Anatomy of a Nano-Float: Explaining Volatility in $BRPA

How an 11th hour, Hail-Mary SPAC deal for a potentially world-changing COVID therapeutic created a 5x face ripper in the equivalent of a single trading session.

$BRPAW $RLFTF $SPY $QQQ $PFE $MRNA

How an 11th hour, Hail-Mary SPAC deal for a potentially world-changing COVID therapeutic created a 5x face ripper in the equivalent of a single trading session.

$BRPAW $RLFTF $SPY $QQQ $PFE $MRNA

My main goal is only to discuss the market structure and SPAC mechanics that have led to the erratic price moves in the $BRPA commons and how they might affect trading moving forward. I am long $RLFTF and $BRPAW, but I'll save valuation for a later thread.

This story began way back in October 2017, when a senior housing development firm called Big Rock Partners listed a blank check company on Nasdaq with the intent to acquire a portfolio of senior housing operators.

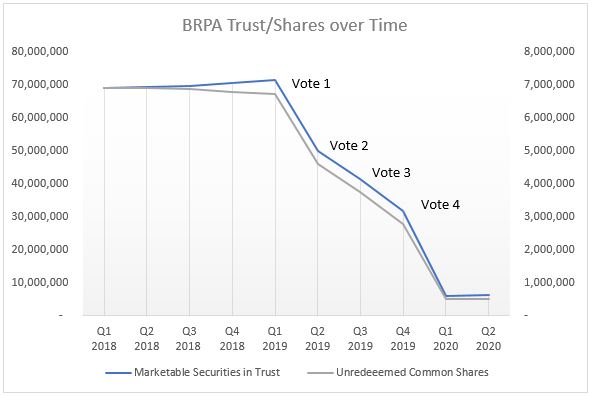

Starting with ~$69 million in the trust, $BRPA had 18 months to secure a business combination before they would need to seek an extension vote under the terms of the SPAC agreement. Fast forward to May 2019, no viable business combination in sight.

The company calls a proxy and holds Extension Vote #1 on 5/21/2019. This vote successfully extends the deadline to 8/22/2019, but 2.1 million common shares opt to redeem for cash value of $10.43 per share, removing those shares from the float and $22 million from the trust.

8/21/2019 rolls around, still no target, Extension Vote #2 is held to push the deadline another 3 months to 11/22/2019. This time 847k shares opt to redeem for cash value, removing those shares from the float and $8.8 million from the trust. Down to $38.2 million now.

Extension Vote #3 happens on 11/21/2019. The vote passes to extend to 2/21/2020. You know the drill by now, another 919k shares hit eject and redeem for cash value, removing those shares from the float and another $9.7 million from the trust. Trust value is now $28.5 million.

Fast forward to the end of Q1 2020. With little hope for a transaction closing, another extension vote is held, the final 2.43 million shares subject to redemption were redeemed. This brings the final value of the cash in the trust to $6.2 million and the float to ~500k shares.

From 4/1 to 12/10, $BRPA did 500k shares of volume…TOTAL. There were 93 (out of 177) days where not a single trade executed. Dead SPAC walking, game over, right? Think again, this Big Rock crew casts the line out there one last time, eyeing liquidation on 12/23 (Today!).

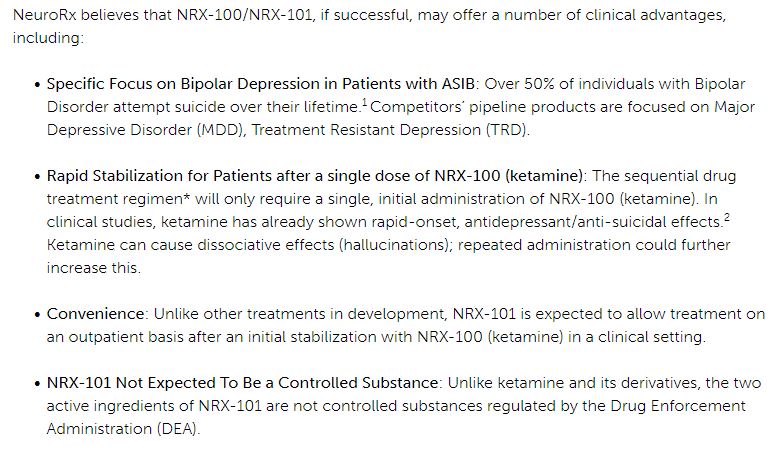

Hat, meet rabbit. Along comes NeuroRx, a pre-revenue biotech company whose internal pipeline consists of a non-psychedelic ketamine drug called NRX-101 currently in Phase 3 clinical trials for treatment of bipolar depression with suicidal ideation.

