Excited that this paper has been accepted to the 𝗝𝗼𝘂𝗿𝗻𝗮𝗹 𝗼𝗳 𝗣𝗼𝗹𝗶𝘁𝗶𝗰𝗮𝗹 𝗘𝗰𝗼𝗻𝗼𝗺𝘆. A brief summary thread (1/10)

Tax data tell us a lot about the top of the income distribution. But not all income appears on tax forms and that matters for measuring inequality. (2/10)

An ideal way to measure incomes is the Haig-Simons definition: income = consumption + change in wealth. Under Haig-Simons, in addition to things like wages, appreciation of stocks or houses (increase wealth) and cash + in-kind transfers (increase consumption) are income. (3/10)

We use the SCF, Census data, and county-level home price estimates to incorporate non-taxable sources in income distribution estimates using tax data and estimate inequality using a broad income definition based on Haig-Simons (4/10)

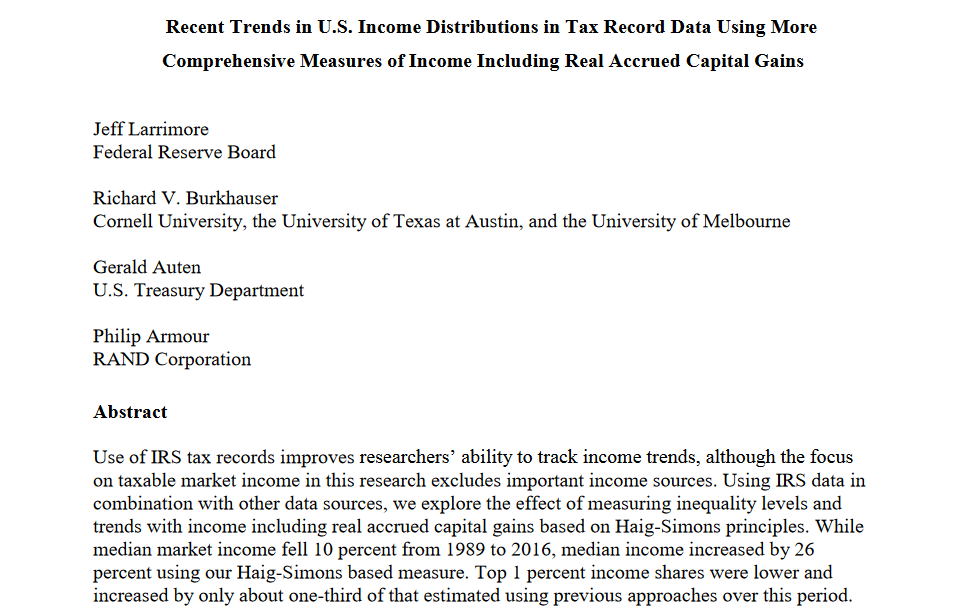

Including transfers and using post-tax income increases the income share of the bottom half of the distribution and offsets the declines in their market income since 1989 (5/10)

We also include real accrued capital gains on both stocks AND housing. These gains are a major source of wealth accumulation for the wealthy and upper-middle class (6/10)

Accrued gains better reflect magnitude and timing of gains than realized gains. From 1989 to 2016, accrued gains were over 2x taxable capital gains (28.8 trillion vs 13.9 trillion). Most gains also only appear on tax forms years after earned, if ever (7/10)

