What is @synthetix_io ?

In short, it's a decentralised synthetic asset issuance protocol that allows 0-slippage trading between any asset.

It can create synthetic assets = issuance

It allows non-custodial trading = decentralized exchange

Let's unpack this..

In short, it's a decentralised synthetic asset issuance protocol that allows 0-slippage trading between any asset.

It can create synthetic assets = issuance

It allows non-custodial trading = decentralized exchange

Let's unpack this..

1/ At the foundation of the SNX protocol is the debt pool

Similar to the way people in @MakerDAO mint $DAI by staking $ETH and a range of other assets..

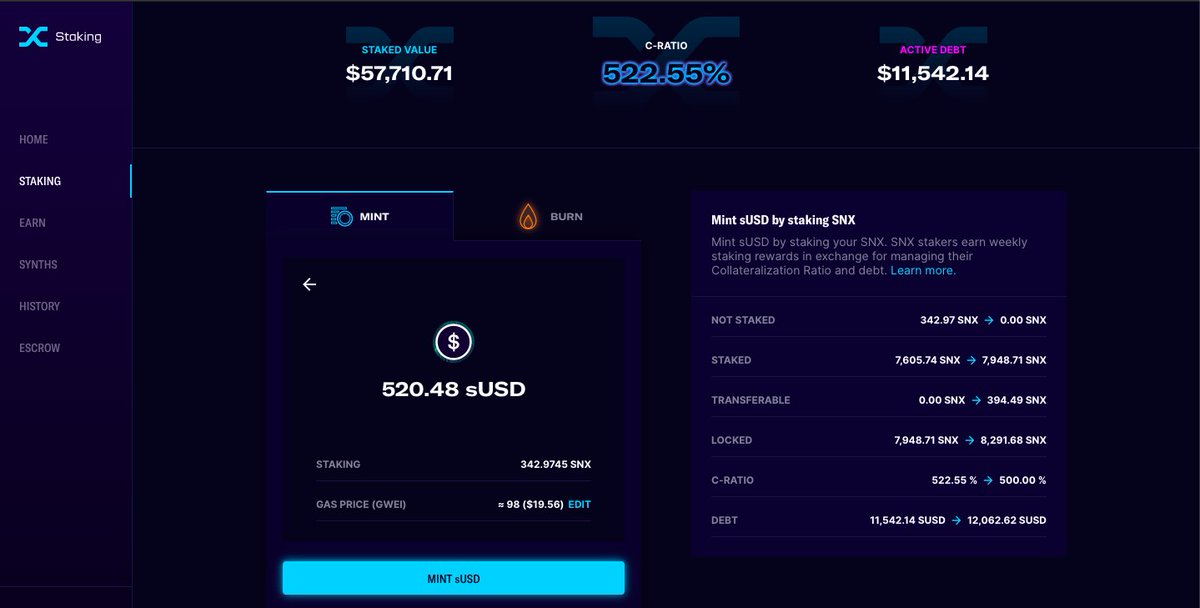

People in Synthetix stake $SNX and mint $sUSD

In return for staking they receive inflation rewards in form of $SNX (28% APY)

Similar to the way people in @MakerDAO mint $DAI by staking $ETH and a range of other assets..

People in Synthetix stake $SNX and mint $sUSD

In return for staking they receive inflation rewards in form of $SNX (28% APY)

2/ So at the outset people mint $sUSD but then they can trade their $sUSD against any other synth offered by the Synthetix protocol

cryptos: $sETH, $sBTC

fiat currencies: $sKRW, $sEUR

commodities: $sOIL, $sXAU

inverses: $iXRP (short $XRP)

even options..

cryptos: $sETH, $sBTC

fiat currencies: $sKRW, $sEUR

commodities: $sOIL, $sXAU

inverses: $iXRP (short $XRP)

even options..

3/ The crazy thing is that when you swap $sUSD for another asset you have 0 slippage

This is because you're not really SELLING the asset in the conventional sense.. there is no counterparty

You're just changing the DENOMINATION of the debt pool

This is because you're not really SELLING the asset in the conventional sense.. there is no counterparty

You're just changing the DENOMINATION of the debt pool

4/ For instance, imagine the debt pool is composed of 5000 $sUSD at t0

t1. Someone swaps 20% (1000 $sUSD) of that into $sBTC at a price of $10,000

t2. And then the $sBTC price increases to $20,000

In that scenario, the size of the debt pool will GROW to $6000 (20% increase)

t1. Someone swaps 20% (1000 $sUSD) of that into $sBTC at a price of $10,000

t2. And then the $sBTC price increases to $20,000

In that scenario, the size of the debt pool will GROW to $6000 (20% increase)