In addition to NRX-101, NeuroRx is partnered with Swiss firm Relief Therapeutics $RLFTF on the development of Aviptadil, a synthetic peptide that has shown incredible promise treating critical Covid patients. See my thread here on the promise of Aviptadil. https://twitter.com/HarveySpecTrade/status/1328582560956489733

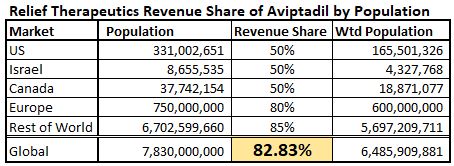

In return for running the clinical trials in the US, NeuroRx receives a revenue share on the sale of Aviptadil around the world. If the Phase 2b/3 results come back in line with the open label trial, this revenue share is potentially worth hundreds of millions of dollars/year.

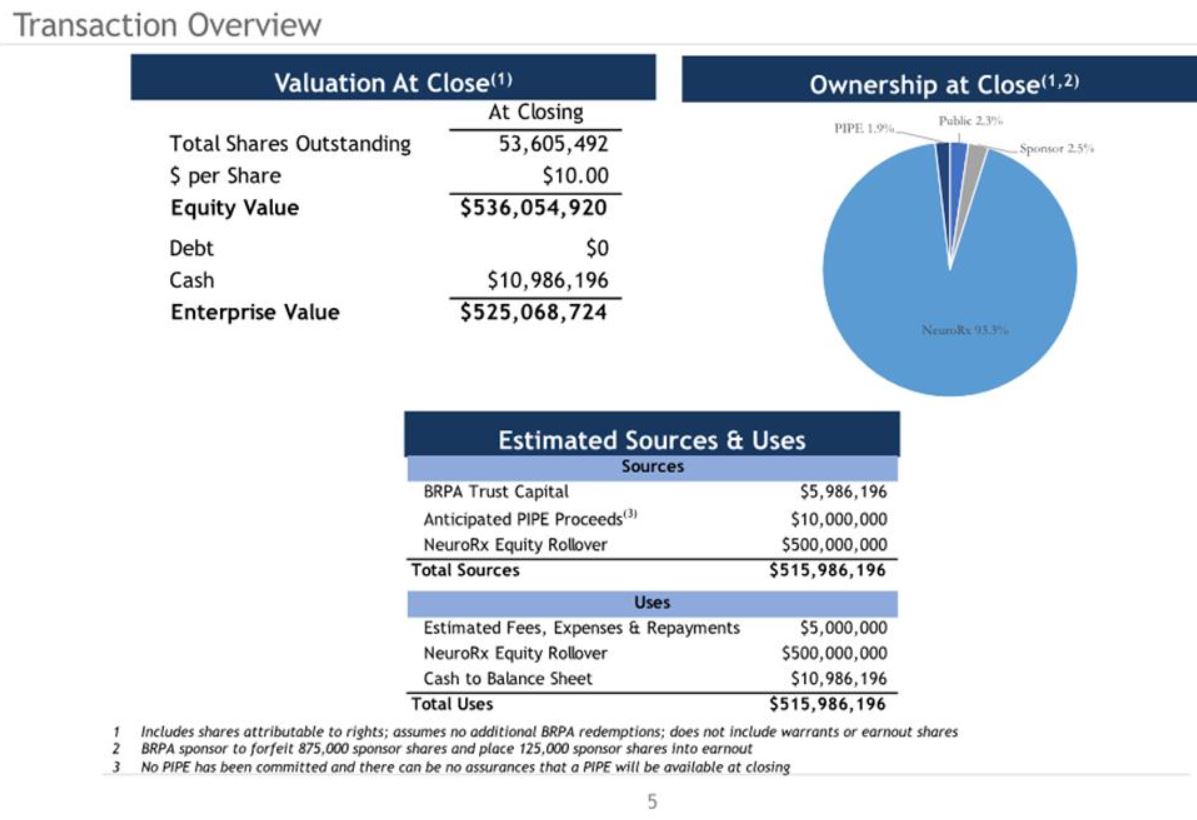

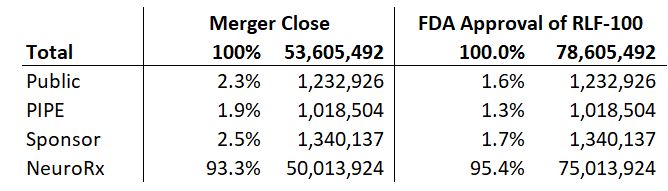

On 12/14, $BRPA announced a definitive agreement to merge with NeuroRx at a post-merger equity valuation of $536 million. Remember, there is only $6.2 million available in the trust, so to achieve $536m, the public shareholders of $BRPA only end up owning ~2.3% of NeuroRx.