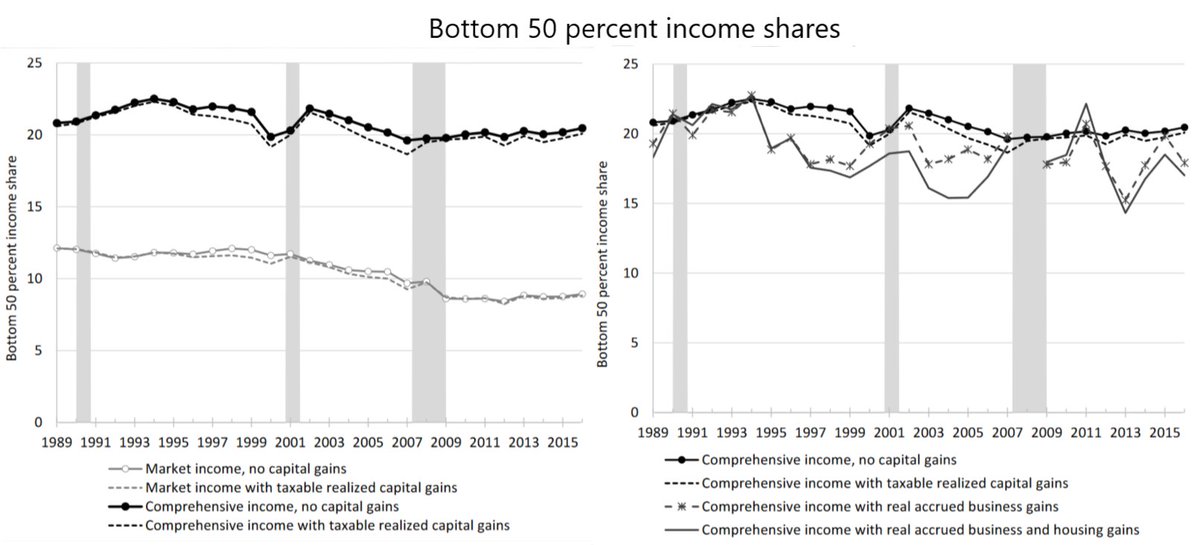

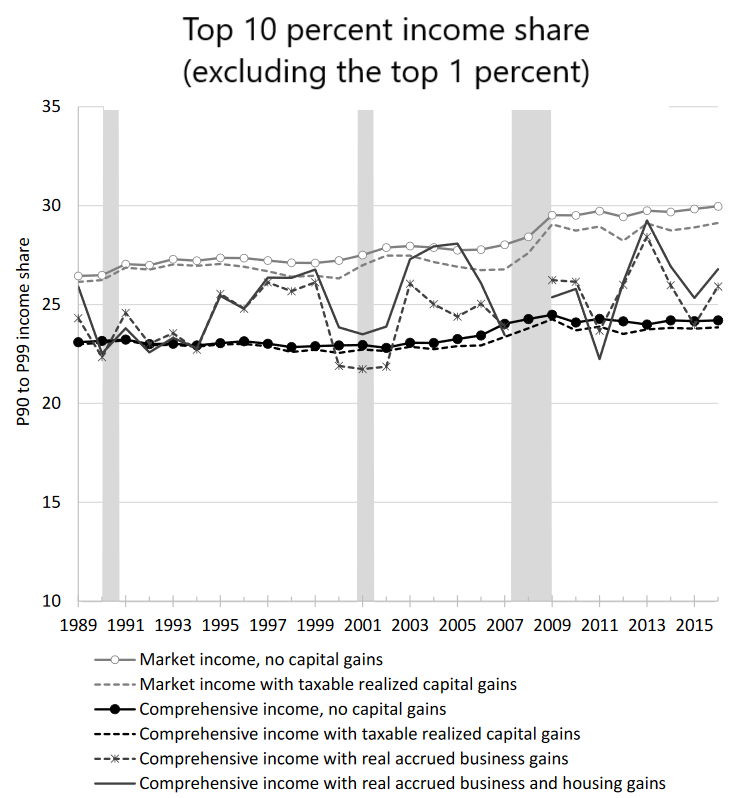

Once including transfers and accrued gains, we find top 1 pct. income shares rose by 2.1% from 1989 to 2016 compared to 6.2% for mkt income w/ taxable gains. But also different timing - using accrued gains shows more inequality growth since Great Recession (8/10)

Housing gains don't change top 1% shares much, but increases the top 10% income shares during the housing boom (and to a lesser extent since 2013) (9/10)

Here is a comparison of our top 1% share estimate to the Piketty-Saez market income results and Piketty-Saez-Zucman post-tax national income. (10/10)

Link to the full paper is available here: https://www.journals.uchicago.edu/doi/10.1086/713098

Read on Twitter

Read on Twitter