5/ As a staker, your debt will grow proportionally

If you own 10% ($500) of the debt pool at t0 you will have

20% more debt so $600

That's why stakers receive inflation rewards: they are taking RISK

If you own 10% ($500) of the debt pool at t0 you will have

20% more debt so $600

That's why stakers receive inflation rewards: they are taking RISK

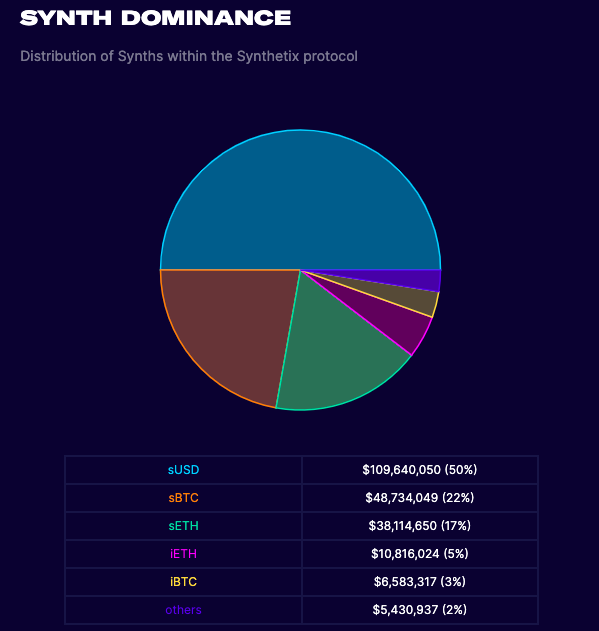

6/ That's why it's important that the debt pool is composed of a diversified set of assets

The gains of some traders shall be cancelled by the losses of others

Good news: the Synthetix protocol can add an infinite number of assets

All they need to add an asset is a price feed

The gains of some traders shall be cancelled by the losses of others

Good news: the Synthetix protocol can add an infinite number of assets

All they need to add an asset is a price feed

7/ This, and the 0 slippage, are the two most interesting parts about the Synthetix protocol.

They can permissionlessly add any financial asset to their protocol using the debt pool

In our opinion, this is the fastest way to get traditional financial assets like stock on-chain

They can permissionlessly add any financial asset to their protocol using the debt pool

In our opinion, this is the fastest way to get traditional financial assets like stock on-chain

8/ Can you trade on http://synthetix.exchange without staking $SNX?

Yes ofc! The same way you can buy $DAI without opening a Maker vault.

These are two separate functions of the protocol:

- $SNX stakers are "service providers"

- traders are users

Yes ofc! The same way you can buy $DAI without opening a Maker vault.

These are two separate functions of the protocol:

- $SNX stakers are "service providers"

- traders are users

9/ To trade on http://synthetix.exchange or @kwenta_io (alternative interface) you just need $sUSD or any other synth

That's why @synthetix_io incentivises liquidity on these assets vs. $USDC, $DAI etc. on exchanges like @CurveFinance, @UniswapProtocol and so on.

That's why @synthetix_io incentivises liquidity on these assets vs. $USDC, $DAI etc. on exchanges like @CurveFinance, @UniswapProtocol and so on.

10/ The more liquidity there is on $ETH/ $sETH or $sUSD/ $USDC the easier it is for people to enter

There are more dynamics that help boost liquidity tho..

Minting more $sUSD: with more $sUSD in existence the protocol becomes more useful for traders, they can do larger trades

There are more dynamics that help boost liquidity tho..

Minting more $sUSD: with more $sUSD in existence the protocol becomes more useful for traders, they can do larger trades

11/ Minting is capped at the protocol level, there is a minimum c-ratio that dictates how much $sUSD a user can mint vs. their staked $SNX

If the c-ratio is not met by a user, they can not claim their weekly $SNX reward for as long as the c-ratio is not corrected

If the c-ratio is not met by a user, they can not claim their weekly $SNX reward for as long as the c-ratio is not corrected

12/ With ongoing price increase of $SNX however, $SNX stakers are minting more and more of $sUSD

In addition, SNX has lowered the min. c-ratio to 500% which also boosts the synth mkt cap

Flywheel: higher price -> lower c-ratio -> higher synth volume https://twitter.com/SNXified/status/1339483061239631872?s=20

https://twitter.com/SNXified/status/1339483061239631872?s=20

In addition, SNX has lowered the min. c-ratio to 500% which also boosts the synth mkt cap

Flywheel: higher price -> lower c-ratio -> higher synth volume

https://twitter.com/SNXified/status/1339483061239631872?s=20

https://twitter.com/SNXified/status/1339483061239631872?s=20

13/ For us, the only impediment to @synthetix_io's moon landing are the gas fees when trading synths

To address this they are migrating to @optimismPBC's Layer-2 solution

So you will be able to trade with 0-slippage and MINIMAL gas costs

https://twitter.com/synthetix_io/status/1334634696781729795?s=20

https://twitter.com/synthetix_io/status/1334634696781729795?s=20

To address this they are migrating to @optimismPBC's Layer-2 solution

So you will be able to trade with 0-slippage and MINIMAL gas costs

https://twitter.com/synthetix_io/status/1334634696781729795?s=20

https://twitter.com/synthetix_io/status/1334634696781729795?s=20

14/ There are also many efforts to reduce the friction for users to "enter" the system and buy synths https://twitter.com/SNXified/status/1339904440774569984?s=20

15/ All in all, one of the most interesting protocol's to follow

The team is super focused and @kaiynne is one of the most ingenious founders in the whole DeFi space

As a user, once you start staking you never look back https://twitter.com/litocoen/status/1338675274507046913?s=20

https://twitter.com/litocoen/status/1338675274507046913?s=20

The team is super focused and @kaiynne is one of the most ingenious founders in the whole DeFi space

As a user, once you start staking you never look back

https://twitter.com/litocoen/status/1338675274507046913?s=20

https://twitter.com/litocoen/status/1338675274507046913?s=20

Read on Twitter

Read on Twitter