Have spent the last few days looking at $ESD. Mixed feelings all around...

First the good:

The project is supported by serious investors/analysts (e.g., @rewkang @delitzer @twobitidiot) and a strong community thinking hard about how to evolve the algorithmic stablecoin. The dialog level is far higher than what I saw (from a distance) in $AMPL.

The project is supported by serious investors/analysts (e.g., @rewkang @delitzer @twobitidiot) and a strong community thinking hard about how to evolve the algorithmic stablecoin. The dialog level is far higher than what I saw (from a distance) in $AMPL.

There is also a clear push to integrate into other defi projects -necessary if the coin is going to be *used* as a stablecoin. The fact that all liquid ESD don’t receive the rebase makes it more straightforward to reason about in other projects

Also, solving for a decentralized collateral-less stablecoin would be a major win for defi, allowing for a medium of exchange that’s capital efficient.

I’m still skeptical for a number of reasons though

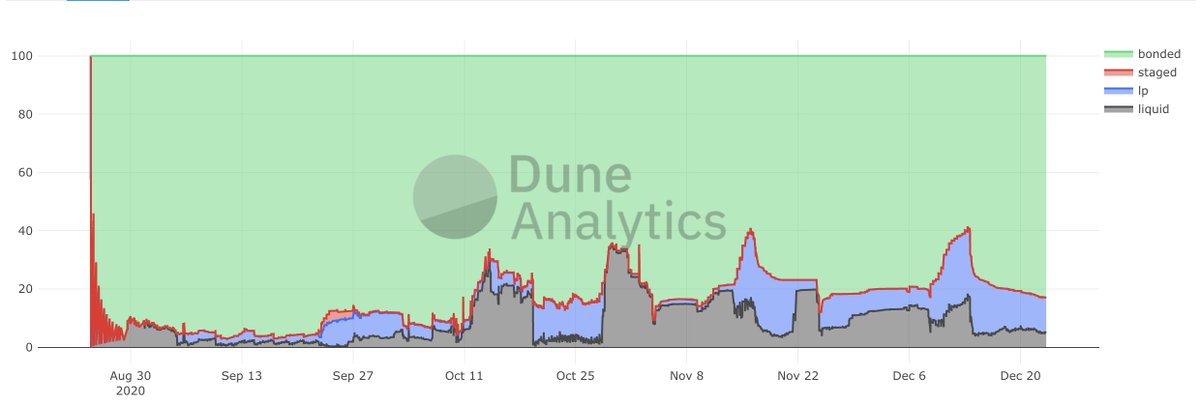

Most importantly, I don’t think ESD solves the core challenge that AMPL and a few of its clones ran into: reflexivity. Right now, ~5% of ESD is liquid, 83% is locked in the DAO, and 12% is liquidity mining in Uniswap.

Current supply of ESD is ~372 million -> ~19m liquid and ~353m locked

That 353m locked is *all* risk capital from investors. It could even be higher as some portion of the liquid ESD is likely just waiting to be bonded

That 353m locked is *all* risk capital from investors. It could even be higher as some portion of the liquid ESD is likely just waiting to be bonded

The problem that none of these algorithmic coins have yet solved is: how do we transition the user base from risk capital to safety capital. And how do we do it before risk capital begins exiting, causing a prolonged death spiral.

ESD may even have it worse as the lock period on bonded capital is a disincentive to trade - hypothetically a good thing, but in practice may result in *more* reflexivity as traders can’t react easily.

And unlike AMPL, the price doesn’t adjust automatically from a rebase on Uniswap. Users have to actually unbond to sell into a rising market. I suspect this is an underrated driver of the growth of the system.

ESD has an interesting possibility for a solution: which is to build a separate community that uses ESD as *safety* capital. Because liquid ESD never gets a rebase, *safety* users might never even know that ESD has the possibility of earning a return.

But as of right now, there needs to be HUGE growth in demand for ESD as an actual stablecoin to dampen reflexivity swings from investors. Which of course can’t happen with the price so volatile.

It feels like a chicken and egg problem that I’m not sure anyone has presented a solution for. I’m sticking around to watch, though.

Read on Twitter

Read on Twitter