Side Note: If you thought $BRPA was negotiating across a barrel here, you'd be right. There is a provision that unlocks a $100 million cash earnout and an additional 25 million shares of NeuroRx to the pre-merger equity holders if RLF-100 achieves FDA approval by the end of 2022.

It's important to know if you plan on holding $BRPA through the merger, that the biggest immediate catalyst for the value of NeuroRx also represents a significant dilution event to the public shareholders of $BRPA. Now, let's move on to this insane run-up from $16 to $75.

Following the announcement of the merger, you now have a SPAC (Hot) combining with company developing a promising Covid therapeutic (Red Hot) and a novel depression molecule that is derived from a psychedelic (Also Hot) all trading on a 500k share float. Absolute powder keg…

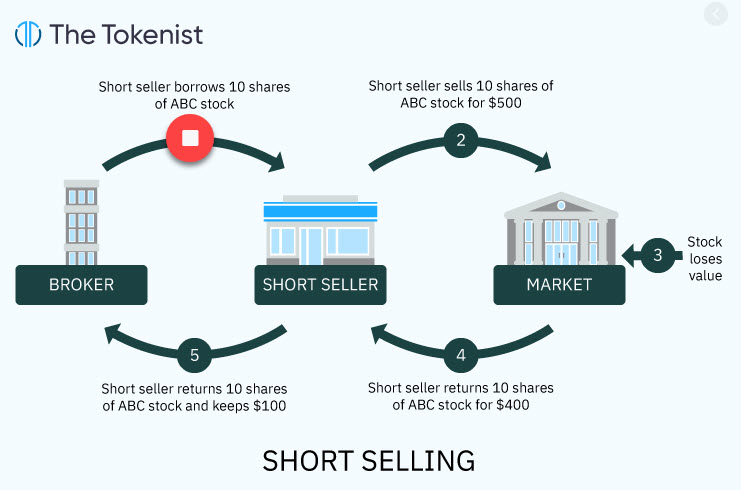

A stock like $BRPA with huge uptick in buying interest all of a sudden found no willing sellers. Why? This is largely because the scarcity of shares available for the public to trade also means it is difficult/expensive to borrow shares to take the short side of the trade.

In order to maintain an orderly market, you need enough liquidity to facilitate the transfer of risk between market participants. With limited ability to trade short, most market-making algos will not be able to provide short-term liquidity. No options chain, same story.

This limited availability for sophisticated traders to take the other side of the trade along with an influx of buying sets the stage for the melt-up conditions we saw Monday afternoon. Once the offers near $16 were taken out, there were no natural sellers until it hit $30. Halt.

Unhalt. Rinse. Repeat. The volatility/halting/unusual volume also attracts algorithms that attempt to follow short-term breakouts through latency arbitrage strategies, making it even more competitive to get executions around market reversals, leaving you always chasing.

If your plan is to try and scale in and out of $BRPA to ride the inevitable volatility until the transaction closes, I would urge caution. In a ticker this thinly traded, only one guy buys the bottom, one guy sells the top, and a ton of other traders get chopped up in between.

Things to remember:

Size matters - Watch your notional order size relative to the visible market.

Mind the gap - Don't use market orders to pay across a $4-$6 spread. Use marketable limit orders to execute at your desired price if you want to improve the visible bid or offer.

Size matters - Watch your notional order size relative to the visible market.

Mind the gap - Don't use market orders to pay across a $4-$6 spread. Use marketable limit orders to execute at your desired price if you want to improve the visible bid or offer.

Note that I'm only referring to the common stock ($BRPA). Common stock in SPACs is the only class with the option to redeem, so the same float mechanics don’t apply to warrants ($BRPAW) or rights ($BRPAR), which is why they haven't tracked $BRPA $-for-$ on these wild swings.

Read on Twitter

Read on Twitter