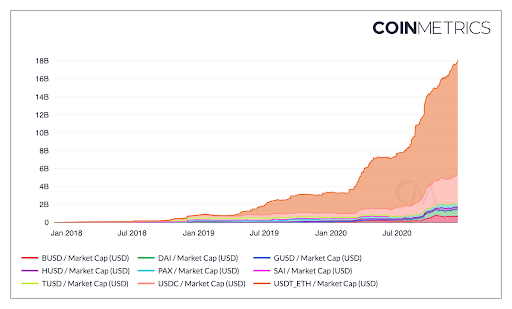

9. Stablecoins on Ethereum

Stablecoins or 'crypto dollars" have flourished over the past two years

And Ethereum has become the dominant platform for these synthetic dollars

There's now nearly $20B circulating the Ethereum economy, up from ~$3B in Jan 2020

Stablecoins or 'crypto dollars" have flourished over the past two years

And Ethereum has become the dominant platform for these synthetic dollars

There's now nearly $20B circulating the Ethereum economy, up from ~$3B in Jan 2020

10. ETH in Deposit Contract

Last one is a bit of a cheat as it can only go up

But ETH reached unicorn status as $1B has been deposited into Eth2, roughly 1.5% of all ETH

And it's only getting started. There's tons of infrastructure coming online to support this new network

Last one is a bit of a cheat as it can only go up

But ETH reached unicorn status as $1B has been deposited into Eth2, roughly 1.5% of all ETH

And it's only getting started. There's tons of infrastructure coming online to support this new network

There’s no shortage of ways to cut it: Ethereum is growing

So it's only a matter of time before we're celebrating ATHs too

Just hang tight :)

Read the full piece on @BanklessHQ https://newsletter.banklesshq.com/p/10-ethereum-charts-that-hit-aths

So it's only a matter of time before we're celebrating ATHs too

Just hang tight :)

Read the full piece on @BanklessHQ https://newsletter.banklesshq.com/p/10-ethereum-charts-that-hit-aths

Read on Twitter

Read on Twitter